Mexico: At the Sharp End of the North American Energy Revolution

This sponsored supplement was produced by Focus Reports. Publisher: Julie Avena

Project Director: Mariuca Georgescu

Editorial Coordinator: Louis Haynes

Project Assistant: Alina Cotfasa

For exclusive interviews and more info, plus log onto energyboardroom.com or write to [email protected]

Once again, the Peña Nieto administration has exceeded all expectations by following up on December's game-changing constitutional amendment with an equally radical tranche of legislation. These secondary laws forge ahead with plans to shatter the 75-year-old oil monopoly of Petróleos Mexicanos (Pemex) and open Mexican oil and gas markets to private sector competition and investment.

A Reform Very Much 'On-Track'

At the end of April, in a highly symbolic demonstration of unity and intent, the president himself, flanked by the ministers of finance and energy, unveiled a far-reaching and eagerly awaited package of nine new bills and 13 amendments to existing statutes aimed at defining the mechanics of implementing the sweeping objectives outlined under the original constitutional amendment. Those proposals have, with some minor tinkering, recently received assent from Mexico's Congress.

"The secondary legislation revolves around three fundamental characteristics," explains Juan Carlos Machorro, Partner of Santamarina y Steta. "Firstly, it is entirely consistent with the main features and spirit of the constitutional amendment that was approved at the beginning of the year. Secondly, the federal package wisely refrains from going into unnecessary detail and is instead characterized by an in-built flexibility that will allow for the constitutional and legal tools to be harnessed for customizing each particular energy project. And thirdly, and most crucially in our opinion, it closely reflects and follows international standards. Herein lies the real quality of the secondary legislation from an industry perspective."

Other industry voices have been quick to concur. "I am exceedingly bullish about what is happening to the Mexican energy sector and how this will translate into exponential growth for Apollo," declares Constantino Galanis, CEO of Quimica Apollo. "The cheaper energy that this reform will produce is going to be a real catalyst to the national economy as a whole by rendering virtually all products more competitive and thus represents an unprecedented opportunity for spreading wealth and prosperity," he explains. "Mexico has become the place to be in Latin America," asserts the Managing Director of C&C Technologies, Jose Aguilar. "Brazil was like a supernova star that, after huge amounts of hype, collapsed and burnt. Now all eyes are on this country. Nowhere else in the region holds quite the same raw potential as Mexico on the eve of liberalization," he remarks.

The significance of passing sound secondary legislation should not be underestimated. Contrary to many assertions in the media, Mexico's energy future was not definitively settled by the constitutional amendment alone and there had been a real risk of backsliding and derailment of the reform process. It was always likely to be much easier for rival parties in Congress to agree on the nebulous macro-economic issues enshrined in the constitutional amendment, than to forge consensus on the fine detail of secondary legislation where interest groups are impacted-first hand. "The more we have delved into the details of Mexico's new energy landscape, the more we have risked running into the sorts of vested interests that are set to lose out from changes to the status quo," points out Sergio Beristain, founder of Beristain & Asociados.

Building the New Pemex

No single actor has been more affected by the sudden removal of the Mexican state's exclusive rights to hydrocarbon production than the national oil champion, Pemex. In accordance with the new energy framework, Pemex must transition from monopoly status to a productive enterprise. It has not been privatized, so will continue to be publicly owned, but will nevertheless be exposed to market forces and obliged to create economic value in the same way as a classic private sector entity.

"Many people erroneously believe that we are simply renaming the same old Pemex and casting it adrift in the open market. This is actually far from the case," explains Lourdes Melgar, Deputy Secretary of Energy for Hydrocarbons. "The fiscal terms have been modified to afford Pemex a tax break and greater budgetary autonomy, and the rules governing joint ventures significantly freed-up enabling the NOC to migrate its entitlements into contracts."

"Pemex has at last been unleashed, with the government take of its profits falling from 79 to 65 percent within 10 years," argues Miguel Messmacher, Undersecretary for Revenues at SHCP. "SHCP will retain only two elements of control and oversight over its finances. Firstly, we demand that Pemex's budgets are balanced and that the NOC does not incur indebtedness. Secondly we have the power to place limits on the company's personnel costs." On top of that, labor liabilities are also being taken out of Pemex's balance sheet and being absorbed by the federal government as public debt, thus slimming down Pemex's financial condition.

