Oilfield water management

Opportunities abound in North American shales

Don Warlick,WarlickEnergy, Houston

Water pond at a hydraulic fracturing operation.

Today, much more attention is being paid to issues surrounding the management of oilfield water used in upstream oil and gas operations. Managing increased volumes of frac flowback water garners headlines, but there is more to be said concerning the huge and growing volumes of produced water. These volumes need more attention, oversight, special handling, treatment, disposal – the list goes on. This report addresses changes now taking place in the business of oilfield water management, with a focus on US shales. Important: We can't lose sight of the principal objective for oilfield water management, which is to minimize total water lifecycle costs in the oilfield.

Current business environment

There is an old Kentucky horseracing proverb that says anyone with a good two-year-old in the barn will always have some fun. That's the case now with those invested in US shale development, and perhaps ultimately those involved in the oilfield water management marketplace now and in the future.

First, in our understanding of this market space we should make sense of the business by quickly defining it: There are two big segments that account for today's oilfield water management challenges:

First there is the water utilized in drilling, fracturing, and completion. This includes services required to treat, recycle, transport, and dispose of the resulting effluent (including frac flowback).

In a recent presentation, Halliburton indicated that on average there will be ~ 100,000 barrels of water required for a typical frac job. Frac flowback volume share of this total can vary by shale play ranging from 15% in the Eagle Ford and up to 40% in the Permian and Mississippian shales.

There are requirements such as water supply, regulations, and transportation, principally trucking (which may account for 65% to 80% of total oilfield water management expenditures). As reported by the New York Department of Environmental Conservation/Division of Mineral Resources, there could be at least 600 truck visits to single shale well that require frac water and frac sand delivery, plus truck removal of flowback water.

All that taken into account, there are changes taking place in producing fields with high density where water gathering/transfer/distribution systems are being installed to reduce trucking costs and impact. Most important for this segment of the water market: Concentration on quality treatment options and requirements for recycle/reuse of shale-produced waters for application in hydraulic fracturing.

Water involved in oil and gas production (produced water) involves hundreds of thousands of wells, some operating for 20 to 35 years. During the lifetime of these wells, increasing volumes of produced water (largely coming from producing oil wells with a growing water-cut) there's a need for constant attention and treatment, more so now that the oilfield is receiving more regulatory scrutiny. As a result, there are requirements for improved fluids and water management for huge volumes of produced water.

Outside North America, oil wells are producing in excess of 200 million barrels of water per day, on average about three barrels of water per barrel of produced oil. In US legacy plays like the Permian, the ratio of water to oil in production can exceed 95% in some cases. Overall, sources indicate 75% to 95% of all "waste" generated by oil and gas development comes in the form of produced water.

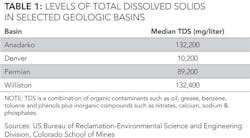

These huge and steadily increasing volumes of water are coproduced with oil and natural gas. These produced waters are in contact with hydrocarbons across various geological formations and will likely contain organic constituents such as grease, oil, benzene, ethyl benzene, phenols, etc. Also present are inorganics that are salt-laden with calcium, phosphates, and nitrates (see Table 1).

An expanding equipment/service market

This newly-evolving business, as defined earlier, could produce a market spend of about $10 billion this year just within major US shale areas. That figure expands if we include all oilfield water management across all conventional land operations.

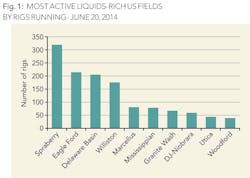

Where is the money being spent for oilfield water volumes involved in drilling/fracturing/completion? Figure 1 gives a straightforward explanation with the Permian (including the Spraberry and Delaware basin) leading the list. The Eagle Ford is right behind. Remember, too, that there will be significant water management services for producing well populations in the more mature plays like the Permian. But for now, the front end of the action will follow completions of long-lateral horizontal shale wells largely in the order shown in Figure 1.

