Indonesia: Re-energizing the Archipelago

This sponsored supplement was produced by Focus Reports. Project Director: Mariuca Georgescu. Journalists: James Waddell, Herbert Mosmuller. Contributors: Marine Neveu, Solène Pignet, Aleksandra Klassen, Nala Nouraoui.Report Publishers: Crystelle Coury, Diana Viola. For exclusive interviews and more info, plus log onto www.energy.focusreports.net or write to [email protected]

Wayag Island, a series of uninhabited islands, rises out of the most biodiverse waters on the planet, Raja Ampat, West Papua, Indonesia. Courtesy of Niko Resources. Photo credits Agustiar Hamdani

For the first decade of the 21st century, the question troubling Indonesia's investors was: "Why is the country not growing as fast as the BRICS?" Yet, as Indonesia accelerated its growth to 6.37 percent in Q2 2012, and BRICS nations averaged out at 4.18 , that question has largely been muted. Satisfying the energy demand of this fast growing economy is hot on Indonesia's agenda and the issue facing investors now is how to invest in this complex, often challenging and multifarious energy market.

Facing Up to Reality

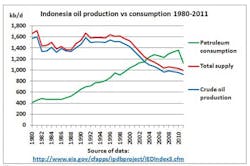

An unfavorable portrait of Indonesia's oil industry in 2012 would depict reserves falling faster than in any other Asian country, dropping 1.9 billion barrels since 1991 to just 3.89 billion barrels. Oil production would fare no better in this portrait with the country straining to reach a 900,000 bpd threshold, down from 1.7 million bpd back in 1980. Last year Indonesia faced a domestic supply deficit of 78 million barrels which deepened the country's reliance on oil imports. With around 60 percent of Indonesia's energy being government subsidized and a global Brent price consistently over USD 100 per barrel, the subsidy bill soared to USD 28 billion which almost negated the USD 30 billion Indonesia receives in oil export revenues; in 2012 the subsidy bill is projected to climb to USD 32.6 billion.

President Susilo Bambang Yudhoyono cited the problem directly in March: "The short-term energy issue which has now become the center of public attention is the skyrocketing global crude oil price," establishing the subsidy issue as a priority challenge for the government to address in 2012.

This portrait of an industry in decline clearly looks out of place next to a mantelpiece adorned with Indonesia's historic achievements in the oil and gas industry. Indeed the discovery of commercial quantities of crude oil in Sumatra just over 100 years ago led directly to the formation of Royal Dutch Petroleum, now Royal Dutch Shell. Indonesia was the pioneer of the production sharing contract (PSC) model in the late 1960s which made the country an instant hit with the international supermajors.

Moreover, the country pioneered the LNG export markets only losing its number one position in the last five years, and until exiting the organization in 2009 Indonesia represented the only Southeast Asian member of OPEC.

Prof. Dr. Subroto,

chairman BIMASENA

The odd juxtaposition of Indonesia's past and present states may be comprehensible to industry experts given the combination of what went wrong: a natural oil reserve decline, a lack of exploration activity and slippage in production schedules; and what went right: rapidly rising energy demand due to the growing affluence of the world's fourth largest population and a 6.37 percent growth in Indonesia's economy.

The trouble is that the new portrait is little understood by the population itself which continues to see Indonesia as a great world oil power in spite of reality. These persistent notions are politically paralyzing. In March this year, after the Indonesian government had scheduled to raise prices for subsidized fuel from USD 50 cents to USD 67 cents starting on 1st April, over 12 thousand citizens and trade union members preempted the price hike, taking to the streets of Jakarta in protest with a further 81 thousand demonstrating in the regions. These civil manifestations were sufficient for the government to back down on its proposed subsidy cuts, though few policy makers doubt the necessity of removing subsidies.

According to Dr. Subroto, a charismatic elder in the Indonesian oil and gas community, former minister of energy of Indonesia (1978-87) as well as being the longest serving secretary general of OPEC (1988-1994) the people must now be freed from their illusions. He says, "One of the biggest steps henceforth is to tell the population that Indonesia is not a great oil power anymore. The population is still under the illusion that Indonesia is oil rich, therefore we need to be more honest with the people."

The recently deceased minister of energy and mineral resources, Widjajono Partowidagdo, concurred that the first step must be for the population to face reality. He saw the removal of subsidies as the first step in creating a more balanced energy strategy, believing that freeing up subsidy money would allow investment in more fruitful energy sources and would stop cheap fuel prices constraining the development of alternative energies.

Something Old, Something New, Something Boosted, Something Blue

In 2011 Indonesia missed its oil production target of 945,000 barrels by 42,000 barrels, on the back of a ten-year decline in oil production. Yanni Kussuryani , head of Indonesia's state-owned oil and gas research organization Lemigas explained:

"There were several technical problems: most fields are brown fields in which production is declining, there were project delays resulting from planned/unplanned shut down as a result of repairing production facilities and there were delays in receiving drilling permits… Production will increase only as a result of intensive exploratory drilling activity, simplification of the drilling permits, speeding up the plan of development (POD) programs, and the application of enhanced oil recovery (EOR) technology on old wells."

