Singapore: Knowledge and Network

This sponsored supplement was produced by Focus Reports.

Publisher: Ines Nandin

Editorial: Fraser Wallace

Project Coordinator: Marie Kummerlowe

Project Director: Roslan J Khasawneh

For exclusive interviews and more info, plus log onto energyboardroom.com or write to [email protected]

Photo courtesy of Matt Paish, Gardens by the bay, Singapore

Nestled at the southeastern end of the 500 mile-long Strait of Malacca, Singapore is a natural trade haven. The waterway connects the Pacific to the Indian Ocean, and the tankers running up and down it carry around a quarter of the world's oil moved by sea. The narrowest point of the strait, just to the south of Singapore, is the Phillips Channel, which at its widest is just 1.5 nautical miles across. It is a bottleneck, but also a tap, from which wealth continues to flow in abundance. Traditional maritime industries, fat from the business generated by vessels snaking through the narrows, have been joined by more and more construction, supply and service companies. From this financial font, Singapore sprang forth.

This maritime trade route explains exactly why the world's leading oil and gas players have been present in Singapore for such a long time. "ExxonMobil has had a presence in Singapore for over 120 years," reveals Matthew J. Aguiar, chairman and managing director of ExxonMobil Asia Pacific. But it is only over the last decade that Singapore has developed a truly prestigious reputation for producing high quality oil and gas equipment. "The country started by manufacturing subsea applications and has made significant gains in manufacturing, technology and engineering," explains Lim Kok Kiang, executive director of the industry cluster at Singapore's Economic Development Board (EDB). "Such progress is attested by many international oil field service companies establishing bases here; expanding their reach into Asia. For instance, Halliburton just opened a brand new, flagship manufacturing and technology facility."

As demand for LNG grows in Southeast Asia, Singapore's significant location only stands to benefit. "Singapore is geographically very well-located at the center of major LNG demand and supply routes and is already a world-class port, trusted financial center and major oil trading hub," says John Ng, CEO of Singapore LNG. "We also have an LNG terminal that is built with the future in mind - with the capability to efficiently unload, store and reload LNG cargo for import and export." However, the city's advantages extend to industries beyond just LNG: "It is also recognized worldwide for its business-friendly infrastructure and policies, as well as its quality workforce," Ng explains. "LNG is the major energy source for the future, and Singapore has the physical and financial infrastructure to be a regional powerhouse in this field," adds Paul Cornelius, partner of corporate and international tax at PwC Singapore.

Singapore knows its strengths and so does the EDB. "Manufacturing in Singapore is a key industry," says Kiang. "It manifests job creation, economic diversity and spin-offs. Southeast Asia is growing rapidly and turning into a manufacturing hub. We want to position ourselves to capture the market potential in not only Singapore but in the wider burgeoning region."

It is not just good fortune that continues to draw major oil and gas companies to Singapore: the city-state is actively pursuing policies to secure key players. "Singapore is channeling a lot of effort into building its R&D capabilities, whether through ship design engineering or through our offshore and subsea equipment players. We want to harness the synergies between sectors and translate these technologies to the maritime and offshore industries," says Kiang.

"The city-state has cultivated a transparent and stable pro-business environment, backed by a strong government philosophy," states ExxonMobil's Aguiar. The efforts of the Singaporean authorities "have resulted in an ecosystem that encourages and attracts business, while not limiting the scope of risk management activities," furthers Andy Milnes, CE of Integrated Supply & Trading, Eastern Hemisphere, BP. "Although it is limited in land area, Singapore is effectively utilizing the space it has and is maintaining investments in upgrading its infrastructure in terms of pipelines, jetties and terminals as well as increased capacity," he adds. "This enables Singapore to bring large parcels of energy products."

Whilst Singapore is famed for its business environment, its neighbors are definitely seeking to forward their oil and gas industries too. Some see the growth in Singapore's neighbors as a sign of the rise of rivals; this is not necessarily the case. Business interests are intertwined across the region, and Singapore's long developing specializations allow the city to take advantage of the direct commercial opportunities arising, whilst also consolidating its position as a regional financial hub through the development of the Singapore stock exchange, the SGX.

Navigating the region

Singapore's Economic Development Board (EDB) reported in 2013 that Singapore is the world's largest manufacturer of jack-up rigs, responsible for 70 percent of global production. Singapore also delivers 70 percent of floating production storage and offloading (FPSO) conversion services. The renowned Keppel and Sembawang shipyards (amongst others) are highly capable, handling a fifth of the world's ship repair operations as well as construction projects.

