Benefits of structuring foreign energy investments through the Netherlands

Niels Geuze and Mark Rebergen

De Brauw Blackstone Westbroek New York BV, PC, New York City

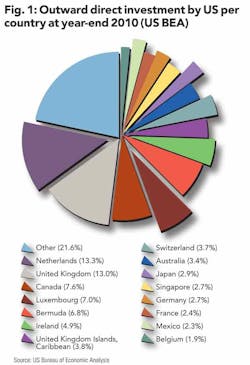

About the size of the state of Maryland and with 16.7 million residents, the Netherlands can be considered a small country. Its GDP of € 610 billion is slightly more significant and makes it the 20th-largest economy in the world. There is a statistic, however, that really stands out. In 2010, for the third consecutive year, the Netherlands ranked No. 1 when it came to US direct investments abroad (outward direct investments).

More than 13% of all US direct foreign investments, or $521.4 billion, was invested in the Netherlands in 2010 (see Figure 1 – US Bureau of Economic Analysis). According to the BEA, 73% of the US position in the Netherlands was accounted for by holding companies, which likely invested the funds in other countries or industries.

This article will explain – in brief – why the Netherlands is such a popular location for holding foreign investments. We will discuss some of the benefits that a US parent company (the "US Parent") may achieve when structuring its foreign investment(s) through the Netherlands. As these figures illustrate, many US multinationals, including energy companies, have already discovered these benefits. Others may still need some convincing.

The benefits: tax planning and more

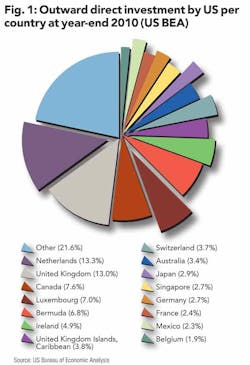

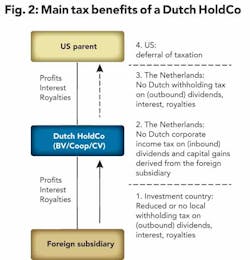

Holding companies in the Netherlands (a "Dutch Holdco") are generally used for international tax planning purposes. A high-level discussion of the main tax benefits that are available is included under items 1 through 4 below. Although tax is the main driver, there are other benefits too that deserve to be mentioned (see Item 5).

In general, and subject of course to certain conditions and limitations, the main benefits for a US Parent of choosing a Dutch Holdco for holding its investment in an entity (the "Foreign Subsidiary") in a foreign country (the "Investment Country") can be summarized as follows:

1. Deferral of US taxation

US corporates often like to defer their US tax liability on overseas profits by accumulating these profits in a foreign holding entity instead of repatriating to the US. Many US corporates have found that a Dutch HoldCo, in particular when it takes the form of a Dutch law limited partnership (CV), is particularly effective for this purpose. A Dutch CV can be structured to be tax exempt in the Netherlands while still being treated as a blocker entity for US tax purposes, to create a true zero-tax structure for accumulated overseas profits.

2. Reduced or no withholding taxes on repatriation to the US Parent

Reduction of withholding taxes is one of the main reasons for using Dutch holding companies. Many countries in the world levy withholding taxes on distributions of profits and on payments of interest or royalties, typically between 5% and 30%. These rates, however, are often reduced by bilateral tax treaties. The Netherlands has concluded tax treaties with more than 90 countries worldwide, many of which significantly lower or fully eliminate the withholding taxes levied by the relevant Investment Country. By investing through a Dutch HoldCo, a US Parent can often lower or eliminate the withholding tax that would have been levied if the US Parent invested directly in the foreign subsidiary.

An example: In Iceland, dividend distributions are in principle subject to 18% withholding tax, unless the rate is reduced under an applicable treaty. The tax treaty between the US and Iceland reduces the rate to 5%, but the Icelandic withholding tax is reduced to 0% if the dividend distribution is made to a Dutch HoldCo.

The reduction of withholding taxes in the investment country of course only pays off if the jurisdiction of the holding company in turn does not levy any significant withholding taxes. Although the Netherlands has a standard statutory withholding tax rate of 15% for profit distributions, an exemption (or reduced rate) is generally available under tax treaties, the EU Parent-Subsidiary Directive or if the shareholder is a Dutch company. A specific form of Dutch HoldCo (i.e. the Cooperative) can be designed in such a way that it is fully exempt from Dutch withholding tax on dividends. No Dutch withholding tax at all is levied on interest or royalty payments.

3. Full participation exemption for dividends and capital gains

In principle, a Dutch resident company is subject to Dutch corporate income tax on its worldwide taxable profits at a rate of 25%. However, the so-called "participation exemption" exempts dividends and capital gains derived from qualifying subsidiaries, including qualifying foreign subsidiaries. The participation exemption generally applies if the Dutch HoldCo owns at least 5% of the share capital of the foreign subsidiary. Certain other conditions apply. This feature of Netherlands tax legislation, combined with the absence of Dutch withholding tax as described above, adds to the image of a Dutch HoldCo as a "zero-tax holding company."

4. Other Dutch tax features

Although the reduction of withholding taxes and the absence of Dutch corporate income tax are often the main drivers, the use of a Dutch HoldCo may also be beneficial from other tax perspectives. The tax legislation of the Netherlands is generally considered to have a high level of sophistication but with a relatively low level of tax reporting and compliance requirements. It provides for a number of useful and internationally valued features that add to the attractiveness of the Netherlands as a tax planning jurisdiction. To name a few, the well-established advance tax ruling practice, a special preferential IP regime and opportunities for tax-efficient financing and licensing structures.

