Upstream News

Seventh Mozambique appraisal nets largest pay count for Anadarko

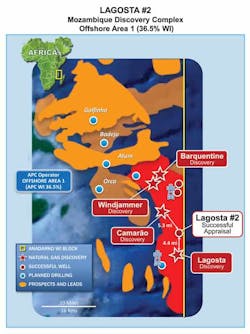

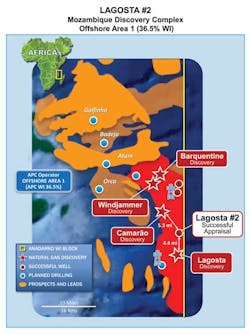

On January 17, Anadarko Petroleum Corp. announced its seventh well in the discovery area offshore Mozambique. The Lagosta-2 appraisal well, located about 4.4 miles north of the Lagosta discovery and 5.3 miles south of the Camarao well, encountered 777 total net feet of natural gas pay in multiple zones.

Across the 2.6 million acre Offshore Area 1 License, Anadarko estimates 15-30 Tcf of recoverable gas. This, the seventh and "largest pay count of any well in the complex to date," according to Bob Daniels, Anadarko senior vice president, Worldwide Exploration, helps support those numbers. The result beats appraisals at previous wells, including Barquentine-3 (662 ft), Windjammer (555 ft.), Lagosta (550 ft.), and Camarao (380 ft.). Just the Camarao-Lagosta portion of the Area 1 license could hold roughly 5 Tcf of recoverable gas, noted Global Hunter Securities in a January 17 note to investors.

"These excellent results continue to support our recoverable resource estimates of 15 to 30-plus Tcf (trillion cubic feet) of natural gas in the discovery area on our block, as well as provide additional information that will be incorporated into our models to help determine the optimal subsea development plans for the complex. In addition, a second deepwater drillship, the Deepwater Millennium, has arrived in Mozambique to begin an accelerated testing program that will include installing observation gauges and conducting several drillstem tests, as we remain on track to reach a final investment decision for this project in 2013," said Anadarko's Daniels.

The Lagosta-2 appraisal well was drilled to a total depth of approximately 14,223 feet in water depths of approximately 4,813 feet in the Offshore Area 1 of the Rovuma Basin. The partnership plans to preserve the Lagosta-2 well for future utilization during its planned drillstem testing program in the Windjammer, Barquentine and Lagosta complex. Once operations are complete, the Belford Dolphin deepwater drillship will be mobilized to drill the Lagosta-3 appraisal well.

While news of the successful appraisal well is certainly positive, GHS analysts note there is much work to be done. Anadarko now has to "start the long and expensive process of building up an LNG project."

Plans are for a two-train LNG project onshore Mozambique to export gas to Asian markets, with hopes to reach Final Investment Decision next year. GHS analysts point out that Anadarko "has little LNG experience and may bring in a more experienced player to share the downstream portion of the LNG project," but that the company is likely to develop the upstream on its own.

Anadarko is the operator of Offshore Area 1 with a 36.5% working interest. The consortium is in a good marketing position, with partners from Japan (Mitsui 20%) and India (Bharat Petroleum (10%) and Videocon (10%)), respectively the world's #1 and #9 LNG importers in 2010, according to GHS. Empresa Nacional de Hidrocarbonetos EP's 15% interest is carried through the exploration phase. Small cap partner Cove Energy holds an 8.5% interest.

While the long lead time of the project (first gas not expected until 2018) makes it difficult for the market to value, noted Jefferies & Co. Inc. analysts in a January 17 note, "we think a mark-to-market of Mozambique could come earlier than expected with the potential sale of Cove Energy. A $1 billion takeout of Cove would imply $8-9/share for Anadarko," noted the analysts.

—Mikaila Adams

OGX hits hydrocarbons in shallow waters of Santos Basin

OGX SA has identified the presence of hydrocarbons in the Albian and Aptian sections of well 1-OGX-63-SPS in the BM-S-57 block, in the shallow waters of the Santos Basin. OGX holds a 100 percent working interest in this block.

"This discovery is important for its huge hydrocarbon column and net pay identified in the Albian section, as well as by the quality of the Aptian reservoir and its behavior," commented Paulo Mendonça, general executive officer and exploration officer of OGX.