Sembcorp Marine is one of the world's largest marine and offshore engineering companies. It is the proprietor of Sembawang Shipyard and reported a 27 percent jump in year-on-year turnover in the first quarter of 2014, growing from SGD 1.05 billion to SGD 1.34 billion (USD 872 million to USD 1.11 billion). Whilst figures like this paint a rosy picture, the full story is less positive, with gross margins shrinking by two percent to 12.8 percent in the same period. This is in part due to solid competition from other shipyards in the region. In some rival ports, the quality of the product delivered is increasing, and, in others, assets are available at a lower cost.

It might seem as if Singapore's maritime construction industries are under siege: neighboring countries are clearly eager to take a share of the wealth that comes from courting the oil and gas sector. "Singapore's rig building industry is facing colossal competition from neighboring markets such as China and Korea," says Paul Carsten Pedersen, CEO of Jasper Offshore, which owns and operates oil rigs for deep sea drilling that are contracted out to oil and gas exploration and production companies. "These markets are now taking as many orders as Singapore, and, ultimately, Singapore has to develop much deeper engagement in this industry."

Pedersen suspects that the sheer abundance of companies in Singapore might start creating economic strains, given the finite population that the island can house. "Singapore is a place where it is relatively easy to attract highly skilled expats, but the tight supply of local and talented people able to work within and service the offshore industry is fast becoming the city's Achilles' heel," he adds."The country must do more to abate this acute issue. If Singapore wants to ensure longevity in the offshore products value chain, then it must find solutions to this issue."

Some worry that there are weak links in the chain that connects Singapore to its prosperity. "A conspicuous challenge that is threatening to derail Singapore's offshore and marine status is the sheer annual cost of hiring people," admits Steffen Tunge, managing director, OSM Ship Management, a global independent provider of offshore management services. "There is an acute talent issue here, and this has been compounded by recent changes in labor laws."

"We are opening a new facility in the bordering regions of Malaysia that is nearly as large as our current one here," says Mark Beretta, COO of KTL Offshore, one of the largest rigging outfits in the world. "Despite its obvious and fantastic advantages, Singapore is becoming an increasingly expensive place to operate. By gradually shifting some 60 percent of our production capacity, we are keen to reduce our cost base but also explore the opportunities present in Malaysia. Nevertheless, our headquarters will always remain in Singapore." Clearly, Singapore's high costs are pressuring some businesses into seeking less fiscally strenuous surroundings.

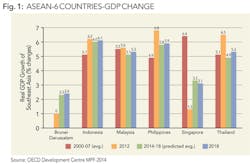

"Everyone has a plan-until they get punched in the face," boxer Mike Tyson once famously stated. However, economic competition lasts longer than the 12 rounds of a boxing match, and a number of Singapore's innate qualities make the city a robust player that will not tumble easily. Arguably, much of the speculation over regional competition makes too much of high GDP growth rates in these countries, ignoring the fact that Singapore is simply a more mature economic unit. This city runs against the mantra of the oil and gas industry: that risk begets reward. Instead, Singapore's success is built on its stability, but the cost of this stability is following the government's economic vision.

"Singapore is a special nation that in essence operates like a successful business: it is always looking to hone and enhance its competitive advantages," says Tunge. "When the Singaporeans apply their collective endeavors to a task, they do it very well and craft the finished result very carefully. The Singaporean government has a deeply ingrained desire to succeed and will supply the necessary resources to ensure the city does."

"Singapore will continue to be a major petrochemicals and refining hub; there is simply too much invested here for that to change," says Paul Cornelius from PwC. "However, in the trading sphere, Malaysia is not only competing but in some ways surpassing Singapore's fiscal incentive package." However, this may not be as much of a threat as it seems. "The Malaysian trading industry struggles to gain traction because the market and network have been and remain firmly rooted in Singapore," Cornelius continues. "Market intelligence is critical for trading entities, and there is no place better than Singapore to gather that. Moreover, the trading activity comes off the back of a gargantuan amount of bunker sales coming out of Singapore." It would appear that, simply, Singapore will naturally gain some industries and lose others, as the forces of economic selection pull some businesses to neighboring countries and encourage others to move towards the center of Southeast Asia's economic activity- Singapore.

Many Singaporean companies are contributing towards extracting resources in other territories, but this activity serves to bring revenues from these countries back to Singapore. "The traditional hydrocarbon titan Indonesia remains a country of considerable potential and a perfect market for a company of our size, though uncertain political and fiscal policies have resulted in a lot of missed opportunities in that country," says Francis Chang, CEO of RH Petrogas, an exploration and production company, referring to the country's proven oil and gas reserves, which currently stand at 3.7 billion barrels of oil and 101.54 Tcf of gas.

