ETRM in today's market environment

Systems still fall short in prescriptive analytics

Carlos Blanco, The Oxford Princeton Programme, San Francisco Bay Area, CA

In this piece we discuss the increasing importance of optimization, risk and trading analytics in energy trading and risk management systems (ETRM).

Optimization of physical assets, and long-term contracts

ETRM systems have traditionally been used primarily for trade capture and data repository providing operational, control, compliance, and limited risk management functionality. To meet user's needs, these systems were designed to excel at performing tasks such as scheduling, nominations, settlements, invoices, or accounting for physical and financial trades.

However, the key requirements from ETRM systems for of oil, gas, and power market participants have changed dramatically in recent years. In a recent study conducted by SunGard1 among more than 100 firms active in North American natural gas markets, 43% indicated that their primary concern is operational and asset optimization.

Their second concern was financial operations, risk management, and regulatory compliance (34%). In other words, firms are lacking prescriptive analytics in their systems in order to optimize their assets and long term contracts. The role of descriptive, predictive and prescriptive analytics in the main functions performed by ETRM systems is shown in Figure 1.

To overcome the limited optimization functionality in ETRM systems, many firms conduct their asset optimization using sophisticated spreadsheets or stand-alone applications developed in mathematical and statistical languages such as Matlab or R.

The development, maintenance, and support of multiple systems and applications often introduce material data and model risks for those firms. In addition, when the traders or developers of those models move to another company, many of those applications are eventually abandoned due to limited scalability and poor documentation, which results in a loss of know-how for the firm.

Physical assets as real options

The main reason behind increased importance for operational and asset optimization analytics supporting decision making is the need to extract maximum value from assets as well as the operational flexibility in long term purchase and sale contracts.

Traditionally, physical assets such as storage facilities, pipelines, transmission networks, refineries, and power plants were operated by engineers rather than trading groups, resulting in suboptimal performance from a profit maximization perspective. Fortunately, one of the more relevant developments in recent years in financial engineering and energy risk modeling is the pricing, modeling, and hedging of physical assets and asset-based strategies for power, oil, and gas portfolios.

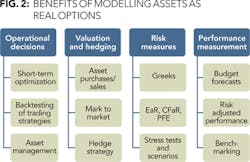

Many energy and commodity firms have established asset-backed trading groups whose objective is to enhance the risk adjusted profitability of its physical assets based on observable market spreads, their potential variability, as well as the specific asset operating constraints. Some of the main benefits of modeling and operating assets as real options are shown in Figure 2.

Decision-support analytics for operational decisions

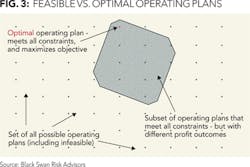

Quantitative models can incorporate the key objective functions, operational, policy, and financial constraints to find the optimal operating decisions (see Figure 3). These models often require large scale simulation and dynamic programming techniques, but computational advances such as least-squares Monte Carlo simulation are making that analysis feasible and relatively cost effective. Asset-based optimization leverage with proprietary data can create an important competitive advantage for firms that develop those capabilities.

Due to its complexity, optimization-based decision-support tools for physical asset and long-term contract management need to strike a balance between flexibility and integration into existing systems. ETRM have data connectivity tools that allow them to take multiple inputs coming from different systems, but their performance often falls short when performing a large number of computations in simulation-based environments.

For example, simulation-based real option models can provide optimal dispatch schedules based on expected market conditions for power plants, injection and withdrawal plans for storage facilities or schedule cargo deliveries for LNG long-term contracts. Those models can also allow for the evaluation of alternative trading and asset management strategies.

Some of the key benefits from optimization-based models is that they can help asset and contract owners improve margins without taking additional risk, reduce operational risk ensuring all constraints are satisfied and improve internal coordination across trading and operational units (scheduling, nomination, etc.).

From a portfolio perspective, the aggregation and integration of the exposures from multiple contractual exposures and physical assets can also uncover hidden opportunities to improve operating plans. For example, a gas marketer that buys and sells gas from multiple clients and locations and owns storage assets as well as transportation capacity can find optimal ways to serve its clients using prescriptive analytics that combine the various contract flexibilities.

Valuation and hedging

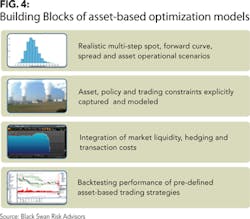

Due to the complex nature and embedded option clauses in contracts and operational flexibilities associated with physical assets, a rigorous quantitative framework can be the cornerstone of valuation and hedging strategies around those exposures and provide a competitive advantage. Figure 4 shows the key building blocks for the design of decision support analytics for asset-based strategies. Asset based models should accurately capture the market and asset dynamics and operational and contractual constraints. The valuation, risk metrics, and hedge ratios calculated from models that do not fit the criteria outlined above are not just likely to be inaccurate and result in over or under valuation of those contracts, but also likely to lead to suboptimal decisions that would impact the asset-based strategy's profitability.

Risk management

Risk management for physical assets and long-term contracts requires a dynamic simulation framework with ability to handle multiple risk factors (e.g. commodities, credit events, operational issues), multiple instruments (e.g., physical contracts, derivatives), and operational events taking place at multiple steps in time.

Once a dynamic risk simulation framework is in place, risk managers can estimate the potential variability of one or more metrics (e.g., cash flow, earnings, Mark-to-Market, liquidity, etc.) based on realistic potential changes in a set of key state variables, as well as the firm's response to those changes (e.g., operating, hedging and trading strategies).

ETRM systems with the ability to store data using a common definition across the enterprise can achieve consistency of risk information across different business units and allow for the calculation of portfolio and enterprise wide metrics. For example, contract, market and counterparty information that often resides in different systems used by market and credit risk groups needs to be integrated in order to perform Earnings at Risk (EaR) and Cash Flow at Risk (CFaR) analysis

Performance measurement

Another area where energy firms can reap tangible benefits from deploying optimization analytics for asset-based strategies is in the process of setting up performance benchmarks. Those benchmarks can be used to set profit targets based on realistic assumptions about the expected profitability of the contracts, and ensure that compensation schemes do not reward simple market exposures (e.g., beta), but trader's skills (e.g., alpha).

For example, storage assets can be dynamically hedged by optimizing the intrinsic value of the asset over time. Performance remuneration schemes that use overall results fail to take into account that the expected value of an asset may be very high (or low). In our storage example, the intrinsic value could be the baseline profit to measure the marginal contribution from trader's decisions.

Summary

ETRM systems have traditionally served as trade capture and repository system providing operational, control, compliance, and limited risk management functionality. However, in order to assist users to compete in the current market environment, ETRM systems should support asset management decisions combining not only descriptive and predictive, but also prescriptive operational and asset optimization analytics.

About the author

Carlos Blanco is a faculty member of The Oxford-Princeton Programme, where he teaches a wide range of courses on energy derivatives hedging, pricing and risk management, real options, simulation, and oil, gas and power trading and hedging. He is also the managing director of Black Swan Risk Advisors. ([email protected])

1. Managing optimization, efficiency and regulatory compliance in the natural gas market (2014) White Paper. SunGard