Bedeviled by technical issues and heavy investment requirements, the question arises: why should any company choose to settle down with Indonesia? Since 1965 Lemigas has been answering that question, taking on the role of matchmaker for the private sector. Lemigas has been directing these international suitors to explore areas of untapped potential and assisting companies in their development programs.

Currently 87% of Indonesia's national oil production comes from mature fields in the West of the archipelago, and therefore Lemigas has worked extensively with Chevron Pacific Indonesia, Pertamina EP and Total in preparing EOR chemical injection plans and feasibility studies. Kussuryani points out that "Almost 20 percent of current production comes from EOR Duri steam flooding [Chevron's EOR program on their giant field located on Sumatra, West Indonesia]."

Owing to rapid but unsustainable extraction in the past, around 60 percent of Indonesia's oil is still contained in these mature reservoirs, and there is consequently a great opportunity to boost production from these reserves. In recognition of this potential, BP MIGAS recently imposed a mandatory requirement for EOR spending for all PSCs.

However, the main buzz currently surrounding the Indonesian upstream industry is less connected with oil than with the potential for giant new offshore gas reserves in the unexplored East of the country. Roughly 80 percent of new offshore discoveries are gas fields and the industry has been spurred on by the Abadi field discovery by INPEX on the Masela block, echoing its giant gas field discovery in adjacent North West Australian continental shelf – the Ichthys project.

Lemigas is now cooperating with Inpex on the Masela block which could become the first floating LNG plant in the world. International companies with substantial means and technological expertise therefore still have much to gain from Indonesia's sizeable dowry.

Eastern Promise

An alternative way of looking on the world's largest archipelago is to see it instead as the largest maritime nation and although Indonesia's strong agricultural past places a land-centric prism on its industrial mind-set, a succession of large gas discoveries offshore in the East of the country is drawing the major oil and gas players seaward. Ministry of Energy and Mineral Resources (ESDM) director general of oil and gas, Evita Legowo, outlined the major shifts now occurring in the country's upstream industry:

"Oil and gas companies should note that there are currently three major paradigm shifts occurring in Indonesia's oil and gas industry which present new opportunities. The first is the movement of production from the West, where most of Indonesia's traditional oil and gas deposits lie, to the East, which is a highly prospective region for future production. The second paradigm shift is the movement of production from onshore to offshore deposits and even deep-water E&P operations. The third paradigm is the shift from oil production to gas production."

Offshore production is naturally a high-risk, high-expenditure business which limits the number of players who can compete to the medium and large international oil companies and this limited competition is partly what attracts companies when domestic players are increasingly favored in land-based tenders.

This is an environment which is also being increasingly incentivized for investors. Offshore frontier blocks are now offering greater production shares for contractors and tax breaks are being incorporated for offshore construction, further sweetening the deal. MIGAS signed 11 new PSCs in the twilight of 2011 which saw offshore blocks going to international players like Hess, BP, Inpex, Statoil and Niko Resources.

Of the companies which have been building up their presence in this sector, Canadian junior, Niko Resources has been the most aggressive in the Indonesian offshore market currently operating 15 PSCs, owning a working interest in an additional seven non-operated blocks, and partnering with some of Indonesia's largest international producers including Norwegian deepwater specialist, Statoil.

In 2012 Niko Resources is launching what is expected to be Indonesia's largest ever offshore exploration program, having secured a rig contract from Diamond Offshore for four years, the longest in Indonesia's history. President director and general manager, Eko Lumadyo explained the strategy underling these ambitious plans stating that the focus will be on the East of the country:

"Regarding the transition towards the East, the majority of our concession areas are located in Eastern Indonesia and Niko Resources has certainly been expanding in this region. The reason for this direction is simply because Eastern Indonesia basins are under-explored basins and offer an opportunity for major discoveries. Across these blocks Niko Resources will pay particular attention to areas which are geologically analogous to major field discoveries on the Northwest Shelf of Australia and the nearby fields in Papua areas".

However, Lumadyo is under no allusions that the greatest challenge will come from operating in the East of the country far away from the current oil and gas support infrastructure and from their offices at the moment. He stated, "In case of an emergency it is necessary to have technical support facilities and safety measures in situ. These are the elements we are working on at the moment."

Picking the Hanging Fruit

Whilst offshore potential draws many of the larger companies, Jossy Rachmantio, chief executive officer of Mitra Energia, subsidiary of London-listed junior, Sound Oil, sees a rich crop of onshore opportunities emerging from Indonesia's past regulatory deficiencies which resulted in undercapitalized projects undertaken by often inexperienced E&P players.

"The key to success in Indonesia is targeting distressed assets and if you run statistics on the tendering rounds from 2003 up until now you see a high volume of acquisitions made between 2004 and 2006. In terms of the quality of investment made during this period you see a lot of small cap companies with no records and no technical background acquiring assets.

The Indonesian government was not experienced enough at the time to configure the bidding strategy to filter companies in terms of quality. This created a lot of horse-trading with high bids and it became a numbers game. This created a lot of assets which were over-capitalized in terms of commitments and on this basis one can calculate how long it would take for these assets to become distressed".