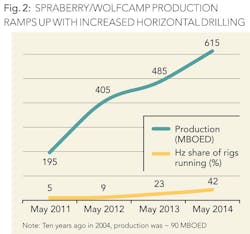

The oilfield water management business seems to be taking off. Why? If you remember one thing about E&P today, it's the fact that there are oceans of oil being produced in US shale thanks to ramped-up drilling via horizontal programs. Let's take the hottest area in the Permian Basin, the Spraberry/Wolfcamp, as an example. In May 2011, just 5% of the total rigs running in that area were horizontal. By May 2014, about 42% of all rigs running were horizontal, a CAGR of 103%. Largely as a result, producing oil volumes grew 47% CAGR during the same period – and we believe oilfield water management activity within these programs predictably lifted up in similar fashion (see Figure 2).

Addressing oilfield water challenges

With regard to the disposal of frac flowback and produced water, the simplest methodology has been to pump volumes down into subsurface zones that are suitable for this kind of disposal. That approach accommodates, by far, the largest volumes of disposed frac and produced waters. Additionally, a share of these total volumes is utilized in pressure maintenance applications and reservoir sweeps for waterfloods.

But we're in a new era replete with the memory of the droughts of 2011 and 2012 in Texas and Oklahoma, plus the pressures of regulatory oversight and public concern about hydraulic fracturing and completion techniques in general. The frac and produced water volumes are becoming too valuable to waste, so the general thinking is now more focused on treatment and recycle techniques to make water volumes applicable for multiple purposes.

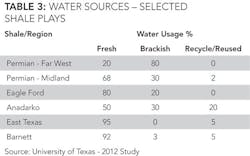

In consideration of that issue, there are essentially four sources of water available to shale drilling and development needs for hydraulic fracturing: Fresh surface water, groundwater, brackish groundwater, and recycled oilfield water. In a recent study conducted by the University of Texas, there were some impactful findings about just where shale development finds its water. Today, however, there appear to be changing attitudes and an emphasis on recycling.

Reviewing Table 2, it's clear that water resources accessed by oil and gas developers tend to favor freshwater in areas where it is available and brackish water where there is a high well concentration (and consequent high volumes of produced water). But the important message in this data is that there is that there's significant potential for utilizing oilfield water that can be treated and recycled.

In the bigger picture we have a number of forces being brought to bear on applications for recycling/reuse of available water in the oilfield:

- Changes in philosophy based on the notion of scarcity and environmental awareness (re: droughts, public and local pressure, regulatory issues under discussion, etc.);

- Growing volumes of oilfield water that will be candidate for treatment/recycling;

- Although the US has more than 172,000 Class II disposal wells for oilfield brines and fluids, oilfield water volumes are growing and there will be higher hurdles for due-diligence for siting and construction on new disposal wells;

- Improvements in systems, logistics, water treatment, and water-handling technologies that are becoming more appropriate and quite timely.

Two examples of supportive trends and forces for change in oilfield water management:

Effective Sept. 1, 2013, the Texas Railroad Commission reestablished its regulations via House Bill 2767 that facilitate oilfield water recycling. It says that no permit is required if the treated fluids are recycled by a "non-commercial fluid recycler" for the use in a base fluid in hydraulic fracturing or other downhole uses. That means operators can maintain control over recycling operations undertaken on the production site directly or through a water management contractor. But commercial recyclers are still subject to permitting by the commission.

Technologies are being brought to oil and gas development that were once deemed inapplicable due to cost and high-end designs. As an example, on July 8, 2012, Rockwater Energy Solutions, a $1.4 billion oilfield water management/environmental service company, purchased Neohydro Corp. Included in the deal is a patent-pending electro-oxidation technology that is reported to reduce suspended solids, petroleum hydrocarbons and bacteria up to 99%, creating a clean brine solution for reuse in hydraulic fracturing.

Treatment applications

In light of the apparent new tilt towards recycle/reuse, we should recognize the basic technologies being employed in oilfield water management today. Selection depends on a mix of factors including as shale location, condition of the media, economics, operator specification, and service company experience in recommendation. Table 3 provides an overview of treatment selections available today.

