Oil money pouring into the Eagle Ford shale

Mark Young, Evaluate Energy, London

A new analysis by Evaluate Energy highlights the large differences in drilling costs between various companies operating in North American shale plays. The data reveal how much companies are set to spend and how many wells they will drill in the coming year in each play. They also provide a benchmark average cost of a drilled and completed well across eight North American shale plays, based on these guidance figures.

Taking the Eagle Ford as an example of Evaluate Energy's new analysis, the raw data itself draw some interesting comparisons. The Eagle Ford was arguably the biggest headline maker of 2011 in US shale. The number of new wells drilled in Texas' liquids-rich shale play in 4Q2011 was double the number in 4Q2010, and the price paid per acre in M&A transactions soared to over $10,000.

Figure 1 is a graph of just six of the major operators in the area, and the average cost per well they reported in annual reports, corporate presentations, and press releases.

Evaluate Energy estimates the average cost per well for the Eagle Ford at $7.8 million, using reported 2012 capex budgets, 2012 planned well activity, and company-reported cost per well. The wide range here shows Anadarko Petroleum predicting to make a healthy saving on this amount, with its reported cost per well at $5.8 million, but Rosetta Resources and El Paso Corp.'s upstream group (currently being acquired by Apollo Global Management LLC) are set to foot a heftier bill, with costs in the range of $9.5 million to $10 million per well.

The cost disparity could be due to a number of things. Location plays a big part in the Eagle Ford. The play's depth varies greatly across Texas, and gas/oil ratios can also be highly varied even within counties. Both factors may cause fluctuation in costs.

The Eagle Ford is still in the relatively earlier stages of development compared to its more mature and higher-producing neighbors. Thus, some companies will have identified the most efficient practices while others are still experimenting.

By comparison, figures from the larger operators in the Haynesville shale play in Louisiana are very similar. New companies entering the play, with either less experience or different methods, will also have an impact on the level of disparity. Evaluate Energy's horizontal drilling data show Anadarko ($5.8 million) has been drilling for oil/liquids in the areas of the Eagle Ford since 1Q2010, while El Paso ($9.5 million) began drilling for oil in the play a year later, and on a much smaller scale. This would suggest that Chinese state-owned company CNOOC has made a good choice in joining forces with Chesapeake Energy, an Oklahoma company that has considerable experience in shale development operations in multiple plays, in Eagle Ford.

(With US gas prices below $2/mcf, well below economic levels, Evaluate Energy assumes that most reported Eagle Ford figures will refer to oil/liquids drilling rather than gas drilling.)

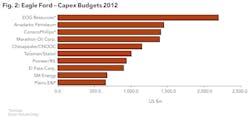

According to Evaluate Energy's new analysis, 2012 will be another big year for the Eagle Ford. Using an average well cost of $7.8 million and reported capex/planned number of wells guidance figures, the companies/joint ventures destined to make major strides in the Eagle Ford this year can be predicted (see Figure 2).

The number of wells depicted for the 10 selected companies/joint ventures is quite remarkable. Even if the average well cost of $7.8 million is applied to the data, these 10 companies will be drilling around 1,500 wells. Given Evaluate Energy's data, it is clear that this number is a low estimate. Of these 10 companies, five report average well costs; Anadarko ($5.8 million), Pioneer/Reliance ($7.5 million), and SM Energy ($7.3 million) are projecting drilling costs below the $7.8 million average.

Two of the three non-US companies listed, Norway's Statoil and India's Reliance Industries, will be looking to the Eagle Ford to build on recent successes. Statoil, a 50/50 joint venture partner with Canada's Talisman Energy in the Eagle Ford, reported record quarterly company-wide production figures in 1Q2012. The Norwegian major moved into US shale in June 2011, acquiring Eagle Ford acres with Talisman, and then further displayed its faith in the sector with its $4.7 billion acquisition of Bakken-operator Brigham Exploration toward the end of the year. The record production figure was mainly made up of gas outside the US, but cleary shale oil is among Statoil's major plans to increase this number further.

Pioneer's ambitious Indian partner, Reliance Industries Ltd., is also on a high right now. Its US shale segment, acquired in three deals in 2010 (two in the Marcellus and one in the Eagle Ford), has reported $250 million revenues and a $30 million profit for the 2011-2012 fiscal year. With low gas prices and Marcellus activity likely to decline this year, operations in the Eagle Ford will be important for Reliance's continued success.

Evaluate Energy provides calculated average well costs using reported 2012 guidance figures and 2012 planned activity in eight North American plays: Bakken, Duvernay, Eagle Ford, Haynesville-Bossier, Marcellus, Montney, Niobrara and Utica. This is the latest addition to Evaluate Energy's shale products, which include horizontal drilling data, acreage holders, gas and liquids production, and M&A deals across the most important plays in the US. For more information, visit www.evaluateenergy.com.

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com