Navigating a fractured future

Insights into the future of the North American natural gas market

Peter J. Robertson,Deloitte LLP, San Francisco

Tom Choi,Deloitte LLP, Washington, DC

Over the past decade, the North American natural gas industry has transformed vast, previously uneconomic shale gas deposits into valuable energy resources. While the so-called "shale gas revolution" has dramatically revitalized natural gas exploration and production, increased supplies combined with the slowdown in demand resulting from the recent economic events have sent North American gas prices down dramatically.

Accordingly, North American gas producers are currently facing a great deal of uncertainty. To unlock the potential of shale gas resources, large investments are needed. However, the investment decisions require an understanding of the rapidly changing market dynamics related to new gas supplies and uncertain demand growth. Those decisions are complicated by a plethora of interrelated domestic and international forces that influence the natural gas market in North America.

Producers are asking many important questions, including:

- How long will US natural gas prices stay low, and will they ever achieve parity to other global markets?

- Will US shale gas production continue its rapid growth and eventually overtake conventional production?

- Will low natural gas prices stimulate significant additional demand in the US for power generation and for other sectors of the economy?

- How do changes in shale gas costs impact US production and prices?

- How will the anticipated increase in global liquefied natural gas (LNG) supply affect the US?

- Will the US ever import large volumes of LNG, and how much of the existing regasification capacity will be utilized?

- Alternatively, will the US become a long-term exporter of LNG?

- How will continuation of China's ravenous appetite for energy affect US and world gas prices?

- How will the announced nuclear shutdown in Japan, Germany, and other countries affect worldwide gas demand, and what are the implications for the US?

Applying an integrated North American model

In order to address many of these questions, Deloitte utilized the analytical capabilities of Deloitte MarketPoint LLC (Deloitte MarketPoint). Deloitte MarketPoint applied its integrated North American Electricity and World Gas Models to analyze the future of North American gas markets under a range of assumptions.

In our reference scenario we assumed current market trajectories will continue without any major regulatory intervention. Under this scenario, worldwide economic growth rebounds fairly quickly from the recent downturn and resumes steady growth. World gas demand grows by 1.9% per annum through 2030. It assumes no US regulatory policy restricting emissions of carbon dioxide (CO2), although there is tightening of mercury, nitrogen oxides (NOx), and sulfur oxides (SOx) regulations.

Even without carbon legislation, gas demand for power generation grows rapidly as gas becomes the fuel of choice for new domestic power plants. It also assumes no new regulations or restrictions on the application of the hydraulic fracturing process to produce shale gas. This scenario does not include the potential impacts from the announced shutdown of nuclear power plants in the aftermath of the Japanese nuclear disaster in March 2011.

We also looked at two alternative scenarios, one altering demand and the other altering supply. The first, referred to here as the "Grand Slam for Gas," is roughly based upon the high demand scenario described by the International Energy Agency's World Energy Outlook 2011. Under this scenario, global demand rapidly escalates as Asian demand, primarily from China, continues to grow at a rapid rate. Gas demand in China is projected to equal all of European gas demand by 2035. Furthermore, some leading nuclear power countries, including Japan, Germany, and the US, are assumed to shut down or scale back their nuclear energy production or expansion plans, leading to increased demand for natural gas.

Under the second scenario, referred to here as "Lower Shale Costs," we assessed the impact of lower shale gas production costs. While large volumes of shale gas are projected in the Reference case, much of it requires a relatively high wellhead price (> $5 per million British thermal units (MMBtu) to make production economically viable. What if the costs were dramatically lower as some have suggested? In the Lower Shale Costs scenario, we lowered the cost to produce shale gas by about 50% to assess the impact on domestic and global prices.

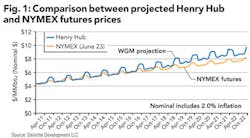

Figure 1 shows the various paths that benchmark Henry Hub prices follow under the Reference scenario and two alternative scenarios. Prices in this and other charts are shown in real terms (i.e., 2011 dollars), unless otherwise stated. The projections of Henry Hub prices rise above current levels under all three scenarios. In an absolute sense, relative to the Reference scenario, the price impact of the lower shale gas cost scenario is much greater than the impact of the higher gas demand scenario.

One of the most significant insights that can be gleaned from modeling these scenarios is that prices rise to levels that are higher than current market expectations, as reflected in recent NYMEX futures prices. Under the Reference scenario, natural gas prices in real terms (i.e., today's dollars) grow by about 50% between 2011 and 2020, or 4.0% per year. Prices escalate in real terms, reflecting demand growth, the rising cost of finding and developing domestic gas resources, and the projected future costs of pipeline and LNG imports.