He continues explaining that between 2003 and 2007 service costs quadrupled which meant that many small cap companies were no longer able to fund their work programs and wells fell victim to underinvestment. In Rachmantio's eyes these trends have left plenty of hanging fruit for the picking.

Switching to a Balanced Diet

When Jero Wacik, the new minister of energy and mineral resources (ESDM), was appointed to his position in October 2011 the President assigned him one straightforward mission: to establish Indonesia's energy security. However, such benign simplicity belies the enormity of the ordeal facing the minister. The behemoth of domestic energy consumption looks set to triple in size by 2030 having grown 11 percent in 2011 alone. Wacik, who recently had to revise down his 2012 oil lifting target from 930,000 bpd, to just 881,000 bpd has recognized the futility of satisfying the beast with an oil industry beset by years of declining production.

However, oil is by far not the only crop on Indonesia's fertile territory. The Indonesian archipelago spans the equivalent distance of Florida to California and sequestered in and amongst its complex of 17,500 islands can be found practically every type of hydrocarbon energy resource ever lifted. Whilst Indonesia's declining oil reserves now place the country 28th in the world, it is up at 13th place in natural gas reserves - around 48.74tscf - and its unconventional deposits are even more impressive comprising an additional 453tcf of coal bed methane (CBM) - placing Indonesia fifth in global rankings - and 334.5tscf of shale gas. Indonesia is therefore a rich country in conventional and unconventional gas. It should not be forgotten that Indonesia is also the world's top coal exporter and ranks 4th in terms of global coal reserves.

The country's energy mix does not even stop with hydrocarbons. Given Indonesia's positioning on the world's most geologically active zone, "the ring of fire," Indonesia is also endowed with 40% of the world's geothermal energy potential. Indonesia also has possibilities in hydroelectricity, bio fuels, solar energy and even nuclear, albeit controversial.

That Indonesia thus far has not made full use of its rich resources is a source of bemusement to Suryo B. Sulisto, chairman of the Indonesian Chamber of Commerce (KADIN). He said, "It is the biggest irony that Indonesia is sitting on top of some of the most abundant energy resources in the world and yet cannot provide energy security to its population."

In his opening address to the 36th Indonesian Petroleum Association (IPA), Minister Wacik finally acknowledged the need to think differently about Indonesia's diverse sources of energy. Wacik declared that his target was now not only to increase oil lifting to over one million bpd by 2014 but that he was shifting the policy paradigm from "oil lifting" to "energy lifting" thereby bringing other energy resources within fold of state budget calculations - gas lifting of 1.3bboe will for the first time to be included in the 2013 budget.

Chief advisor to Yudhoyono and secretary general of the National Energy Council, Lobo Balia, elaborates on how Indonesia's energy policy is being redrafted. They are laying out a 2050 roadmap centered on domestic energy security and diversification out of Indonesia's traditional hydrocarbon paradigm. He explained:

"Indonesia needs to improve the efficiency of its energy sector and diversify our energy sources with new, unconventional and renewable energy as well as carbon capture storage. The share of coal bed methane (CBM) and shale gas will increase within the energy matrix. Indonesia will dramatically cut its use of diesel power plants. In the longer-term future we are going to use other resources than fossil fuels. The use of renewables will increase significantly, especially geothermal, solar, hydro, and bio fuel."

The diversity of Indonesia's energy resources offers a rich smorgasbord of feedstock to satisfy the ever deepening hunger for energy in a country steadfastly growing at over six percent year on year. The switch in policy focus from feeding external markets to feeding the domestic market also means that the advantages of oil's exportability have become less significant. Alternative energy sources within the energy basket offer a great opportunity to deliver power at a local level.

A Hot Topic

Under Presidential Decree No. 5/2006 and within Indonesia's 2025 energy diversification strategy five percent of consumption should be met by geothermal energy. The Ministry of Energy and Mineral Resources has set a 2015 target of 4,000 megawatt geothermal production, up from 1,400 today.

CEO of Australian-based Panax Geothermal, Kerry Parker explains that the attraction of the Indonesian geothermal sector is not just the fact that Indonesia has 40 percent of the world's geothermal potential. Parker says that, "Indonesia has taken the right approach in that geothermal is not an addendum to a clean energy policy or a renewable energy policy, but rather geothermal is considered as a broader energy security issue".

Parker explains that Indonesia is now looking beyond the old hydrocarbon paradigm, having realized geothermal's capacity to provide 28,000 megawatts of power to the domestic market including the 35 percent of Indonesia's 245 million-strong population which currently exists without electricity.

Geothermal energy faces many similar challenges to oil and gas relating to local authority permits, land regulations and dealing with land owners holding often spurious registration documents. But although these delays have grown in scope with the decentralization of governance, Parker found local government to be supportive of Panax' Sokoria project recognizing the potential of geothermal energy to end their power shortages.

Parker also saw the economics improving: "Many of the earlier geothermal projects had unfavorable tariffs but this is now improving. There is a USD 9.7 cents/Kwh minimum price which may be increased" improving overall profitability for the sector. Given this greater profitability, Parker identifies host of opportunities outside of Java and Sulawesi for small geothermal stations supplying local populations and industrial projects located far from existing energy infrastructure.

