Upstream News

Total awarded exploration license for offshore Uruguay Block 14

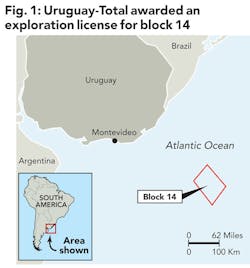

Total has been awarded an exploration license for Uruguay's offshore Block 14, following the second bidding round held by the national company, ANCAP. The license remains subject to further approval by Uruguayan authorities.

Block 14 has a surface area of 6,690 km2 and is located in the Pelotas Basin 250 km offshore. Water depths in this area range from 2,000 to 3,500 meters.

"Our successful bid on Block 14 is consistent with Total's bold exploration strategy focused on exploring new, high-potential plays. The bidding process for this particular block was very competitive in terms of the proposed work program and financial commitment, and we are delighted with our success," said Marc Blaizot, Total's senior vice president, Exploration. "Together with our recently-acquired licenses in Ivory Coast, Kenya, Mauritania and Angola, this award in Uruguay further increases our potential for frontier exploration."

Spectraseis achieves high-speed imaging of microseismic data

Spectraseis, a provider of microseismic fracture imaging, stimulation evaluation and seismic monitoring, has achieved a substantial speed-up for processing microseismic data using proprietary algorithms and techniques to maximize NVIDIA® Tesla® graphics processing units (GPUs) based on NVIDIA's Fermi architecture.

The accomplishment provides faster turnaround times of both elastic and acoustic imaging of microseismic events. This faster data processing method enables additional quality control and analysis of microseismic fracture-monitoring datasets. Accurate event location enables asset teams to make more meaningful evaluations and planning of well completions and well spacing.

"Oil and gas operators are harnessing the power of GPU computing for applications such as seismic survey modeling and reverse time migration," said Spectraseis CEO Ross Newman. "Spectraseis has taken things further and implemented the full elastic wave equation for microseismic data on GPUs. Computation times measured in minutes and hours, instead of weeks, have now been achieved, even with complex imaging conditions. This allows higher quality, full wave fracture mapping, using both pressure and shear data, to be delivered to customers in commercial time frames."

Sumit Gupta, senior director of the Tesla business at NVIDIA, said, "The 28X acceleration Spectraseis is seeing in elastic wave equation imaging underscores the tremendous benefits GPUs provide to the oil and gas industry. NVIDIA GPUs are a true game changer in this industry, enabling companies to accelerate turnaround on major projects due to the availability of faster and more accurate results."

NVIDIA awakened the world to computer graphics when it invented the GPU in 1999. From its roots in visual computing, the company expanded into parallel computing and mobile computing. Today, its processors power a broad range of products from smart phones to supercomputers. NVIDIA's mobile processors are used in phones, tablets and auto infotainment systems. PC gamers rely on GPUs to enjoy immersive worlds. Professionals use them to create visual effects in movies and design everything from golf clubs to jumbo jets. And researchers utilize GPUs to advance the frontiers of science with high-performance computers. The company holds more than 2,300 patents worldwide, including ones covering ideas essential to modern computing.

Hong Kong-based CNOOC signs contract with Roc Oil for exploration off Bohai

Hong Kong-based China National Offshore Oil Corp. has signed a production sharing contract (PSC) with Roc Oil (Bohai) Company for Block 09/05 in Bohai. Block 09/05 is located 50 kilometers southeast of Tianjin, with a total area of 355 square kilometers and water depth of 4-10 meters.

Roc Oil will conduct 3D seismic surveys and drill exploration wells in Block 09/05 during the exploration period, in which all expenditures incurred will be borne by Roc Oil. CNOOC has the right to participate in up to 51% working interest in any commercial discoveries in the block.

"We are very pleased to join hands with ROC again. We, like ROC, have full confidence in the resource potential of Bohai," said Zhu Weilin, executive vice president of CNOOC and general manager of its exploration department.

