US companies consolidate core areas while North Sea sales gain traction

David Michael Cohen, PLS Inc., Houston

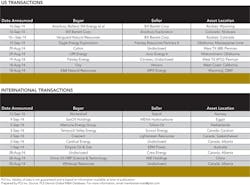

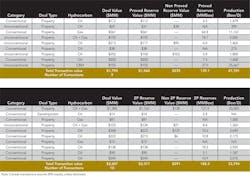

PLS reports that after four straight months with deal totals in the $6-12 billion range, US upstream markets took a late-Q3 breather during August 17 to September 16, 2014 with $2.2 billion transacted in 25 deals. Conspicuously absent were any billion-dollar acquisitions after an average of 2.75 for each of the previous four months.

The primary driver during the period was US unconventional explorers either consolidating their positions in premier resource plays or selling off legacy conventional assets to fund development of those plays. A case in point is Bill Barrett, which signed agreements to sell its remaining conventional Piceance Basin gas and most of its Powder River Basin oil assets for $688 million while boosting its working interest in core Niobrara assets in Colorado's northeast Wattenberg field. The Wattenberg assets acquired include 390 boepd of net production on 7,856 net acres and are valued by Barrett at $69 million. CEO Scot Woodall called the deals "significant steps in meeting strategic objectives to simplify our portfolio, focus on our highest return assets, and strengthen the balance sheet." Resource play consolidation also continues in West Texas' Midland Basin, where pure-plays Callon Petroleum and Parsley Energy both announced bolt-on deals exceeding $200 million. Both acquisitions include significant existing oily production plus considerable multi-zone inventory of horizontal locations including multiple Wolfcamp benches and other horizons.

The Parsley buy highlights a growing evaluation trend in multi-zone horizontal plays. In its discussion of the 5,472-net-acre acquisition, Parsley estimated the leasehold to have an "effective acreage" of 27,020 net acres accounting for the stacked potential in the Wolfcamp A, B, C and D (Cline) as well as the Atoka. The company also gave an estimate of 327,480 effective net acres for its overall pro-forma position of 121,211 "surface" net acres. We expect to see more discussion of "effective acreage" as development continues to de-risk the stacked pay in resources plays like the Bakken/Three-Forks and the various stacked Mid-Continent plays.

Internationally, PLS reports 27 upstream transactions totaling $5.5 billion during the period, keeping pace with recent deal flow. Encana's $2.3 billion sale of its remaining 54% equity in Canadian royalty spinoff PrairieSky via a secondary offering chalked 40% of the total value. Encana launched PrairieSky in May with Canada's biggest IPO in 14 years, capitalizing on growing investor interest in the oil and gas royalty business. Diamondback successfully spun off its own royalty sub Viper Energy Partners south of the border and others like Anadarko and CNRL have expressed interest in similar moves to monetize royalty assets.

Overseas, established North Sea producers are beginning to gain traction in their efforts to reduce their footprint in the mature petroleum province in search of greener pastures. Most notably, Norway's state-controlled Statoil sold non-core producing fields and farmed out exploration and development projects to emerging North Sea powerhouse Wintershall for $1.3 billion. The deal high-grades Statoil's Norwegian portfolio while reducing its capital commitments through 2020 by $1.8 billion. For Wintershall, the deal continues a Norwegian growth strategy embarked upon in earnest less than two years ago via a $1.45 billion acquisition, also from Statoil. That deal had catapulted Wintershall's Norwegian production from 3,000 boepd to 39,000 boepd; this one boosts it by 50% to 60,000 boepd.

The North Sea is also catching the eye of non-traditional upstream buyers, as witnessed by commodities trader Mercuria Energy Group's $81 million acquisition of gas fields and licenses off the Netherlands from Tullow Oil. Private equity is also getting in the game, with Riverstone Holdings, Barclays Natural Resource Investments and Singapore-based Temasek announcing the launch of North Sea E&P firm Origo Exploration with $525 million of startup funding. These new entrants provide fresh capital for companies looking to reduce or eliminate their exposure to the maturing region, including Talisman, Apache and BG.