"Malaysia is another country which has good hydrocarbon potential. We will continue to explore new opportunities, including marginal field development, in the country," Chang continues. "We are also particularly interested in Myanmar's onshore capacity, and last year we submitted three bids to participate in the second onshore bid round. Even though we were not successful in securing new blocks, Myanmar continues to be our strategic focus in the near future," he concludes. The volumes of oil around the Asia Pacific region will continue to attract the attention of exploration and production companies- and clearly they will require full access to engineering and support services in order to achieve their targets.

"Southeast Asia is a complex market. Indonesia and Malaysia have implemented a cabotage regime, and there are risks to foreign owners associated with such policy that have to be managed," explains Andrew Coccoli, general manager of Farstad Shipping. This means that businesses frequently have to deal locally with such regulations in order to do business.

"To mitigate the risk factors, it is crucial to find trustworthy partners, build enduring relationships to establish local representation and a solid management structure," expands Coccoli. "One should hold ownership within such a country, sail under the local flag and compete on a more level playing field. If you are operating as a foreign ship-owner under a foreign flag, you face a myriad of uphill battles, namely not being able to qualify or participate in a lot of activity."

Despite neighboring nations' policies frequently aiming to attract business from Singapore, the city-state is more than able to retain business. "Although slightly more expensive than their neighbors, the superior planning and efficiency of the Singapore-based shipyards gives the owner more certainty," Coccoli explains. "Supplementing this is an array of incentives offered by the government and its regulators to set up shop and stay in the country, which, whether in technology, R&D or fiscally, go a step further than the neighboring states. It is amazing how supportive agencies such as the Maritime Port Authority are to ship-owners and the marine community generally," he concludes. Currently, Farstad uses Singapore as a ship repair hub, with the majority of the company's dry docks and upgrade projects taking place in the country. "We have considered Batam and elsewhere, but we are more comfortable with the extensive engineering support and reliability of the shipyards in Singapore," he explains.

Intertwined interests

"A good analogy for interacting with competitors would be that of a fishing boat, in an immense sea," says Thana Balan P Jaganathan, Group Executive Chairman of Global Oil 57, an international trading company. "There are sufficient resources to go around if one has the ability to pull the fish out of the water. Bigger fish are worth more, however, so rather than seeing other oil and gas companies as rivals, I see them as companions that can help me better haul in my nets- and catch bigger fish."

"Viewing other players in the market as competitors is myopic and unconstructive," continues Jaganathan. "Making deals, working cooperatively; this is constructive and as long as another player has this same attitude, I can do business with them."

Policymakers are aware of the importance of constructive cooperation too: the OECD's Economic Outlook for Southeast Asia, India and China 2014 notes that one of Singapore's strategic objectives ought to be "to strengthen companies' abilities to seize business opportunities in Asia."

Jaganathan describes how being located in Singapore benefits his company: "Singapore is a great location from where one can access the gatekeepers between East and West. These gatekeepers are essential for one to be able to penetrate any market. One has to be able to recognize these key figures, and connecting with them is vital to achieve success in international trading and access to the resources one needs," he explains.

The practical implications of this attitude have created notable successes for Global Oil 57. "This enterprise started as a very small company but can now sign multi-billion dollar contracts because the company has built rapport with its partners," says the chairman. "Performance is performance, regardless of whether it is on a small scale or a large one. Our partners see we can consistently deliver on a scalable level, and, thus, they trust us."

"A trait I like about Southeast Asia is the pragmatic attitude towards Headland's investment approach," says Paul Kang, senior partner and head of Southeast Asia for Headland Capital Partners. "It is a region open to new ideas and robust partnerships. Family business are prevalent in Southeast Asia -we have sat down with many such entities and seek to help them in meeting their goals and manifest creative ways to elevate these companies to the next level - usually from a domestic to a regional player. There are a stream of companies in the region that have reached a growth ceiling and need guidance and capital to facilitate their next phase of growth. We can help them achieve this."

Singapore-based businesses reach round the planet to complete operations. "In Indonesia, we undertake work for ConocoPhillips, and in Thailand business is relatively simple," says Hendrik ten Hoeve, managing director of Compass Energy, an engineering service company. "Our work in Malaysia often sees us act as a subcontractor to avoid a heavy bureaucratic burden there. We outsource what work we can to India or Thailand to reduce costs. Whilst we undertake work there, we utilize Singaporean standards and knowledge to ensure that quality is kept high. The business is very conscious of keeping quality high,and part of our strategy to ensure this is the case is to have engineers at the client's desk."

