Revenue and income slide halted in 1Q2014

Don Stowers, Editor – OGFJ

Laura Bell, Statistics Editor – Oil & Gas Journal

Revenues for the group of publicly-traded US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal reversed a protracted slide in the first quarter of 2014. They grew by more than $7.1 billion from the previous quarter, representing about a 3% increase. However, compared to the same quarter in 2013, revenues rose by only $1.2 billion, less than a 1% increase. Total revenues for the companies amounted to almost $236.7 billion for the first quarter of this year.

Net income for the 1Q2014 among the collective OGJ150 companies grew by nearly $4.3 billion compared to the prior quarter, a gain of about 25%. However, the first quarter income gain was more than $4.2 billion less than the first quarter of 2013 – about a 16% decline year over year.

The number of reporting companies grew by two to 123 in the first quarter. Eleven companies on the OGJ150 failed to report their earnings to the US Securities Exchange Commission by press time for this issue.

Year-to-date capital spending stood at just over $49.3 billion so far this year, up nearly $1.8 billion from the same quarter in 2013, about a 3% increase.

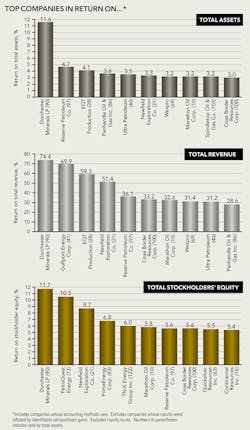

Total asset value for the group of reporting companies grew to more than $1.436 trillion compared to $1.416 trillion for the previous quarter, representing about a 1% rise in value. Total assets were up slightly more than $81 billion over the first quarter of 2013, about a 5% increase.

Stockholder equity for the entire group grew by $36.4 billion (5%) from the same quarter in 2013 and by nearly $3.1 billion (less than 1%) from the previous quarter.

Largest in net income

The largest 20 companies ranked according to net income had $23 billion in collective net income for the first quarter of 2014. This compares with $26 billion for the same quarter in 2013 and $22.4 billion the previous quarter. The latest numbers represent an increase of about 2% over the prior quarter, but a nearly $3 billion decline (about 12%) year over year.

ExxonMobil Corp., Chevron Corp., and ConocoPhillips continued as the top three companies in net income for the 1Q2014. Of the three, Exxon increased its income the most – $1.02 billion, for about a 12% rise over the previous quarter.

New companies added to the top 20 in net income this quarter are Chesapeake Energy Corp. with $466 million in income; Newfield Exploration Co. with $284 million in income; Murphy Oil Corp. with $155.3 million in income; and Pioneer Natural Resources Co. with $123 million in income. Four companies dropped out of the top 20: Forest Oil Corp. with $106.2 million in net income; Concho Resources with $105.8 million in income; Fidelity Exploration & Production Co. with $90.7 million in income; and Denbury Resources with $90 million in net income.

The top 20 companies' total net income of $23 billion topped the income for the entire group of 123 companies by nearly $2 billion because many of the smaller companies reported losses. Of the reporting companies this quarter, 42 (34%) reported a net loss. The largest companies reporting losses were No. 6 ranked Anadarko Petroleum ($2.6 billion); No. 15 Linn Energy LLC ($85.3 million); No. 26 Sandridge Energy Inc. ($134.1 million); No. 30 Halcon Resources Corp. ($73 million); and No. 34 BreitBurn Energy Partners LP ($9.8 million).

Largest in total revenue

The top 20 companies in total revenue had $223.2 billion in total revenue for the first quarter compared to $216.9 billion for the prior quarter and $224.4 billion for the first quarter of 2013. The former represents about a 2% increase and the latter less than a 1% decline in total revenue.

The top 20 companies in total revenue did not change from the fourth quarter of 2013 to the first quarter of 2014, although they did move around a bit in the rankings. Sixteen of the companies saw a revenue increase over the quarter, while four (Chevron, Occidental, Murphy Oil Corp., and Pioneer Natural Resources Co.) saw slight declines. Whiting Petroleum Corp., the No. 20-ranked company on the list, will undoubtedly see an increase in production and revenue when its proposed $6 billion acquisition of Denver-based Kodiak Oil & Gas Co. goes through. Closing is expected before the end of 2014.

Total revenue for the entire OGJ150 group was $236.7 billion, so the top 20 companies combined had 95% of the revenues for the collective group of 123 companies.

The top three companies in total revenue (ExxonMobil, Chevron, and ConocoPhillips) together took in $176.1 billion, which represents roughly 75% of the total revenue for the entire group.

Top spenders

Spending by the top 20 companies in the first quarter of 2014 grew to nearly $40.6 billion. This was up less than 1% over the roughly $39.6 billion spent in the first quarter of 2013.

Top spenders were, in order: Chevron ($8.5 billion), ExxonMobil ($7.6 billion), ConocoPhillips ($3.9 billion), Anadarko ($2.5 billion), Apache Corp. ($2.4 billion), Occidental Petroleum Corp. ($2.3 billion), EOG Resources ($1.7 billion), Devon Energy Corp. ($1.6 billion), Hess Corp. ($1.4 billion), and Noble Energy Inc. ($1.2 billion).

Fastest-growing companies

The fastest-growing company, ranked by stockholders' equity, for 1Q2014 was Devon Energy Corp., which saw a 22.2% increase in value. Oklahoma City-based Devon is the No. 7 ranked company on the OGJ150 quarterly report as ranked by total assets. On June 30, Devon announced it had entered into an agreement to sell all of its designated non-core US oil and gas properties to Houston-based Linn Energy for approximately $2.3 billion. This includes properties in the Rockies, the onshore Gulf Coast, and Mid-Continent regions of the US.

No. 39 ranked Vanguard Natural Resources saw a 13.5% increase in stockholders' equity and was the second fastest-growing company in the first quarter. Newfield Exploration Co., ranked No. 21, and No. 73-ranked PetroQuest Energy Inc. were the third and fourth fastest-growing companies, respectively. Newfield grew at a 9.9% rate, while PetroQuest saw a 9.0% rise in stockholders' equity.