5. Protection of assets in the investment country

The Dutch tax treaty network has already been mentioned, but the Netherlands has also created one of the largest networks of bilateral investment treaties (BITs) in the world. Investors who plan to invest in countries in, for instance, the developing world can generally rely on these treaties if they structure their investments through a holding company in the Netherlands. The Netherlands investment treaties provide the investor with guarantees against, among others, expropriation without compensation, discriminatory treatment, and other unfair or inequitable treatment. The investor may enforce these guarantees in international arbitration and thereby obtain damages for any breaches of these guarantees by a host state.

While many other countries also have investment treaties, their networks are often substantially smaller, and their treaties may, for instance, require the investor to demonstrate significant presence in the country to be eligible to the investment treaties. A Dutch incorporated company typically does not need to demonstrate actual presence in the Netherlands to be eligible for protection under the Dutch BITs.

The Netherlands network of bilateral investment treaties spans approximately 90 countries, including China, Russia, and India, energy-rich countries such as Kazakhstan, and many other countries in for instance the developing world. In addition, the Netherlands is a member of the Energy Charter Treaty (ECT) which is ratified by 46 countries from Europe and Asia and which provides protection for investments in the energy sector.

That the bilateral investment treaties provide real protection is illustrated by the CME v. Czech Republic case. An arbitral tribunal awarded total damages of $350 million to CME because – in short – the Czech Media Council had practically squeezed CME out of its television business in the Czech Republic. After a failed attempt to annul the award, the Czech Republic paid the full amount of the award to CME. The importance of the Energy Charter Treaty is illustrated by the fact that investors in petroleum company Yukos have used the ECT to institute arbitral proceedings against Russia.

Other considerations

There are of course alternatives to the Netherlands as a holding company jurisdiction. Although it may be possible to achieve similar tax benefits in these alternative jurisdictions, there are other aspects to consider when determining the best holding company location.

Many jurisdictions require a certain level of "presence" (or substance) in their jurisdiction before they allow a company the benefits of their local tax legislation and tax treaties. A local address or even real office space, local bookkeeping and bank accounts, local resident employees on the payroll, local residents on the board of the holding company, and local board meetings are ways to create such presence.

Substance requirements vary from country to country; the requirements in the Netherlands are relatively low. Unlike many other jurisdictions, the Netherlands in most cases extends the benefits of its tax legislation and tax treaties to any Dutch incorporated company regardless of the local presence.

Widely appreciated is the well-developed Netherlands advanced tax ruling (ATR) practice, through which the Dutch tax treatment of structures or transactions can be confirmed in advance. Dutch tax authorities offer a quick and transparent mechanism to obtain tax certainty in advance and provide their confirmations in writing.

The Dutch tax authorities even have specialized teams with extensive knowledge in the field of energy and resources to assist Dutch and foreign companies in that sector. Contrary to other popular tax planning jurisdictions, the Dutch tax authorities, on the one hand, do not publish or otherwise share tax rulings with third parties and, on the other hand, do not impose any restrictions on the sharing of rulings with third parties such as foreign authorities and auditors.

One final aspect that also should be considered is the growing political attention for international tax planning. Rightly or not, some governments believe international tax planning by corporations causes their countries to miss out on considerable tax income. For example, a controversial legislative initiative known as the Stop Tax Haven Abuse Act was introduced in the US in 2009, and (a revised version) again in 2011. This proposal is not expected to become law any time soon, at least not in its current form. Whatever direction the political discussions may take in the coming years, it is good to know that the Netherlands is frequently considered to be a more robust choice compared to other jurisdictions with preferential tax regimes.

Set-up and compliance

The Netherlands is generally known for its flexible corporate law. A Dutch HoldCo usually takes the form of either a BV (a private company with limited liability, comparable to a German "GmbH" and a Luxembourg "Sàrl") or a Cooperative (a special form of an association, with members instead of shareholders). For some structures, a CV (a limited partnership) is the appropriate legal form. All three types of company have the flexibility to tailor the constitutional documents. Some time is required to set up the Dutch HoldCo, a minimum of one to two weeks on average.

Corporate services providers (or "trust companies") are often engaged to provide a local address, Dutch resident directors or employees (if needed), and keep the company compliant during its existence. Compliance usually involves preparing corporate action documentation, annual accounts, tax returns, and trade register filings.

In addition, from a substance perspective, it may be advisable under certain circumstances to hold a certain number of physical board meetings in the Netherlands. For US resident directors of the Dutch HoldCo this may be a nuisance, or a nice opportunity to explore Amsterdam, depending on one's view of the world.

All in all, the costs associated with setting up a holding company and compliance and substance requirements can be quite considerable. However, the benefits achieved through a Dutch HoldCo outweigh the costs significantly. Because of its long tradition as an open economy and a tax planning country, the Netherlands has an excellent economic infrastructure and the legal, tax, and accounting experts to provide the necessary support.

Final remarks

This article has briefly discussed the two main drivers for structuring energy investments abroad through the Netherlands: tax planning and asset protection. Although there is political attention for international tax planning, the Netherlands is often considered a robust choice. The protection offered by investment treaties can be very relevant and valuable, especially in the energy sector. OGFJ

About the authors

From left: Mark Rebergen, (partner) and Niels Geuze (senior associate) are lawyers at De Brauw Blackstone Westbroek. De Brauw is a premium international full-service law firm based in Amsterdam, the Netherlands, with additional offices in New York, London, Beijing, and Brussels. Rebergen and Geuze specialize in setting up international structures for their clients, including many in the oil and gas sector.

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com