Gas on a Budget

Providing cheap gas is easier said than done on the complex archipelago where insufficient gas transportation infrastructure drives up operator overheads. In some cases the high cost of developing gas infrastructure will provide impetus for greater partnerships and tie-ins to existing infrastructure. Australian junior E&P company, AWE operates three blocks in Indonesia which are all at the exploration stage, however one of these blocks, Atlas 1, lies close to an existing gas discovery on the Bulu Block, with a different operator. President and general manager of AWE, Herry Wibiksana explains that:

"The distance [from the Atlas 1 block] to the discovery in the Bulu block is only 25km so we are hoping for a similar find. If there is another discovery on Atlas 1 then we would propose to develop this prospect simultaneously with the Bulu block operated by our partner in order to reduce costs by building a shared pipeline and minimize the risk of the project."

As a result of this emphasis on price reduction, Oscar Widiatmoko, the founder of Surya Manikam the official representatives of German Netzsch Pumps and American Peerless products saw a growing opportunity in rental markets. He explained that

"Price is our best competitive advantage, we are very flexible on that aspect because we can adapt to the needs of the companies. We always try to know what their budget is and we find solutions to accommodate it, such as finding local suppliers that are less expensive."

The Not-for-profit Gas Company

As gas looks set to play an increasing role in Indonesian power supply, potential investors are weighing up the economics. Soekoesen Soemarinda, former senior vice-president of Pertamina, now the Indonesian general manager of Singapore Petroleum Company, a part of PetroChina, explained: "Private companies have always been concerned that domestic gas prices will be too low to make gas sales attractive. Investors will compare domestic and export (LNG) gas prices and the price right now for the domestic market is around 5 USD per unit. However the export price stands around 9 USD."

For gas production in East Kalimantan, close to the Bontang LNG facility the lure of higher international LNG prices is prompting many conventional and unconventional producers to set up shop. However Soemarinda advises investors to forget profits and focus on Indonesia's domestic needs with potential rewards of gaining greater acreage from the government. In his eyes they should look to reduce production costs to create profitability.

Putting CBM on the Fast Track to Development

Indonesia's gas potential has energy leaders like director general of oil and gas, Evita Legowo seeing it as the main tool for guaranteeing Indonesia's energy security. Legowo regards coal bed methane (CBM) as especially interesting, stating that last year Indonesia launched its first CBM to power project and that on top of the 39 CBM contracts already signed and she was looking for 15 more in 2012.

She stated: "The gas pressure for CBM is less than that of conventional gas but this means that it can produce over a longer stretch of time. CBM is therefore the best gas for Indonesia's future power supplies and it tallies with Indonesia's present political strategy of using energy in an efficient and sustainable way."

However, the CBM industry in Indonesia is young and according to Sammy Hamzah, CEO of Ephindo, a domestic pioneer of the industry, it faces the problem of having a larger footprint than oil and gas while undergoing the same administrative processes. Nonetheless, Hamzah remained optimistic, saying that on Indonesia's first CBM to power project, local authorities were actually very easy to convince of the value of CBM given its potential to close the supply gap and end power shortages in the city. Hamzah is "confident that the domestic gas market will grow in its attractiveness for unconventional plays like CBM."

Hamzah went on to explain that East Kalimantan and South Sumatra were the coal rich regions of Indonesia holding 60 percent of Indonesia's CBM potential and that the interesting feature of the region was its proximity to the Bontang LNG facility allowing CBM to be channeled into export markets in CBM-LNG conversion. He even saw this as an opportunity for Indonesia to overtake neighboring Australia in CBM-LNG exports, as Australia will need several years to construct this infrastructure in Queensland and is subject to significant environmental issues.

Hamzah said: "With this in mind, Indonesia can be right on top of the global CBM production list and I believe 2012 will be an important year for Ephindo and this industry."

Building Connections

The new paradigm for Indonesia's energy strategy is to utilize energy to feed its domestic industries and generate GDP growth rather than to generate export revenues. Andy Sommeng, Chairman of BPH Migas, Indonesia's downstream regulator is therefore planning an extensive program of downstream infrastructure projects under Indonesia's Master Plan – an economic plan launched by President Susilo Bambang Yudhoyono in 2011 for Indonesia's economic development, fleshing out his vision to make Indonesia a top ten economy by 2025. Sommeng mentions a couple of projects:

"Indonesia requires better refineries and projects are underway to construct three new refineries producing 250,000 barrels per day. It is better than to continue importing fuel because of the value created by providing employment and security of supply in Indonesia.

By 2025 Indonesia's energy matrix will depend not just on oil and gas but also on nuclear, coal, geothermal, wind, wave, and solar energy. Indonesia needs as many specialist companies who can provide these new forms of energy to consumers as possible."

One of the international downstream players that started to develop infrastructure projects in Indonesia's downstream market following the market liberalization enshrined in the 2001 oil & gas law is Vopak, the world's market leader in tank storage. The company has started construction of a fuel terminal in Jakarta and a chemical terminal in Merak. Its managing director in Indonesia, Mark Noordhoek Hegt commented on Vopak's vision:

"When entering a market it is crucial for Vopak to understand who will be the players of the future. In Indonesia both international oil companies and national oil companies showed interest, which automatically sparks our interest in setting up infrastructure.

