MANAGING PORTFOLIOS: The impact of petroleum asset life cycles

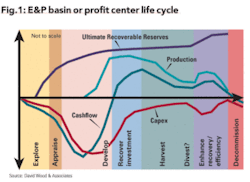

Key performance indicators give different impressions at different stages of an upstream petroleum asset’s life cycle (Fig. 1). Portfolio management should help to smooth out the capital expenditure profiles, optimize cash flow and production growth, and reserves replacement trends for the portfolio as a whole. To achieve this, a portfolio should have a combination of assets in different life cycle stages and plenty of new ventures to secure long-term reserve replacement.

David A. Wood

Consultant

Lincoln, England

These characteristic trends must be taken into account and exploited by a portfolio manager wishing to optimize a portfolio of assets. These trends highlight that upstream projects are characterized by large initial capital investment.

In some cases, relatively high levels of capital investment may be required in the latter stages of an asset’s life. This is done to introduce secondary and tertiary recover techniques, or to abandon site and sub-surface facilities.

Large upstream assets are usually characterized by long payback periods, particularly those located offshore, in remote areas, or those requiring complex technology (e.g. gas liquefaction plants). High risk and uncertainty continues well beyond the exploration period and varies depending upon the attribute considered (e.g. technical, commercial, fiscal, etc.).

Fig. 2 illustrates how uncertainty changes over the life-cycle of an upstream asset and how exposure to technical risks early on can be replaced by political and fiscal risks as the field development progresses. Dependency of the revenue stream upon volatile product prices and demand is an uncertainty that remains throughout an upstream asset’s life cycle.

The trends shown in Figs.1 and 2 simplify the complexity associated with most upstream assets and the cycle of projects associated with them. Each field discovery is characterized by multiple stages of work (i.e. appraisal, phases of development, decommissioning). Each stage is associated with deferrable decision points and flexibility of options depending upon technological choices, commercial forecasts, commitments on related or independent assets in the portfolio, and financial circumstances of the company or its joint venture partners.

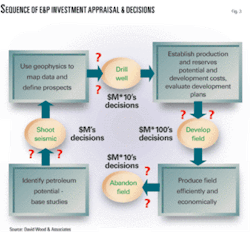

Information is progressively obtained about the sub-surface characteristics of a discovered reservoir, its production capabilities, and reserves potential. This information arrives incrementally following each phase of the E&P program (i.e. after seismic acquisition, after drilling each well, after periods of sustained production, etc.).

Key decision points are often linked with the arrival of new information following capital investment work programs, but much of the time uncertainty remains. Joint venture partners or engineers/geoscientists in the same organization may disagree about the interpretation of the existing and new data.

While almost all upstream decisions could benefit from more information, they always seem much more straight-forward when viewed in hindsight.

Fig. 3 illustrates the progression of the typical decision sequence over the life cycle of an oil and gas field. It commonly involves at least two orders of magnitude increase in the capital investment value of the decisions required from early exploration to field development.

Figs. 1, 2, and 3 emphasize the high level of financial and risk exposure during the field development phase of an upstream asset. The complexity of this phase in the life cycle also requires a huge commitment from an organization’s staff, as well as technical and financial resources. This must be taken into account when managing portfolios containing a combination of assets to avoid compounding risk exposure.

When too many major field developments progress at similar stages at the same time, the company risks over-stretching its available resources. A portfolio model should be designed to identify periods of over-commitment and risk exposure in the planning horizon and be able to suggest adjustments to the portfolio that alleviate such problems. OGFJ

The author

David A. Wood [[email protected]] is an international exploration and production consultant specializing in the integration of technical and economic evaluation with management and acquisitions strategy.

About this Series

This series of articles addresses fundamental issues of petroleum asset-portfolio management. The material is drawn from training courses in strategic portfolio management that the author has developed for the petroleum industry since 1998. The author writes in greater detail about these subjects in four executive reports available for purchase through the Online Research Center of Oil & Gas Journal Online. For a list of titles and descriptions, go to www.ogjonline.com, click “Online Research Center” on the left navigation bar, then click the link under “OGJ Executive Reports.”