Oil and natural gas strengthen America's trade balance

IPAA, Washington, DC

Surprises seem to have become the order of the day in the energy world, especially when it comes to America's oil and natural gas reserves. Once thought to be "outdated" fossil fuels, the abundance of America's oil and natural gas reserves, now unleashed through hydraulic fracturing and horizontal drilling, are truly shifting the balance of trade in America's favor.

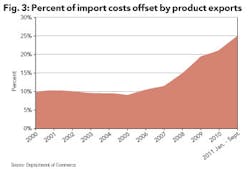

The surprise has taken the form of a solid increase in American liquids production and a shift towards declining imports. In addition natural gas plant liquids (NGPL) output has been exceeding 2 million barrels per day for the first time ever, providing additional feedstock for the industry at home. In fact, both petroleum product and natural gas exports are even increasing.

The import trends are also occurring on the natural gas front, with a turnaround that has put American natural gas production in position to reach an all-time high this year. It's worth a detailed look at the significant impact all these positive developments have had on US trade, as well as some thoughts on where this might lead.

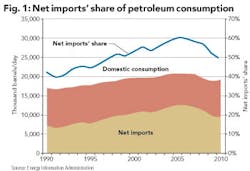

On the liquids side, imports have declined some 2 million barrels per day since 2005, while product exports nearly tripled over that period. In fact, product exports in August exceeded 3 million barrels per day for the first time ever, according to Energy Information Administration (EIA) data. As a result - in a positive trend for energy security - our reliance on foreign petroleum has shrunk from more than 60% in 2006 to less than 50% last year. A slow economy surely results in lower demand, which accounts for part of the shift away from imports. However, the effect of a slow economy is insufficient to explain the entire shift.

American liquids production - including both crude oil and natural gas liquids - has jumped roughly 1 million barrels per day between 2008 and so far in 2011. Much of that has come from the increased production of the onshore Lower 48 and reflects the significant contributions of America's independent producers.

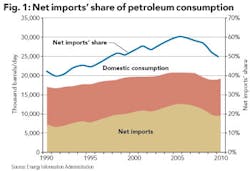

On the natural gas side, the reversals brought about by increased American energy production have also been striking. Even with natural gas consumption increasing over the past five years by more than 2 trillion cubic feet (tcf), or nearly 10%, net imports have fallen by 1 tcf, from 3.6 tcf in 2005 (and a peak of 3.8 tcf in 2007) to 2.6 tcf in 2010.

What enabled that remarkable development was the work of the American oil and gas industry, which through innovative technology brought about a jump in US natural gas production of nearly 20% in just five years. As a result, the net import percentage for natural gas was at its lowest point in 17 years at 10.8%, down from a peak of 16.4% in 2005.

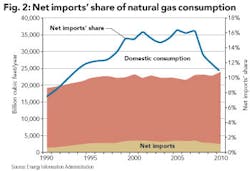

The impact on trade in dollar terms of the takeoff of natural gas production has been even more dramatic, if one allows that the increasing abundance of America's resources has contributed to lower market prices for natural gas. Lower prices have greatly reduced the cost of what natural gas the US still imports, even as the need for imports has declined.

In 2005 the cost of US net trade in natural gas was about $32 billion. For 2010 that had fallen to $12 billion, with roughly a third attributable to lower net imports and the rest to lower prices. So far in 2011, the net cost on the natural gas balance has fallen even further from a year ago, trailing 2010's January-September dollar figure by nearly one third.

Rising US supplies have also led to increasing interest in the prospect of LNG exports, with one new project recently approved and several more under review - contrasting with the many dozens of licenses being pursued just a few years earlier to import, rather than export, LNG.

Where do things go from here? To the degree that the US experiences a much-needed economic recovery over the next several years, American energy demand is likely to rise with economic recovery. Also, on the flip side, we have demonstrated that petroleum consumption is a key component to economic growth.

One thing is clear in the larger world energy picture: An ever-increasing share of Middle East petroleum is heading to supply burgeoning developing economies in the East, rather than Western economies. In fact, roughly three-fourths of Middle Eastern petroleum now already goes to Asia. Thus, supplies from the Western Hemisphere and from the US in particular, are of increasing strategic value. This is especially true, given that some 80% of the world's oil reserves are already controlled by government-owned national oil companies that are not always subject to market-based behavior.

The US is in a great position. According to a recent Goldman Sachs study, the US is on target to be the world's top producer of oil, bypassing Russia and Saudi Arabia in just five years. The US - especially its policymakers - cannot neglect the tools in its own hands that can enhance American energy security and increase the availability and affordability of energy essential to our economy.

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com