M&A pace increases as China strikes its biggest deal to date

Ronyld Wise, PLS Inc., Houston

As previously reported by PLS Inc., Chinese and Asian NOCs have been active buyers in the acquisition markets accounting for approximately 15% - 20% of the global value for E&P deals since 2009.

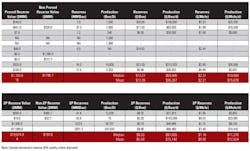

So it’s not surprising that state-owned China National Offshore Oil Corp. (CNOOC) stepped up big in late July with China’s largest E&P deal to date. On July 23, CNOOC announced a definitive agreement to buy Calgary-based Nexen Inc. for $27.50/share cash – a 61% premium to Nexen’s prior-day close. Including debt assumed, PLS calculates the deal to be US$17.9 billion, eclipsing China’s prior largest deal - state-owned Sinopec’s $8.5 billion buy completed in August 2009 of Addax Petroleum, an international E&P firm focused on West Africa and the Middle East.

CNOOC has an established foothold in Canada and a prior relationship with Nexen, having made a major move just about a year-ago with the $2.1 billion corporate buy of oil sands producer OPTI Canada, announced July 2011 and closed November 28, 2011. At the time, OPTI’s core asset was a 35% interest in the Long Lake oil sands project, operated by none other than Nexen.

CNOOC expects to close Q4 2012 and sees a rare opportunity to acquire long-life assets and create a North and Central American platform by retaining the existing Nexen management, technical and operating teams. Nexen’s assets expand CNOOC’s ownership in Canadian oil sands giving it total ownership of Long Lake as well as a 7% entry to Imperial-operated Syncrude. CNOOC also gets an operated position in the Horn River gas shale with joint-venture partner Inpex. In the US, CNOOC gains a material entry into the deepwater Gulf of Mexico which significantly expands its global exploration portfolio. In the UK portion of the North Sea, CNOOC now becomes the second largest oil producer with Buzzard field anchoring a set of key assets.

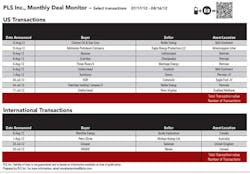

In addition to the blockbuster CNOOC buy of Nexen, on the same day China’s state-owned Sinopec agreed to pay $1.5 billion to buy 49% interest in Talisman’s UK North Sea business. Sinopec gains just over 30,000 boepd (98% oil) of net production and 2P reserves of 222 MMboe (94% oil). PLS calculates metrics of $49,000 per daily boe and $6.74 per Boe of 2P reserves.

In effect, on July 23, Chinese state-owned companies acquired UK North Sea production of over 144,000 boepd (114,000 by CNOOC via Nexen and 30,000 by Sinopec via Talisman) and 2P reserves of over 530 MMboe (CNOOC – 310 MMboe, Sinopec – 222 MMboe).

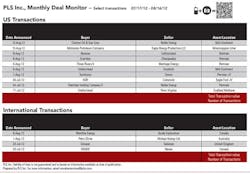

In the US Devon struck another large joint venture, this time with Japan’s Sumitomo Corporation for $1.4 billion. This is Devon’s second large JV this year following its $2.2 billion January deal with Sinopec covering five unconventional US shale plays. In this deal, Sumitomo gains a 30% position in ~650,000 net acres in the Cline and Wolfcamp (Midland) shales in the Permian basin. Sumitomo will invest $340 million cash at closing plus another $1.025 billion as a drill carry which will fund 70% of Devon’s costs. PLS calculates deal value of $7,000 per acre.

This period also witnessed an uptick in more traditional US M&A deals. The largest announcement, though value is not disclosed, is Houston-based EnerVest’s agreement to buy the Midland basin portion of the Permian assets that Chesapeake put on the market earlier this year with estimated production of about 7,000 boepd. This is the smallest of the three Permian packages Chesapeake put on the market.

Other notable deals include recently IPO’d Midstates Petroleum’s purchase of Eagle Energy of Oklahoma’s Mississippian Lime assets for $441 million. PLS estimates acreage values of $2,500 per acre in the core Oklahoma Mississippian and $750 per acre in the Kansas extension. Three Rivers didn’t take long to re-start following their May 2012 $1 billion exit to Concho. Backed with a fresh $400 million commitment from Riverstone, Three Rivers II bought 1,900 boepd in the Permian’s Wolfberry play from Denver-based Meritage III. KKR is back in the Eagle Ford with a drilling JV with Comstock Resources on de-risked lands in the black oil window. KKR is paying $25,000 per acre, about the same price at which they sold out a year ago (with partner Hilcorp) in a $3.5 billion exit to Marathon. Noble Energy is executing on its divestiture program and sold two packages recently. The first package for legacy Permian oil properties with upside sold to Sheridan Holdings for $320 million. The second package, also oil-weighted, included Kansas Arbuckle legacy production with upside and sold to Citation Oil & Gas for $140 million.