Another company with investments across the region is Integra, a leading global petrochemical trading and logistics supply solution provider. Investments in Malaysia, Indonesia and Singapore are part of its portfolio. "Integra views these developments as a triangle of petrochemical capacity that benefits all involved parties," says Gina Fyffe, executive director of the business. "Although national interests are clearly at play, not everyone will produce the same products. Furthermore, companies from a country on one leg of the triangle stand a very good chance of being able to upgrade value by exporting to a neighboring country, who will then be able to turn that mid-grade product into something better, which can finally move on to the final leg of the triangle to be exported. Such triangle dynamics are truly fascinating, and they ensure that by 2020, Malaysia, Singapore and Indonesia will add value to each other's economies." Fyffe believes that the primary bottleneck to the execution of this strategy is the lack of logistics capacity to support the increase in trade. "Integra can help to fill this logistics gap that has developed within the commercial network," she explains.

Other players agree that Singaporean standards allow them to capitalize on advantages in other countries - which often means lower production costs. "We have developed greater traction in China than in other markets: ultimately, it is a country that we could not ignore," says Dorcas Teo, CEO of Nordic Flow Control, a manufacturer of marine and offshore control systems. "Indeed, today we have a strong local presence in China with two production facilities located in Suzhou. The fact that we are a Singaporean company and have a superb track record with the domestic yards allowed us to leverage the stamp of quality that is associated with Singapore and take that into China."

"As a locally-based entity, Singapore is of significant importance to Jebsen & Jessen (SEA) as its regional headquarters," says Jebsen and Jessen SEA's chairman Heinrich Jessen. "In terms of group-wide business activity, although Singapore is amongst our larger markets, across the region Thailand and Malaysia are our main markets and Indonesia is on track to becoming a significant source of business for the group," he explains. "However, in terms of the offshore market, it comes as no surprise that the city-state is of paramount importance given the nation's international leadership in the segment and the concentration of offshore businesses here."

"Owing in part to Singapore's unique geographical positioning at the crossroads between East and West, the country has evolved into an internationally recognized offshore and marine hub," notes Aw Chin Leng, regional managing director at Jebsen & Jessen Offshore. "Singapore has become a critical node for the maintenance and repair of offshore and marine vessels, as well as the world's largest bunkering hub. Furthermore, Singapore is home to two of the world's largest jack-up rig manufacturers and commands a leading position in the FPSO conversion industry." This has had implications for the industry. "Naturally, this created a pull in the market and attracted a slew of both clients and suppliers that now compromise the island-state's rich offshore cluster. That dense ecosystem of offshore and marine industries makes Singapore an important oil and gas hub for players across the value chain."

"Despite increasing overheads, Singapore has an assortment of positive attributes," says Yves J.G. De Leeneer, managing director of Deepblue, which provides quality-engineering support for the offshore oil & gas industry throughout Asia. "Singapore also provides a brand synonymous with legitimacy, transparency and quality and, therefore, being associated with such a country generates a positive image for Deepblue." He describes Singapore as a launch pad to wider Asia for his business. "A number of people champion Kuala Lumpur as a preferable destination to spearhead an offshore oriented company. However, we started here and will stay here and might expand to Kuala Lumpur in the near future. There is an abundance of activity occurring in Singapore: new mega-shipyards are being built, and regional business decisions are conjured and negotiated here."

Business decisions are made in Singapore, planning how best to harness the resources of the wider region. OSM sources crews from across the world. Tunge of OSM Ship Management states that "many of [these recruitment locations] are in frontier markets: Myanmar, Mexico and Africa. In particular, we use the Philippines as a source for offshore and marine talent. Reflecting on what this means for OSM in Singapore, he continues, "in Singapore, there is a shortage of qualified people, and the cost is perennially rising, which makes it a challenging place to hire from. Consequently, the company is trying to leverage office synergies between different global branches." OSM is boosting its business in Singapore by capitalizing on resources from the wider region.

Oil and gas drive-thru

Singapore-based enterprises can capitalize on the regional dynamism of the oil and gas industry thanks to the city-state's level of economic development. Whilst much of the region is seeing fast rates of economic growth-quantitative increases-Singapore has spearheaded the route towards development-qualitative expansion-seeing more variations, types, forms and categories of business emerge here. One company that has taken advantage of this is Headland Capital Partners. It has seized on the opportunities available in Singapore, principally by investing in Kreuz Subsea, a subsea services company, and Miclyn Express Offshore, an offshore services business. "We have more than USD 200 million invested in Miclyn and almost USD 200 million invested in Kreuz, and, for Headland, these are the largest investments ever," says Kang. "I believe that in the offshore space, these two businesses are best in class. Such investments attest to our commitment and interest in the oil and gas space. I am absolutely interested in deploying more capital into the buoyant offshore industry."

Companies are also seeking to engage with the demand for a broader range of services by diversifying and expanding their own offering internally to capture a broader section of the market.

