The high cost of overhead among large and mid-sized E&Ps

Steve Wright, Wipro Technologies, Houston

Many US exploration and production companies (E&Ps) have made some dramatic strategic changes in the past several years. Many have chosen to shed non-core assets and, in light of the current oil-gas price differentials, focus capital dollars toward liquids-rich and oil plays. While they have been quick to re-focus capital, they have not dedicated much attention to the allocation of human capital or to the development of low-cost operating structures.

Examining cost performance and resource allocation among large and mid-sized US operators, Wipro found that, relative to their larger peers, these operators devoted much larger portions of their general and administrative (G&A) budgets to non-core or back-office activities. Among large and mid-sized E&Ps, more staff was devoted to finance and accounting than to any other G&A area. To remain competitive, these companies must begin to reallocate resources toward greater investment in core activities. Here I examine what is behind the observed differences in core and non-core G&A spend, and what large and mid-sized E&Ps might do to address this imbalance.

Growing pains, support costs

In terms of domestic production, large and mid-sized E&Ps have grown at a much faster rate over the past five years than have the largest E&Ps. (Note: I define "large" and "mid-sized" E&P consistent with the framework used in IHS Herold's 2011 Global Upstream Performance Review.) And relative to their larger peers, large and mid-sized E&Ps are more likely to have a high percentage of their total production from natural gas. Although a gas focus in the current environment should imply a desire to keep costs down, the growing pains many companies have faced have doubtless added to their support costs.

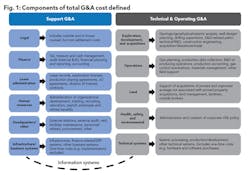

Wipro's upstream G&A Benchmarking Study, initially conceived at Arthur Andersen LLP in 1994, defines G&A to include all gross costs above first-level field supervision. It includes both in-house and outsourced costs. The study divides G&A into two components: Technical and Operating G&A and Support G&A, each of which should be managed differently from a strategic perspective (see Figure 1). Technical and Operating G&A is related to supervision of core activities central to the success of a competitive exploration and production company. Support G&A (often referred to as traditional overhead) is a necessary expenditure, but additional investments in those areas do not necessarily make for a more competitive E&P. Information systems span both types of G&A.

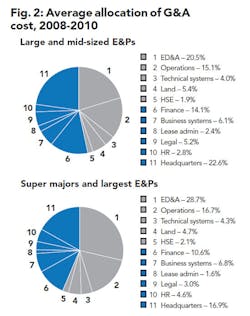

Figure 2 demonstrates how large and mid-sized E&Ps allocate their G&A in comparison to that of their larger peers. Note that the large grey area among super majors and the largest E&Ps indicates their relatively greater proportion of Technical and Operating (i.e., core) G&A spend. Note also the relatively bigger slices devoted to finance and headquarters among large and mid-sized E&Ps. Overall, these companies spent over 53% of total G&A in Support areas, whereas their larger peers devoted only 43.5% to non-core functions.

Some may argue the results in Figure 2 are a function of the relative positions on the growth curves of the two set of companies. Companies begin growth by hiring key leadership and management (i.e., high-salaried) staff and then add lower-priced talent in areas like finance and accounting. But neither that argument nor the greater economies of scale among the largest E&Ps explains why smaller E&Ps are relatively heavier in Support G&A per se. Our research suggests further these high costs among large and mid-sized E&Ps are not offset by significantly higher production. On a per barrel of oil equivalent (BOE), thousand cubic feet equivalent (MCFE), or revenue basis, these companies have higher G&A than their larger peers in all Support G&A areas other than Human Resources. On a production-normalized basis, their headquarters G&A spend is 73% higher than that of the largest operators, and their finance and accounting G&A is 65% higher. (The spend among these companies is higher than their larger peers in all finance areas listed in Figure 1.) Taken together, the percentages allocated to finance and headquarters are larger than those allocated to operations and exploration, development and acquisitions (ED&A).

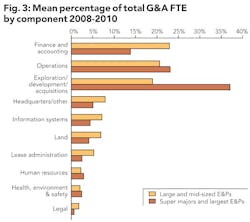

When one examines the allocation of full-time equivalent employees (FTEs), the differences between these two sets of companies are even more stark. Figure 3 demonstrates that, in terms of headcount, the largest single G&A area for large and mid-sized E&Ps is finance (accounting for nearly one-fourth of all G&A FTE). Altogether nearly one-half of the total FTE is comprised of Support (i.e., overhead) G&A at these companies, compared to less than 30 percent of the staff among super majors and the largest E&Ps. And large and mid-sized E&Ps devote relatively fewer FTE to the core areas of operations and ED&A.

Managing overhead costs

While it is fashionable to focus on cost management when commodity prices are low, in the current environment it is necessary to devote attention not simply to the application of capital to core asset acquisitions, divestitures, and development. The upstream industry's increasingly competitive nature will drive successful companies to move toward sustainable low-cost operations as well.

Specific steps such companies could take include:

- Outsourcing in select areas. The largest E&Ps and super majors have long recognized the cost benefits of business process outsourcing (BPO) in areas like accounting, procurement or information technology. Yet relatively few large and mid-sized E&Ps have taken this step, in part because of concerns it might backfire. They should investigate the long-term benefits of outsourcing functions where costs need to be lowered.

- Centralization and standardization of processes. Wipro's research indicates many large and mid-sized E&Ps do not maintain centralized or standardized processes and systems in areas such as accounting and lease administration. Reliance on manual systems and spreadsheets is especially common for ED&A; finance and accounting; health, environment and safety; and legal. In addition to lowering costs, standardization facilitates performance measurement.

- Development of a measurement culture. Other industries have long recognized the need to gather cost and performance data as part of a continuous improvement process. It is perhaps the best way to identify improvement opportunities and measure performance gaps. With sufficient data. benchmarking can also allow E&Ps to assess the impact of acquisitions, divestitures, reorganizations or other strategic changes.

- Targeting technology investment. Even smaller E&Ps should be leveraging technology allowing for production optimization, collaborative work environments, real-time data management, and remote field monitoring and centers of excellence. The benefits include streamlined information management (and reduced information management costs), and more productive workforces and asset bases as well.

Without changes, higher-cost large and mid-sized operators, particularly those with a natural gas focus, will face an uphill battle. Convincing senior management at these E&Ps that cost management is not a seasonal activity designed for a low price environment would be a useful first step.

About the Author

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com