Indonesia is bringing more fuel into the country. We expect that there is ample room to improve the supply chain and logistics of the import and distribution flows in Indonesia. The logistic infrastructure has to become more efficient to service the downstream fuel market."

The World-Class Domestic Producer

Indonesia's oil and gas industry has for the past ten years been based on Law No. 22 of 2001 on Oil and Gas which still serves as the foundation for the upstream industry. One of the fundamental tenets of this law was the removal of Pertamina's responsibility for regulation thereby downsizing its scope of operations.

This measure was in part designed to make Pertamina more competitive and capable of competition on a global level. Former CEO of Pertamina, Ari Soemarno who was behind Pertamina's strategic vision to become a world-class oil company by 2023 explained to us that before his tenure was up he had attempted to negotiate a takeover of Indonesia's second largest domestic producer, Medco, thereby gaining access to assets in Libya. Although the Medco takeover proved unsuccessful it was part of a drive to take the company international and to some extent it has been continued by Soemarno's successor, who is globally the first female CEO of an NOC: Karen Agustiawan. In May 2012, Agustiawan was in Kazakhstan negotiating with the Kazakh national oil company (KNOC) where according to Agustiawan: "Pertamina and KNOC will study the possibility for exploration, development and production of hydrocarbons at various locations, domestic and overseas, including in Kazakhstan."

Five CEOs give their perspective on building Indonesia's energy infrastructure

In 2012 around USD 4.7 billion is projected for investment in energy related construction in Indonesia. Pandri Prabono, chairman of Indonesia's oil and gas construction association said that he can "see a significant change occurring in 2012 in comparison to the last few years. The future of infrastructure projects has become a lot more concrete and clear-cut. Consequently growth predictions are high and possibly as much as ten percent". But where will this infrastructure investment be directed?

Bambang Gyat, director of Indonesian engineering company ENERKON, which worked on the South Sumatra-West Java pipeline, a jewel in Indonesia's energy infrastructure, saw that "2012 promises to be a big year for the energy-related construction industry as all the stakeholders from government to private companies now recognize that energy infrastructure is the key priority for both the development of Indonesia and increasing production. One can observe this push particularly in relation to Indonesian gas infrastructure." In fact, according to Gyat, 2012 will offer growth beyond the capacity of local engineering companies stating that: "Currently local EPC contractors or indeed local engineering consultants and project management companies cannot fulfill the new projects being offered by the market." Gyat explains that the expansive market eliminates tough competition among local engineering companies meaning that the main challenge is simply convincing chief contractors and operators of their capabilities.

Steven Budisusetija, former president director of Tripatra, one of Indonesia's top three EPC companies alongside IKPT and Rekayasa Industries, concurred that he saw demand increasingly coming from the downstream sector in the form of FRSUs and regassification terminals given that the archipelago makes pipeline infrastructure mostly uneconomic. His successor Joseph Pangalila stated that:

"With more future development in offshore deep-water projects, downstream projects (LNG and Refineries) and mine and minerals processing, Tripatra has been preparing itself for these markets. Tripatra has started bidding for projects in this market segment with partner(s) in the form of consortia or joint operations"

The growth in the construction market has already resulted in a tripling of the company's backlog between 2010 and 2011. Tripatra was also invited by ExxonMobil to participate on the Banyu Urip field on Indonesia's Cepu block. Providing a degree of local know-how in handling this notoriously challenging project in regard to permitting issues, Tripatra has now created a corporate affairs unit to better support the project in dealing with the external conditions created by local government and local communities. Therefore where the company may require further development from a technical perspective, local knowledge provides them with an advantage in major projects.

Whilst opportunities are plentiful for standard EPC contracts, the technical challenges of new upstream offshore projects promise what James Tsang, operations manager of Wood Group Kenny Indonesia, sees as a "strong demand for specialized oil and gas engineering, including subsea and pipelines". Wood Group Kenny's presence in Indonesia was first developed thanks to their breakthrough project for BP's Tangguh LNG facility. After being convinced of the value of this market the company grew roots and expanded rapidly since then to become the leading subsea engineering company in Indonesia focusing on special materials. Tsang now sees a second wave in the growth of the market which was, "kick started by Chevron with Gendalo Gehem, but there are other deepwater developments coming up including Inpex's Abadi Field, ENI Jangkrik and Terang Sirasun". Tsang sees growth across the SEA region and highlights Indonesia as a center of engineering excellence for other regions.

Leaders of Indonesia's oil and gas industry recognize this need to go international indeed R. Priyono, chairman of BP MIGAS, Indonesia's upstream regulator said that:

"Pertamina will only improve by becoming more ambitious. The famous boxer, Muhammad Ali, became the greatest boxer and heavy-weight champion of the world because his sparring partner was always bigger and stronger than he was. This spirit must be brought to Pertamina, who must look internationally for their sparring partners and look to aggressively acquire blocks outside of Indonesia."

However, Priyono insists that this internationalization must come after its national responsibilities have been met. He stated that "Pertamina will be the backbone of Indonesia's future production and carries a great national responsibility to explore and develop these fields", but that the company must become more aggressive in developing their domestic assets.

