APV and Real Options

Better tools for the valuation of petroleum assets

Luiz Gustavo de Souza, Petroleum economist, Rio de Janeiro

Petroleum projects are hard to value because they are limited in time, so perpetuities cannot be used. They have a long maturation period and can run for more than 30 years, so prices are hard to forecast. And there are high uncertainties and risks on every stage of the project. EMV (expected monetary value) is the simpler tool to use, but APV (adjusted present value) and Real Options can help the analyst to appropriately address the crucial points of the analysis.

The problems with EMV

A simple discounted cash flow can provide an estimated return for one specific scenario, but it will not provide a comprehensive notion of value for the asset. The common solution is the EMV calculation. Four scenarios for each exploratory opportunity can be used: three for successes and one for failure. Weighting these scenarios by their probabilities (using Swanson's rule), the EMV can be calculated as follows:

EMV=Pg × (30% × NPV10+40% × NPV50+30% × NPV90 ) − (1 − Pg) × DHC

Where DHC is the dry hole cost; Pg is the probability of geologic success; NPV 10, NPV 50 and NPV 90 are the Net Present Value for the high case (P10), median case (P50) and low case (P90).

Projects with low uncertainty will have a small P10/P90 ratio, and chances are that if the project has an attractive NPV 10, it will also have an attractive NPV 90. If these values are positive enough, they will produce a positive EMV, indicating that the wildcat well should be drilled. In this case, the Pg will be a good proxy for the full-cycle chance of success.

Projects with higher uncertainty, however, may have a very high NPV 10 and negative values for NPV 90 and NPV 50. In this case, if the volume discovered is large enough, the project is very positive, but the chances of finding a volume larger than the minimum economic threshold are very small. The Pg will no longer be a good proxy for the full-cycle chance of success.

So if a company were offered two projects with these characteristics as alternatives, its choice would be dependent on the risk aversion of its managers and/or shareholders, and not simply dependent on the comparison of the EMVs. A risk-prone management would choose the second project, while a risk-avert management would choose the first one.

This simple example shows that some risk assumptions are implicitly taken in the EMV calculation, and that in many cases the EMV doesn't represent the real value of a project to a company. The EMV is the weighted average of several NPVs, and to calculate the NPVs, one needs a cash flow and a discount rate. The cash flow projection can be straightforward, but the discount rate is a little more complicated to calculate.

The most common approach is to use a 10% discount rate, the industry standard. This approach, however, completely disregards the risk of the company and the risk of the project. A more sophisticated approach would be to calculate the WACC (weighted average cost of capital), and use this value to discount the cash flow to the present value. The WACC can be calculated using the following expression:

WACC = D⁄V × Kd × (1-t) + E⁄V × Ke

Where D is the market value of debt, E is the market value of equity, V is the sum of D and E, t is the income tax rate, Kd is the cost of debt and Ke is the cost of equity. If the company's D/V ratio is used, the implicit assumption is that the company is giving riskless assets as guarantees to pay for risky projects. In this case, the project would be increasing the risk of the company as a whole, and in return it would have a smaller discount rate. Alternatively, the project's D/V ratio can be estimated, varying year-by-year depending on the stage of the project. But in this case, another problem will arise in the calculation of Ke.

Ke can be calculated summing the risk free return rate (Rf) and the risk premium. The risk premium is the difference between market return (Rm) and Rf, multiplied by a coefficient (β) that measures the relationship between the risk of the asset and the risk of the market.

Ke = Rf + β × (Rm − Rf )

The problem is that different lines of the cash flow have different risks. Considering risk as the chance of happening, and not the chance of providing successful results, the exploration expenditures are mostly risk-free, but every other investment, expenditure or revenue is conditional.

The solutions from APV

The concept behind APV methodology is to calculate the present value of cash flows as if they were fully funded by equity, and then adjust it by the present value of benefits obtained by the financing alternative. This differentiation allows one to use two different discount rates for two cash flows that are different in essence, and sum the results to obtain the present value of the complete operation.

The same concept should be applied to the valuation of a petroleum project. More than just differentiating equity and debt cash flows, it is possible to differentiate a total of eight cash flows, each one with a specific risk level.

