US M&A shifts toward larger deals with Encana's Eagle Ford entry leading the pack

David Michael Cohen, PLS Inc., Houston

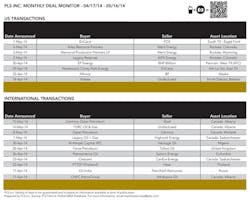

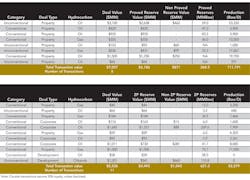

PLS reports that the period from April 17 through May 16, 2014 saw larger deals (exceeding $100 million) in the US upstream sector, resulting in an average deal size of $437 million vs. $231 million during Q114. In all, the period saw 33 US upstream transactions totaling $11.8 billion.

As was the case during the previous period, the biggest US deal reported involved Encana. This time instead of a high-profile divestment (Jonah field for $1.8 billion), Encana was on the buy side, acquiring Freeport-McMoRan Copper & Gold's Eagle Ford assets for $3.1 billion. The deal adds a sixth core liquids play to the five outlined in Encana's new strategy last fall. The acquired assets are located primarily in Karnes County, TX, in the same part of the play where fellow Canadian company Baytex Energy Corp. made its debut with the $2.6 billion purchase of Aurora Oil & Gas in February. They are also offset by leading Eagle Ford producers EOG Resources, Marathon Oil and ConocoPhillips.

Global miner Freeport-McMoRan acquired the Eagle Ford assets in its $17.6 billion takeover of Plains E&P in December 2012. It bought Plains primarily for its Gulf of Mexico assets, as illustrated the day after the Encana deal when it announced a $1.4 billion deepwater GOM acquisition from Apache. That agreement includes Apache's interests in the Anadarko-operated Lucius and Heidelberg developments (11.7% and 12.5% WI) and 11 primary-term exploration leases. It boosts Freeport-McMoRan's stake to 35% at Lucius, which is on track for first oil during H2. Heidelberg is expected online in mid-2016, and Apache had projected 20,000 boepd net at peak from the two fields.

MLPs continued to be reliable buyers, particularly of long-life conventional reserves as demonstrated by privately held Merit Energy's sale of Rocky Mountain oil properties to Memorial Production Partners for $935 million and Atlas Resource Partners for $420 million. These acquisitions featured notably high proved reserve life indices, even by MLP standards: 38.6 years for Memorial's CO2-flood acquisition in Wyoming and 44.4 years for Atlas' non-operated Rangley field buy in Colorado.

Another noteworthy US deal is privately held Hilcorp's $1.5 billion debut acquisition on Alaska's North Slope, where it is buying some of BP's operated oil fields. This is the second recent North Slope entry by a private company, following Apollo Global Management-backed Caelus Energy's $300 million acquisition from Pioneer Natural Resources which closed in mid-April.

Canadian M&A shows no sign of slowing down, with strong buying activity by domestic producers as well as a resurgent flow of foreign capital. One of the biggest acquisitions of the period was Crescent Point's $1.0 billion purchase of private Saskatchewan producer CanEra Energy, which increased its footprint in the emerging Torquay unconventional oil play—the Canadian extension of North Dakota's Three Forks formation.

As for foreign buyers, PetroChina moved forward with its buyout of partner Athabasca Oil Corp. at the Dover oil sands project for $1.2 billion, triggered by regulatory approval and a settlement with local First Nations. Meanwhile Sinopec came forward as the buyer of a 15% stake in Petronas' Montney gas and associated LNG project—and then immediately sold 5% to Chinese electrical generator China Huadian Corp., bringing the number of foreign entities with interests in the project to five.

Outside North America one of the biggest deals was Nigeria oil producer Heritage Oil's $1.6 billion takeover by Al Mirqab Capital, the private investment vehicle of Qatar's former Prime Minister Sheikh Hamad Al-Thani. This is the second time this year that a wealthy individual has bought an oil company for over $1 billion, following the $7.1 billion purchase of RWE Dea by Russian billionaire Mikhail Fridman's LetterOne Group in March. Heritage produces primarily from the multi-field oil mining license 30 offshore Nigeria, which it bought from Shell and partners for $850 million in 2012.