In 2012 ESDM has much touted the possible revision of the 2001 law. The Indonesian government has now set a 2025 target of 50 percent production coming from local companies which apart from domestic producers, Medco and Energi Mega Persada, essentially means a much greater responsibility for Pertamina. A redrafted oil and gas law would therefore likely increase Pertamina's domestic role, taking it from having 25 percent rights to all new PSCs to having first right of refusal on all new blocks prompting the company to take a greater share of domestic production.

The question is whether Pertamina is ready for such responsibility in technical capacity terms. Developing the East Natuna block, one of Indonesia's most challenging projects with 70 percent CO2 content, prompted Pertamina to seek international expertise first with Norway's Statoil and then with Total.

Pertamina is also locked in extensive negotiations with Total regarding a potential 51:49 partnership on the Mahakham Block in East Kalimantan, although these are stalling on the fact that Pertamina wants operatorship. Indonesia's NOC has a steep learning curve ahead of it in the domestic market and it has domestic challenges, capacity building and new responsibilities to attend to before stepping onto the world stage.

A Teenage Revolution

Samudra Energy is one of the runner-ups among Indonesia's E&P companies and very close to the top three, according to its CEO Frank Inouye. He sees a major role for juniors in actually driving forward innovation in the industry.

Samudra Energy holds seven assets in Indonesia, out of which it operates five. The majority of these assets are located in central and south Sumatra. For the last two years Samudra Energy has been piloting a chemical enhanced oil recovery scheme, a technique that is just now just starting to be applied in Indonesia. "Players such as Chevron and Medco are looking at the technique as well, but I would argue we were the first to run an in-field pilot study," Inouye said.

He continued: "A lot of the new ideas on exploration and technology, on how to squeeze a little bit of extra oil out of the existing areas, will come from the smaller players. Historically the majors are the first to enter new areas, such as deep water and/or adopt new technology ideas but I believe this is changing and the entrepreneurial spirit of many smaller companies, such as Samudra, is challenging this tradition."

Allocating Resources - a Splitting Headache

Article 33 of the Indonesian constitution drafted in 1945, states that Indonesia's energy must be used for the maximum benefit of the Indonesian people but who decides this? 14 years after the fall of Suharto's authoritarian regime Indonesia is now a stable democratic country. Under Yudhoyono's leadership the country's 33 regional governors became democratically elected and whilst the fear of balkanization has largely been laid to rest, previous inequities in resource management meant that a side effect of this democratization process has been the decentralization of oil and gas governance. Satya Yudha, member of Commission VII of Indonesia's House of Representatives stated: "Through the process of Indonesia's democratization new stakeholders have entered the fray, and they are demanding their fair share of resources, benefits and investments".

Yudha points out that in the past central government has not always been the best arbiter of what is required to meet local energy needs highlighting that thanks to the centralized system areas such as East Kalimantan (an area around the size of New Mexico) on the island of Borneo is responsible for 54 percent of Indonesia's gas production, and yet the whole region including its capital city Sangatta suffers from rolling electricity blackouts.

On the other hand, there have been prominent cases of key national oil and gas projects undermined at the regional level. Indeed, Indonesia's largest oil discovery of the past decade, the Banyu Urip field on ExxonMobil's Cepu block, from which ESDM targets 165,000 bpd by 2014, was originally due to start production in 2012 but because of permitting issues at the regional level, was pushed back two years.

Madame Proust: In Search of Extra Time

Bulwark of Indonesia's national gas production, having occupied the top spot since it began production in 1968, is French company, Total E&P Indonésie. Total's president director and general manager in Indonesia, Elisabeth Proust, has recently been nominated as head of the Indonesian Petroleum Association and Focus Reports caught up with her to discuss the strong yet challenging position of IOCs in Indonesia.

How do you see the main challenges for an IOC in Indonesian production today?

Indonesia faces a strong need to accelerate the development of proven fields not yet in production and exploration to bring new reserves. In order to achieve this, the uncertainties both in the regulatory frameworks, in the stability of the contracts and in the future pricing mechanisms for gas must be eliminated.

The conditions for performing exploration work-programs must also be improved with rationalization of the regulations on local content in order to create a better match between the requirements and what is actually feasible.

These various issues have had a negative impact on the development of oil and gas projects and have slowed down production in Indonesia. The government must give confidence to the investors and provide attractive terms to promote the development of fields and exploration.

In the second half of the decade the PSCs of several IOCs will expire, including Total's Mahakham Block. In a climate of Indonesian production being increasingly offered to domestic companies, how is this affecting your investments on the block?

The Mahakam block has been the primary reason why Total is the number one gas producer in Indonesia. As such, the company's ongoing priority is to maintain a high production level from this field and Total still performs exploration and developments to achieve this. In terms of current activity the company is at the peak of its operations. Last year, Total drilled 125 wells when we had initially intended to drill 110 and every year we increase our investment budget – last year it stood at USD 2.3 billion.

Total is investing with the assumption of a positive outcome beyond 2017. However, soon Total will need to have an indication of the terms and conditions of its possible participation in the block after 2017.

