The challenges of transfer pricing

Current environment will remain difficult for the near future.

Purvez Captain and Margaret Brown, Ernst & Young LLP, Houston

The highly complex nature of transfer pricing lends itself to being misunderstood as a scheme by a multinational corporation (MNC) to shift profits to affiliates in low-tax jurisdictions. In reality, arm's-length transfer pricing in its current form, when effectively managed, is a powerful mechanism for both tax authorities and corporations to reduce audit controversy while proving to apportion income fairly among multiple taxing jurisdictions worldwide.

Conversely, if inadequately administered, transfer pricing can be costly for all stakeholders, leading to lengthy audits and litigation, transfer pricing adjustments, potential nondeductible penalties, and double taxation.

In a nutshell, transfer pricing is the pricing of goods, intangibles, services, and financial instruments when transferred between affiliates in various countries within an organization. A transfer price impacts the allocation of total profits across entities in different tax jurisdictions and is therefore an important determinant of the total taxes paid by the MNC. From a global perspective, the world economy is becoming more integrated, and MNCs account for an increasing proportion of the global economy. Intercompany transactions represent a growing factor of cross-border trade, and, according to the Organization for Economic Co-operation and Development (OECD), approximately 60% of world trade takes place within multinational enterprises.

A typical fact pattern experienced by large, vertically integrated MNCs operating in the oil and gas industry may include exploration and production of crude oil in Africa, use of technology owned and developed by an affiliate's research and development team based in Europe, transportation of crude oil to refineries via vessels owned by an affiliate in Panama, provision of services by a shared service center in Malaysia, and leverage of financial resources provided by the corporate parent in the US. With varying functions being performed by decentralized affiliates worldwide, MNCs face the challenge of establishing their transfer prices and defending them against tax authorities on both sides of each transaction, with all looking to maximize their own interests.

As intercompany transactions are prevalent in the daily activities of all MNCs, corporate tax executives and tax authorities alike are recognizing the importance of transfer pricing and are devoting increased resources to enforcing compliance and managing controversy worldwide. Unfortunately, transfer pricing rules are highly complex and vary by country, making it difficult for MNCs to comply with all local regulations in countries where they operate and even more challenging for tax authorities to enforce global compliance.

Recent developments have further increased the focus on transfer pricing, including initiatives to expand audit scopes and complexities, redefine "aggressive" tax positions, and enforce more stringent transfer pricing documentation requirements. For example, the OECD's project on base erosion and profit shifting (BEPS) aims to develop approaches for addressing concerns that MNCs are inappropriately avoiding taxes and reducing their tax liabilities through BEPS activities.

Through a series of 15 action plans, the OECD identifies actions needed to address BEPS, sets deadlines to implement the actions, and identifies the resources needed and the methodology to implement the actions. Subsequently, the OECD also issued a white paper that emphasizes transparency in transfer pricing documentation to enable risk assessments throughout the supply chain. These are two examples of the dynamic and ever-changing sphere of transfer pricing.

Summary of 2013 Global Transfer Pricing Survey results

EY conducts two transfer pricing surveys on alternate years to monitor the pulse of the current transfer pricing environment, one surveying executives of leading corporations and the other surveying tax authorities worldwide. EY's 2013 Global Transfer Pricing Survey (2013 GTPS) provides a snapshot from a corporate perspective based on our interviews with executives from 878 companies across 26 markets. As expected, the 2013 GTPS indicates a clear shift toward prioritizing risk management in transfer pricing, with heightened concerns regarding controversy and double taxation.

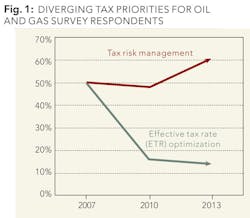

Over the past decade, EY's global transfer pricing surveys have recognized that tax authorities worldwide are identifying transfer pricing noncompliance as fertile ground for raising tax revenues. Since EY's last transfer pricing survey, the pace of globalization and integration of economies has accelerated, and businesses have increased their focus on managing transfer pricing issues across the supply chain. Approximately 61% of oil and gas survey respondents in the 2013 GTPS identified tax risk management as their highest priority for transfer pricing, an increase of 27% and 22% over surveys conducted in 2010 and 2007, respectively.

Correspondingly, the percentage of oil and gas companies identifying effective tax rate optimization as their top priority fell from 50% in 2007 to 14% in the most recent survey. The 2013 GTPS identifies several factors leading to the prioritization of risk management, as further described in Figure 1.

