Unaware of unknowables: attempts at tax reform in Alaska

Roger Marks, Petroleum Economist, Anchorage, Alaska

In 2007 the State of Alaska enacted an increase in the production (severance) tax rate for oil and gas on the North Slope. The new tax was called "Alaska's Clear and Equitable Share," or "ACES."

The tax is a significant revenue component for the state. In 2011 it accounted for about 60% of Alaska's total general unrestricted revenues. Along with royalties, property tax, and state corporate income tax, oil (and gas to a much smaller extent) accounted for 91% of state revenues. In addition, the producers pay a federal corporate income tax.

The tax is based on pre-tax net value (market price less downstream transportation costs [pipeline and marine shipping] and upstream capital and operating costs). In 2011 the estimated downstream costs were $9/bbl and the estimated upstream costs on existing fields were $18/bbl. At the average Alaska North Slope (ANS) West Coast market price in 2011 of $118/bbl, the effective tax rate, including all state and federal taxes and royalties, was 75% of net income, of which 41 percentage points of those 75 percentage points was the production tax.

The tax has a base tax rate of 25% on the net value of oil, the value after all exploration, development, production, operating, and transportation costs are deducted. There is also a progressivity element that is added to the base tax rate. The tax rate rises as per barrel net value increases, and is applied to the total net value. Progressivity starts as per barrel net value rises above $30/bbl. Progressivity rises at a rate of 0.4% for every per barrel dollar of net value above $30. Above $92.50/bbl in net value the progressivity rate increase drops to 0.1% per dollar of net value. ACES also contains several credit provisions, most notably a 20% credit on capital expenditures.

Over the prior 20 years the production tax system was based on an "Economic Limit Factor," or "ELF." Under that system a tax rate based on gross income was determined by field based on average well productivity and production. A field that produced 150,000 bbl/day would get 300 bbls/well/day tax free. As daily productivity increases the field would get relatively fewer tax free barrels per well per day. As daily productivity decreases the field would get relatively more tax free barrels per well per day. By the time the ELF regime ended in 2006 the average production tax rate on the North Slope was about 7.5% of gross. Some very large fields such as Kuparuk, producing at about 100,000 bbls/day, paid no tax. In addition, all small fields of less than about 20,000 bbls/day paid little or no tax.

ACES has resulted in much higher production tax revenues than would have been received under ELF, especially when coupled with recent high oil prices.

As stated above, when the progressivity surcharge kicks in at the $30 net value trigger, it applies to the entire net value. As the price goes up, the tax rate on all dollars of value is drawn up. This creates high marginal tax rates. At $120/bbl market price the marginal tax rate (including all state and federal taxes and royalties) is 92%, of which 74% is from the production tax. High marginal tax rates eliminate much upside potential, important in investment decisions.

As a result, many people have concluded that the taxes under ACES are excessive in being internationally uncompetitive, with the result being a decline in investment and production in Alaska. The author has opined this perspective.

There are opposing views, as well, that believe reducing the tax will not generate more investment and production, and consequently, consider the current tax adequate. The rationale for those views is the subject of this paper.

The 2011 Alaska's governor proposed a bill to reduce the tax (HB 110). The House of Representatives passed the bill that year. The Senate took up the issue in 2012 (the second year of the two-year legislature).

The author was a consultant to the legislature on these matters, mostly to the House of Representatives.

The Senate did not pass the legislation, concluding that reducing taxes would not lead to any palpable increased investment and production, but rather would lead to a loss of revenue.

This outcome was based on a series of perceptions regarding how tax reform would or would not affect investment, production and tax revenues. These perceptions entailed comparisons between what was observable under the status quo, and what might happen under alternative tax structures.

Of course the outcomes of alternative histories are unknowable. I call these "ghosts." While they are not physically present, they are necessarily very much alive when contemplating what may have resulted had circumstantial inputs been different.

The tax structure is a significant determinant of the investment climate, exceeding development and production costs. The perceptions involving the possible outcome of those alternative tax structures must embrace implicitly different inputs to the investment climate, which would produce outcomes different than the status quo.

In some cases different tax structures were examined, but with the investment climate (amount of investment) unchanged. Because the tax structure affects the investment climate, however, the conclusions drawn about how tax reform would affect investment, production, and revenues may be drastically different from what could actually occur.

