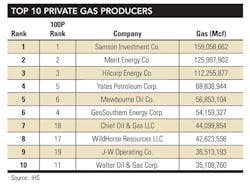

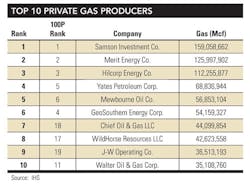

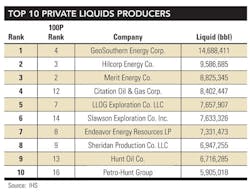

Independent research firm IHS has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

Since the October issue, Sheridan Production Co. LLC moved up from No. 11 to the No. 9 spot, knocking Chief Oil & Gas LLC out of the Top 10 by BOE to rest at No. 12, whereas Walter Oil & Gas Corp. moved up from No. 12 to enter the list at No. 10. One big mover in the Top 10 Gas Producer space is WildHorse Resources LLC. The No. 17 by BOE company moved into the list at No. 8. And while the Top 10 lists moved only slightly this issue, expect the recent GeoSouthern/Devon Energy deal to shake things up once state agencies reconcile the transaction with production totals.

Asset sales

In a deal to secure low-risk, light oil assets with strong well economics and self-funded growth, Oklahoma City, OK-based Devon Energy Corp. agreed to purchase Eagle Ford assets from privately-held GeoSouthern Energy Corp. for $6 billion.

The Woodlands, TX-based GeoSouthern currently ranks as the No. 4 privately-held E&P company on the list, and the No. 1 privately-held liquids producer. Those numbers translate well for Devon, who will acquire Eagle Ford assets that include current production of 53,000 barrels of oil equivalent (boe) per day and 82,000 net acres with at least 1,200 undrilled locations. The risked recoverable resource is estimated at 400 million barrels of oil equivalent, the majority of which is proved reserves. Devon estimates peak production from the acquired assets, located in DeWitt and Lavaca counties, will be 140,000 boe/d.

Currently, US oil accounts for 12% of Devon's total volumes. In a report released following the transaction, Canaccord Genuity analyst Robert Christensen called the acreage a "great fit" for Devon as the company "was first to develop on a ‘mass manufacturing basis' in the Barnett Shale." This experience, coupled with an estimated $4.3 billion of cash on hand, could grow production 31% in 2014 and 23% in 2015, he said, noting that GeoSouthern produced 23 MMboepd in 2012 – an amount that, alone, would increase Devon's US oil volumes by over 25%.

Christensen added "We believe that greater oil growth and a higher mix of oil as a share of its total output are key elements to DVN receiving a higher valuation for its deeply undervalued E&P business."

GeoSouthern holds a 50% working interest in 173,000 gross acres in the Black Hawk field with partner BHP Billiton. The company also has 68,000 net acres further north in Fayette County.

For Devon, the price of shoring up its light oil inventory amounts to roughly $113,000 per flowing boe (without crediting value for acreage or other assets purchased in the deal), according to calculations by Jefferies & Co. analysts.

The development drilling program is immediately self-funding and expected to generate annual free cash flow of approximately $800 million beginning in 2015 and growing thereafter.

GeoSouthern will continue to operate all of its other assets in the Texas Gulf Coast region and other areas.

In another deal, private equity backed Templar Energy LLC, in conjunction with its wholly-owned operating subsidiary, Le Norman Operating LLC and its joint venture partner Le Norman Fund I LLC, closed on the acquisition of Texas Panhandle assets from Forest Oil Corp.

In late November, CO-based Diversified Resources Inc. acquired privately-held Natural Resources Group Inc. (NRG). NRG, with operations in the Denver-Julesburg and Raton basins, will now operate as a wholly-owned subsidiary of Diversified after it issued 14,558,150 shares of common stock to the NRG shareholders, retired 2,680,033 shares, leaving a total of 17,128,117 shares outstanding.

New companies

The quarter also saw new companies enter the list. In December, Bravo Natural Resources LLC was formed with a $200 million equity commitment from Natural Gas Partners (NGP) and the Bravo management team. Based in Tulsa, OK. Bravo is led by CEO Charlie Stephenson, president and COO Robert Schaffitzel, and CFO Trent Richey.

In a separate deal, a $350 million equity commitment from EnCap Investments helped launch Silverback Exploration LLC, a San Antonio-based company led by CEO George M. Young, Jr., COO Stephen Lipari, and CFO Chris Williford.

Appointments

In October, Sabine Oil & Gas LLC promoted Todd Levesque to COO. Levesque had previously served as the company's senior VP of engineering and development.

Ward Petroleum named David J. Stone as the company's new VP of exploration. Stone retired from Marathon Oil after 31 years, most recently as the company's North America exploration director. He was active in the company's involvement in the Anadarko Basin Woodford Shale Play, among others. Privately-held Ward Petroleum is focused on the Anadarko and Arkoma Basins in the Mid-Continent and the DJ Basin in the Rockies.

Click here to download pdf of the "2013 Year-to-date production - alphabetical listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.