"We have come to the realization that clients seek and prefer a fully integrated product and services package," says Tom Kers, partner, at KBC Advanced Technologies, an independent provider of consulting and software services to energy and other process industries. "Traditionally, when we are approached by clients, we examine the various inputs and metrics and return to the client with our recommendations. However, we have found that although our suggestions would likely ensure our clients a certain increase in profitability, problems tend to arise in the execution of the project." According to Kers, this usually stems from suboptimal client-side organizational structures related to accountability and reliability concerns. "We intend to extend service offering to clients to go beyond providing premium advisory services," he continues. "Doing so will position KBC as an integrated services provider that enables clients to implement recommendations we provide and effectively realize their benefits. This holistic approach takes into consideration the technical elements to ensure operative implementation."

Even in the lifting and rigging business, the need for diversity is apparent. "One clear trend in the lift industry is the transition into ever-heavier lifting and rigging with increasingly large vessels and cranes," says Beretta of KTL Offshore "Gone are the days where a standard one-size-fits-all solution will do. Each project requires a thorough technical analysis and input from our side before we can begin to supply our customers. We sell a total solutions approach."

Companies cannot rest on their laurels in competitive Singapore. "Technology and quality are the cornerstone principals of our organization," says Beretta, reflecting values that could be said to be embodied by Singapore itself. "We conduct a good deal of our own R&D and testing before bringing products to market. That philosophy has endowed KTL with an excellent reputation in the market, particularly in Asia. One of the world's largest heavy lift contractors based in the Netherlands has been a frequent client of ours, demonstrating the reputation and trust we have earned."

Across Singapore, a proactive spirit is what drives business forward. "In terms of the business in Singapore, we have sought a more cohesive and focused approach to operations," says Steve Connolly, COO of Cape PLC. "This involved some quite drastic, but necessary, changes and required a shift in company culture. This has already had a significant impact on the company, and, along with a new, more integrated management structure, has brought about a really positive improvement in culture and staff attitudes; our business is all about people and, importantly, the right people."

In order to deliver on these projects, Cape has expanded its offering, including by acquiring in early 2014 Motherwell Bridge, a Scottish firm recognized as a leader in the specialist storage tank market. Connolly explains that the acquisition has "expanded the range of critical services [Cape] can now offer, and we are assessing a number of opportunities at the moment in the region. The storage facilities in Singapore, Malaysia and Indonesia are significant, and the blend of Motherwell Bridge's tank management experience, Cape Environmental Services Tank cleaning technology and also the traditional Cape core trades of access, insulation and coatings are a fantastic and unique combined offering." Again, this is an example of qualitative change; synergies morphing the range of services businesses offer, as they use Singapore as a platform to reach the market. The city collectively offers a myriad of solutions- it is an urban one-stop shop.

For every lock there is a specific key, and the congregation of companies in Singapore is able to provide a solution to every requirement. Paul Carsten Pedersen of Jasper Offshore explains how Jasper Offshore allows cost-effective access to hydrocarbon resources by filling a gap other companies have not yet occupied. "Generally the global rig market is very competitive, and there is currently excess supply in many areas; nonetheless, there are niche areas requiring special rigs. For instance: in countries with high local content requirements, technology must be kept at a manageable level, which complements the characteristics of an older rig. The Jasper Explorer addresses this and, another very important niche, namely the mid-water rigs where jack-ups are not readily used and the fifth and sixth generation drill ships are too expensive. The work can easily be done by a less advanced rig than the sixth generation new builds at an attractive commercial rate. The broad desire for low day rates is one area now working well for Jasper."

"Ultimately, oil and gas companies have to focus on their bottom line and will seek to save costs on rig rates if they can," he concludes, mulling the consequences rig rates have on his business. "Consequently, it is not always the most shining piece of equipment or cutting edge rig that is awarded the job, so there is room for a well performing older rig like Jasper Explorer in the right markets."

Viking Offshore and Marine has a 'bolt-on strategy,' which has seen the business take over a sequence of companies, allowing Viking to now provide heating, ventilation and air conditioning (HVAC) technologies, winch systems and instrumentation equipment. "Speaking with customers, the business knows that clients appreciate our aim of becoming a truly 'one stop shop' supplier- meaning far less organizational hassle for them," says JK Low, CFO of Viking. "Viking is seeking to approach its expansion from a value-chain perspective, adding value through the tiers of client's need for equipment. In expanding our offering, the business is also building a deeper relationship with its clients."

