Capital One energy survey

Outlook positive, but increased regulation is a concern

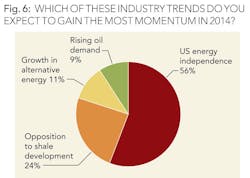

Fifty-six percent of energy professionals surveyed by Capital One identified US energy independence as the industry trend likely to gain the most momentum this year. Other trends expected to gain traction in 2014 include opposition to shale development (24%) and growth in alternative energy (11%).

Capital One conducted the survey of a broad range of industry professionals on key energy-related issues at the North American Prospect Expo (NAPE) held in Houston on Feb. 6-7, 2014. Respondents included professionals from different specialties within the energy industry, including company executives, landmen, geologists, engineers, capital providers, analysts, and traders. Percentages are based on 106 responses.

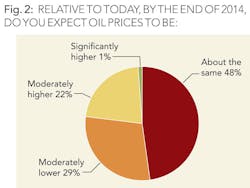

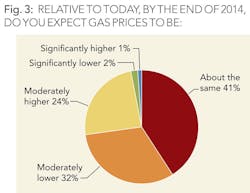

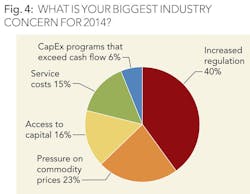

The survey revealed a positive outlook on oil and gas prices; two-thirds of respondents expect gas prices to remain steady or increase this year, and 71% anticipate similar stability for oil prices. Increased regulation was cited as the year's biggest industry concern by 40% of those surveyed, followed by pressure on commodity prices (23%), and access to capital (16%).

"This upbeat view of oil and gas prices goes hand in hand with the progress toward US energy independence," said Russ Johnson, head of Energy Investment Banking, Capital One Securities. "However, our survey data also revealed concerns over regulatory pressures and resistance to shale development, as well as access to capital."

The pace of merger and acquisition activity is expected to pick up this year as well. Fifty-eight percent of the Capital One survey respondents expect M&A to increase in 2014, while 38% expect the level of M&A activity to stay the same as the prior year.

"The energy industry seems likely to see stepped-up M&A activity in 2014," added Scott Joyce, managing director of Energy Origination, Capital One Bank and Capital One Securities. "As that activity continues in the year ahead, Capital One will continue to provide the support companies need to take advantage of opportunities that will strengthen their goals for growth and expansion."

Capital One Financial Corp. is a financial holding company whose subsidiaries, which include Capital One NA, and Capital One Bank (USA) NA, had $204.5 billion in deposits and $297 billion in total assets as of Dec. 31, 2013. Headquartered in McLean, Va., Capital One offers a broad spectrum of financial products and services to consumers, small businesses, and commercial clients through a variety of channels. Capital One, NA has more than 900 branch locations primarily in New York, New Jersey, Texas, Louisiana, Maryland, Virginia, and the District of Columbia. A Fortune 500 company, Capital One trades on the New York Stock Exchange under the symbol "COF" and is included in the S&P 100 index.

Capital One Securities Inc. is Capital One's Institutional Broker/Dealer. Securities products and services are offered through Capital One Securities Inc., a non-bank affiliate of Capital One NA, a wholly-owned subsidiary of Capital One Financial Corp. and a member of FINRA and SIPC. The products and services offered or recommended are: Not insured by the FDIC; Not bank guaranteed; Not a deposit or obligation of Capital One; May lose value.