Revenue rises 23% from 3Q10, income up 41% over same period

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

Revenues in the third quarter of 2011 dipped 3% over the second quarter but were still up 23% over the same quarter in 2010 for the group of publicly-traded, US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal. Net income for this same group of companies fell by 15% from the previous quarter, but grew by 41% compared to the third quarter of 2010.

For the 132 companies reporting third-quarter revenues, total revenue was just over $318.2 billion, down nearly $8.9 billion over the $327 billion reported in the 2Q2011. Revenues grew by more than $59 billion over the same quarter in 2010.

Net income for the group decreased by $5.4 billion from the second quarter to the third. However, the $30.6 billion in total income for the group represents a 41% increase in the third quarter of 2011 compared to the 3Q2010.

Year-to-date capital spending stood at $128.1 billion at the end of the third quarter, up $46.5 billion from the prior quarter. Compared to the same quarter last year, spending was up by nearly $32.2 billion, a 34% increase.

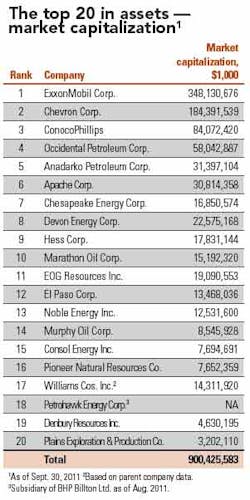

Total asset value for the combined OGJ150 group of companies grew to $1.29 trillion from $1.28 trillion – about a 1% increase – from the previous quarter. Assets were up by $129.4 billion over the third quarter of 2010, approximately a 12% increase.

Stockholder equity for the entire group rose 2% to $629.1 billion in the third quarter, an $8.3 billion increase over the second quarter. This figure increased by nearly $62.7 billion from the same quarter in 2010, representing growth of about 11%.

Largest in net income

The 20 largest companies ranked according to net income had $30.9 billion in collective net income for the quarter. This compares with $33.3 billion for the previous quarter, a decline of 7% for the group. However, net income grew by $8.1 billion from the same quarter in 2010, a 36% increase.

This $30.9 billion figure represents more than the $30.6 billion net income for the entire OGJ150 group because the remaining 112 companies collectively had a net loss.

Of the 132 companies in the group, 26 showed a net loss in the income column. Among the larger losses reported: $3 billion by Anadarko Petroleum Corp.; $428.7 million by Delta Petroleum Corp.; $88.3 million by Plains Exploration & Production Co.; $65.9 million GMX Resources Inc.; $27.5 million by FX Energy Inc.; and $10.2 million by Dune Energy Inc. Individually, some of the smaller companies had significant increases in net income, but in general the larger companies performed better.

The four largest companies in this category – ExxonMobil, Chevron, ConocoPhillips, and Occidental Petroleum – had approximately $22.9 billion in net income, up from $19.9 billion the previous quarter. This represents around 74% of the net profits of all 132 reporting companies in the group. ExxonMobil alone accounted for about 35% of the net profits of the OGJ150 group of companies. The Irving, Texas-based super-major had about 40% of the total revenue for the entire group.

The top five companies by net income for the quarter are ExxonMobil ($10.7 billion), Chevron ($7.9 billion), ConocoPhillips ($2.6 billion), Occidental Petroleum ($1.8 billion), and Devon Energy ($1.0 billion). They are followed by Apache Corp. ($1.0 billion), Chesapeake Energy ($922 million), SandRidge Energy ($636 million), EOG Resources ($541 million), and Noble Energy ($441 million). No. 3 ranked ConocoPhillips and No. 13 Marathon Oil have spun off their upstream business units from their other operations, and it remains to be seen how this will impact their rankings in future OGJ150 quarterly reports.

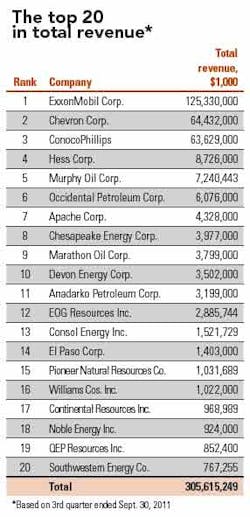

Largest in total revenue

The seven largest companies according to revenue are, in order, ExxonMobil ($125.3 billion); Chevron ($64.4 billion); ConocoPhillips ($63.6 billion); Hess Corp. ($8.7 billion); Murphy Oil ($7.2 billion); Occidental ($6.1 billion); and Apache Corp. ($4.3 billion). Chesapeake ($4.0 billion) moved up two spots from the previous quarter to No. 8 on the list, while Marathon ($3.8 billion) slipped a notch from No. 8 to No. 9; and Devon ($3.5 billion) moved up a spot to No. 10. The remaining companies on the list, in order, are: Anadarko ($3.2 billion); EOG Resources ($2.9 billion); Consol Energy ($1.5 billion); El Paso Corp. ($1.4 billion); Pioneer Natural Resources ($1.0 billion), a new member of the top 20 that debuts in the 15th position; Williams Cos. Inc. ($1.0 billion); Continental Resources ($969 million); Noble Energy ($924 million); QEP Resources ($852 million); and Southwestern Energy ($767 million). Newfield Exploration ($628 million) dropped out of the top 20 in revenue for this quarter.

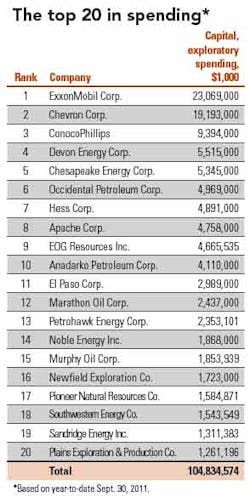

Top spenders

Spending by the top 20 companies in 3Q11 skyrocketed by 56% from $67.2 billion in the second quarter to $104.8 in the third. Compared to the same quarter in 2010, spending grew by 29%. The top 10 spenders were, in order: ExxonMobil, Chevron, ConocoPhillips, Devon, Chesapeake, Occidental, Hess, Apache, EOG, and Anadarko.

Fastest-growing companies

Tulsa-based RAM Energy Resources Inc. was the fastest-growing company as measured by stockholders' equity among the group. RAM Energy Resources grew by 265.9% compared to the prior quarter. RAM Energy's core producing properties are in Texas, Oklahoma, and Louisiana.

Another Oklahoma company, SandRidge Energy, based in Oklahoma City, was the second fastest-growing company. SandRidge recorded a 66.2% growth in stockholders' equity. SandRidge focuses its E&P activities in the Mid-Continent, Permian Basin, West Texas Overthrust, Gulf Coast, and Gulf of Mexico. The company recently entered into a $1 billion joint venture agreement with Spain's Repsol in the Mississippi Lime in western Kansas.