Within Pemex, however, the mood would not seem to be quite so rosy. According to Fluvio Ruiz, an Independent Director on Pemex's board, the company risks finding itself "trapped in a no-man's land where it doesn't enjoy the privileges of being an autonomous actor, but still has all of the responsibilities of being a public organization attached to the state." "I simply don't believe that the fiscal reforms go far enough in liberating Pemex from its tax burden," he continues. "Pemex is part of a fiscal regime that renders it the second most profitable oil company pre-tax and the 86th after taxes. That alone demonstrates how disproportionately burdened Pemex is." Even more concerning, he points out the state can force Pemex to undertake projects of high social impact. "That is in effect a euphemism for projects that nobody else wants to do because they are not economically viable. There is no problem with Pemex taking on this sort of assignment if it is a public monopoly, but if you are competing at the same time as having to do this, then you are going to find it very damaging to your market position."

Preparing to Compete

In order to prepare itself for the challenges ahead, Pemex has been undergoing an internal restructuring every bit as radical as the reform itself. For Pemex Exploration and Production (PEP), the main task has been to define what reserves it needs to create a sustainable production environment for the medium- and long-term while simultaneously leaving enough space for the industry to develop and monetize reserves to the benefit of the nation. "Round zero represents, without doubt, one of the most important decisions in the entire lifespan of Pemex and marks the first step towards transforming our way of thinking," remarks PEP's Director General, Gustavo Hernandez. "As we have never before needed to fight for acreage, this involves a paradigm shift in mind-set."

PEP's other core priority has been to anticipate a possible flight of human capital. "Pemex is aware that its recruitment efforts have to be firmly focused on sourcing and retaining PEP personnel because there is going to be a high-risk of losing geoscientists, reservoir engineers, geophysicists and geologists who will be in great demand by the incoming multinationals requiring local talent. We are already restructuring our pay-scales to bring them in line with international market going-rates to counter any flight tendency," reveals Hernandez.

A further area in which Pemex has been making significant headway has been in the centralization of its procurement functions.

This was a pressing issue because, as Chief Procurement Officer Arturo Henriquez candidly explains, "Having an unsynchronized and fragmented process where decision making was scattered across 120 purchasing offices spread over the five different companies that make up Pemex failed to leverage the purchasing power of a USD 25-30 billion annual spend. What's more it was actually inherently wasteful with, in some cases, identical equipment being purchased at wildly different prices." Henriquez has been dismantling what he calls the 'big spider's web' of disconnected interactions and replacing it with the 'big door', a single outward face with which to engage suppliers. "In short, we will end up with a much simplified process that will be fair, efficient and will crucially not scare off potential suppliers and contractors," he declares.

One figure who firmly agrees that Pemex has to be much more strategic in its sourcing of technologies is Vinicio Suro, Director General of the Instituto Mexicano del Petróleo (IMP). "Pemex needs to be much smarter in its technology management. The issue is not about a lack of access to advanced technology, because Houston is a vast supermarket of technologies, but rather a lack of understanding as to which device or solution is best suited to fixing a specific problem. Developing the capacity to make smart choices must be a priority for the NOC," he asserts.

Investment Destination

Bruno Portilla, the General Manager of London Offshore Consultants Group (LOC), a well-established British success story in Mexico, offers some insight into why Mexican oil and gas is of increasing interest to outside investors and participants. "Underwriters don't regard Mexico as a special case any more because the country is becoming ever more closely aligned with international norms and standards. Foreign firms used to have to put up with irregularities such as the use of substandard offshore supply vessels, but Pemex has put a lot of pressure on its contractors to improve these sorts of anomalies," he remarks.

Others concur. As far back as 2011, Shell considered Mexican supply chains to be of such caliber and added-value that the company opted for Mexico as a location for one of its four global sourcing offices. "The office has been a huge success. Don't underestimate the way in which Pemex has contributed to driving up the quality of Mexican contractors over its 75-year history of working with in-country suppliers by subjecting them to rigorous standards and discipline," recommends Shell Mexico's GM Alberto de La Fuente.

For certain types of firm there are also additional advantages to be accrued. "Mexico's culturally diverse make-up renders the country receptive to the sorts of innovative and novel concepts that we have been endeavoring to introduce into the petroleum sector," explains the Venezuelan President of R2M, Hernando Gomez De La Vega. "The polyglot nature of Mexican culture means Mexicans are well used to embracing new ideas and ways of thinking. The country's energy sector has thus been strategically useful for using as a test-bed to pioneer new ways of how to conceptualize risk, reliability and uncertainty in the oil and gas production process."

That is not to imply, however, that market entry is especially easy, as demonstrated by the experience of LOC Group. "LOC's success today is partly attributable to having done the right preparatory groundwork prior to market entry. We actually made the decision to enter Mexico as long ago as 2000, but it took a full four years to build effective contact networks, to identify a suitable local team that could be relied upon to establish the office, to get a grip on the dynamics of the local market, and to source appropriate technical experts to drive the business forward," admits Portilla.

