PE keeps up US conventional gas buying as buzzer-beater deals push Canada to Q1 high

David Michael Cohen, PLS Inc., Houston

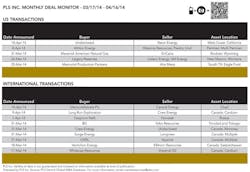

PLS reports that US upstream dealmaking during the period from March 17 through April 16, 2014 was dominated by two transactions: Encana's $1.8 billion sale of its legacy Jonah field assets in southwest Wyoming to Maverick American Natural Gas and Athlon's $873 million Permian acquisition from five unrelated sellers. These two deals accounted for 89% of the $3.02 billion total US deal value recorded during the period, which saw 28 total transactions announced.

The Jonah field transaction demonstrates private equity's continuing role as one of the most enthusiastic buyers of conventional gas assets. Maverick was launched in 2011 as a portfolio company of PE firm TPG Capital managed by Dan A. Hughes with a $1.0 billion commitment and a specific mandate to acquire North American gas production. The Encana buy is Maverick's first publicly announced purchase. Furthermore, prior to the deal announcement media outlets had reported that two other PE firms were jointly bidding for the Jonah assets: Carlyle Group and NGP Energy Capital Management. Maverick is getting properties in Sublette County with 2013 net production of 351 MMcfed (8% oil and NGLs) from 1,553 wells (78% WI) on a productive area of 24,000 acres located in the over-pressured core of the field. The transaction also includes more than 100,000 net undeveloped acres within the normally pressured area adjacent to the core producing properties. Total YE13 proved reserves on the asset come to 1.5 Tcfe.

As for Athlon, the Fort Worth, Texas-based driller is adding significant scale to its northern Midland Basin-focused portfolio, acquiring 100% operated producing properties and undeveloped acreage near its existing operations. The largest deal is with Hibernia Resources LLC for $377 million and covers Martin County, Texas assets with proved reserves of 19.4 MMboe (72% oil, 31% PD). A $291 million transaction with Piedra Energy II covers assets in Martin, Pecos and Reeves Counties with proved reserves of 14.5 MMboe (64% oil, 26% PD). The Piedra package is rumored to be part of Linn Energy's 54,600-net-acre, 18,350 boepd (64% oil, 18% NGLs) Midland Basin package being offered for sale or asset swap via RBC Richardson Barr. The remaining $205 million in assets acquired by Athlon comes from three undisclosed sellers. In aggregate, Athlon is getting 23,500 net acres owned with 97% WI and 73% NRI along with net production of 4,800 boepd (67% oil), 31 MMboe proved (39% PD) and reserve potential exceeding 250 MMboe.

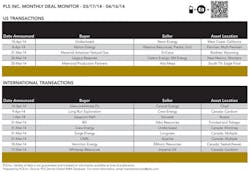

The biggest international deal announced during the period was the $1.26 billion acquisition of Calgary-based Chad explorer Caracal Energy by Swiss global commodities trader and miner GlencoreXstrata. This transaction cancels a previously announced deal by Caracal to acquire Egypt-oriented Calgary-based TransGlobe Energy for $627 million. It gives Glencore majority ownership and operatorship of three production sharing contracts where it previously held minority stakes. The PSCs cover 6.4 million acres in southern Chad where Caracal holds 66.7% WI and Glencore holds 33.3% (with the state holding a right to take 25% upon issuance of exploitation licenses). Within those PSCs are exploitation licenses for four oil fields where Caracal holds 50% WI. Glencore holds 25% WI in two of those licenses and 35% in the other two, one of which—Badila field—is currently producing ~10,000 bopd gross after coming online last September. Another field—Mangara—is expected online this year. Overall the deal increases Glencore's net oil reserves by 18.8 MMbbl proved and 45.5 MMbbl probable.

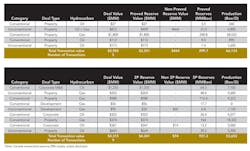

Despite this large African deal, international A&D activity during the period was led by Canada with a series of buzzer-beater deals exceeding $300 million apiece that boosted the country's first-quarter total deal value to over $8.4 billion. That's more than during the first three quarters of 2013 combined ($7.2 billion) and more than the quarterly average for the past seven years ($7.5 billion). In terms of the number of transactions, however, Canadian activity was down in Q1 with only 46 deals announced vs. 52 the previous quarter and 72 a year earlier.

Meanwhile in the US, Q1 total deal value was flat vs. Q4 2013 at $14.8 billion but up 6% year over year while the total deal count slipped to 98 vs. 117 in Q4 2013 and 140 in Q1 2013. Globally, deal values totaling $40.7 billion were also flat against Q4 2013's $40.4 billion, but represent a 60% jump vs. the $23.5 billion in deals announced during Q1 2013. As in the US and Canada, the global deal count of 192 was down vs. both the previous quarter (226) and the year-ago quarter (260).