LEIF: Venture capital investment in water technology bubbling up

A report released May 11 by the London Environmental Investment Forum reveals increasing venture capital investment activity in companies that are providing innovative water solutions to the oil and gas and mining industries.

The report, "Water Innovation in Extractive Industries," identifies 25 private early and growth stage companies operating in the sector. According to publicly available data, 18 have successfully raised funds over the past five years, with several completing multiple rounds, and three are currently seeking funding, according to company announcements.

The key findings are as follows:

• Increase in investment activity in the sector over the past five years, with 18 companies raising more than $400 million in equity and debt;

• Majority of activity has taken place in North America;

• A handful of venture capital funds have focused on this area and taken early positions, including Energy Ventures, XPV Capital, Meidelinger Partners and Enertech Capital;

• Several corporate venture funds and corporate development units of large corporations have taken strategic positions, including Teck Resources, Cenovus Energy, BASF Venture Capital and Total Energy Ventures; and,

• Water companies currently serving the municipal and other industry sectors are now applying or looking to apply their technology and services to the resources markets.

"Some investors are ‘cottoning on' to a very significant change in extractive industries: water innovation is not a luxury item to decorate your CSR report, but a means of gaining competitive advantage," said LEIF Chairman Tom Whitehouse.

"It is too early to talk of an investment boom, but there is enough evidence to suggest that attention will continue and grow. Most of the innovation and investment is taking place in the US and Canada, but UK- and Europe-based companies are also active and the markets are global."

Ex-Im pledges $2.95B to finance US exports for Australia LNG project

The Export-Import Bank of the United States has authorized a $2.95 billion direct loan to support US exports to the Australia Pacific liquefied natural gas (LNG) project. The transaction is Ex-Im's second-largest, single-project financing in history and is also the bank's first LNG project in Australia.

The project on Curtis Island in south-central Queensland will produce natural gas from coal-seam wells and will have total capacity of 9 million metric tons per year. China Petroleum and Chemical Corp. (Sinopec) and Kansai Electric Power Co. Inc. of Japan will purchase most of the LNG produced. China Ex-Im Bank and commercial lenders are also providing debt financing for the project.

Ex-Im's financing is expected to support an estimated 11,000 American jobs. Principal US exporters are ConocoPhillips Co. and Bechtel International, both of Houston, Texas. Additional exporters and suppliers include numerous small businesses in Texas, Colorado, Nevada, California, Oregon and Oklahoma.

"Our authorization paves the way for US companies to export equipment and services to this major LNG project and, in so doing, to maintain thousands of American jobs across the country," said Ex-Im Bank Chairman and President Fred P. Hochberg. "This financing also demonstrates how the United States and China can work together for our mutual benefit to foster trade and develop critically needed energy resources."

The transaction, approved by Ex-Im's board of directors on May 3, was announced following Chairman Hochberg's trip to China, where he participated in the fourth round of the Strategic and Economic Development Dialogue (S&ED) with Treasury Secretary Timothy F. Geithner and other officials. The S&ED was held in Beijing on May 3-4.

Bechtel official Jay C. Farrar, who manages the company's office in Washington, D.C., cited the importance of Ex-Im's financing for US exporters to large international projects.

"Since 1992, Ex-Im Bank has been instrumental in the successful awarding and completion of projects involving Bechtel that have supported thousands of jobs for highly skilled employees at our company. The bank's financing also has helped to maintain thousands of additional jobs related to the supply chain for these projects," Farrar said.

The Australia Pacific LNG project will involve development of coal-seam natural-gas fields, two gas transmission lines to a collection hub, a natural gas liquefaction plant and an adjacent marine shipping export terminal on Curtis Island near the city of Gladstone.

Credo Petroleum discovers six new oilfields in Kansas, Nebraska

Credo Petroleum Corp., an independent oil and gas exploration and production company with assets in North Dakota, Kansas, Nebraska, Texas and Oklahoma, has updated its Kansas and Nebraska drilling project with the discovery of six new oilfields.