Finance: the glue that binds a city together

Since Singapore's stock exchange, the SGX, was founded in 1999, the number of mineral, oil and gas companies (MOG) has increased steadily. The proliferation of MOG companies on the SGX is "simply a question of time," according to Lawrence Wong, executive vice president and head of listings at the SGX. Linc Energy, a diversified energy company's move to list in Singapore from the ASX in Sydney in December 2013 was indicative of the growing interest in Singapore as a key location in Asia for oil and gas companies to access share capital.

"I believe that the so-called tipping point is an arbitrary concept; it is far more important what a given market denotes for a company. MOG companies are attracted to list on the SGX because of the matching industry clusters we have here and because we are perceived as a far more international and independent center," states Wong.

Kris Energy's listing in 2013 saw the exchange begin to formalize the rules that impact energy and resource companies whose shares are held on the main board of the exchange. These had previously not been fully matured due to the relatively recent maturing of the exchange but will now add to the supportive regulatory framework that facilitates business here.

"Singapore is one of the most important financial centers in the greater Asian region," according to Wong at the SGX. "Being the asset and wealth management center of Asia, with a sovereign wealth fund alone which exceeds USD 2 trillion, Singapore is most certainly the regional hub for financial investors of all types."

The new dynamic of the SGX also offers advantages to energy companies beyond that of the larger, more established exchanges. "Compared to the global exchanges, the SGX is a minnow. Yet, I see this as an advantage," says Simon Crellin, director of Deloitte Petroleum Services in Singapore. "For instance, on the ASX, TSX and AIM, smaller independents have been drilling wells and indeed have a good story to tell. Yet their share price is flat-lining because there are simply too many companies listed: each one is like a tree in a forest, unable to stand out!" To be recognized and generate value on these markets, says Crellin, smaller independents need to consolidate. "By contrast, the SGX has a concentrated list of oil and gas E&P companies, and, because of this, a good story will get a lot more traction than on the bigger exchanges. As investor appetite in Asia is voracious, the regional energy industry is buoyant and Singapore is fast becoming a wealth management hub, I can see the number of E&P companies gravitating towards the SGX expanding."

Mans Lidgren, CEO of Rex Energy, an independent upstream oil and gas company, concurs: "Exploration and production companies naturally gravitate to London for their IPOs as it has one of the largest energy exchange markets. Nonetheless, the Singapore exchange only has eight listed companies, and we prefer to be one of the few than one of the many. Additionally, there is a need for foreign and local investors to invest locally to help Singapore's future inflow. We have very ambitious plans to grow in Southeast Asia, and this is why we listed in Singapore."

This gravitation of companies is building up the SGX, step by step. When asked what it will take for Singapore to become a key investment center, PwC's Cornelius replies: "The government is putting in a lot of effort to educate the mining and oil and gas community. However, I am still somewhat skeptical over the SGX's ability to compete against the major international exchanges. Specifically, for alternative areas of energy, a number of clients still come to me and state it is easier to raise money in London and Hong Kong. Their perception is that the market is more attuned to the risks associated with the energy industry and are drawn by the established track records of raising capital in these markets. Nonetheless, Kris Energy has had a very smooth and successful listing, and, if it can develop a good track record, it can be the flag bearer for the SGX's oil and gas sector. We need another three or four companies like Kris Energy to come through onto the SGX to really evolve the exchange into a sector powerhouse. A further development in Singapore's capital markets has been the growth of the analyst community, which I view as essential. They are partly responsible for making recommendations on companiess and have thecapacity to stir the investment community to invest."

"Singapore is critical to the company's holistic development and to the future of our assets here," says Kang of Headland Capital Partners. "Being based in Singapore is very important because it allows us to operate in a business ecosystem that is transparent, stable and business friendly - all traits that are instrumental for a private equity house." Whilst Headland itself focuses on investing in small to medium sized enterprises, these qualities equally benefit both listed and unlisted companies.

There is a confidence in the city's ability to attract the companies that will build up the SGX. "The city-state has a fantastic business ecosystem," says RH Petrogas' Chang. "In the past year, we have seen several new oil and gas companies come to the market. Despite a surge in IPOs from this sector to the SGX, the exchange for listed O&G companies is still a fledgling and rather immature home. I would like there to be more proper, two way dialogue between the SGX and listed O&G companies."

Chang anticipates the emergence of Singapore as a fully established exchange as taking a little longer. "Return on investment may take years from discovery to first production. Patience and sector understanding are traits that competent oil investors should embrace, and we are trying to educate our stakeholders to be with us for the long-term. That is the challenge we face in Singapore: educating the investor market."

