Revenues and net income continue decline in 4Q13

Don Stowers, Editor – OGFJ

Laura Bell, Statistics Editor – Oil & Gas Journal

Revenues for the group of publicly-traded US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal continued to decline in the final quarter of 2013. They dropped approximately $11.6 billion (4%) from the previous quarter and were down even more, $23.5 billion (9%) from the final quarter of 2012. The last quarterly increase in revenues was in the second quarter of 2013 – a modest $3.4 billion (1%) increase over the first quarter last year.

Net income for the fourth quarter 2013 among the collective OGJ150 companies plummeted by $3.9 billion (18%) from the previous quarter. However, in comparison with the fourth quarter of 2012, income was down only $62 million (less than 1%).

The number of reporting companies remained constant at 121, same as the previous quarter. Fourteen companies on the OGJ150 failed to report their earnings to the US Securities Exchange Commission by press time for this issue.

Year-to-date capital spending stood at $204.5 billion in the fourth quarter of 2013. This was virtually identical to YTD spending for the prior year -- $204.7 billion, a decline of only $201 million.

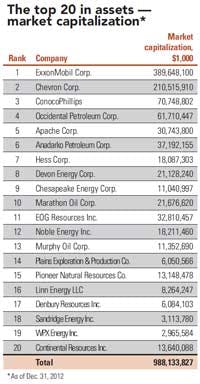

Total asset value for the group of reporting companies grew to more than $1.42 trillion from $1.33 trillion year over year, representing about a 6% rise in value. Compared to the previous quarter, asset value grew by nearing $10 billion – less than a 1% increase.

Stockholder equity for the entire group grew by $43 billion (6%) from the same quarter in 2012 and by $14.7 billion (2%) from the previous quarter.

Largest in net income

The 20 largest companies ranked according to net income had $22.37 billion in collective net income for the fourth quarter of 2013. This compares with $22.58 billion for the same quarter in 2012 and $21.45 billion the previous quarter. The latest numbers represent an increase of 4% over the previous quarter, but a $204 million decline (less than 1%) year over year.

Four of the five top companies in net income – ExxonMobil Corp., Chevron Corp., ConocoPhillips, and Occidental Petroleum Corp. – all showed small increases in income over the prior quarter. However, the fourth-largest company, Hess Corp., jumped from eight-place in the 3Q13 report to fourth-place in the fourth quarter with a dramatic 358% in net income from $418 million in the third quarter to $1.9 billion in the fourth quarter. That pushed it ahead of Occidental, Marathon Oil Corp., EOG Resources, and Devon Energy Corp. in the net income rankings.

ExxonMobil led the pack with $8.4 billion in net income followed by Chevron with just under $5.0 billion, ConocoPhillips with $2.5 billion, Hess at $1.9 billion, and Occidental at $1.6 billion. Collectively, the top five companies had nearly $19.4 billion in net income. This compares with approximately $22.4 billion for the top 20 companies and $16.9 billion for the entire group of 121 companies reporting for the final quarter of 2013.

Of the reporting companies this quarter, 75 (or 61%) reported a profit while 46 reported a loss. The largest companies reporting a loss were No. 6 ranked Anadarko Petroleum ($725 million), No. 9 Chesapeake Energy ($116 million), No. 15 LINN Energy ($785 million), and No. 16 Pioneer Natural Resources ($1.36 billion).

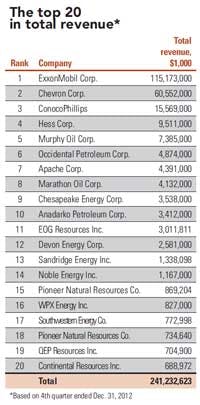

Largest in total revenue

The top 20 companies in total revenue had $216.9 billion in total revenue compared to $228.8 billion for the previous quarter and $241.2 billion for the same quarter in 2012. The former represents a 5% decline and the latter a 10% drop in total revenue.

Total revenue for the entire OGJ150 group was $229.6 billion, so the top 20 companies had 95% of the revenues for the collective group of companies.

The top two companies in total revenue (ExxonMobil and Chevron) together took in $162.2 billion, which represents roughly 71% of the total revenue for the entire group.

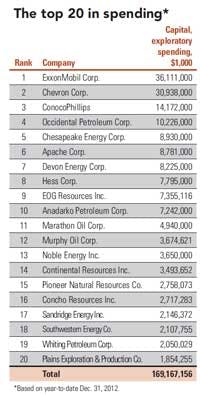

Top spenders

Spending by the top 20 companies in the fourth quarter of 2013 grew to $170.6 billion. This was up less than 1% over the $169.2 billion in spending for the third quarter, but it jumped 36% from the $125.1 billion in spending for the same quarter in 2012.

The top spenders were, in order: Chevron ($38 billion), ExxonMobil ($35.6 billion), ConocoPhillips ($15.5 billion), Apache ($10 billion), Occidental ($9 billion), Anadarko ($7.7 billion), EOG Resources ($7.1 billion), Devon Energy ($6.8 billion), Hess ($5.8 billion), and Chesapeake Energy ($5.6 billion).

Fastest-growing companies

The two fastest-growing companies for the fourth quarter of 2013, ranked by stockholders' equity, were Texas Vanguard Oil Co., based in Austin, Texas, and Abraxas Petroleum Corp., headquartered in San Antonio. No. 109-ranked Texas Vanguard had a 47.2% growth in stockholders' equity, while No. 86-ranked Abraxas grew by 45.8% over the same period.

Founded in 1979, Texas Vanguard is an onshore producer with assets in Texas, New Mexico, Oklahoma, Nebraska, and Wyoming. Abraxas, formed in 1977, focuses primarily on the development of conventional and unconventional resources in its primary operating areas in the Rocky Mountains, South Texas, Power River Basin, and the Permian Basin.

Click here to download the pdf of the OGJ150 Quarterly "4th Quarter ending Dec. 31, 2013"