"Our initial analysis of the new fields indicates potential for about 25 direct offset locations. In addition, successful offset drilling should generate step-out locations," said Credo Petroleum CEO Michael D. Davis. "Credo's working interest ownership in the new fields ranges from 49% to 75%. Nebraska is a relatively new oil play for Credo where there is more opportunity to apply our regional concepts to higher potential wildcat drilling compared to the Central Kansas Uplift."

To date, Credo has shot over 200 square miles of 3-D seismic in Kansas and Nebraska, and has drilled 110 wells in Kansas and 18 wells in Nebraska. The company's drilling success rate is 40%, yielding "all in" risked adjusted internal rates of return (at current oil prices) of approximately 100%.

For fiscal 2012, the company budgeted $9.8 million for drilling in Kansas and Nebraska, up 17% from last year. Forty-five (45) additional oil wells are scheduled for the remainder of this year with three new seismic shoots covering 66 square miles.

Credo Petroleum Corp., based in Denver, Colo., has significant operations in the Williston Basin of North Dakota, Kansas, Nebraska, the Anadarko Basin of the Texas Panhandle and northwest Oklahoma, and in southern Oklahoma.

Memorial Production closes on East Texas, Louisiana properties

Memorial Production Partners LP has closed its previously announced acquisition of oil and natural gas properties in East Texas and North Louisiana from an undisclosed seller for $37.3 million. The acquisition was funded with borrowings under MEMP's existing credit facility.

The acquisition includes: estimated net proved reserves of approximately 22.2 Bcfe; 65% proved developed reserves; proved reserve-to-production ratio of approximately 17.5 years; current net production of approximately 3.5 MMcfe per day (approximately 61% is natural gas and 39% is oil and natural gas liquids); producing wells with 166 gross (16 net) capacity, of which 75% will be operated by WildHorse Resources, LLC, an operating subsidiary of Memorial Resource Development LLC.

Memorial Production Partners LP is a Delaware limited partnership that owns and acquires oil and natural gas properties in North America. MEMP's properties are in South and East Texas and North Louisiana and consist of mature, legacy onshore oil and natural gas reservoirs.

MEMP is headquartered in Houston, Texas.

ATP Oil & Gas Corp. begins drilling at Shimshon well offshore Israel

Houston-based ATP Oil & Gas Corp. and its wholly-owned subsidiary ATP East Med BV have initiated drilling at the Shimshon well in the Levant Basin of offshore Israel in the eastern Mediterranean Sea with the Ensco 5006 drilling unit.

The Shimshon well is in a water depth of 3,622 feet with a target depth of 14,764 feet. After spudding, several protective casing strings will be set until the well has penetrated the salt layer. A full set of electric logs will be run at total depth to assist in evaluation of target reservoirs. ATP expects to announce results during the third quarter of 2012. ATP through ATP East Med operates with a 40% working interest.

"With the recent discoveries in the Levant Basin already exceeding 35 trillion cubic feet, the basin is a prolific area for natural gas exploration efforts," said T. Paul Bulmahn, ATP's chairman and CEO. "Of the 26 ATP invention and system patents and pending applications, 16 deal with deepwater natural gas development methods and facilities, giving ATP an advantage if it secures an exploration success with this well."

ATP Oil & Gas is an international offshore oil and gas development and production company with operations in the Gulf of Mexico, Mediterranean Sea, and the North Sea. The company trades publicly as ATPG on the NASDAQ Global Select Market.

US, Japan complete methane hydrate production trial

US Energy Secretary Steven Chu announced May 2 the completion of a successful, unprecedented test of technology in the North Slope of Alaska that was able to safely extract a steady flow of natural gas from methane hydrates – a vast, entirely untapped resource that holds enormous potential for US economic and energy security.

Building upon this initial, small-scale test, the Department is launching a new research effort to conduct a long-term production test in the Arctic as well as research to test additional technologies that could be used to locate, characterize and safely extract methane hydrates on a larger scale in the US Gulf Coast.

