The money runs through it

Private equity firms targeting midstream sector for investments.

Nathen J. McEown, Whitley Penn, Dallas

Chandler A. Phillips, Energy Spectrum Capital, Dallas

Much could be said about the midstream oil and gas industry today. Throughout 2012 and 2013, we have seen countless headlines regarding multi-billion-dollar midstream mergers and acquisitions, initial public offerings of master limited partnerships, the formation of new management teams with multi-million-dollar commitments from private equity sponsors, controversies over new pipelines, and the emergence of transporting crude by rail. Despite its relative size in the greater energy industry, midstream has become a targeted investment opportunity for many private equity firms.

The oil and natural gas industry can be very capital intensive. From independents to majors, everyone is chasing an opportunity that requires serious money, and usually a significant amount of it. The midstream sector is no exception, and private equity-sponsored midstream companies are filling an essential need as a great source of capital, expertise, and execution.

These PEMCs have the wherewithal and willingness to take risks and provide the midstream solutions that are needed and/or are otherwise not available. A midstream solution could include any number of different services that require a variety of capital-intensive assets (see Figure 1).

These essential assets and services move oil and natural gas production from wellhead to market. Many assets can be complex and require technical expertise. The throughput-volume business model of most midstream businesses helps mitigate cash flow volatility.

An INGAA Foundation / ICF International infrastructure study found that natural gas midstream infrastructure capital investment in North America for the next 25 years is estimated to be more than $205 billion with an additional $46 billion in capital investment for natural gas liquids and oil pipeline infrastructure. As a result of this investment, an average of 2,000 miles of new natural gas transmission lines and laterals are anticipated to be added each year through 2035 in combination with more than 200,000 horsepower of compression, 24 billion cubic feet of gas storage capacity and 1.3 bcf per day of annual processing capacity additions.

On average, an additional 1,300 miles of oil and NGL transmission pipeline would also be constructed each year. One can observe these investments progressing with just a quick review of the activities in an investor presentation of any large, publicly-traded midstream MLP.

As many industry participants have noted, the shale land grab for E&P companies is over. In 2013, there was $137.7 billion in total upstream M&A activity compared to $270.8 billion in 2012. It is evident that E&P companies are focused on developing and pursuing highest-value opportunities instead of acquiring new acreage. This increasing E&P development should result in greater oil and natural gas production volumes that the midstream companies must serve in the near future.

In addition to the projected increase need in the midstream sector, PE groups have found that capital-intensive energy investments have been rewarded in recent history. According to PitchBook's 4Q 2013 inventory report, over the last 10 years energy investments have offered a quicker return on investment for private equity groups. The average hold time for all industries outside of energy was about six years, while the hold time for energy investments was approximately 4.5 years.

PE groups also consider that relative to the higher risk nature of E&P and oilfield service opportunities, midstream sector opportunities generally offer more attractive risk-adjusted returns. It is important to remember that return profiles are generally inverse to the investment capital allocated to pursuing such opportunities. The midstream risk profile has been lower due to the fee-based business model supported with long-term contracts or dedications.

Structure of PE midstream investments

Traditionally, a PEMC would be formed between a PE fund and an experienced management team around the acquisition of an asset or with a signed contract to develop a project. Times have evolved however, and these "marriages" between the PE capital and the experienced management team aren't always consummated around an asset acquisition or a signed contract. These days many proven and experienced management teams can establish a marriage with a PE fund prior to even securing an asset or project.

When these "marriages" are formed, the headlines often indicate a multi-million-dollar commitment from a PE fund to a PEMC, but do not be misled. Just like any real marriage these unions are not carte blanche or blind pool commitments. The PE fund must approve any investments and do so through strong governance and control of the PEMC. Typically, if a PEMC without assets is unable to secure an opportunity within two years, a reassessment of the strategy and partnership is considered.

A management team initially could be an individual or a full staff of several members, from a variety of backgrounds including engineering, construction, operations, finance, legal, trading, business development, regulatory, etc. Most PEMC management members usually have a significant amount of experience with the types of assets and projects they plan to pursue earlier in their careers at medium to large public or private E&P companies and midstream MLPs.