Such regional involvement in energy governance inevitably creates bottlenecking for the producers and the service industry alike with operators facing a complex web of local stakeholders and suppliers achieving lower than expected financial returns due to project slippage.

Kuntoro Mangkusobroto, the head of the Presidential Delivery Unit, the Indonesian equivalent of the White House's West Wing, is responsible for overseeing the progress of the countries' national priorities as implemented by the ministries, resolving bottlenecks and managing the President's Situation Room.

"Two things were ignored at the time when the decision was made to decentralize: the capacity of the local government to manage their own region, and how local regulations would be issued. In the past twelve years almost 12,000 new local regulations were issued, and the majority of them are in conflict with the regulations of the central government. We have to rectify this, and today almost 10,000 of those 12,000 regulations have been resolved," Mangkusubroto explained.

Betting their Batam dollar on growth

Whilst Indonesia's energy focus will likely be directed inwards for the coming years, there is at least one region which will keep its eyes fixed on the horizon. Tucked just below the southern tip of Singapore lie the Indonesian islands of Batam, Riau and Karimun. Although Singapore has traditionally held the regional position as a strategic hub and headquarters for many companies in the marine construction and engineering industries, the city state suffers from a fundamental lack of space and human resources, which drives up operating costs.

Like a well rehearsed understudy waiting in the wings, Batam has always sought to share the limelight. McDermott first pioneered investment in Batam back in 1970 and Scott Cummins, senior VP & GM Asia Pacific feels that Batam was instrumental in McDermott's expansion in the APAC region which now contributes USD 1.9 billion in revenues, over half of McDermott's global turnover. He described the benefits of Batam:

"there are huge logistics savings brought through Indonesia's strategic location and proximity to fast growing oil and gas production in countries like Australia. The Batam facilities have steadily expanded through investment over the last 40 years thanks to the availability of land and labor. This expansion has allowed McDermott to attune to the increasing scale and complexity of projects in the Asia Pacific (APAC) region.

In 2011, McDermott's workforce in Batam peaked at 9,000 employees and although the cyclical demands for labor rise and fall, we have a very strong base level of engineers, 98 percent of whom are Indonesians. This high level of local participation makes the operation very competitive at the same time as providing jobs for Indonesia".

Even though McDermott has now established a new manufacturing base in China, Batam will continue to represent the regional hub for the company. McDermott's Umbilical, Riser, Flowline (URF) for INPEX-operated Ichthys LNG Project is their largest order internationally and will see the Batam facilities fabricating 16,000MT of subsea equipment from early 2013.

Assessing the growth of offshore and subsea projects in APAC and McDermott's involvement in projects from Inpex's Ichthys URF and Chevron's Gorgon project in Australia and Chevron's Gendalo-Gehem and Inpex-led Masela LNG in Indonesia, Cummins sees his Batam facilities as "well positioned to deliver on our client's needs."

However, the export-led growth model for Batam is under review. Indonesia's overall economic success is now more predicated on a growing domestic market which has been sheltering it from the vagaries of the global slowdown. As an export-oriented region, Batam's investment growth has fallen behind the rest of the country. The region is consequently changing strategy having initiated a 2011-2015 roadmap designed to develop their activities towards logistics and transshipment industries.

Asroni Harahap, deputy for supervision of the Batam Indonesia Free Zone Authority (BIFZA) explained that Indonesia is now turning towards transshipment. Given that the country can claim the same strategic position as Singapore on the major shipping routes between China, India and the Middle East and go one better on price and human resources, he sees this direction as vital for the region's economic future:

"The transshipment port project, designed to become operational in 2015, is a key element in our new economic strategy. Lying on the same shipping routes as Singapore, Batam can become a transshipment hub for the region and although geographically close to Singapore… the limited land availability in Singapore represents a limit on capacity and drives up the cost of transshipment creating opportunities for Batam".

A Deceptively Challenging Supplier Market

Ostensibly the Indonesian service market looks buoyant with projections of USD 21 billion investment in the oil and gas sector in 2012 driving a significant growth in the services market. Chevron alone will invest USD 7-8 billion in deepwater fields Gehem and Gendalo, Inpex is looking to invest USD 4.9 billion in its floating LNG platform on the Masela block and Total staked out USD 2.3 billion on its Mahakam block last year. And yet despite this growth opportunity, according to survey of 502 industry executives quoted by the IPA, Indonesia fell three places to 114th out of 135 countries in terms of its oil and gas investment climate.

Robert Harvey, president director of oilfield services company Weatherford, bemoaned that in spite of a record turnover for his company last year their return on investment was the lowest in the region. The trouble, according to Harvey, is that "There are too many punitive disincentives present in the government regulated tendering process. The main problem is that the process enables operator supply chains to manipulate the penalties of sanction points to their advantage. There also exists the operator's ability to pass its risks onward."

Measures such as the procurement regulations PTK007 introduced over the last five years draw the most fire from service companies. PTK007 privileges local service companies in contracts with a 35 percent minimum even when that becomes impracticable and results in an inevitable back and forth which means that tenders take on average three to five months longer than before to complete. Weatherford's own success in tenders for completion dropped from 28.8 percent to four percent from 2010 to 2011 simply as a result of changes in PTK 007.