However, despite burgeoning US demand for gas-fired power generation, natural gas prices are not projected to reach the peak prices seen several years ago. In this scenario, with increased production from shale gas and the availability of other supplies, production costs will play an increasingly critical role in determining the value of individual gas resources. Cost is projected to be the crucial driver to producer profitability.

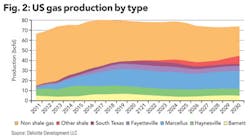

Based on these scenarios, our analysis also shows that basis differentials are anticipated to diverge from historical relationships as new supply basins grow in prominence. Prices in different regions are projected to grow at different rates, altering pipeline flows and capacity values. The biggest change takes place in the Eastern US, where increased production from the Marcellus Shale is expected to displace supplies from the Gulf and other regions - a displacement that is projected to reverse some regional pipeline flows.

The Western states, meanwhile, may experience rapidly rising supply costs due to an absence of significant shale gas resources, strong competition from other market regions for available supplies, and a regulatory environment that discourages LNG imports. As a result, prices are projected to escalate rapidly, which would leave California with some of the highest prices in North America. For midstream operators and investors, these basis shifts carry strong implications for the direction of flow and the value of existing and future pipeline capacity.

North American supplies, prices may soon begin to firm

The bottom line is that North American prices may soon begin to firm and more closely reflect the long-term marginal cost of domestic supplies. Under these scenarios, our models indicate that current market expectations, represented by the NYMEX futures prices, are too low to support the level of investment required to bring the necessary supplies on-line to meet projected demand.

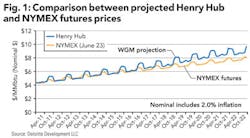

US natural gas demand, led by the power sector, is projected to grow rapidly, far exceeding the projected volume by the US EIA's Annual Energy Outlook 2011. Shale gas production is projected to increase to the point where it becomes the dominant domestic supply. However, it requires heavy investment that must be supported by sufficiently high prices. Furthermore, there are significant cost differences across shale gas fields, and prices typically reflect the costs of marginal fields.

LNG import facilities may continue to experience low rates of utilization in the near term, but the future could be brighter as global supplies are projected to almost double between 2011 and 2030 and more LNG could eventually reach US terminals once higher priced Asian and European markets are satisfied. Whether or not oil-price indexation continues as the paradigm for long-term LNG supply contracts is a key factor determining US LNG imports.

The two alternative scenarios demonstrate the importance of considering a wide range of market scenarios in order to provide a more thorough understanding of how markets are interconnected and how changes in variables affect the broader market. Under the rapid global gas demand growth assumed in the Grand Slam for Gas scenario, prices increase significantly, especially in Asia and Europe where LNG plays an important role in their supply portfolio. However, prices do not rise as much as many would expect from such a large increase in demand.

As the results from these scenarios imply, even large increases in global demand could be met without a huge increase in price as long as the demand growth can be anticipated by the market. The world has abundant resources, although much of it in remote and difficult locations, that should buffer price impacts of demand growth in the long run as gas producers and transporters respond to that rising demand and make decisions accordingly.

Under the Lower Shale Costs scenario, North American shale gas costs are assumed to be almost 50% lower than those in the Reference case. US prices fall sharply, but not nearly as much as the decrease in shale gas costs. Again, markets are interconnected and strong feedbacks take place that dampen price impacts. Shale gas production, projected to grow to comprise the majority of US supply under this scenario, displaces some non-shale gas supplies and almost completely drives out US LNG imports. Importantly, US gas demand is projected to grow sharply in this scenario as lower gas prices increase gas demand for power generation. The supply-demand dynamics must be properly considered in order to accurately forecast future markets.

While no analysis can remove all of the uncertainty about the "shale gas revolution," we see clear trends emerging with anticipated market shifts. Under any of the three scenarios we expect several key commonalities:

- Shale gas becomes the dominant US supply source

- Gas demand for power generation grows strongly

- Cost of US shale gas production is key

- Basis relationships change

- US natural gas prices rebound

A copy of Deloitte's full report, Navigating a Fractured Future, is available at: www.deloitte.com/us/natgas.

About the authors

Peter J. Robertson is an independent senior advisor to Deloitte LLP's oil and gas group. As the former vice chairman of the board of directors of Chevron Corporation, he has more than 40 years of industry experience and advises Deloitte's oil and gas leadership on critical issues facing the industry.

Tom Choi is the natural gas market leader for Deloitte MarketPoint LLC. He is an international energy economist and has led projects for leading energy companies around the world. During his 25-year career in management consulting, Choi has assisted senior management in client organizations globally, helping them make strategic decisions in the face of uncertainty and risk.

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com