"The Energy Department's long-term investments in shale gas research during the ‘70s and ‘80s helped pave the way for today's boom in domestic natural gas production that is projected to cut the cost of natural gas by 30 percent by 2025 while creating thousands of American jobs," said Secretary Chu. "While this is just the beginning, this research could potentially yield significant new supplies of natural gas."

The Department is making $6.5 million available in 2012 for research into technologies to locate, characterize and safely extract natural gas from methane hydrate formations like those in the Arctic and along the US Gulf Coast. Projects will address deepwater gas hydrate characterization via direct sampling and/or remote sensing field programs; new tools and methods for monitoring, collecting, and analyzing data to determine reservoir response and environmental impacts related to methane hydrate production; and, clarifying methane hydrate's role in the environment, including responses to warming climates. As part of President Obama's budget proposal for 2013, the Department is requesting an additional $5 million to further gas hydrates research domestically and in collaboration with international partners.

OTC poll: Oil, gas operators should be liable for E&P risks

A poll of delegates attending the Offshore Technology Conference in Houston has revealed that oil and gas professionals think operators should be liable for the risks associated with their exploration and production activity. Of those polled, 66% thought that operators should accept complete liability, while 33% thought that E&P risk should be passed on to contractors.

The Industry Snapshot Poll was conducted by global independent technical advisor GL Noble Denton.

PEMEX outlines procurement needs

The loss since 2004 of 1.5 million barrels/day from its super-giant Cantarell field has prompted PEMEX E&P, the upstream unit of Petroleos Mexicanos, Mexico's state-owned oil company, to look again at its portfolio of undrilled prospects in the shallow waters of Campeche. At a PEMEX procurement panel on April 30 at the Offshore Technology Conference, New Ventures Manager Sergio Guaso outlined PEMEX's plans for public tenders of offshore blocks, including, by year-end, ones in deepwater areas.

He explained that an intense campaign to increase production is taking place, and operators will be paid by their incremental production. Terms in the new contract model provide for 100% cost recovery for exploration expense, 75% recovery for operations and a fee per barrel that will be the sole biddable element in the public tenders.

This offshore development will require the contracting of dozens of jackups and associated support vessels and services. A fundamental requirement for the success of PEMEX's campaign is the timely availability of hotel vessels for the crews.

On April 12, PEMEX E&P renewed its contract with a consortium of three Mexican companies, TRESE, ARDICA and JB del Golfo, for a hotel vessel, the Armada Firman 3, and associated services, for the period 2012-13. The vessel has capacity for 200 beds and is equipped with dynamic position technology (type 2) and a helicopter pad.

The vessel is leased by the consortium from Malaysia-based Bumi Armada Navigation, an offshore services provider with a presence in over 10 countries and in four continents.

Columbia Power awards InterMoor contract for wave energy system

Columbia Power has awarded InterMoor, an Acteon company, the contract to design a cost-effective and survivable mooring system for its StingRay offshore wave energy converter prototype.

The project, which has already started with some advanced modeling and design work, will last for two years with potential for further work. InterMoor will provide analysis along with the design for the WEC's mooring system; field engineering; and operational logistics for deployment and recovery procedures in addition to overseeing offshore marine operations.

The design will be targeted for offshore locations in the US, Western Europe and other high-energy sites around the world.

Designed to produce energy on a utility scale, the StingRay has been hydro-dynamically optimized to produce energy with just a few moving parts. The device comprises a three-piece, fiber-reinforced plastic hull and two high-torque, low-speed, large-diameter direct-drive rotary generators. It targets simple operation and inherent survivability to reduce operating and maintenance costs, and to produce electricity at prices competitive with other legacy and renewable energy sources with minimal environmental impact.

Ken Rhinefrank, vice president of Research and Development at Columbia Power, said, "We are pleased to be working with InterMoor on this mooring design solution. Their experience in offshore moorings, combined with enthusiastic interest in Columbia Powers' wave energy technology, will ensure the survivability of the system and help us to make strong progress toward reducing the cost of energy."

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com