What is your R&D worth?

Valuation methods for technology and R&D have rarely been addressed systematically

Shahnawaz Vahora, OTM Consulting, Houston

Advances in technology have been a major driver of E&P company profitability in recent years. Examples include accessing deepwater resources with complex reservoirs and reducing uncertainty through increased information sources from production operation. Even then overall R&D spend has not increased dramatically, since justifying the business case for technology development is very difficult for oil companies. As the industry moves towards another cost reduction cycle, senior management across the industry is once again under pressure to review spending in R&D and technology.

With these cost pressures, all types of E&P investments (including R&D), will need to credibly demonstrate the "value add" with the same rigor as can be analyzed and predicted by other types of capital investments. Indeed, valuation for capital investment projects has long been established in the upstream industry. However, rarely have valuation methods for technology and R&D been addressed systematically in oil and gas.

Essentially, R&D valuation is done by building the R&D business case against a critical operational need. Some of the supermajors have pioneered a number of techniques which have seen success in measuring R&D value. For example, Shell data highlights almost $1 billion value addition from just three technologies: underbalanced drilling - $200 MM; expandables - $0.5 bn in savings and monetization; and smart wells - $200 MM NPV.

However, the fundamental issue is that it is not always clear what the overall value of an R&D investment is as valuing technology is by no means a trivial task. It is difficult to apportion the unique contributions of technology versus other essential enablers as technology does not always generate value directly and true value depends not on the technology, but how it is used. In this scenario, it is difficult to make critical strategic choices without a robust approach to technology valuation.

Broadly speaking, there are two main options for valuing technology: forward looking valuation and backward looking valuation. They are rarely used together because the intention behind the valuation is essentially different. Where R&D managers need to justify budget they have already spent, backward looking valuation can be an excellent tool to articulate the cost-benefit gained (i.e., how much have we gained from this investment?). However where R&D managers need to justify innovative technology programs, forward looking valuation can help predict the benefits to be gained (i.e., how much could we gain from this investment?) and help choose the most valuable R&D projects for the future.

OTM recently conducted a study of approaches taken by major operators around the world, a unique undertaking that has never been completed to this level across such a wide array of technology developers. The intent of the study was to inform decision-makers on how to value technology in both forward and backward looking cases. The study has found that technology valuation can be a powerful tool, provided that the scope and objectives of any technology valuation exercise are clear. Valuing technology and R&D projects (in a credible manner) can:

- Reassure top management that R&D investments are adding value

- Enhance the credibility of R&D within assets and operating units

- Provide a logical way of choosing between different R&D projects

- Optimize portfolio of R&D projects

- Help to manage individual projects better

- Underpin buying and selling technology or patents

- Build the case for R&D budget

Backward looking analysis

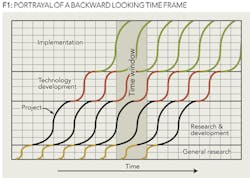

One of the major IOCs, Shell, has relied on backward looking analysis using a fixed time frame (3 to 5 years) for their analysis (Jonkman/de Waal, 2001). This approach is suitable for companies with a steady level of investment in development and implementation of new technologies throughout the time frame. Reference to a fixed time window rather than project duration is preferred, as tracking and evaluating the path leading to the eventual technology deployment can be complex, time consuming, and it does not take into account costs associated with failures during the technology development (i.e., cost of failures leading up to the technology being selected). Considerations also need to be taken for not counting recurring benefits and assuming certain depreciation.

Essentially, the three- to five-year backward looking cost-benefit analysis is based on the comparison of 'costs' for the development and implementation against the commercial 'benefit' realised from the technology in a given time period. A period of three to five years is usually chosen because it does not require looking too far in the past and matches the maximum extent of R&D benefits.

The reference to a fixed time frame rather than project duration is acceptable in a "steady state" scenario as illustrated in Figure 1 and corresponding to a reasonably constant level of investment for the development and implementation of new technologies.

To define a sensible value for the benefits of a new technology and reduce the uncertainty involved with calculating all possible benefits from the entire lifetime of that new technology, another assumption can be made that the commercial advantage given by any new technology is exhausted after a period of three to five years. This is portrayed by the time window in Figure 1.