A hydrocarbon column of approximately 3,280 feet was encountered in Albian reservoirs with about 360 feet of net pay. The drilling of the well, which is still in progress, already reached the Aptian section of the reservoir identifying hydrocarbons through a high gas presence that resulted in a kick, which is already controlled.

The OGX-63 well, known as Fortaleza, is still in progress and located in the BM-S-57 block and is situated approximately 102 kilometers (63.38 miles) off the coast of the state of Rio de Janeiro at a water depth of approximately 155 meters. The Ocean Quest (mid-water semisub) initiated drilling activities on October 08, 2011.

Chevron subsidiary makes natural gas discovery offshore Australia

Chevron Corp.'s Australian subsidiary has made a natural gas discovery in the Exmouth Plateau area of the Carnarvon Basin, offshore Western Australia.

The Satyr-3 well encountered approximately 243 feet of net gas pay. The well is located 113 miles north of Exmouth in the WA-374-P permit area, and was drilled in 3,688 feet of water to a depth of 13,369 feet.

George Kirkland, vice chairman, Chevron Corp., said, Satyr-3 represents the company's thirteenth offshore discovery in Australia since mid-2009.

Chevron's Australian subsidiary is the operator of the WA-374-P permit area and holds a 50% interest, with Exxon Mobil and Shell each holding 25%.

World's first, modular small scale GTL facility passes Petrobras test program

CompactGTL, a provider of modular gas to liquid solutions, has provided an update on its plant supplied to Petróleo Brasileiro SA (Petrobras). Petrobras' CENPES Research and Development Centre has concluded its qualification test program of the world's first modular small scale GTL facility and has qualified and approved its process conception for use by Petrobras.

The CompactGTL solution offers an alternative to gas flaring and the plant incorporates all aspects required for commercial application in treating associated gas at remote onshore and offshore oilfield locations, including gas pre-treatment, pre-reforming, reforming, waste heat recovery, process steam generation, syngas compression, Fischer Tropsch synthesis, FT cooling water system and tail gas re-cycling, which can be integrated to a host facility or operated as a stand alone operation.

The proprietary mini-channel SMR and FT reactors, operating in conjunction with new catalysts coated on metal substrates (combustion, reforming and FT) demonstrate a compact, low centre of gravity GTL process for the first time.

Nicholas Gay, chief executive, commented: "It has been a real team effort working with Petrobras throughout the past year on this test programme which has produced some extremely positive results and has shown the plant can be robust, with the operational availability expected of large scale commercial facilities. We can now progress our plans in conjunction with clients throughout the world to develop commercial scale modular gas to liquid plants."

CompactGTL is predominantly backed by funds advised by Coller Capital, a global private equity investor.

Jeremy Coller, chief investment officer of Coller Capital, commented: "With this approval from Petrobras the company has passed a critical milestone, demonstrating its leadership in an area with the potential to be a game-changer for oil and gas exploration. I would like to thank Petrobras for its support during this important stage of the company's development."

CompactGTL is a UK based turnkey solution provider which has developed a modular GTL technology that handles the problem of associated gas. The solution empowers oil and gas companies to develop fields previously considered uneconomic in remote (onshore and offshore) or deepwater environments.

Chesapeake Energy to cut capital spending to dry gas operations

Chesapeake Energy Corp. has decided to cut natural gas directed spending for 2012 and redirect the savings to its liquids operations.

As part of the plan, the company plans to cut its operated dry gas rig count to 24 rigs—a decline of nearly 50 dry gas rigs from its 2011 average operated dry gas rig count. In two unconventional resource plays, the Barnett and the Haynesville, the Oklahoma City-based company plans to cut operated rigs down to six in each play and run 12 rigs in the dry gas portion of the Marcellus.

In addition, the company plans to immediately cut gross operated natural gas production of 6.3 bcf/d by roughly 0.5 bcf/d (an 8% reduction of the company's production and a 0.8% trim of US production) and defer any new dry gas well completions and pipeline connections.

As for spending, undeveloped net leasehold expenditures are expected to decline to approximately $1.4 billion, down 58% from similar expenditures in 2011. "Approximately 90% of undeveloped net leasehold expenditures are expected to target liquids rich plays and none of the capital is intended for new plays," noted Global Hunter Securities analysts January 23.