This approach by the Senate entailed deriving the same explicit outputs while using different implicit inputs. I will refer to this method as DIRE reasoning, Different Inputs: Results Equal. It is problematic in that the perceptions involving the possible outcome of those alternative tax structures must embrace implicitly different inputs to the investment climate.

The paper examines the areas where this occurred. It reviews the process by which the prospective tax reform was analyzed. Three areas are identified where the analysis implicitly assumed the same tax investment climate under different tax structures.

The principle of corporate profit maximization for investment decisions is assumed.

DIRE reasoning

The 2012 legislative debate on tax reform, which resulted in no tax reform, was shaped by three significant examples of DIRE reasoning, which formed the perspectives of the Senate leadership.

Past production decline rates

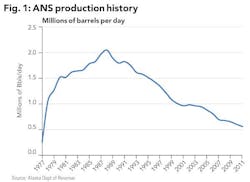

During the ELF era (1977-2006) production declined from a peak of 2 million bbls/day in 1988 to 840,000 bbls/day in 2006. Some used this to conclude that this decline, coupled with the relatively low taxes at the time (especially the latter years), meant that lower taxes would not cause increased investment and production.

Figure 1 shows ANS production history.

This is a DIRE approach simply because nobody knows what the decline would have been had taxes been higher. In 2011 the ELF rate of 7.5% of gross would have had an effective tax rate of 56%, as opposed to the 75% under ACES.

Moreover, that production peaked at such a high level is notable. During that period over thirty fields were developed; two have been developed since. (It is recognized that in an oil province each subsequent field is generally more difficult to produce.) Oil prices averaged $18/barrel during the ELF era.

Investment response to investment climate/production response to investment

State forecasts are that nearly 90% of all future production will come from existing fields. Producers are currently investing $1.5 billion annually in these fields, mostly for maintenance. This is about the same amount invested in 2007 ($1.3 billion) when oil was $60/barrel.

Elsewhere worldwide investment has soared at higher prices. Of the three major North Slope producers, BP, ConocoPhillips, and ExxonMobil, worldwide capital expenditures and investments increased from $53 billion in 2007 to $82 billion in 2011.

The Department of Energy estimates there are 5 billion barrels of potential reserve growth from existing North Slope fields. Two billion barrels of this is conventional oil, not heavy or viscous oil.

These fields contain hundreds of structural and stratigraphic traps/isolated fault blocks. It was these fault blocks, coupled with advances in horizontal drilling, that led to the proliferation of fields in the ELF era referenced earlier.

In addition, capital is necessary for producing the existing fields, and for processes that expedite production sooner from these fields.

The producers could be investing less, reducing production. Or they could be investing more, increasing production. The decline rate is not fixed.

Yet there was a belief in the Senate that production in the existing fields would not respond to additional investment. As a result the legislation finally proposed by the Senate (and rejected by the House) only addressed new fields.

Two other beliefs led to this reasoning. First, it is plausible that many unfunded projects would be profitable, even under the existing tax structure. Accordingly, it was thought that if they were profitable, then they do not need tax reform.

However, corporations have a finite amount of capital to invest. Cash flow is limited. Borrowing is capped to preserve the desired capital structure. Thus not all profitable projects get financed, only the most profitable ones. Jurisdictions compete for capital. Capital is fluid and goes to where it gets the best deal. There are no shortages of worldwide opportunities. (Oil reserve growth is up 60% worldwide over the last 20 years. The reserve to production ratio is currently 55 years, up from 45 years 10 years ago. In 2011 alone 270 billion barrels of reserves were added, 8 years of consumption.)

In addition, it was pointed out that Alaska is relatively very profitable on a BOE equivalent basis. However, Alaska is nearly 100% oil and no natural gas for the three major North Slope producers, where worldwide oil is only 48%-54% of their hydrocarbon production. On a BTU equivalent basis oil has been worth nearly 10 times as much as gas.

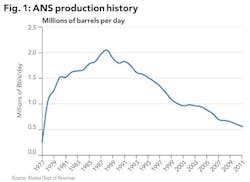

The second belief that led to the reasoning that tax reform is not necessary relates again to perceived profitability in Alaska, only relatively so. Figure 2 shows the effective tax rates for a multiplicity of jurisdictions as prepared for the Senate by PFC Energy.

Alaska ranked 14th highest out of 51 jurisdictions, and many deemed that to indicate adequate competitiveness. However, in comparing fiscal regimes it is necessary to look at comparable jurisdictions. Comparable jurisdictions means places with a comparable risk/reward balance, in terms of features such as reserves, costs, and geological risk.