Experience among various end-users/customers

The core of oilfield water management, its direction, and future growth rest with the final customer, the E&P sector. The oil & gas companies determine the way forward in any short term or future application for this facet of shale development. As follows, some notes about what certain shale-focused E&P companies are doing in this area:

- Apache Corp. has a corporate goal to reduce water usage. Last year the company reported that it recycled over 1.2 million barrels of produced water in the Granite Wash in Wheeler County, Texas. It plans to expand water storage and pipelines to accommodate even greater volumes. In the Permian, Apache developed a treating system near Barnhart, Texas to accommodate the use of brackish water from the Santa Rosa Aquifer, not suitable for human or agricultural uses. There is an installed gathering system for flowback and produced water, then for iron treatment/removal plus chemical agent addition to kill bacteria. Money is saved by avoiding freshwater acquisition costs and disposal in injection wells.

- EP Energy, formerly the E&P division of El Paso Corp. that was acquired by Kinder Morgan and subsequently sold, operates today as a stand-alone E&P shale player with core concentration in the Eagle Ford, Permian Wolfcamp, Uinta Basin, and the Haynesville Shale. EP has a measured but growing water management group with concentration in the Eagle Ford where the company is engineering field water treatment installations for water recycling purposes.

- Range Resources, ranked either first, second, or third as the lowest-cost producer in the Bank of America Low Cost Producer Study since 2005, dominates wet-play activity in the Marcellus with its production growth expected to exceed 20% this year. The company has IRRs near 100% in its super-rich, wet and dry plays. Importantly, operating in Pennsylvania where there is strict oversight, Range has implemented significant water reuse/recycle programs since 2009.

- Pioneer Natural Resources may be the most sophisticated in terms of US oilfield water management. The company has installed significant water logistics and treatment infrastructure in the Permian, and to some extent, in its Eagle Ford holdings. With aggressive hydraulic fracturing and fast-growing field production, Pioneer has advanced experience in water logistics, treatment, and recycling for both the drilling/fracturing/completion and production segments of the business.

Business models

How is this total business evolving in terms of product and service delivery? Not too long ago the generally accepted definition of so-called water management consisted of water sourcing, intermediate handling, limited treatment, and final disposal. That is changing. And now, with the earlier-described conditions, regulation (supportive in some cases), attention to recycling, and new, less-expensive technologies, the business is evolving even more rapidly.

How is the oilfield water management business model evolving? If one looks back in history to the industrial water management/treatment space across several sectors they would get a sense of how product/service opportunities adjust to match a new market. For example, in the power generation industry, it appears that the chemical supply companies were instrumental in aggregating and revolutionizing the product and service business overall.

The service model was to move bulk chemicals to the user sites and provide analytical and advisory services to the end customer; in some cases innovative water management service entities became contract operators. As competition grew, the larger industrial companies like Nalco and GE Water enhanced their offerings by bringing specialty treatment equipment to the market.

Upwards of $10 billion may be spent on oilfield water management programs this year in shale plays across the US and Canada. Thus, there is a lot at stake and the changing marketplace will affect and alter business models. WarlickEnergy's analysis of the market during the first half of 2014 indicate logical business segmentation with equipment and services employed in the value chain categorized as: Advisory/technical support, water sourcing, logistics, storage, treatment, laboratory analysis, disposal, and, to some extent, air environmental and solids environmental services.

This appears to be a healthy and growing market, which, for the time being, continues to experience change, but will ultimately evolve into a generally consolidated business model. The ultimate goal for water management participants will be to deliver efficient solutions to the E&P end-customer.

Analyzing the financial aspects of the space is complex and results vary widely. We project average EBITDA margins to typically be highest for treatment, laboratory analysis, and liquids disposal. But, there should be high-end EBITDA for solutions providers who bundle delivery of selected equipment and services in an expanded business perspective.

Examples of commercial players

Our review of the oilfield water management business and how it is commercially segmented, at least at this time, is categorized into four product/service delivery groups:

- Specialty services will include companies with special capabilities and technologies appropriate for certain field situations. For example, Omni Water Solutions recycles produced and frac flowback water; Ridgeline Canada supplies drilling waste management and remediation services; Fountain Quail has been successful in partnering with E&Ps for on-site recycling.