This progression, from cauldron of technical capabilities to launch pad for fully listed companies, did not happen instantly, and this is reflected in the companies that have built themselves up in Singapore over the years. "Established in 1998, we have leapt from a mere service agent to a fully integrated automation solutions provider," explains Teo, the CEO of Nordic Flow Control. "In 1998, we were a tiny company consisting of five people and two desks. Over time, we have established a manufacturing capability and a large-scale marketing team. In 2010, the progress of the company reached a new peak when it listed on the SGX. Through unwavering energy, commitment and determination, we have secured our place as one of Singapore's premier automation service companies."

How to "sexy" up the industry for Singaporeans

"The majority of the younger generations have looked increasingly towards the business and technology industries for professional development" says the president of Singapore Maritime Foundation, Michael Chia. We caught up with Paul Carsten Pedersen, CEO of Jasper Invests Limited, to discuss how Singapore can revert the local perception by showing that offshore engineering and operation provides a 'sexy' career path. With Singapore engineering potential hamstrung by a dwindling talent pool, Pedersen - based upon his diverse management career - lays out a cohesive national blueprint to abate and ultimately help solve this potent issue.

Taking the lead from the aeronautic industry, Singapore should take the easy step and invest in a simulator-based training center, which will act as the nucleus for drilling activities. The focus will be on developing candidates for top jobs in operations, but with candidates spilling into rig building and equipment engineering industries. It needs to be attached to one of Singapore's principle polytechnics, which can foster a pipeline of young and aspiring engineering talent. A simulator-focused training center will appeal to students as the curriculum is innovative and aligns with current youth attractions such as travel and computer gaming. Incorporating periods of practical and well-paid work offshore, the curriculum will help to reshape the image of offshore activities, which has incorrectly connotations of being mundane, rather than cutting edge.

Singapore's rig producing industry is facing more competition from China. The attraction of contracting new rigs in Singapore would be enhanced if a training center - next door to the shipyards - churns out regularly a highly capable, trained and modern offshore rig workforce. Furthermore, training centers develop an environment of interest. When placed within a university or polytechnic, Singapore will start to see master's students in drilling technology who will look to developing the equipment for the new rigs. In this next wave of equipment improvements, automation will be key, and thus another core competency of Singapore's engineering and manufacturing arsenal can enhance the value generation in rig building. As an added bonus, a large percentage of rig crews operating in southeast Asia are from the region, but many of them do not get their training here. If they would come to Singapore and train at the center, they can receive certified training which has Singapore's stamp of quality attached to it. This acts as a further revenue stream for the center.

Underlying China's manufacturing competitive advantage is a vast amount of state capital. Equally, one of Singapore's competitive disadvantages is the fact that Singaporeans are reluctant to work abroad, particularly if there is no second career opportunity in Singapore after experiencing an offshore life. Consequently, similar to what Petronas has done in Malaysia, Singapore needs to engender a Singaporean "state" company that can create such comfort for Singaporeans second career. It would be energy services focused as Singapore has no hydrocarbon reserves. Through such a national drilling vehicle, Singapore can foster an enduring link between its nationals and the oil service industry. The sovereign fund Temasek already investing in drilling rigs outside Singapore would be well placed to absorb a role of main investor in an SGX-listed company. If any one country could pull this off, it would be Singapore, being a forward thinking, constantly evolving nation that is always looking to be one step ahead of the game and prepared to invest public funds to create work places with long-term value for the country.

Pedersen started in the Maersk Group in 1981 after finishing university with a Master's Degree in Engineering. On completing the company's widely-acclaimed training scheme - which forms the framework of Pedersen's Singapore 'talent solution' proposal - he has gone on to enjoy a diverse career spanning three decades in the oil and gas industry.

Making waves in the offshore industry

In 2012, regional conglomerate Jebsen & Jessen (SEA) completed the purchase of Singapore-based Halcyon Offshore, in an expansion move that extends the multi-disciplinary company into the service of offshore marine vessels and shipyards.

As new as the offshore and marine sectors might be for the group, there is still a strong degree of complementarity in its growing business. Originally a trading company founded in Hong Kong in 1895, the Jebsen & Jessen family enterprise is now a global conglomerate with four independent groups operating from Hong Kong, Singapore, Hamburg and Perth. Established in 1963, the Southeast Asian part Jebsen & Jessen (SEA) is one of Singapore's most successful family-owned groups composed of eight independent business units with manufacturing, engineering and distribution capabilities in sectors such as material-handling, cable-technology and chemicals.

By leveraging its existing capabilities in industrial cables; cranes, hoists and technical service; as well as its established regional infrastructure and back-office excellence, Group Chairman Heinrich Jessen, has big plans for the new unit. Unlike most of its business units that focus on ASEAN markets, Heinrich Jessen explains that "Jebsen & Jessen Offshore is one of the businesses that we have global ambitions for, beyond the region." The unit recently established a service center in Dubai, UAE and continues to explore other opportunities for service points in international vessel accumulation points including West Africa and Europe. Jebsen & Jessen (SEA)'s recent acquisition of a 35 percent stake in Norwegian offshore technology firm Scantrol, also supports the growth of the unit - ensuring it remains connected to the cutting edge know-how, expertise and R&D offered by this global player in anti-heave compensation (AHC).