Overall there are a number of variations on this methodology used by the industry, such as changing the time frame to one year, including intangible benefits, and calculating exact project costs for calibration. However, this methodology is too complex. To reduce complexity, there are three simplifying factors that should be considered:

- There is a strong creaming effect, where typically 80% of the benefits are given by 20% of the technologies. This assumption can greatly simplify the analysis and shortlist the number of technologies.

- Nearly all technology benefits fall into a small number of categories. This assumption simplifies the analysis and creates buckets where value can be placed.

- Access to reserves

- Increased recovery

- Accelerated recovery

- Cost reduction (CAPEX, OPEX)

- Reduction of process cycle times

- Uncertainty reduction

- Improved HSE, public image or reputation (harder to quantify)

- The methods described are not static but tend to evolve over time to accommodate changes. In fact, industry experience shows that the application of R&D evaluation methods typically follows a lifecycle where companies swing between using very complex, time-consuming models and simple quantitative methods that require basic assumptions.

One complication with all valuation methods is that the second best alternative must be calculated, as the baseline is hardly ever "to do nothing." In order to calculate a practical number which technology can be allocated to, there must be a baseline calculation, which is the second best alternative. For example, if there were a new pump invented in-house, all of the extra barrels pumped due to this new invention cannot be allocated to the invention. A baseline in this instance could be that a similar service company offering must be taken into account so that the true benefits are calculated.

Usually valuation exercises are carried out by the R&D department technology management function in conjunction with input from assets, economics and corporate. Typically, it is seen that there is a cyclical trend in requests from upper management to confirm/explore the benefits of spending substantial money on R&D. This is most often the case when a new board or CEO questions each expense line item.

Overall, for properly articulated benefits, the backward looking analysis reinforces in the minds of the asset managers the contributions made by the technology in helping them to achieve their business goals and highlights the historic differences in the assets' ability to extract value from technology. The historic differences can be calculated if the valuation exercise is carried out over regular time periods and the value is calculated by investments in various technology areas. All of these indications can lead to an improved value extraction from R&D and technologies.

Many business managers are initially positively surprised at the size of the benefits demonstrated by a backward looking approach (e.g., Shell reported benefit-cost ratio in the order of 8:1). Additionally, companies find that the better communication and shared understanding promoted by a well-conducted cost/benefit analysis is even more valuable than the numbers that emerge from such studies.

Forward looking analysis

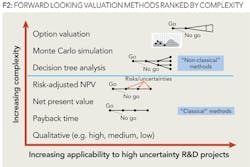

A major limitation of the backward looking approach is that it does not give information on the future value contribution of current R&D and technology investments. It also fails to provide guidance in selecting new R&D projects/technologies and deciding the relative level of investment that is most appropriate in the given business environment. Forward looking analysis is the natural fit for reviewing project proposals before approving their initiation. There are a several methodologies which can be undertaken to evaluate technology value in a future sense (See Figure 2).

The more qualitative approaches are the easiest methods to use when running a forward looking analysis but suffer heavily from managerial scrutiny when there is a great degree of uncertainty related to the success of a technology project (often the case for potentially big win technologies characterised by high value but high risk). In these cases, management often feel it is "not good enough" to use an educated guess to represent the value of a new technology project.

In contrast, rigorous quantitative approaches such as Monte Carlo simulations require a number of key data inputs (often not known when the decisions are being made) and take significant time to execute.

The correct method is dependent on the nature and culture of the company and the overall basis for doing the valuation in the first place. Some companies are consistent technology developers and have annual R&D budgets available for technology. In these cases, they are generally more interested in comparing technology options against one another on a simple qualitative level (so as to select the right options for the future) instead of trying to seek approval for funding on a project-by-project basis.

Some IOCs take a more pragmatic approach to forward valuation and do not get hung up on numbers. They see the value in the discussions that need to take place between the R&D functions and the business units (assets). They recognize the value in the debate (and therefore internal alignment) as being more important than just generating the numbers through complex modeling activities.

