Oil and gas services

Gaining the upper hand when purchasing transportation and storage services

Sean Windle, IBISWorld, Los Angeles

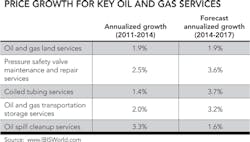

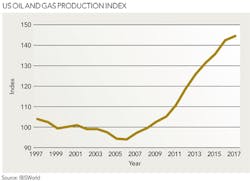

As US oil and gas production surges, demand and prices for related services are rising and lifting the importance of smart purchasing decisions. In 2013, the United States surpassed hydrocarbon-producing giants like Saudi Arabia and Russia to officially become the world's largest producer of oil and natural gas. Three quarters of the way into 2014, all signs point to the United States remaining the world's leading oil and natural gas producer for the foreseeable future.

The US oil and gas production index, which measures growth in annual crude oil and natural gas production, is expected to increase 4.4% by the end of 2014, and at a forecast annualized rate of 3.3% in the three years to 2017. Underpinning the surge in domestic oil and natural gas production are advancements in hydraulic fracturing and horizontal drilling techniques, which have enabled oil and gas companies to extract previously untapped oil and natural gas deposits from the Marcellus Shale and the nation's many other shale formations.

Concerns about climate change and the environment are also driving increased production of natural gas, a lower-carbon alternative to coal. The abundance of natural gas and record low prices are spurring many coal-fired power plants to transition to natural gas. In fact, the US Energy Information Administration projects that natural gas will surpass coal as the nation's largest source of electric power by 2035. Increasing oil and natural gas production has fueled higher demand and prices for a host of related services, including oil and gas land services, pressure safety valve maintenance and repair, coiled tubing services, oil and gas transportation and oil spill cleanup services. Buyers that understand the impact of increased hydrocarbon production on the price and availability of these services will be better equipped to make sound purchasing decisions.

Oil and gas land services

The process of drilling for oil and natural gas begins with land surveying, mineral leasing, land purchases, and other private and governmental negotiations that fall under the umbrella of land services. Due to the potential for landowner concerns, resistance from environmental groups and government regulations that vary by region and state, land services are a critical initial component of oil and gas production. In the three years to 2014, the average price for these services has been increasing at an estimated annualized rate of 1.9%, with similar price growth forecast for the next three years. A major factor driving demand and price growth for oil and gas land services is the rapid development of the Marcellus and Bakken shales. As recently as 2005, these shale formations were not considered major natural gas and oil resources due to the difficulty of extracting gas and oil from the shales' natural vertical joints using traditional vertical wells. However, horizontal wells drilled perpendicular to gas-filled joints, combined with fracking to widen the joints further, have significantly increased the amount of retrievable gas and oil.

According to the EIA, the Marcellus Shale produces about 18.0% of the nation's natural gas. Similarly, the EIA estimates that the Bakken Shale accounts for about 12.0% of domestic oil production. The rapid expansion of drilling and production in these shale formations has triggered a rash of mineral leasing and land purchasing activity, which has driven up service prices. While higher prices for land services are largely inevitable, buyers can take steps to minimize the impact of these costs. Buyers are strongly advised to lock in current rates now, before prices increase further. In addition, while most supply agreements end once the specific service has been completed, buyers with extensive oil and gas operations should consider signing a long-term contract. Long-term contracts lock in a guaranteed price for an agreed-upon timeframe, allowing buyers to pay a set rate for multiple projects over the course of one or two years.

Pressure safety valve maintenance and repair

Pressure valves are integral components in every segment of the oil and gas sector. In upstream drilling and exploration applications, valves are used to control the flow of oil and natural gas coming from deep underground up to the choke valves and blowout preventers at the top of the well. In storage, transportation, loading, offloading, and other midstream operations, valves are used to protect pipelines without restricting flow. Finally, valves also provide flow control solutions for oil refining and natural gas processing.

Due to the unique and extreme operating conditions that characterize oil and gas activities (e.g., high temperatures and deep-sea and underground environments), as well as the cost-prohibitive nature of continually replacing worn or malfunctioning valves, maintenance and repair services are an effective means for oil and gas operators to minimize costs and disruptions to operations.

In the three years to 2014, the average price for pressure safety valve maintenance and repair services has been rising at an estimated annualized rate of 2.5%, with price growth forecast to accelerate to an annualized rate of 3.6% from 2014 to 2017. Increased oil and natural gas production will cause more wear and tear on valves and other related equipment, which will strengthen demand and price growth for repair and maintenance work. Fortunately for buyers, routine maintenance ultimately reduces operating costs because it is generally easier and more cost effective to service a valve rather than replace it. Furthermore, carefully planned maintenance can often be performed without having to halt operations, thus eliminating downtime costs. Buyers also retain an advantage when procuring these services due to the low level of market share concentration among suppliers, which spurs price competition in the market. As a result, buyers usually have many supplier options, and can pit suppliers against one another to get the best price or highest value.

Coiled tubing services

Once an oil or natural gas well goes into production, a number of problems can occur that negatively impact operations and revenue generation, such as mechanical equipment failures and pressure fluctuations. These and other well issues require intervention work to diagnose the problem and come up with a solution. While well intervention can be accomplished with workover rigs and other equipment, the use of coiled tubing is popular because it allows production to continue while service is being carried out. Common applications for coiled tubing include well cleanouts and retrieving and replacing damaged equipment within the well.

