Fayetteville

The Shale Gale Reaches Arkansas

Fred Lawrence, IPAA

WASHINGTON, D.C.- Arkansas' Fayetteville shale gas play has carved itself a significant role in the turnaround of US natural gas production. The Fayetteville still touches the same immense order of magnitude of the very largest US natural gas shale plays, such as the Marcellus, which produced 4.2 trillion cubic feet in 2013, and the Haynesville, which produced 2.8 trillion cubic feet that year.

The Fayetteville has continued to produce roughly one trillion cubic feet in 2013 - contrasting with just 0.007 trillion cubic feet in 2005 - despite reduced activity for plays (like this) that are heavily weighted towards natural gas with little liquids content. It stands as a testament to the efforts of producers focusing on increasing rig efficiency, reducing costs, as well as making intelligent choices for drilling sites and well treatments in order to maximize well productivity.

History and Geology

Natural gas was first discovered in Arkansas in 1887 towards the northwestern edge of the state in the Arkoma Basin, and commercial development began in 1902. The Arkoma Basin, in which the Fayetteville play is located, straddles Oklahoma and Arkansas. Over the years, the Arkoma's conventional natural gas production has typically been from sandstones in the Atoka formation. The Fayetteville shale lies deeper, and although the rock formation extends into neighboring states, the play itself centers on the northern part of Arkansas (Fig. 1), particularly the middle and western sections, on the eastern side of the Arkoma Basin. Activity in the Oklahoma portion of the Arkoma Basin has focused on the Woodford shale play, a geologically older and deeper formation.

The Fayetteville shale was formed from sediments deposited in shallow seas in the Mississippian age, roughly 350 million years ago. The shale is found at depths anywhere from a few hundred feet to perhaps 7,000 feet, with thickness ranging from roughly 50 to 500 feet. For the most part, surface outcrops occur in the counties north of the Play region; specifically Washington, Madison, Newton, Carroll, Boone, Searcy, Stone, and northern Independence counties. Geologic processes have made this a "natural gas only" formation, with little if any liquids content. The Fayetteville shale has been known for a century or more and interest in its hydrocarbon potential goes back to at least the 1930s, but traditional wells were not prolific producers because the shale was too dense to allow natural gas to flow easily.

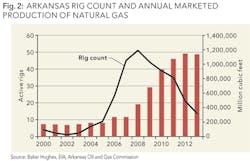

With the development of horizontal drilling and hydraulic fracturing, the prospects for the Fayetteville changed markedly. This became apparent when news of the prolific Thomas 1-9 well in Conway County, drilled in 2004 by Southwestern Energy, became widely known, and interest in the Fayetteville surged. There had been only two active rigs in Arkansas in 2003. By 2008 there were over 50 (Fig. 2). Natural gas production in Arkansas, which had never risen much beyond 0.2 trillion cubic feet per year in prior decades, more than doubled by 2008 and again by 2010. Since then, production has continued at about one trillion cubic feet per year. As recently as 2004, Arkansas trailed behind 14 other states in natural gas production. By 2013 it had jumped to eighth place, according to data from Energy Information Administration (EIA).

Assessment of the Fayetteville's potential has evolved as well. In a 2010 report, the US Geological Survey estimated undiscovered technically recoverable natural gas in the Fayetteville shale at a mean of 13.2 trillion cubic feet (and with no appreciable liquids reserves). However, by the end of 2011, EIA put proved reserves (a much more conservative measure) in the Fayetteville at nearly 15 trillion cubic feet. Even though EIA revised that figure down to 9.7 trillion cubic feet for 2012, it was still well above the 2004 pre-horizontal drilling figure for proved reserves of just 1.8 trillion cubic feet.

Improving Efficiency, Reducing Costs

Natural gas prices dropped sharply following their peak in 2008 when spot prices reached an annual average of $8.86 per million BTU. In 2012, spot prices averaged just $2.75, with an uptick in 2013 to $3.73 in 2013 per million BTU, according to EIA data. Thus, especially in plays that produce primarily natural gas, it became especially important to focus on drilling efficiency, well planning, and overall management of costs. This has been particularly true of "dry" natural gas plays such as the Fayetteville. Currently, one of the attractions of "wet" natural gas plays is the value of their liquids content which can boost the prospects' economic attractiveness, an advantage not available in dry natural gas plays.

