Oil price downturn hits upstream M&A markets; Halliburton surprises with offer for Baker Hughes

David Michael Cohen, PLS Inc., Houston

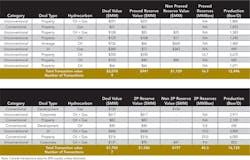

PLS reports that upstream deal markets slowed significantly during the period from October 17 to November 16 both in the US and internationally as oil prices fell to a four-year low in the mid-$70s. In the US, companies announced 33 upstream deals of which 20 had disclosed values totaling $2.3 billion, vs. $16.5 billion during the previous month. Similarly, international deals totaled 47, with 23 having a cumulative disclosed value of $2.0 billion-down from $11.3 billion the previous month.

Accounting for nearly half of the disclosed US deal value during the period was Aubrey McClendon's American Energy Partners. Continuing an aggressive buying spree that now exceeds $6.7 billion since early 2013, AEP announced a $726 million Wolfcamp bolt-on acquisition for its Midland Basin affiliate American Energy-Permian Basin and then completed purchases totaling $251 million in Oklahoma's SCOOP and STACK plays via its American Energy Non-Op affiliate. AEP's key backers include private equity firms The Energy & Minerals Group and First Reserve, and these deals highlight PE's growing role in the deal markets. While private equity continues to be among the most reliable buyers of conventional properties, these deals show an increasing interest in higher-capital shale plays as well, as do recent acquisitions involving Blackstone in the Haynesville shale and First Reserve in the Marcellus.

The acquired Permian acreage in Reagan Co., Texas covers 27,000 net acres but is estimated by AEP to include 110,000 effective net acres based on development potential in the stacked Wolfcamp A, B, and C intervals. The company estimates it paid $6,000 per effective acre in this deal, which bulks up the Permian affiliate's Midland Basin asset base ahead of an IPO planned for early next year. This would follow the recent trajectory of rapidly growing Permian pure-plays like Parsley Energy, RSP Permian and, of course, Athlon Energy. At a September conference in Dallas, McClendon said he plans to go public with all of the regional shale companies he has established since early 2013.

Internationally, the biggest deal of the period was PrairieSky Royalty's $617 million acquisition of fellow Western Canadian royalty company Range Royalty Ltd.-its first major acquisition since being carved out of Encana during Q2. The deal will increase PrairieSky's position by 60% to 9.3 million acres and add a significant presence in western Saskatchewan's active Viking light oil fairway: 500,000 acres (79% undeveloped) with more than 1,600 identified Viking locations. The Viking play accounts for 27% of Range's production and 41% of its revenue, and 75% of the wells drilled or licensed YTD. PrairieSky's royalty model has been enthusiastically embraced by investors, leading Diamondback Energy to copy the formula with its Viper Energy Partners spin-off in the US and encouraging fellow Canadian companies like Canadian Natural Resources Ltd. and Cenovus Energy to plan for similar offerings.

Following the end of the period, leading oilfield service competitors Halliburton and Baker Hughes surprised markets with the announcement of a $38.0 billion deal for Halliburton to buy Baker Hughes. The deal consolidates the service sector's Big Four to a Big Three, with rival Schlumberger still at the top of the totem pole and Weatherford at the bottom. Baker Hughes shareholders will receive 1.12 Halliburton shares and $19 cash per Baker Hughes share, valuing Baker Hughes at $78.62/share-a 40.8% premium to its stock price on October 10, the day before Halliburton's initial offer. The deal value also includes Baker Hughes' $3.4 billion debt. The two companies' diverse portfolios overlap in at least seven major product lines, providing an estimated $2.0 billion in synergies. And Baker Hughes production chemical and pump segments fill two gaps in Halliburton's lineup.

Investors and analysts are taking a cautious approach to the deal, perhaps worried about potential anti-trust complications. But the $3.5 billion termination fee built into the deal demonstrates Halliburton's confidence that it will clear regulatory hurdles, and the company has agreed to divest businesses that generate up to $7.5 billion in revenues if needed to complete the acquisition. Closing is expected during the second half of 2015.

Oil price downturn hits upstream M&A markets; Halliburton surprises with offer for Baker Hughes

David Michael Cohen, PLS Inc., Houston

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com