First, there has been a drastic increase in controversy activity among governments worldwide. Tax authorities are requiring more transparent disclosures from taxpayers, re-examining economic substance doctrines and, in countries such as Argentina and Israel, imposing criminal penalties associated with transfer pricing misstatements or underpayment of tax (See Figure 2). Respondents of the 2013 GTPS say that examinations by tax authorities have expanded in scope and complexity, while the outcomes of examinations resulting in adjustments and penalties are also increasing.

According to survey respondents in the oil and gas industry, the top three countries with recent audit activity were the US, Canada, and Norway, with 26% of recent audits resulting in an adjustment or partial adjustment. In addition, for survey respondents across all industries where examinations resulted in adjustments, penalties were imposed in 24% of the instances, up from 19% in 2010 and 15% in 2007. Furthermore, 52% of oil and gas respondents reported that transfer pricing adjustments in the past two years resulted in double taxation.

The second reason that MNCs report risk management as an increased priority is the rise in transfer pricing regulation and audit activity in emerging markets. Approximately 30% of oil and gas survey respondents with operations in Brazil, Russia, India, and China (BRIC) and African countries indicate that these jurisdictions are one of the top three most important areas of focus in managing their overall transfer pricing risk. Specifically, oil and gas respondents to the 2013 GTPS have reported recent examinations in countries such as Argentina, Bolivia, Colombia, India, Indonesia, Kenya, Peru, South Africa, and Tanzania, where transfer pricing documentation requirements are relatively new in several of these countries. Furthermore, oil and gas survey respondents indicated that tax authorities have imposed penalties in emerging markets such as China, India, Indonesia, and South Korea, highlighting the need by MNCs to increase resources devoted to transfer-pricing-related issues in these jurisdictions. Additionally, emerging market transfer pricing has historically been concentrated on the outsourcing of support functions to lower-cost jurisdictions. However, as further discussed below, the expanding definition of intangibles by tax authorities worldwide warrants the reassessment of transfer prices relating to issues such as the creation of marketing intangibles and location cost savings in emerging markets.

Lastly, reputational risks also play a major factor in the shift toward transfer pricing risk management. Transfer pricing has been a hot topic in the media as a controversial scapegoat commonly identified by journalists, politicians and social organizations for the inadequate tax revenues collected by governments worldwide. What the public media fails to acknowledge is the highly complex nature of transfer pricing and the immense efforts taxpayers are devoting to transfer pricing as a result of the increased compliance burden. The media's oversimplified assumptions and relatively low level of technical transfer pricing knowledge impart a misleading negative connotation. Although taxpayers' intercompany transactions have economic substance and may be fully compliant with local regulations, the potential for a tainted reputation leads taxpayers to dodge such public scrutiny at all costs.

BEPS implications for oil and gas taxpayers

Globalization has empowered MNCs with the flexibility to make business decisions that increase their organization's overall efficiency. In particular, the ability to transition routine activities to low-cost jurisdictions while maintaining regional service hubs and centralized management has allowed MNCs to expand their global footprint while streamlining the organization's operations.

To cope with the increased separation of functions and risks within taxpayers, the OECD's BEPS action plan reflects a new emphasis regarding the arm's length standard with a heightened focus on economic substance. In addition, several of the BEPS action plans address issues such as functional and legal ownership in examining the allocation of income among tax jurisdictions relative to measures of value-creating activities.

For taxpayers, this means that a thorough functional analysis across the entire supply chain is highly important to appropriately characterize each entity's functions, assets and risks. While the BEPS action plan has transfer pricing implications for all MNCs, several important issues are particularly relevant for oil and gas companies.

A mere 24% of oil and gas survey respondents to the 2013 GTPS expect intangible transactions to be the most important area of tax controversy in the next two years, but tax authorities are thinking otherwise. From a value creation perspective, the BEPS action plan specifically proposes the development of rules to prevent BEPS by moving intangibles, transferring risks or allocating excessive capital among group members. The capital-intensive and R&D-focused nature of the oil and gas industry renders it a prime battleground for controversy related to intangibles and services. In addition, the oil and gas industry heavily relies on equipment and tool leasing, as well as the contract manufacturing of certain equipment and parts. Oil and gas taxpayers have historically relied on public indices, comparable uncontrolled prices/transactions, or routine benchmarks to establish and document their transfer prices. However, with the new focus on value creation, tax authorities are expected to favor profit-based methods going forward in assessing the overall allocation of system profits. Furthermore, the broadening definition of intangibles will encourage the re-evaluation and assessment of functions previously characterized as being routine in nature.