Harvey said that the Q4 activity spike expected from Niko Resources and Chevron's West Seno projects should act as the foundation for a few relatively strong years, but further down the line the PSC expiry for Total in 2017, Chevron in 2018 and Conoco Phillips in 2020 will cause a dip in the market as equity is transferred to new owners.

Asked why Weatherford continued to invest in the market Harvey replied "the government is engaging us to address our concerns, to shed light on the problems and find solutions… When you consider the opportunity for change in Indonesia, you appreciate that the country offers vast potential for the growth of business".

Many high-quality service and equipment providers to the Indonesian oil & gas industry also have to deal with is the slow adoption of new technology. Swedish Alfa Laval, which develops heat transfer, separation and fluid handling technologies, knows the issue all too well. Andre Tjhai Tjin Fung, managing director of Alfa Laval in Indonesia explained that as is the case with the oil & gas industry in many other countries, it takes the industry in Indonesia time to adopt new technologies, and this can indeed be a challenge to innovative equipment providers like Alfa Laval. This situation is mainly due to long decision making processes that involve comprehensive approval & licensing. To overcome this challenge, they must involve many parties to find out when our new technologies can be implemented.

Investment Perspectives

A question to Chris Wren from the British Chamber of Commerce, Andrew White from the American Chamber of Commerce, Nicolas Cambefort from International French Chamber of Commerce and Industry and Ananda Idris, from Intsok Indonesia, on doing business in Indonesia.

Would you give your perspective on the main opportunity and challenge for companies from your country operating in Indonesia's energy industry?

IFCCI: Advantage: French companies present in Indonesia are complementary, the big ones bring the financing and the smaller ones bring the specified expertise and know-how. Challenge: the recent regulations encouraging domestic and national companies over foreign ones might have reduced the optimism to invest in the long-term in Indonesia."

British Chamber: "The UK is back on the map as being a provider of quality technology— In the list of British energy companies growing and investing in Indonesia I would mention BP and Premier Oil. Regarding smaller players, Business is very difficult for foreigners, instead of trying to be completely autonomous, they need to build and use local networks first."

American Chamber: "American companies have the best technology and processes, and most importantly they do what they say and stand by their commitments. Clean energy is one area where there is tremendous opportunity. However, current regulations make it difficult to start up a new enterprise to the detriment of local firms and investors."

Intsock: "Norwegian companies have competencies that can be of great value here in Indonesia. They can bring beneficial knowledge and change certain processes such as in deepwater drilling, in EOR, or creating the gas value chain. However, their prices and costs are high. Norwegian companies are used to operating at very high cost in the Norwegian Sea, but I do not think that it is realistic to expect to operate at the same costs in Indonesia."

Regulations like PTK007 force international suppliers to engage in localizing strategies. One of Japan's leading EPC companies, Toyo Engineering is doing just that. Jae Yong Choi, Chief Representative of TOYO Engineering in Jakarta, comments on their recent moves:

"Localizing is one of the priorities of our strategy. We have built excellent relationships with local companies over time. We believe that harmonizing with the local enterprises is the most significant key factor to conduct successful business in Indonesia. This is why last year we achieved a very important milestone in that regard with the decision to acquire a major share in a local company called IKPT. We are a global company, but we like to act local."

A Talent for Service

Where supplier costs are being squeezed, one resource which continues to carry a high value in the industry is people. On the back of a decade-long EPC partnership with Total E&P Indonésie in Balikpapan, French company, SPIE Oil and Gas was approached to provide expertise and staff replacements. SPIE's director in Indonesia, Samir Abbes explains that the human resources challenge, was more acute in Indonesia because of a growing respect for the country's engineers. Abbes said:

"From 2003 to 2007 it was easy to find local people to work on these projects. Local content was not a major issue at the time. However, from 2008 onwards many oil and gas companies especially from the Middle East came to Indonesia to recruit Indonesian specialists to work on their projects in the Middle East, Malaysia, Singapore, Kazakhstan and even in Europe."

SPIE, which provides training and expertise services, now sees an opportunity to establish Indonesia's largest training facility within the next five years in order to support Indonesia's major transitions in energy projects. Abbes explained that there are a limited number of training facilities in Indonesia with many of them utilizing obsolete equipment. SPIE which now has 665 employees doubled its growth between 2010 and 2011 and through its planned training center intends to explore the opportunity to provide for Indonesia's higher value niche industries such as geothermal and CBM.

Final Perspectives

The mood in Indonesia's oil and gas industry is a little somber given the lack of major discoveries for over a decade, falling oil production levels and troublesome transitions from the domestic takeover of expiring PSCs to local content clauses. Yet, having placed energy security as a key focus in Indonesia's policy framework and in view of the ravenous domestic market for energy as well as the diversity of resources in the energy basket, Indonesia offers up an archipelago of energy opportunities.

Whilst in the past Indonesia might have envied membership of the so-called BRICS nations, the sight of nearby neighbors India and China beginning to lose puff might inspire Indonesia to instead identify more with the MIST nations (Mexico, Indonesia, South Korea and Turkey) whose steadier movement to the front of the field looks set to be a feature for the coming years. Indonesia now hopes to keep pace with more sustainable energy.