Albeit ascribing Alaska's "peer" group is a matter of judgment, it is necessary to come to terms with whom Alaska is competing.

The author has suggested in the aforementioned referenced material that comparable jurisdictions are other North America jurisdictions, Arctic jurisdictions, other tax and royalty regimes, and places with similar production and reserves. Compared to its peers Alaska's taxes are very high. (In that analysis Alaska was fourth highest out of 24 regimes. For 17 of those regimes Alaska's effective tax rate ranged from 12 to 37 percentage points higher. At a $118/bbl market price, and a $91/bbl net value, each percentage point difference is worth 91 cents/bbl after-tax.)

Because of taxes, given a pre-tax net value, producers can demonstrably make considerably more money nearly anywhere else in the other comparable jurisdictions than in Alaska.

Thus in summary, DIRE reasoning led to the conclusion that changing the investment climate (competitive taxes) would not change investment, and that greater investment would not increase production.

Comparing revenue estimates between different tax structures

The third pattern of DIRE reasoning stemmed directly from the second. In looking at the fiscal (revenue) impact of reducing taxes, the Senate used the Alaska Department of Revenue (DOR) fiscal note, which embraces their production forecast. The fiscal note used the same number of barrels under all tax plans. So a reduced tax could not but show a revenue decline.

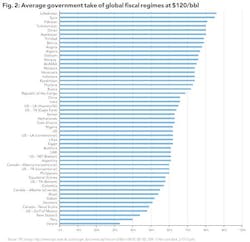

These production forecasts are notoriously too high. Figure 3 compares two items. The top line shows the production forecasts DOR made between 1995 and 2006. It shows the forecast for five years out. For example, for 2005 the top line shows the forecast they made in 2000 for the year 2005. Second, it shows the actual production for the year indicated. For 2005 the bottom line shows actual 2005 production. So the two lines compare what was forecasted and what actually happened. It shows the forecasts made in 1995-2006 for the years 2000-2011. The forecasts have averaged 27 percent too high over the period. This has continued. Since 2006, the forecast for 2016, for example, has cascaded down each year from 737,000 bbls/day in 2006 to 550,000 bbls/day in 2011.

The DOR production forecast does not consider availability of capital. It uses decline curve engineering models that generate forecasts of produced barrels without regard to the economics or relative profitability of producing them. That is a primary reason why the forecast is always too high, and why the status quo production forecast (with ACES) is also too high.

Moreover, revenue estimates between tax plans cannot be compared using the same number of barrels. With lower competitive taxes not only is investing in the current forecasted production more attractive, but the development possibilities themselves are expanded. Exactly how much is uncertain, but it would take only a very modest increase in production (i.e., reduction in the decline rate) to generate more long-term total petroleum revenue (including royalties, property taxes, state corporate income taxes) with the governor's bill relative to the status quo.

Nevertheless, the decline in revenues from the proposal in the fiscal note was depicted by many as a "giveaway," i.e., a tax cut that would result in no beneficial stimulus to production.

Conclusion

These perspectives caused leadership to conclude that a tax reduction would not lead to increased investment and production. Accordingly, they wanted a commitment from the producers to invest more if taxes were reduced.

The corporations could not make such a commitment. It is difficult for management to promise to increase investment if taxes are reduced. Only corporate boards have authority to commit these billions of dollars, and after analyzing detailed financial parameters and cost estimates, laid out against competing opportunities. So the corporations did not make such a commitment.

Moreover, the state would be prohibited from any agreement not to raise taxes again in exchange for a commitment. The constitution prohibits surrendering, suspending, or contracting away the power of taxation.

So the governor's bill failed to pass in the Senate.

Each of these DIRE assumptions resulted in a potential under-estimation of the amount of additional investment that could occur with reduced taxes, and a potential under-estimation of the amount of additional production and revenue that could have resulted.

It is a given that what might happen under alternative structures is unknowable. This is an ongoing problem in social science research: the inability to orderly experiment to re-run history. However, assuming the same explicit outputs from different implicit inputs is problematic. Recognizing what is unknowable, the "ghosts," and embracing sensitivities as to their outcomes reflects an appreciation of the complexities inherent in comparing alternative policy futures. OGFJ

About the author

Roger Marks is a petroleum economist in Anchorage, Alaska focusing on tax, regulatory, and resource development issues. He also writes on oil and gas issues, and teaches economics locally.