M&A activity increasing with large deals struck in the US

Ronyld Wise, PLS Inc., Houston

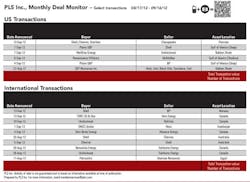

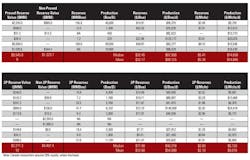

Major oil companies (including Shell, Chevron and BP this month) are increasingly active in the global upstream M&A markets. This month, U.S. deal value surged to $11.8 billion in 32 deals versus $2.9 billion in 35 deals last month. In Canada, deal value totaled $964 million in 11 deals (vs. prior month of $18.4 billion – including the $17.9 billion CNOOC/Nexen deal - in 4 deals) and internationally, deal value totaled $6.1 billion in 10 deals (vs. prior month of $1.8 billion in 9 deals).

In the US, Plains E&P surprised the markets with two back-to-back acquisitions in the deepwater Gulf of Mexico for $6.1 billion. The deals bring 67,000 boepd of production (87% oil with LLS pricing) and are expected to generate $4 to $5 billion of total excess cash flow from 2013 to 2016. PXP paid $5.5 billion for BP's interest in select deepwater fields including 100% operated interests in Marlin, Dorado, King and Horn Mountain plus a 50% operated interest in Holstein. PXP picked up the remaining 50% interest in Holstein from Shell for $560 million. Assuming $100 oil and $3.00 gas, PXP paid 3.5X cash flow which compares to PXP's pre-deal corporate EV/Cash Flow multiple of 5.4X. Together, the deals transform PXP and shift the operational profile to two-thirds Gulf of Mexico, one-third onshore. PXP plans to de-leverage by, among other things, divesting $1.5 to $2.0 billion of non-op gas assets.

In another impact deal, Chesapeake sold the majority of its Permian basin assets, representing 6% of CHK's reserves and 5% of production, in three separate deals for a total of $3.3 billion. PLS values this total at about $15 per boe or $60,000 per boepd and $1,000 per undeveloped acre. In the southern Delaware basin, Shell paid $1.9 billion and picked up 618,000 net acres and 26,000 boepd. Chevron bought the northern Delaware basin package and got 246,000 net acres and 7,000 boepd. Earlier in August, EnerVest bought the Midland basin package getting 101,000 net acres and 7,000 boepd.

In the Bakken, QEP Resources paid $1.4 billion cash for 27,600 net acres in a sweet spot adjacent to the western border of the Fort Berthold reservation. Sellers included Helis, Unit Corp., Black Hills E&P, Sundance Energy and others. Current production is 10,500 boepd (90% oil). PLS values the transaction at $99,000 per boepd and $15,000 per acre based on an estimated 22,960 net undeveloped acres. The acreage is yielding above average EUR's from the Bakken and Three Forks/Sanish zones of 1.16 MMboe and 0.9 MMboe, respectively.

In Canada, NuVista completed a significant milestone in its transformation by selling 3 packages for $241 million. The sold assets include a large portion of NuVista's W5 gas assets plus select heavy oil assets W4. In total, NuVista received about $2.00 per Mcfe 2P (60% proved gas, 69% gas). Likewise, Fairborne Energy is transforming itself and sold two packages for $184 million. Fairborne is now a Deep Basin focused growth company and will have virtually no debt.

Internationally, the highlight is in Australia where Shell and Chevron swapped assets to bolster respective LNG projects. Shell is acquiring Chevron titles in the Browse area (operated by Woodside) including a 16.7% interest in East Browse and a 20% interest in West Browse. Post-transaction, Shell's ownership jumps to 25% in East Browse and 35% in West Browse. To secure the deal, Shell paid $450 million cash and contributed to Chevron its 33.3% interest in the Clio-Acme fields (supporting the Wheatstone area LNG resource base) boosting Chevron's stake to 100%. Based upon an April 2012 $2.0 billion Browse deal sold by Woodside to Mitsubishi and Mitsui, and the cash paid to Chevron, PLS estimates that Shell paid $2.3 billion in cash and assets while Chevron paid $1.9 billion in assets.

Looking forward, large deals hitting the market as of mid-September include the potential sale of Yates Petroleum, Plains E&P divesting Haynesville and Pioneer shedding the Barnett. In Canada, PennWest is targeting sales up to $1.5 billion and Encana continues to seek a partner for its Cutbank Ridge resource play. Internationally, Videocon is looking to sell 10% of Mozambique's Rovuma offshore Area 1.