It is important to note that E&P companies are the PEMC's customers, so former E&P senior management understand what the current demand is, and they have the contacts to drive deal flow. Also, PEMC senior management is generally expected to "put their money where their mouth is" and invest a material (i.e., relative to that individual's personal circumstance) amount alongside the PE fund.

The capital that is obtained from the senior management team can be insignificant to the total committed capital to a project, but it is an important factor to motivate the management team. Basically, the PE firm wants management to invest enough to make it hurt if something goes awry. However, remember that management is incentivized with the opportunity for a potentially large financial reward if the investment is successful for the PE fund. Some industry observers claim there are approximately 60 PEMCs currently active with or without assets/projects, but that figure depends on selective criteria.

Once a PEMC is formed there are several types of strategies they can implement to deploy their committed capital. Some of the most common strategies are outlined below:

- Construction of new assets or "Greenfield" development – gathering/transportation pipelines, compression, treating/processing facilities, storage/terminals, etc. because none previously existed or because existing infrastructure cannot adequately meet the current needs (e.g., insufficient size/capacity, old/inefficient operations, etc.);

- Expand existing infrastructure – acquire existing assets with the intent to expand to better meet the current needs;

- Turn-around – acquire existing distressed assets and use capital to improve/update/modernize the assets;

- Contrarian hold – acquire assets viewed to be unfavorable and hold until some type of production or economic shift that makes the assets favorable again;

- Consolidation through M&A – acquire multiple midstream assets and add value through consolidation;

- Joint venture with an E&P company – partner with an E&P company to construct assets that will often be centered around the E&P company's existing and/or soon to be developed acreage.

Regardless of the strategy, a PEMC is generally looking for commercial terms similar to what any other midstream provider would pursue. Most midstream providers generate fee-based (preferably fixed, but also sometimes as a percentage of proceeds or index) revenue through services such as gathering or processing natural gas.

Depending on the risk nature of a midstream opportunity, the customer (usually an E&P company) may be asked to provide certain risk mitigation terms such as minimum volume or take-or-pay commitments to a midstream provider. Also, many midstream contracts generally have 7- to 10-year terms. However, those assurances are becoming harder to obtain these days with the competition in the marketplace.

That increased competition is a direct result of the increased PE capital that is currently pursuing midstream investments through the PEMCs. Sometimes, all a PEMC can obtain from the E&P company is a limited acreage dedication for a limited period of time. These days, it is not unusual to hear about more than 10 bidders (i.e., midstream companies such as PEMCs, MLPs, or other industry investors) participating on a midstream asset/corporate auction or an E&P request-for-proposal process.

A PEMC is generally more able than a constrained MLP to pursue new construction development projects because a PEMC is better equipped to assume the related early acquisition / project risks and/or endure the delay of cash flow after capital investment in construction/expansion.

What's the end game for these PEMCs? As you would imagine, the idea is to deploy the capital as soon as possible and generate a profit through an exit within five years. Often the management teams are incentivized by having their ultimate cash-out payment tied to the internal rate of return and/or the cash-on-cash return on investment of the PE capital utilized. Exit strategies for PEMCs include:

- Strategic sale – identify a competitor, other PEMC, MLP, or E&P company that wants the assets.

- IPO via a MLP vehicle – take the assets public through a MLP, which initially provides the PEMC access to public capital, versus the more expansive PE capital, for growth and future liquidity and exit for the original investors. There were 22 Energy (upstream, midstream, and downstream) IPOs in 2013 that raised a total of $10.7B and these IPOs had an average return of 28.9%.

- Recapitalization – obtain additional capital, continue to construct or acquire midstream assets, and buy-out the original PE group.

It should also be acknowledged that midstream investments are not immune to the cyclical nature of the larger oil and gas industry. As such, investment entry and exit dynamics evolve. Many have observed at the end of 2013 that the M&A premiums buyers would offer in a pursuit of growth, sometimes at high costs, have diminished as buyers appear to be entering a "show-me" phase and want to see additional development/progress, especially in cash flow performance, before paying for future potential.

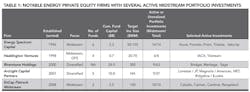

Who are some of the major PE players in this midstream movement? There are a handful of PE firms with an established and successful midstream track record. We have highlighted a few of these established PE firms that have focused on midstream investments in Table 1.

