Resurgent IPO market provides fresh capital for increasing deal activity

David Michael Cohen, PLS Inc., Houston

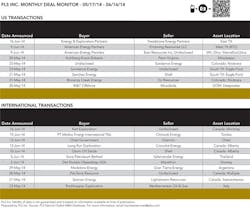

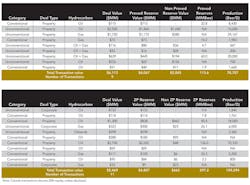

PLS reports that year-to-date, the upstream A&D markets are significantly outperforming year-ago comparisons. From January 1 to June 16, the 2014 global tally of $87 billion in 276 deals (with values disclosed) is up over 110% from 2013's $41 billion in 275 deals. In the US, the 2014 total of $36 billion in 128 deals is also up 80% from 2013's $20 billion in 139 deals.An emerging new theme adding more capital for acquisitions is the resurgence of upstream IPOs which so far in 2014 are shaping up to the best in several years. Thus far, US market-based upstream IPO proceeds of $3.8 billion have already surpassed the full-year 2013 total of $2.2 billion by 75%, and there's still over six months to go. In recent weeks, two interesting IPOs indicate the public investor's strong appetite to participate directly in the rewards of mineral ownership. In Canada on May 29, Encana completed its PrairieSky Royalty IPO in a US$1.5 billion capital raise and the stock soared 32% on its first day of trading. This IPO monetizes a 5.2 million-acre fee position in Alberta which will provide shareholders the benefit of royalty revenue and lease bonuses and rentals. On the heels of the PrairieSky IPO, Diamondback Energy completed its IPO of Permian Basin royalty sub Viper Energy Partners on June 18. The Viper offering surged 28% in its first day of trading on top of an initial pricing of $26/share, far above the indicated price of $19-$21/share.

The performance of these IPOs provides confidence for aggressive private companies rapidly growing in the traditional upstream A&D markets to stay the course. A case in point: Aubrey McClendon's American Energy Partners announced its two biggest acquisitions since launching in April 2013. On June 9 the company simultaneously announced its Permian debut via a $2.5 billion acquisition from privately-held Enduring Resources and a $1.75 billion purchase from East Resources and an unnamed private company within its core southern Utica play and a new southern Marcellus operational area. The Enduring assets on the southeast edge of the Midland Basin add a third regional leg to AEP's initial Appalachian focus and the Mid-Continent position it announced earlier this year. In the southern Utica, AEP is notching up its seventh major acquisition, increasing its already industry-leading leasehold in the play to 280,000 net acres. Finally, AEP is entering the West Virginia part of the Marcellus, adding to acreage already held in under-explored south-central Pennsylvania.

Globally, the super majors continue to shed non-core assets, providing buyers unique opportunities to gain impact deals. Shell had a busy month, selling its primary Eagle Ford asset to Sanchez Energy for $639 million and then its Orion oil sands project in Alberta to privately-held Osum Oil Sands Corp. for $298 million. The Harrison lease block (100% WI) in South Texas marks a transformational opportunity for Sanchez, which is roughly doubling its production, reserves and Eagle Ford leasehold to 42,800 boepd, 119 MMboe and 226,000 net acres while increasing its potential drilling inventory by a third to almost 3,000 locations. Meanwhile, Chevron sold its non-op 25% WI in an oil concession and 21% WI in the related export pipeline in southern Chad's Doba Basin to the government for $1.3 billion, citing current market conditions and asset size relative to its international portfolio. The assets had 2013 net production of 18,000 bopd, down from 22,000 bopd in 2012.

Also, the overseas sell-off by US onshore-focused large independents remains entrenched. Case in point is Marathon Oil, which agreed to sell its Norwegian sub to local explorer Det Norske for $2.7 billion. Det Norske is getting 16 licenses with Q1 production of 70,300 boepd (88% liquids), all geographically focused and tied into the Alvheim FPSO. The transaction marks a seismic shift toward established production for the Norwegian company, whose four producing fields flowed just 2,900 boepd during Q1.