Global M&A jumps 29% in Q2

21 deals exceed $10 billion

David Michael Cohen,PLS Inc., Houston

PLS reports that the transition from the second to the third quarter of 2014 was bookended by two major US upstream transactions: Devon Energy's $2.3 billion sale of its entire non-core US asset base to Linn Energy and Whiting Petroleum's $6.0 billion acquisition of Bakken/Three Forks rival Kodiak Oil & Gas. In all, the period from June 17 to July 16, 2014 saw 38 US deals of which 21 had disclosed values totaling $10.3 billion.

The Devon-Linn deal completes Devon's portfolio shuffle set in motion last fall with the $6.0 billion Eagle Ford acquisition from GeoSouthern Energy and the spinoff of its midstream assets into new MLP entity EnLink Midstream Partners. It also follows the sale of Devon's conventional Canadian portfolio during Q1 to Canadian Natural Resources Ltd. for $2.8 billion. The assets sold to Linn consist of low-decline gas properties that are peripheral to Devon's strategy of liquids-rich unconventional growth but fit well into Linn's dividend-driven MLP structure.

The Whiting/Kodiak deal will make Whiting the top Bakken/Three Forks producer with pro forma Q1 output of 107,300 boepd, catapulting over long-time play leader Continental Resources and its 97,500 boepd. More importantly, the Kodiak buy represents a 158% jump in Whiting's drilling inventory from 1,339 to 3,460 net locations across 855,000 net acres.

Taking a broader view, Whiting/Kodiak is tied for third place among the top US unconventional acquisitions of all time, right alongside the $6.0 billion Devon/GeoSouthern Eagle Ford deal last November. Ahead of these two acquisitions are ExxonMobil's $41 billion acquisition of XTO Energy in 2009 and BHP Billiton's $15 billion Petrohawk buy in 2011.

Outside the US, activity from June 17 through July 16 was dominated by Encana's Bighorn divestment to privately held newcomer Jupiter Resources in Canada for $1.8 billion and Shell's $5.7 billion sell-down of its equity in Woodside Petroleum (dropping from a 23.5% stake to 4.5%). In all the period saw 66 international deals including 33 with disclosed values totaling $9.5 billion.

The Bighorn acquisition gives Apollo Global Management-backed Jupiter liquids-rich gas properties with significant development upside in Alberta's Deep Basin as its foundational holdings. It also highlights the continued role of private equity (alongside MLPs) as the primary buyers of long-life conventional reserves in North America, and particularly gas. Meanwhile Shell's Woodside sale scored the highest value of any deal in Q2 and illustrates the continuing shareholder-driven mandate among majors and large independents toward portfolio course corrections. Shell has been among the most aggressive practitioners of this portfolio whittling with nearly $12 billion in divestments so far in 2014.

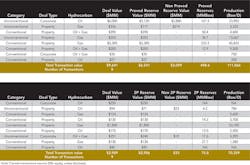

Global M&A activity surged 29% during Q2 to $54.9 billion in 200 transactions with 21 global deals (14 outside the US) topping the $1.0 billion mark during Q2. Historically since 2007, the average number of $1.0 billion-plus deals has been 10.

In the US, after five straight quarters of deal activity range-bound to $10-16 billion, the M&A market jumped to $22.3 billion in Q2, up an impressive 41% from the previous quarter. The number of deals saw about a one-quarter drop to 107 transactions from 139 in Q1 (or 66 in Q2 vs. 88 in Q1 if only looking at deals with disclosed values). The combination of these data points marks a major upswing in average deal size to $338 million, up 88% vs. Q1's $180 million.

Canadian activity slipped 17% during Q2 to $7.2 billion, although this comparison was skewed by Q1's curve-wrecking $2.8 billion Devon/CNRL deal. Backing out this large Q1 transaction, Canadian dealmaking would actually have risen 23% during Q2. Internationally, deal value rose a healthy 41% during Q2 to $25.4 billion, the highest level since 3Q13's $26.5 billion mark.