Other PE firms with multiple active midstream investments include Energy Capital Partners, Energy & Minerals Group, First Reserve, Global Infrastructure Partners, Natural Gas Partners (NGP, which is affiliated with the Carlyle Group), and Quantum Energy Partners. (Please accept our apologies if we left any pertinent firms off this list. The PE firms we mention above have had success in recent years. Some of the more prolific PEMC success stories have been summarized below.)

- Velocity Midstream (PE Sponsor: Energy Spectrum Capital); Project: East Texas Buy & Build Natural Gas Gathering and Eagle Ford Greenfield Condensate Gathering) – Velocity Midstream was established in November 2008 with an initial focus to acquire, build and develop midstream assets with organic growth opportunities in the Continental United States. In July 2009, Velocity acquired existing East Texas gas gathering assets from Berry Petroleum Company and subsequently expanded and sold those assets in November 2010. Velocity then constructed an Eagle Ford Shale condensate gathering and storage system in South Texas (Webb, Dimmitt, and LaSalle counties), which was ultimately sold to Plains All American Pipeline (NYSE: PAA) in November 2011.

- Stonehenge Energy / Keystone Midstream (PE Sponsor: Energy Spectrum Capital); Project: Marcellus Greenfield Natural Gas Gathering and Processing Plant JV with partner Sumitomo) – Keystone Midstream, a JV between Stonehenge Energy, Rex Energy Corporation (NASDAQ: REXX), and Sumitomo, constructed a Marcellus natural gas gathering and processing system in Butler county, PA. Keystone was sold to MarkWest Energy Partners (NYSE:MWE) in May 2012 for $512 million.

- Cardinal Midstream (PE Sponsor: EnCap Flatrock; - In December 2012, Atlas Pipeline Partners (NYSE: APL) completed the acquisition of substantially all of Cardinal Midstream's assets for $600 million. These assets include three operated cryogenic processing plants located in the Arkoma region of Oklahoma's Woodford Shale totaling 220 million cubic feet per day in processing capacity, approximately 66 miles of gathering pipelines, treating and compression facilities, and a natural gas contract treating business.

- TEAK Midstream (Sponsor: NGP) - TEAK constructed an Eagle Ford greenfield natural gas gathering and processing system and subsequently sold to APL in May 2013 for $1 billion.

- Wildcat Permian (Sponsors: Liberty Energy & Highstar Capital) – Wildcat Permian, a JV between Wildcat Midstream and Approach Resources (NASDAQ:AREX) constructed a crude oil pipeline system in Crockett county, TX and subsequently sold it to JP Energy (Sponsor: ArcLight Capital) in October 2013 for $210 million.

- Summit Midstream Partners LP (Sponsor: Energy Capital Partners) – Summit was formed in September 2009 and has grown primarily through an acquisitions and expansions strategy. Summit IPO'd as a public MLP in September 2012 and has continued their growth strategy with their private and public investment vehicles. Summit and its affiliates own several midstream systems across the Barnett Shale, Niobrara Basin, Marcellus Shale, and Bakken Basin.

No one knows exactly what the future might hold for PE firms and their midstream investments, but we do believe the midstream sector will experience an increasing amount of M&A and consolidation and continued strong competition for midstream management teams and project opportunities. It is likely that the midstream MLPs in registration for an IPO will proceed barring any major adverse events.

We suspect that many PEMCs unable to secure a project will reconsider their strategies. Regardless, midstream management teams would be prudent to partner with an established and appropriately experienced PE firm that can be a true partner in making a midstream marriage successful.

About the authors

Nathen J. McEown is a senior manager of Assurance and Advisory Services with Whitley Penn, a CPA and Professional Services firm in Dallas. He has more than nine years of assurance and advisory public accounting experience, auditing both public and private energy clients. McEown also has extensive SEC consulting experience that includes assisting companies with their corporate accounting and financial reporting procedures. He earned BBA and MS degrees in accounting from Texas Tech University.

Chandler Phillips is a vice president with Energy Spectrum Capital, a midstream energy-focused private equity fund. His responsibilities include investment sourcing, due diligence, and monitoring portfolio companies. Phillips previously worked as an engineer in Tom Brown Inc.'s acquisitions and divestitures group, and as an engineer coordinating the management of Matador Petroleum's outside-operated properties. He earned his BS degree in industrial engineering with honors from Texas A&M University.