Permian becoming largest US tight oil play

Apache operations in the Bivins

Ranch area of the Permian Basin.

Photo courtesy of Apache Corp.

Tight oil production, spending in the area may surpass Eagle Ford, Bakken

Rystad Energy

The following article by Rystad Energy originally appeared as one of the company's quarterly US shale newsletters. Rystad Energy is an independent oil and gas consulting services and business intelligence data firm offering global databases, strategy advisory and research products for E&P and oil service companies, investors, investment banks and governments. |

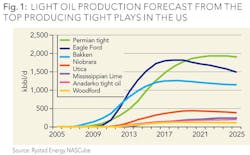

The Permian Basin, known for its vast conventional resources, has experienced over the past years an activity renaissance targeting unconventional formations. More recently, unconventional activity in this basin has shifted from vertical to horizontal wells yielding more recoverable volumes and higher D&C costs per well. Hence, both tight oil production and spending are expected to grow in this area, possibly surpassing other mature shale plays such as Eagle Ford and Bakken.

The accelerated drilling into the Wolfcamp and other horizons in the Permian Basin anticipate this area will produce more tight oil volumes than any other tight play in North America. Currently there is the same number of horizontal rigs (~250) targeting horizontal formations in both Permian and Eagle Ford. However, the Permian Basin is in an earlier unconventional development phase than the Eagle Ford. The latter has had a stable rig count for the last two years, while the Permian has seen an increasing trend.

It is expected that by ~2020, the Permian Basin will be the area with the highest tight oil production rate in North America at more than 1.8 million bbl/d. The largest volume additions are expected from dedicated companies in the area such as Pioneer, Concho and Apache. These companies are among the largest spenders in the area; large portions of their Permian budget are allocated to unconventional development. Rystad Energy estimates spending in Permian unconventional will increase 25% in 2014 compared to the previous year to reach ~$25 billion. Going forward, the spending is expected to increase steadily for the next 3-4 years, nearly reaching $35 billion by 2018.

In 2014, nearly 5,000 wells are expected to be drilled in the Permian Basin to develop the various unconventional plays. Peak drilling activity is uncertain as companies keep de-risking more multi-stacked potential. At current activity levels and potential formations, a steady increase in activity is estimated for the next three years, possibly reaching ~5,500 wells in 2017 with a large portion of horizontal wells.

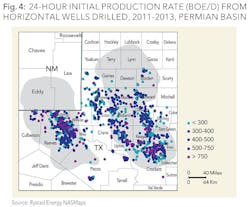

In terms of well performance, the highest 24-hour production rates from horizontal wells have been reported in the Midland Basin by Pioneer Natural Resources with rates above 3,000 boe/d (>900 bbl/d of oil). In 2013, dedicated Permian Basin companies such as Pioneer, Energen and Laredo reported 24-hour production rates above average for horizontal wells drilled in the Texas part of the Permian Basin. The distribution of 24-hour production rates from horizontal wells drilled in 2011-2013 within Permian Texas is depicted in the map, as officially reported by operators.