In the three years to 2014, the average price for coiled tubing services has been rising at an estimated annualized rate of 1.4%. Over the next three years, IBISWorld forecasts that this growth will accelerate to an annualized rate of 3.7% as US oil and natural gas production continues to rise. Higher prices have created a difficult purchasing environment for buyers, especially given the high level of market share concentration in this market. With the top four coiled tubing service providers accounting for more than half of the market's total revenue, buyer choice and leverage is limited. The financial muscle of large-scale suppliers like Baker Hughes and Schlumberger also makes it difficult for new suppliers to enter the market, thus stifling price competition. Nonetheless, buyers can potentially save money and gain more value by working with a smaller supplier, which is more likely to accommodate their needs in exchange for new business. Because demand for coiled tubing services is partly driven by fluctuations in oil and natural gas prices, price volatility for these services is high. Buyers can minimize their exposure to price fluctuations by locking in current prices with long-term contracts.

Oil and gas transportation storage services

Surging US oil and natural gas production has increased demand and price growth for related transportation and storage services. Once extracted from the ground, oil and natural gas must be moved to refineries and production facilities. Afterward, refined oil and gas is transported to end markets. A variety of methods exist for transporting oil and natural gas, including pipelines, trucks, barges, and rail cars. In the three years to 2014, the average price of oil and gas transportation storage services has been rising at an estimated annualized rate of 2.0%, with growth forecast to accelerate to an annualized rate of 3.2% heading into 2017. The constrained capacity of existing pipeline infrastructure has contributed to higher transportation prices. For example, according to the Congressional Research Service, oil production in the Bakken formation, which underlies parts of North Dakota, Montana, Saskatchewan, and Manitoba, has increased tenfold since 2005. With oil production expanding so rapidly in a short period of time and no way to quickly ramp up the construction of new pipeline, operators have turned to other forms of transportation, such as rail. In fact, demand for crude oil rail transport has risen so quickly that it has caused a shortage of available tank cars and double-digit annualized price growth for rail tank car leasing over the past three years.

Unfortunately for buyers, high prices are expected to remain the norm until pipeline infrastructure and rail car production catch up to oil and gas production volumes. Buyers are advised to lock in current service rates with a long-term contract. In addition, the current 18-month manufacturing backlog for rail tank cars is still less than the time it will take to fully update the nation's pipeline infrastructure. As such, buyers should continue to consider rail, as well as trucks, barges and other alternative transportation methods.

Oil spill cleanup services

A consequence of rising oil production is an increased number of oil spills. While active cleanup of the 2010 Deepwater Horizon explosion and subsequent oil spill ended earlier this year, remediation efforts will continue as new areas and needs are identified. In addition, while railroads traditionally spill less oil per ton-mile than any other mode of land transportation, the increasing use of rail cars to transport oil has resulted in rail-related oil spills rising to their highest level in four decades. According to the Pipeline and Hazardous Materials Safety Administration, more than 1.2 million gallons of crude oil was spilled from rail car incidents in 2013 alone.

The most deadly of these accidents was the derailment of a 72-car freight train in Lac-Megantic, Quebec, which released 1.6 million gallons of Bakken crude oil, causing a massive explosion and fire and killing 47 people. With stronger demand for oil spill cleanup and remediation, the average price for these services has been rising at an estimated annualized rate of 3.3% in the three years to 2014. Over the next three years, prices are forecast to continue rising at an annualized rate of 1.6%. While price growth will decelerate heading into 2017, another major accident on par with the Deepwater Horizon oil spill or Lac-Megantic derailment could easily result in prices spiking again.

The best way for buyers to minimize oil spill cleanup costs is to take steps to reduce the risk of oil spills. Buyers should avoid skimping on purchases of services that ensure the safe extraction and transportation of oil. A higher price paid upfront for the appropriate equipment and personnel is far cheaper than dealing with natural resource and property damage claims down the road. Many suppliers offer hazardous waste management and site assessment and engineering services, which act as preventative measures against an oil spill. In addition, offshore operators should invest as many resources as possible toward keeping spilled oil away from the shoreline.

Oil spills confined to the water are generally less complicated and costly to fix because they can be treated with dispersants. Oil spills that reach the coastline and other sensitive areas are more expensive to treat because they require manual labor. Buyers should take advantage of the fragmented nature of the oil spill cleanup services market, which comprises a large number of small suppliers serving local and regional clients. This market structure allows buyers to pit suppliers against one another to get the lowest possible price.

Obtaining the edge in purchasing

The oil and natural gas boom has had a profound impact on the US economy. Oil producers have been able to reap large profit margins by ramping up production of shale oil and selling it to domestic and foreign markets. Earnings have generally been slimmer with domestically produced natural gas, which has fallen in price over the past three years. Nonetheless, as prices fall and regulations on carbon emissions tighten, more coal-fired power plants are expected to convert to natural gas. In addition, domestic natural gas prices have fallen to the point where it is profitable to liquefy it and ship it overseas. These factors will spur stronger demand and profitability for natural gas production over the next three years. Buyers with an understanding of how oil and natural gas production affects the prices of related services will be better equipped to negotiate favorable purchasing agreements. Furthermore, because many natural gas and crude oil products are homogenous and typically carry the same price within a region or market, buyers can gain a competitive advantage by minimizing related maintenance, transportation and other service costs.

About the author

Sean Windle is an oil and gas analyst at IBISWorld, which specializes in market research that encompasses price trends, major suppliers, supply chain risks, and more. Windle holds a degree in Journalism from Indiana University.