Some companies also favor off-the-shelf tools for forward looking technology valuation. Essentially, these tools require certain assumptions from the user and use internal algorithms and other codified assumptions to calculate the overall value of a technology (or a project). However they can be "black boxes" where "rubbish in and gospel out" can occur, and as a result, management can lack confidence in their accuracy. Overall, these tools can be powerful but users need to be careful to avoid "black box syndrome."

What about intangible value?

The introduction of intangible value (brand, company reputation, capability, growth) into the methods raises the problem of how to estimate the overall value and therefore the complete justification for a technology investment. This is a common problem between the backward looking and forward looking methods because of inexact methodology for soft aspects like brand or company reputation. This is the trade-off between accuracy and breadth of implementation (i.e., including a number of KPIs).

Two companies, Saudi Aramco and ENI, have undertaken a detailed approach that looks at statistical calculation of tangible and intangible benefits. By relying on some form of statistical analysis, both companies developed a useable management process to allow the calculation of both tangible and intangible benefits of a project without getting hung up on numbers.

The Saudi Aramco (SPE 11196) method places a strong emphasis on intangible value and uses a qualitative scorecard system to predict this value. The intangible value is imposed over a generic distribution that indicates how this intangible value will vary over time. The tangible value distribution is then estimated using a standard cash flow analysis. The combination of the two distributions gives a profile of the total technology value. This method makes some crude assumptions about the nature of intangible value, but it has built in flexibility that can scale down the emphasis on intangibles as required.

ENI (SPE 65181) suggests a more systematic approach that outlines a series of gates that a project must pass through before receiving approval to commence. The first gate considers the intangible benefits without going into a rigorous analysis of the project value; it is used to sanity check the projects. The second two gates consider the financial benefits only. The third gate gives the project a rigorous financial treatment. No single metric is used to measure the project value, rather a robust series of financial measures.

Conclusion

Valuation methods for capital projects have been addressed quite extensively in literature and the upstream industry. However, rarely has R&D valuation been systematically addressed. This article has attempted to give an insight into how different approaches are undertaken for backward and forward looking valuation.

Different operators have shown different preferences as to the depth and thoroughness of these valuation exercises. There is no right or wrong answer so long as there is a fair and reasonable method to set future R&D budgets and make decisions on "go" or "no go" project movements. Sometimes, the point of an evaluation exercise is not to get an accurate number, but to provide sufficient information to make the right investment decision.

Used diligently, technology valuation can be an extremely powerful tool which can credibly articulate the value of a company's R&D investments to top management and even to the stock market (Shell did so in the 1990s). For backward looking valuations, the baseline is hardly ever to do nothing but it is difficult to predict how good the next best investment would have been, while in forward looking valuation, forward benefits often require crystal ball gazing into the future.

Whichever approach is chosen to evaluate the economic impact of R&D, there are additional advantages to the valuation exercise than simply financial impact. It can also help answer the following questions:

- Which business units are using the technology to its potential? Valuation can allow benefit benchmarking where best practice can be shared. Additionally, if the valuation exercise is done repeatedly over time, then benefits of new technology can be monitored in different assets over time.

- Which technology providers are giving us the best value? Benefits can be distinguished from corporate proprietary research, local in-house technology development and third party contributions in order to distinguish who is providing the best value. This can benchmark proprietary research effectiveness against market offerings.

- Which technology area is providing the most value from R&D? Benchmarking the track record of R&D effectiveness in different technology usage areas (subsurface, subsea, drilling, etc.).

- What is the nature of the value (e.g,. increasing reserves, reducing costs, etc.)? This can be used to calculate the nature of value adding activities in order to help focus future R&D projects.

- How can the wider organization understand the nature of technology and its benefits? Holding discussions around the technology and its uncertainties can help the organization understand the nuances. Often this can be the biggest benefit for companies.

About the author

Shahnawaz Vahora is an expert in strategy, technology, and innovation in the upstream industry, having worked with four of five supermajor IOCs, key NOCs, service companies, and national governments. He is based in Houston and leads consulting activities in Deepwater Americas for OTM Consulting, a division of global technology advisory and product development company Sagentia Group.