Aw Chin Leng, an offshore industry veteran and newly appointed Jebsen & Jessen Offshore Regional Managing Director, points out that 2014 will be a year of consolidation of the offshore unit into the Group as it completes a major upgrade of its Singapore production facility and fine-tunes the integration of its back-office functions into Jebsen & Jessen's regional platform. "This will set the course for subsequent substantial growth and expansion of the topline and bottom line of the business unit starting 2015 onwards," says Aw. "Ultimately, our goal is to mold Jebsen & Jessen Offshore into a reliable and trusted supplier of tier one products and services."

Aged heads; new solutions

"The wave of experienced industry experts going into retirement exposes all sorts of energy players to talent shortages, posing challenges for the development of any organization and the industry as a whole," says Tom Kers, partner at KBC Advanced Technologies.

It is clear that in many ways, the retirement of experienced, knowledgeable staff can be as significant a problem as repair of aged platforms. KBC seeks to help alleviate the loss of skills in part caused by a shortage of talent. "our Petro-SIM 5 software is the only purpose-built rigorous process simulator that combines process simulation and extensive thermo physical properties," states Kers.

He expands on what this has meant for the business' products: "Traditionally, this package has been developed for refining-based processes but has evolved into the petrochemical and more recently the upstream processes by incorporating added on modules for refining and production processes. Simply, downstream users can optimize refinery-wide operations, minimizing energy intensity across all process units, while upstream, users can maximize facility performance throughout the life cycle of the reservoir and optimize gas production throughput and balance power generation."

"We have identified opportunities that enabled our clients to reduce operating costs of their ethylene production processes by USD 10-20 per ton with little capital cost," highlights Steven Kantorowicz, VP of petrochemicals at KBC.

THE HUMAN ELEMENT

Three executives speak on how they seek to deliver the optimal human power to their client's projects:

VINCENT TAN, MANAGING DIRECTOR - MTQ

We are always looking at how best to retain the soft skills of our staff. Many companies have tried to emulate what MTQ has achieved. They often invest in hardware in an attempt to copy us- and there is plenty of money in Singapore to fuel that investment. However, it is the soft skills that differentiate MTQ from its competitors.

Not only is MTQ aware of the need to retain workers with these skills, the company also understands the necessity of being able to transfer these skills through consecutive 'generations' of workers. This is the key to our success- MTQ nurtures these skills.

STEVE CONNOLLY, COO, CAPE PLC

Geographically, Cape focuses on the APAC region, rather than the individual constituent countries here. This greater visibility creates improved efficiencies and we have brought the best human resources our global organization has access to here in order to drive forward growth.

We have also been able to attract some quality human resources from our competitors. This is particularly interesting as this represents the confidence of these staff in Cape's future- the business has a small order book here at the moment, but the future and Cape's prospects are already clear.

CHARLES PFAUWADEL; SWIFT WORLDWIDE RESOURCES

There is one discipline at the moment which is particularly valuable - that of subsea skills. This is a wide area of activity, but with many fields being developed and more complex and challenging projects moving forwards to secure marginal resources, individuals able to deliver success in these projects are ever more valuable.

The shortage of staff in this area is something that Swift is seeking to address for its clients. Each of our recruiters has a target to build a pool of subsea candidates. Once a month we have meetings to re-evaluate our progress on this front and to review the status of progress in the subsea sector.

REGIONAL (NOC) ECTIONS

Access to key business decision makers is one of the key motivations for many companies to locate themselves in Singapore. It provides a route into eastern markets for western companies and vice versa.

Prior to moving to Singapore, Nathan Oliver, Regional President, Asia Pacific MultiClient, PGS, the seismic exploration company, had invested over five years into seeking engagement with the Chinese NOCs and Japanese E&Ps. "The NOCs are driven by a very different agenda to the traditional IOCs: where shareholder value creation is the key for the latter, resource security is the focus for the former. The establishment of relationships with the Asia Pacific NOCs was driven by the variable resource density found in their own backyard. Put simply, delivering resource security has required an increasing focus on an international growth agenda which has seen expansion by the Chinese NOCs in areas such as Brazil, for example. I readily recognized this customer segment as a valuable business relation." PGS' international operations required them to meet the NOCs on their doorstep in order to create a relationship that would exist the world over. Singapore was the logical place to locate-the location where these enterprises congregate.