Third quarter 2012 deal value is $50 billion globally

Ronyld Wise, PLS Inc., Houston

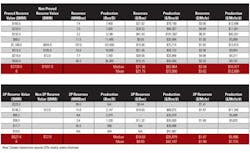

PLS Inc. reports that oil and gas upstream M&A deal value in Q3 2012 increased around the world to $49.8 billion in 154 transactions (with values disclosed). This includes CNOOC's $17.9 billion bid for Nexen announced July 23rd. Compared to Q2, deal value is up 79% from $27.8 billion while deal count is down 25% from 193. Regionally, the markets are getting bigger deals done while smaller deals are slowing down. The Q3 market as measured by deal count is the lowest in two years.

In Q3, 11 deals hit the >$1 billion mark led by CNOOC's $17.9 billion offer for Calgary-based Nexen. Rounding out the other top 5 deals are Plains E&P's buy of select BP Gulf of Mexico assets ($5.6 billion), Shell, Chevron and Enervest's purchase of Chesapeake's Permian basin assets ($3.3 billion), Shell's purchase of an Australian LNG project from Chevron ($2.4 billion) and ExxonMobil's buy of Denbury's Bakken assets ($2.0 billion).

In the US, deal value surged to $19.4 billion in 56 transactions, up from Q2 total of $11.0 billion in 69 transactions. In Canada, deal value rose to $19.7 billion (31 deals), up from $7.7 billion in Q2 (37 deals). Internationally (outside of North America), deal value totaled $10.7 billion (67 deals), up from $9.1 billion (87 deals).

Regarding activity this month (as shown in the table below), the US continues to see significant activity in conventional Gulf Coast and Gulf of Mexico regions. W&T Offshore paid $216 million for the last tranche of Gulf of Mexico assets from Newfield Exploration – a company that created tremendous value as a Gulf of Mexico exploitation firm. EPL Oil & Gas bought all of Hilcorp's Gulf of Mexico shelf assets for $550 million. Moving onshore, Forest Oil sold its conventional south Louisiana assets for $220 million to privately-held Texas Petroleum. On the unconventional side, ExxonMobil bought out all of Denbury's North Dakota Bakken assets for $2.0 billion. PLS analysts estimate the acreage part of this deal to be $834 million - 74,000 acres in the core at $10,000 per acre plus 99,000 acres non-core at $1,000 per acre. In return, Denbury received cash plus two significant Exxon owned C02 fields – one in the Rockies and one on the Gulf Coast. PLS estimates the value of these two fields to be $400 million.

Activity in Canada slowed significantly this month as producers are hesitant to sell during a low cycle in gas prices.

Internationally, activity also slowed. The largest deal is OMV's $321 million purchase of a 20% WI in the Edvard Grieg oilfield development project (formerly known as Luno) in the Norwegian North Sea.

At press time (late October), several significant developments are also impacting the M&A markets. Once the US elections conclude on November 6, the markets should gain some clarity on future US policies. In Canada, on October 19, the government moved to block Petronas' June 28 $5.8 billion bid for Progress Energy citing insufficient "net benefit" to Canada. Petronas and Progress have thirty days to work with government officials to address and clarify the ruling. The vagaries around "net benefit" will be a primary focus in Canada for the foreseeable future. Others foreign entities are interested in Progress. The issue has analysts factoring additional risk into government approval of CNOOC's $17.9 billion bid for Nexen announced July 23.

Also, in Canada ExxonMobil offered $3.1 billion on October 17 to buy Celtic Exploration marking Exxon's largest unconventional Canadian deal to date in the country. And, on October 22, Rosneft surprised the markets with an offer to buy 100% of TNK-BP for a total of $60 billion. AAR (controlled by Russian billionaires) agreed to sell 50% of TNK-BP for $30.8 billion in cash plus net debt assumed while BP agreed to sell the other 50% of TNK-BP for $28.2 billion in cash, net debt assumed and stock of Rosneft. If completed, this deal would rank as the second largest oil deal ever – behind the $82 billion Exxon's $82 billion takeover of Mobil in 1998.

Looking forward, as of mid-October, PLS estimates that there is $107 billion of deals on the market globally (excluding TNK-BP). This is up slightly from the $105 billion tally PLS prepared in mid-July 2012. Leading the list of sellers are Total (selling an estimated $10 billion upstream), Shell (selling $8 billion in Australia), BP (selling an estimated $7 billion in Argentina) and Petrobras (selling up to $7 billion in the Gulf of Mexico).