The international nature of the oil and gas business renders transfer pricing planning, coordination and documentation of utmost importance. Documentation efforts within the oil and gas industry are complicated by each MNC's expanding global footprint, especially in emerging markets where transfer pricing regulations are relatively new and where comparable market benchmarks may not be readily available. As tax authorities increase focus on transparency, improve data collection processes and share information with each other, transfer pricing documentation will not only facilitate compliance but also serve as an effective risk management strategy to protect against penalties associated with transfer pricing.

The sheer volume of transfer pricing reports required can be overwhelming for tax departments, and with the increased focus on value chain reporting, the level of financial data detail required for the analysis may not be readily available in many enterprise resource planning systems. However, if the process is effectively managed, quality transfer pricing reports serve to mitigate controversy by establishing the framework that documents the appropriateness of the transfer prices. Furthermore, a coordinated global transfer pricing policy provides consistency and reduces the administrative burden in managing an organization's intercompany transactions. On the other hand, the lack of transfer pricing documentation, or even poor-quality transfer pricing documentation, invites tax authorities to initiate further reviews and, in worst-case scenarios, may paint a clear road map for tax authorities to identify transfer pricing exposures.

The BEPS initiative may put an end to the "single tested party" principle as MNCs may be required to show the taxing authorities the transfer price and levels of profitability across every step of the supply chain (i.e., from the purchase of a component from a vendor to the sale of a complete machine to a third-party customer, and every step in between). In addition, taxing authorities will want to analyze legal entity profitability by function. For example, if an MNC has a legal entity in the United Kingdom that has manufacturing, distribution, R&D and service functions, the taxing authorities will want clarity on the profitability of each of the individual functional segments. At present, most companies' financial systems are not set up to handle such rigor in segmented financial detail. This increased focus will lead to very contentious audits and the potential for double taxation.

An effective dispute resolution strategy in this environment is to enter into an advance pricing agreement (APA) with tax authorities. APAs, especially on a bilateral basis, allow for certainty on both sides of an intercompany transaction and therefore eliminate transfer pricing adjustment and penalty risks associated with the transaction for the covered years.

Based on the 2013 GTPS, 37% of oil and gas survey respondents reported entering into APAs in the last three years, up from 21% in 2010 and 25% in 2007 (see Figure 3). Although APAs may be time-consuming, 91% of the survey respondents that entered into an APA recently reported that it was an effective process and that they would consider it again, up from 83% in 2010. For oil and gas companies with large intercompany volumes or high-risk transactions, APAs present an attractive option to prevent adjustments to taxable income, reduce risks of double taxation and create some level of certainty in a highly uncertain transfer pricing world.

Conclusion

EY's 2013 GTPS and recent developments such as the OECD BEPS action plan converge in their indication that tax authorities have been and will continue to increase their scrutiny of the pricing of intercompany transactions. The increased transfer pricing sophistication of tax authorities worldwide presents a source of concern for taxpayers, but the additional governmental resources devoted to controversy management procedures can also be a potential relief. As a result, the current transfer pricing environment will remain difficult in the near future, and taxpayers must be proactive in addressing transfer pricing risks to stay ahead of the game and prepare for the challenging road ahead. OGFJ

About the authors

Purvez F. Captain is the Americas Director of the Transfer Pricing and Economics practice for Ernst & Young LLP. He is also the leader of Ernst & Young LLP's Global Energy Transfer Pricing and Economics practice. He assists clients in the areas of intercompany pricing, production and cost-sharing structures; valuation of intangible and tangible assets; economic modeling, litigation support; market share analyses, corporate strategy; and general economic advisory. Captain has 23 years of experience in various aspects of global transfer pricing for a diverse range of industries. He holds PhD and MA degrees in economics from Rice University. He received his bachelor's in economics from the College of Wooster.

Margaret Brown is a member of EY's Transfer Pricing and Economics practice for the Southwest Region. She is based in Houston. She holds MA and BA degrees in economics from the University of Southern California. She is a member of the California Board of Certified Public Accountants. Brown has more than seven years of transfer pricing experience with EY and has served clients in energy and other industries.