- Classic and synergistic oilfield is a mix of experienced service providers of pressure pumping and well servicing, plus some interesting combinations of service delivery. Baker Hughes, like Halliburton, is bundling water-related service offerings in stand-alone units. Leading pressure pumping entities like FTI, Schlumberger, and others have direct servicing to hydraulic fracturing projects in the shales and will, of course, have synergies with the drilling/fracturing/completion phase requiring water services. Nabors Completion & Production Services has significant water transfer and disposal services (and just recently combined their pressure pumping with C&J Energy Services) in a larger interface to shale hydraulic fracturing markets. Rockwater is combining a classic oilfield service approach with water technologies. Select Energy Services is working in a somewhat similar fashion.

- The industrial water/wastewater group is made up of service companies with decades of industrial water treatment and processing who can bring tested technologies to the oilfield. Some examples: Veolia Water is selling evaporation and crystallization technology for frac flowback and produced water treatment while Dow Water & Process Solutions offers water technology and is also participating in a few joint ventures.

- The produced water services group includes companies that specialize in treatment of the ever-growing volumes of produced water via chemical solutions, but there are process-oriented and specialty services as well. Nalco Champion is a provider of production enhancement and environmental compliance solutions into oil & gas markets. Also involved is the workover sector with companies like Nabors, Basic, and Key are participating here with widespread services in water transport, handling and disposal.

Certain E&P vertical services

Some of the E&P companies entered into the service business during the heated-up hydraulic fracturing era of 2008-2013. There may also be potential entry by some into oilfield water management as well:

- Pioneer Natural Resources has reportedly been considering a new company division devoted entirely to oilfield water management for their own (continuing) use but also offering to third parties. Pioneer is experienced at vertical services with ownership and operation of eight frac spreads in the Permian and Eagle Ford plus their own frac sand mine (via their earlier acquisition of Carmeuse) as well as various well servicing equipment.

- Principally in the Bakken, Oasis Petroleum has its own own oilfield water gathering/injection disposal system for self-use and possibly for third-party offering. It has two frac spreads with interest in possible additions.

- SandRidge Energy, the leader in Mississippian shale development, is one of if not the largest, operator of produced water disposal systems in the US, currently processing 1 million barrels of water daily. SandRidge has formed a new business unit for stand-alone performance to serve its needs as well as those of third parties and has considered the possibility of an MLP spinout.

What's ahead in the short term

We foresee several major trends in the short-term in this new wave of oilfield water management:

- Increasing applications of recycling that will produce uptrending volumes of water needing treatment and related handling for ultimate reuse in shales

- Better-planned and engineered disposal in combination with recycling programs

- Smart applications of treatment and handling allowing increased usage of brackish waters, and even salt water.

- More incentive-focused regulation (e.g. Texas House Bill 2767) that supports and even drives recycling with less risk faced by E&P companies.

- Improvements in water transportation, transfer and handling (such as pit covers to prevent evaporation) especially in high-density field development such as the Permian where infrastructure allows a more factory-like approach to overall management.

In summary, there is no question this is an oilfield business in transition – all for the better with regard to the environment, proper oilfield operations, and marketplace opportunity. We believe there is potential for faster-cycle growth in the management of frac-related oilfield waters and also for produced waters in their new role as water volume provider for recycle and reuse in drilling and development. We look for upward growth in the US and Canada and then followed by a good start in rest-of-world shale developments that probably begins realistically sometime in late 2015.

About the author

Don Warlick is president of WarlickEnergy in Houston. His firm provides analysis and reporting on unconventional oil and gas development in North America to the E&P, energy services, and financial sectors. He has published and spoken broadly on the subject of E&P investment and energy services markets in North America. WarlickEnergy publishes a series of proprietary market intelligence reports addressing major liquids-rich plays in the US and Canada and is launching a new report on shale water and fluids management markets. Warlick's background includes corporate planning and marketing at Getty Oil Company, Williams Companies, and PepsiCo Inc. He established WarlickEnergy in 1975. He has BS and MS degrees from the University of Tulsa, is a member of SPE, and is a contributing editor to Oil & Gas Financial Journal.