However, one potential cost efficiency offered by the Fayetteville is that the formation is not as deep as some of the other major plays. The average depth drilled in the Fayetteville is in the neighborhood of 5,000 feet, contrasting with a roughly 7,000 - 8,000 foot range for the Barnett, the Arkoma Woodford, and the Marcellus, and 11,000 to 12,000 feet for the Haynesville.

Further, many incremental operational improvements can add up to sizeable gains. With experience, operators have learned which techniques work best in different geographic areas of the Fayetteville. For example, in high pressured areas, letting the completion "rest" for 10 to 30 days has improved production. In other areas, altering the proppant proportions has been the key to enhanced outcomes. Some operators have gained efficiencies by moving equipment and services "in house" to gain tighter logistical coordination and to benefit from economies of scale. Drilling several wells from one drilling pad has reduced rig setup and takedown time. Given the shallower nature of the Fayetteville compared with some other plays, purposing compact rigs for the job can help manage equipment costs and as well as reduce downtime for moving a rig to the next site. Water recycling has not only reduced total water requirements but has also reduced transport costs and truck traffic.

The results of these efforts have been dramatic. Evidence for this can be seen in publicly reported results for Southwestern Energy, which maintains that the time to drill a well in 2013 was cut to one third of the time required in 2007. This was even though the horizontal length drilled about doubled from 2,700 feet to nearly 5,400 feet, and with the average number of fracture stages increasing to 12 in 2012 and to 18 stages in 2013. The company reports that the cost per well over the period declined 17%.

Economic Impact

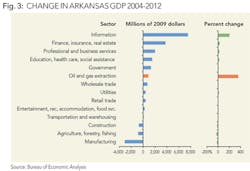

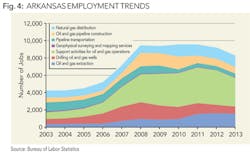

According to a study by the Center for Business and Economic Research at the University of Arkansas, the sector of the state's economy containing the oil and gas industry saw employment double between 2001 and 2010. In fact, it has been the fastest growing sector of the state's economy (Fig. 3). Average annual pay in the oil and gas industry in 2010 was twice that the all-industry average within the state. This was particularly beneficial for Arkansas, since, as the report notes, "High paying jobs are essential for the economic development of the state because Arkansas consistently ranks in the lowest quintile among all states in terms of annual per capita personal income." The report states that shale activity in the state increased personal incomes and personal expenditures, which in turn led to increased sales tax revenue. It also spurred additional investments in the state, including pipelines and other infrastructure, and increased royalty payments to mineral rights holders living in every county of the state. "From 2008 to 2011, total economic activity of more than $18.5 billion was generated as a result of Fayetteville Shale activities in the state." Despite some slippage in industry-related employment in 2013, according to recent Bureau of Labor Statistics data, industry employment remains at a level still easily double what it was in 2005 (Fig. 4).

According to data collected by the Independent Petroleum Association of America, the state's severance tax revenues have grown from less than $10 million in 2004 to nearly $80 million in 2011, and according to IHS estimates, the state in 2012 received $530 million in state and local taxes from unconventional oil and gas activity. IHS also estimates that unconventional oil and gas activity contributed $3.8 billion of value-added economic activity in the state in 2012 and supported, directly and indirectly, over 33,000 jobs in the state.

A Bright Future

The strong employment and revenue impacts of the Fayetteville shale illustrate the role that just one shale play can have on a state's economy, particularly in a state that relies on oil and natural gas for more than 55% of its energy needs. Companies active there are showing the impressive efficiencies that can be realized from such geographic and geological focus.

As the number of shale/tight oil plays grows, it is equally important to provide a running historical and economic update of some of the earliest plays that continue to accelerate their value creation in states that rely increasingly on the oil and gas industry. Thanks to the efforts of America's independent producers, Arkansas' oil and gas history has more chapters to unfold - 125 years after the first discovery.