The reduction of dry gas spending was expected, but asset sales are still needed to bridge the company's funding gap, said Jefferies & Co. Inc. analysts the same day.

"Chesapeake plans to cut leasehold spending to $1.4 billion, net of JV reimbursements, from levels of $3.4 billion and $5.8 billion in 2011 and 2010, respectively. Our model already assumes this lower leasehold spending level: we assume $2.0 billion of gross spending and $500 million of reimbursements from assumed Mississippian and Williston JVs. Yet, we still see the funding gap at $7 billion. Asset monetizations are still needed to bridge the gap," said Jefferies analysts.

Monetization can take many forms for the company. Jefferies sees the options as follows: the sale of FracTech and Chaparral stakes, an IPO of Chesapeake Oilfield Services, VPPs and royalty trusts, JVs in Mississippian Lime and the Williston Basin, and potentially more midstream dropdowns. "We believe the sale of dry gas assets is also in the cards if CHK could find a buyer with a longer-term view of gas pricing," Jefferies analysts concluded.

Overall, noted GHS analysts, the announcement "should bode well for natural gas in the short term as the largest US rig operator and top five natural gas producer begins to put the brakes on most of its natural gas portfolio. Yes, the cure for low gas prices is low gas prices and this starts the process."

But is it sustainable?

How long will Chesapeake maintain this type of capital discipline and will other companies follow suit, wondered Stifel Nicolaus analysts in a January 23 note. "While CHK does carry significant weight, accounting for nearly 10% of the nation's gas production, given the highly fragmented market and smaller producer's need for cash flow, wide scale shut-ins may only occur when cash operating costs exceed spot prices. In April 2009, CHK elected to curtail 0.4 bcf/d of gas production citing low gas prices, only to reverse the decision shortly after as others operators did not follow their lead," the analysts noted. Given daunting storage numbers, however, this time around things may be different, they concluded.

—Mikaila Adams

Kuwait Energy finds oil in Gulf of Suez

Kuwait Energy plc has made a new oil discovery in Egypt's Ahmad-1X well, located in the Gulf of Suez's Area A concession.

The newly discovered Ahmad-1X well was drilled to a depth of 6,922.57 feet. The initial test recorded a flow rate of 890 barrels of oil equivalent per day from the Kareem formation level. This discovery brings the total number of oil, gas and condensate discoveries made by Kuwait Energy in Egypt, since 2008, to 14 discoveries, three of which were made in Area A.

Kuwait Energy is the operator of Area A and holds a 70% working interest. Omani independent Petrogas E&P holds the remaining 30% interest.

Kuwait Energy Plc deputy chairman and CEO, Sara Akbar, said, "The Ahmad-1X well is located in a potentially rich area and we look forward to continuing testing and development activities in the area to reach its maximum potential."

Egyptian operations contribute the largest share to Kuwait Energy's working interest production, comprising 17,700 barrels of oil equivalent by the end of 2011. Kuwait Energy is the operator of three blocks in Egypt, namely the Area A, Burg El Arab development lease and the Abu Sennan concession. It also has interests in two other non-operated blocks: Mesaha concession and East Ras Qattara development lease.

Pemex confirms Veracruz hydrocarbon find

The exploratory well Puskon-1, Petróleos Mexicanos (Pemex) drilled 37 miles off the coast of Tuxpan, Veracruz proved the existence of an active petroleum system in the area, recording a series of demonstrations of hydrocarbons.

The well was drilled in a water depth of 2,122 feet, in order to evaluate the potential for a possible formation of the Mesozoic, which extends over an area of about 7,722 square miles.

The Puskon-1 was set to reach a total depth of 26,657 feet, but confirmed the presence of wet gas at 23,622 feet and recorded temperatures and pressures higher than predicted at 25,039 feet.

Pemex is currently working on characterizing structural-stratigraphic and petrophysical aspects of the find in order to define its distribution and potential.

The company has also updated the geological-geophysical interpretations to propose a new location for future exploration to assess the potential of the oil objective.

Based on the rock samples and geophysical log analysis, Pemex was able to identify a thickness of 2,598 feet of rocks of Paleocene age, attractive porosities and two intervals of economic interest between 23,294 feet and 24,426 feet of oil.

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com