Private equity and MLP trains picking up steam in US markets

DAVID MICHAEL COHEN, PLS Inc., Houston

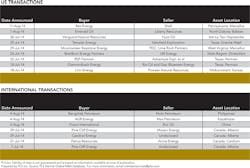

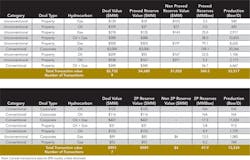

Private equity and MLP buying for US deals is gaining strength while super-major sell-downs are providing substantial supply. Headlining recent deals are the $3.0 billion merger of Breitburn Energy Partners and QR Energy-two Top Five upstream MLPs with broad US asset bases-and Shell's $1.2 billion Haynesville divestment to newly formed Vine Oil & Gas and its private equity backer Blackstone. In all, PLS reports that the period from July 17 to August 16, 2014 saw 48 US deals of which 37 had disclosed values totaling $9.0 billion.

Breitburn's acquisition of QRE will create the largest oil-weighted upstream MLP with a pro forma enterprise value of $7.8 billion. Both companies have deep portfolios of long-life conventional properties in oil-rich basins across the US. QRE's YE13 proved reserves of 109 MMboe (85% proved developed) and Q2 production of 20,300 boepd (58% oil, 12% NGLs) will boost Breitburn to a pro forma total of 323 MMboe and 57,300 boepd (67% liquids). Besides complementary assets in regions where it already operates, the merger also gives Breitburn exposure to the ArkLaTex region including East Texas and to Jay field in the Florida Panhandle. QRE unitholders gain exposure to assets in California and Wyoming.

As for Vine and Blackstone, they are getting over 107,000 net acres plus net dry gas production of 250 MMcfd. Vine is led by Eric Marsh, a former EVP of Shell's 50:50 Haynesville JV partner Encana. Shell and Encana were among the first to target the Haynesville with their 2007 JV before the gas price crash of 2008-2009 brought drilling there to a crawl. In the past year Encana has expressed interest in moving rigs into the play while, in contrast, Shell cancelled a $12.5 billion Louisiana gas-to-liquids project that would have monetized its Haynesville production. For its part, Blackstone in 2012 invested $2.0 billion in Cheniere Energy's LNG export facility at Sabine Pass, which is also intended to monetize Haynesville gas.

Concurrent with the Haynesville deal, Shell announced the sale of its conventional Pinedale properties in southern Wyoming to Ultra Petroleum for $925 million plus an additional 155,000 net acres owned by Ultra targeting the Marcellus and Utica with existing production of 100 MMcfed. These deals bring Shell's year-to-date global divestment total to $10.6 billion.

Internationally, PLS reports 39 upstream deals from July 17 through August 16, 2014, including 29 with disclosed values totaling $1.4 billion. A major driver of this activity is the growing presence of Asian traders and other non-traditional buyers in the upstream market, particularly in their own backyards. The most recent examples are the takeovers of Roc Oil by Chinese conglomerate Fosun International for $407 million and of Nido Petroleum by Thai refiner Bangchak Petroleum for $105 million. Roc's largest producing properties are in China's Bohai Bay and Beibu Gulf; it also holds other assets in China as well as Australia, Malaysia, Myanmar and the UK North Sea. By accepting the Fosun offer, Roc nixed a previous reverse merger agreement it had with fellow Asia-Pacific player Horizon Oil. Nido's assets are in the Phillipines and Indonesia.

Finally, although this report usually restricts itself to upstream A&D, no discussion of recent dealmaking would be complete without including US pipeline giant Kinder Morgan's $71 billion acquisition of affiliates Kinder Morgan Energy Partners (KMP), Kinder Morgan Management LLC (KMR) and El Paso Pipeline Partners LP. The deal will create North America's largest infrastructure company and marks the second-largest transaction ever across the global energy industry, beaten only by Exxon's $75 billion acquisition of Mobil in 1999. More importantly, this type of deal is almost unprecedented in the energy industry: a corporate parent re-acquiring its MLP offspring.

Richard Kinder and David Morgan pioneered the midstream MLP model in 1997 with the launch of KMP. In late 2011 another pipeline operating MLP was added after the $38 billion acquisition of El Paso. Kinder Morgan is now abandoning the MLP model in favor of a C-Corp structure that not only simplifies the organization but also lowers the cost of capital and creates a more competitive acquisition currency to accelerate growth. The MLP space is seen as ripe for consolidation with more than 120 companies having a combined enterprise value exceeding $875 billion. In addition, KMI believes its new, sleeker structure will better position it for organic growth via a slice of over $640 billion in US infrastructure investments needed through 2035.