Oil commodities outperform oil stocks in 2004

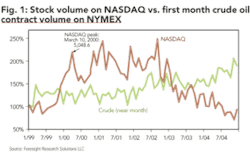

During 2004, the robust US oil futures market drew far greater attention than did the US corporate oil stock markets. Some hedge fund managers and other traders shifted out of stocks into commodities.

Investors watched oil company stock values discount a benchmark oil price of $32/bbl, while oil for prompt delivery on the New York Mercantile Exchange (NYMEX) traded at about $50/bbl during November 2004.

Bernard J. Picchi, senior managing director with Foresight Research Solutions LLC, New York, commented, “The world looked at oil’s dizzying climb last year in slack-jawed wonder. . .Commodities of late have had the rock-‘em, sock-‘em action of internet stocks in the late ‘90s, combined with something the tech stocks didn’t have - immense leveragability.”

He noted that oil wasn’t the only energy commodity to undergo price inflation in the last two years. Coal and natural gas “have been on a tear, as have such soft industrial commodities as oil tanker rates.”

Supply, demand

The fundamentals of supply and demand drove the price increases, said Picchi, who has nearly 30 years’ experience as a research investment professional and has been recognized by Institutional Investor magazine 12 times for his work in the energy sector. The disconnect between oil stock values and oil futures prices stem from the way in which the stock market and the commodity market each distinctly reflect supply and demand.

“The mechanisms by which the two markets capitalize those fundamentals could not be more different,” Picchi said. “For example, one can buy or sell futures contracts with little cash down and no interest on the balance. Margin requirements are four times higher for stocks, and the carry is a loan on which the buyer pays interest.”

Margin is a performance guarantee in futures markets, whereas in the stock market the margin is a down payment with the balance of stock being purchased through a financing arrangement.

For instance, margin buyers of commodity contracts need 10 to 12 cents of equity to support $1 of contract value, while buyers of stock on margin need $1 of equity for each $1 borrowed on margin.

“Given this difference and the generally lethargic performance of stocks, it’s easy to understand traders’ preference for the commodity markets,” Picchi said.

Although the 2004 commodities market reflected energy supply and demand fundamentals, Picchi believes that, “Cheap credit combined with the enormous leverage of futures contracts-as well as traders’ occupational need for volatility-exaggerated oil and gas prices on the commodity exchanges.”

Markets can get “off-kilter for long periods” as seen with technology stocks in the late 1990s, Picchi noted. But he does not believe that supply and demand fundamentals can support oil futures at $50 to $60/bbl or gas at $8 to $10/Mcf for the long run.

“Still, until a cushion of energy production capacity can be restored to the market, prices are more prone to rise on bullish news than fall on bad news,” Picchi said. “There’s even a possibility of a ‘superspike’ in oil prices-$100 to $150/bbl-in the event of a calamitous loss of production somewhere in the world.”

If oil prices were to go the other way and drop suddenly, he said oil stock prices might dip in the short term but would hold their own again before very long.

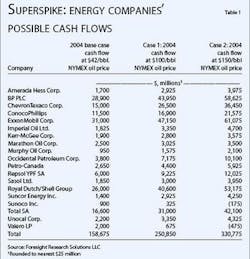

“In examining the cash-flow compositions of nearly 20 major oil companies, we have discovered that the shares of most major oil companies still discount oil prices well below the current benchmark, even below the average of the [NYMEX] strip,” Picchi said.

Oil Prices

Many supply and demand fundamentals contributed to robust oil futures prices during 2004, but the biggest factor was that the Organization of Petroleum Exporting Countries was “missing in action,” he said.

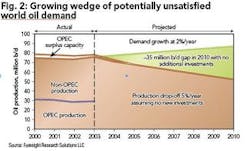

“The countries of OPEC, with 80 percent of world oil reserves, have lost control of the oil market by failing to expand capacity to keep pace with the growth in demand. This failure of market leadership has brought energy price anarchy to the marketplace and is likely to have adverse strategic consequences for OPEC-especially for the Saudis-well into the future,” Picchi said.

OPEC’s total production capacity has not grown in 30 years, he noted.

“In short, OPEC has flunked the acid test of supplier reliability that every successful enterprise must pass. Until 2003, OPEC suppliers had passed the test, but only because the bar was set low. . .Of the 11 current members of OPEC, only one-tiny Qatar-enjoys higher production capacity now than it did in 1973. Indonesia actually became a net importer of oil,” during 2003, Picchi said.

Saudi Arabia, Iran, and Iraq consistently have refused Western investment in their petroleum industries, he noted.

It’s almost too late for OPEC to restore order to the market, he said. Several Persian Gulf oil producers together could add two to three million barrels of new oil production capacity, but the world is estimated to need 30 million b/d of new production within10 years.

“High prices aside, demand growth has accelerated in the last few years, even as production has dropped from mature fields in many countries. The means by which consumers and producers will fill that ever-growing wedge between oil demand and supply will be the dominant energy investment theme of this decade,” Picchi said.

Other factors that converged to support the oil price escalation last year included:

• An acceleration of oil demand in China, India, and the US.

• The end of the long-consumption decline-a fall-off of nearly four million b/d during the last decade- in former Soviet Union countries.

• The major oil companies’ small capital programs since 1998-99 when virtually every oil company slashed spending 30 to 50 percent.

• Political instability in key oil exporting countries, including Venezuela, Nigeria, Indonesia, and Iraq.

• The failure of oil consuming nations, especially the US, to develop a rational energy demand policy. The US accounts for just five percent of global population but 25 percent of world oil consumption.

• Lengthening oil supply chains stemming from the US’s growing reliance on distant oil supplies from Russia, the Middle East, and central Asia. OGFJ

null