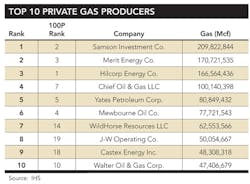

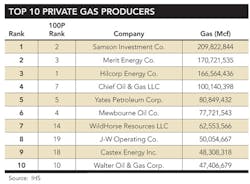

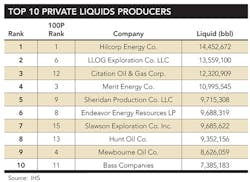

Independent research firm IHS has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

The biggest mover in the OGFJ100P private company space since the April installment is The Woodlands-based GeoSouthern Energy Corp. To say the company, now ranked No. 92 from its previous position at No. 4, dropped in the ranking is an understatement. However, the drop comes after the company monetized—to the tune of $6 billion in cash—a substantial portion of its oil production from the Eagle Ford to Devon Energy Corp. in November of last year. In that transaction, Devon acquired assets in DeWitt and Lavaca counties that included production of 53,000 boepd.

Another result of the oil-rich divestiture? GeoSouthern gives up its previous spot as the No. 1 privately-held liquids producer to Hilcorp Energy Co.

Financing

Laredo Energy has secured a total of $130 million in private equity commitments from Avista Capital Partners and Liberty Energy Holdings. The company, ranked No. 35, will use the financing to support its South Texas drilling program. The company has two rigs running and expects to drill a total of 25 wells this year. The company has more than 300 bcfe in proved reserves and more than 50 MMcfe per day in gross operated production. The company's assets include 62 operated producing wells, more than 110,000 gross acres of operated leases and non-operated interests in more than 31,000 gross acres.

Permian Basin-focused Parsley Energy, coming in at No. 25, launched its initial public offering of 43,900,000 Class A common stock mid-May. Credit Suisse Securities (USA) and Goldman, Sachs & Co. acted as joint book-running managers. JP Morgan Securities and Wells Fargo Securities acted as book-running managers. Morgan Stanley & Co., Raymond James & Associates, Tudor, Pickering, Holt & Co. Securities Inc., RBC Capital Markets, Global Hunter Securities, Macquarie Capital (USA) Inc., Scotia Capital (USA) Inc., Simmons & Co. International, and Stephens Inc. acted as co-managers for the offering.

M&A

Oak Valley Resources LLC agreed to sell all of its subsidiaries, inclusive of producing assets, undeveloped acreage, and approximately $138 million of cash, in exchange for nearly 9.1 million shares of common stock of Earthstone Energy Inc. The cash represents existing cash on hand plus $107 million of capital commitments available. Upon completion, there will be approximately 10.9 million shares of Earthstone common stock outstanding with current Earthstone stockholders owning 16% of the combined company and Oak Valley owning the remaining 84%. At closing, Oak Valley's management team, including president and CEO Frank A. Lodzinski, will assume the same roles in the combined company which will be relocated to Houston. The company will maintain an office in Denver. With assets concentrated in the Eagle Ford and Bakken, the combined company has significant exposure to oil-weighted reserves. As of Dec. 31, 2013, the combined company had total proved reserves of nearly 14.6 MMboe and total proved PV-10 of $186 million, and for the quarter ended December 31, 2013, total net daily production of 2,750 boepd.

In early May, Sabine Oil & Gas LLC signed a merger agreement with Forest Oil Corp. Upon completion, Sabine unit holders will own approximately 73.5% of the new combined entity and Forest shareholders will own approximately 26.5%. In addition to a top-tier 207,000 net acreage position in East Texas, the combination of assets creates a 65,000 net acreage position in the Eagle Ford. The combined company will have estimated proved reserves of 1.5 trillion cubic feet equivalent (71% gas) (as of Dec. 31, 2013), and estimated daily production of 345 million cubic feet equivalent (65% gas) for 2014.

The combined company is expected to fund its drilling program though 2015 without accessing equity markets.

Barclays Capital Inc. and Wells Fargo Securities acted as financial advisors to Sabine. Tudor, Pickering, Holt & Co. is acting as an advisor to Sabine on portfolio optimization. Vinson & Elkins acted as legal advisor to Sabine, while Simpson Thacher & Bartlett advised Sabine on financing matters. Gibson, Dunn & Crutcher acted as legal advisor to First Reserve. JP Morgan Securities acted as financial advisor to Forest, and Wachtell, Lipton, Rosen & Katz acted as legal advisor to Forest.

Houston-based Ursa New Ventures LLC has entered into a deal with ASX-listed Sun Resources in which Sun will purchase a 50% non-operated working interest in a gross 10,028 acre package (5,014 acres net to Sun) within the Eagle Ford and Austin Chalk formations. The remaining 50% WI will be retained and operated by Ursa. Sun and Denham Capital-backed Ursa plan to spud the first horizontal, multi-staged, fracture stimulated well before the end of Nov. 2014.

Click here to download the PDF of the "2013 Year-To-Date Production Ranked By BOE"

Click here to download the PDF of the "2013 Year-To-Date Production - Alphabetical Listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.