- Exploration Cash Flow – Includes all expenditures needed to acquire and survey an area, define a location and drill a wildcat, and any other unconditional investment. This cash flow should be discounted at the risk-free rate, because it is mandatory.

- Appraisal Cash Flow – Appraisal will never occur unless exploration is successful. Therefore, a higher discount rate must be used to reflect the chance of not reaching this stage.

- Development Cash Flow – the field will only be developed if the volume discovered is higher than the minimum economic field size. Even though developments costs are correlated to oil prices, most part of these costs will be fixed after the Final Investment Decision (FID), therefore the cost variation due to oil price volatility can be disregarded.

- Production Cash Flow – This stage is highly dependable on oil prices. The variation of oil prices directly affects the value of the project: if oil prices fall, the project value decreases, but if it goes up, project value increases. Therefore, to consider volatility of oil prices as a risk and increase the discount rate to adjust for this risk is a too conservative approach. New tools must be used here – we will come back to this.

- Debt Cash Flow – It also depends on the development decision, but does not depend on external factors. If the company decides to use debt, it will certainly have to repay the debt.

- Exploration & Appraisal Tax Shields Cash Flow – Considering a standalone project (to avoid transferring value between projects within the corporation), the tax shields created by the exploration and appraisal cash flows will only be amortized in case of a commercial discovery. This discount rate should also compute the inflation expected for the period, if oil price is projected in real terms and the investment cannot be monetarily corrected.

- Development and Production Tax Shields Cash Flow – The tax shields created by the investment in development and the expenses of production are less risky than the production revenues. If prices fall, income will decrease, but as long as the EBITDA is greater than the amount to be amortized, the investment will be fully amortized. As well as in the exploration case, inflation should be computed.

- Debt Tax Shield Cash Flow – Debt tax shield will be created when EBIT is greater than the interest due. The shorter the debt and the smaller the D/V ratio, the smaller the Debt Tax Shield Cash Flow risk, and vice versa.

APV solves most of the uncertainty and risk issues in the valuation process, but it fails to address the volatility of oil prices properly.

The Real Options sophistication

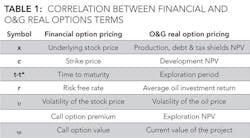

The Black-Scholes-Merton Option Pricing Model establishes a functional relationship between the value of an option (w), the value of the underlying stock (x), the risk free rate (r), the time to maturity (t-t*), the strike price (c) and the variance of the underlying (u). Specifically for oil and gas projects, the following correlation can be made. As an investor pays a premium to receive an option to buy a stock for the strike price at the maturity, an oil company pays the exploration CAPEX to have the option to develop the project at the end of the exploration period. This investment is irreversible: it can be recovered in the secondary market, but it will not be reimbursed if the investor of the company decides to give up on the investment.

If the stock price is below the strike price, the investor will not exercise its option, as the oil company will not develop a project whose NPV is lower than the development cost. On the other side, if the stock price is above the strike price, the investor will exercise its option and receive a profit, as the oil company will develop a project whose NPV is greater than development cost.

Using the Real Options approach to value an asset allows the inclusion of the volatility of oil prices without simply increasing the discount rate of the production cash flow, which would incorrectly reduce the value of the asset.

The value of the underlying asset should include the Production Cash Flow NPV, the Debt Cash Flow NPV, and all the Tax Shields Cash Flow NPVs, since these cash flows are dependent on the exercise of the option. The Development Cash Flow NPV is the strike price, since this is the amount of capital investment needed to receive the underlying asset value, but that will only be invested when the uncertainty about the economics of the project is sufficiently reduced.

The exploration NPV can be subtracted from the current value of the project to calculate the full-cycle value of the project, but this result should not be used to take decisions of development or relinquishment of the concession.

About the author

Luiz Gustavo de Souza is a petroleum engineer from the Universidade Estácio de Sá with a master's degree in finance from the IE Business School. He helped the Brazilian start-up HRT establish its valuation model. He currently works as a consultant for other Brazilian companies.