Two-thirds of oil & gas companies planning higher 2014 capex

Spending rise follows increases by 70% of companies in 2013

Nearly two-thirds of oil and gas companies are planning to increase their capital spending in 2014, a quarter of them by 10% or more, according to a global industry survey by UHY LLP Certified Public Accountants and Oil & Gas Financial Journal.

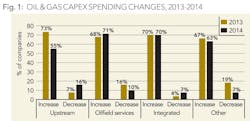

Next year's planned increases come on the heels of capital spending hikes in 2013 by 70% among the survey respondents, of which one-third were increases of 10% or more. For 2014, one-in-four survey respondents report plans to expand capital spending by 10% or more; 18% expect their companies' capex to expand 15% or more.

"Across industry segments, almost 70% of companies report increased capex spending for 2013 and 2014, with the exception of a decline to 55% of upstream companies in 2014 plans," said UHY LLP Energy Partner Scott Barker. "This likely reflects companies' needs to focus their unconventional projects on improved production in 2014 following a period of intensive expansion and exploration investment, and to align with current market price trends."

Other study highlights

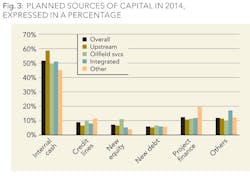

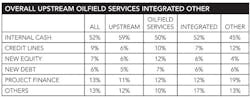

- More than half (55%) of the respondents indicated that internally generated cash was the primary source of capex funding in 2013 with 52% citing internal cash as the primary planned source in 2014;

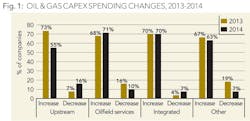

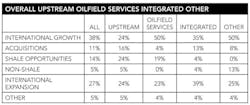

- The two primary drivers for increases in capex spending were internal growth and international expansion opportunities;

- Current political and economic conditions had more impact on non-US survey respondents then their US counterparts; and

- The survey's 129 respondent companies accounted for more than $700 billion in 2013 revenues, and almost $100 billion in capex expenditures. Half are headquartered in the US, half in other countries. The survey was conducted online between Nov. 27 and Dec. 9, 2013.

The study is the second in a joint series by UHY LLP and Oil & Gas Financial Journal. In early October, OGFJ reported results of http://www.ogfj.com/articles/2013/09/one-in-six-oil-and-gas-companies-have-considered-going-public-privatizing-or-other-restructuring.html">the first survey that found that more than one-in-six energy companies have considered major changes in their company structure, primarily to improve value for investors. The study found that the rate among oilfield services companies was more than two-thirds higher than other sectors in the industry.

A copy of the full survey reports are available upon request via [email protected].