Newcomers may, however, be impressed by the many similarities to conditions in their home markets. They should, for example, have little trouble in identifying the types of sophisticated partners that they are used to dealing with elsewhere round the world that comprise all that is required for a reliable, tailor-made joint venture. One such company is Quimica Apollo. "The most intelligent entry strategy for such firms will be to associate with a Mexican company that knows how to handle the local market. We are actively looking to partner with high-technology companies that can assist us, Pemex and private E&P players in extracting oil at the lowest possible cost per barrel. Rather than reinventing the wheel, the idea will be to blend their proven expertise with our local know-how to achieve tangible results for the clients," explains Apollo's Constantino Gallanis.

Predicted Upturn for the Geo-seismic Segment

Some management consultancies such as AT Kearney and Deloitte have been predicting that firms offering geophysics and geo-seismic services could turn out to be some of the big beneficiaries of the Mexican energy reform despite slow order books for the industry in recent months. As the Country Manager of Petroleum Geo-Services (PGS), David Pring explains, "Because geophysics providers are so far out on the leading edge of the exploration cycle, any slowdown will ordinarily hit us before it strikes anyone else. The fact that bidding is currently on hold, as the reform takes effect, has been detrimental to business in the short term, but once we have traversed this period of uncertainty, we do forecast a lot of light at the end of the tunnel."

Central to this positive outlook is the idea that, with the liberalization of the market, there will be an increased appetite for introducing the latest geophysical technology into Mexican waters. "Despite Pemex's emphasis on the integration of new technology, the current contractual framework that Mexico possesses has inhibited the scope for companies to valorize latest generation seismic survey tools," observes CGG's Geomarket Director, Dominique Gehant. "If we draw parallels with the Northern zone of the Gulf of Mexico, we can definitely foresee the extensive use of high tech products over here too," he adds.

PGS is keen that this should happen, given the widespread successful use of its patented Geostreamer technology for multi-client surveys in the US portion of the Gulf of Mexico. "There is a whole world of new generation geophysical data is out there waiting to be shot," remarks Pring. "Whereas first round bids will likely rely on the existing data, by the time the second round occurs, there will be a significant demand to redo many of the studies deploying GeoStreamer type data collection. New entrants will require this information before being able to commit resources and that should open the door to us collaborating directly with SENER and CNH to perform multi-client surveys," he predicts.

The other big benefit will be the renewed demand for geophysical surveys in the soon-to-be-developed deepwater plays. "Up until now, due to a distinct lack of deepwater activity in Mexico, we had to be creative in applying our offshore geophysical mapping expertise to the onshore arena. The reform, however heralds new opportunities and we are excited by the imminent prospect of finally being able to apply our globally established expertise in deep-water geotechnical services to the Mexican market." remarks the Managing Director at C&C Technologies, Jose Aguilar.

Balancing the Regions

One positive outcome of the reform should be to unlock the energy potential of hitherto under-developed regions. Pemex's leadership has made no secret about the fact that it seeks to convert Tamaulipas into an energy development similar to Ciudad del Carmen in Campeche, from which the largest number of barrels are extracted nationwide. The NOC's 2014-2018 project plan reflects this containing a USD 4.98 billion exploratory scheme aimed at discovery of new deepwater fields in Perdido Area, and initiatives to transform the state's ports of Matamoros and Altamira into some of the most economically important contributor cities in Mexico. A further USD 3.91 billion exploration program aimed to increase gas reserves is also be executed across a combined area comprising the states of Tamaulipas, Nuevo Leon and Coahuila.

Bruno Portilla, General Manager of LOC Group, whose in-country headquarters are based in the city of Tampico (in Tamaulipas), agrees that the state is well on the way to becoming an important energy hub both because of "its proximity to the soon-to-be open deepwater plays" and because "it happens to be where many of the fabrication yards are concentrated for the building of rigs and offshore supply vessels." He points out one obvious drawback that risks putting a break on development: "Many of the other international companies based in Tampico have to pay substantial risk premiums to their foreign personnel because of the region's reputation for violent crime and this adds considerably to their overheads," he explains.

Others see the lack of existing infrastructure as another hurdle that could constrain Tamaulipas' potential. "Geo Estratos' own bet is that Mérida, Yucatán, will one day be known as the 'Mexican Houston' because of its strategic connections to both the Gulf of Mexico and the Caribbean, which means to both North and South America. While Tamaulipas certainly holds a lot of potential, it could take a few years to reach the level of Campeche because of the amount of infrastructure that needs to be installed. By then, we hope to already have become a large company in Mérida," asserts the compay's founder, Vicente González Dávila.

However, becoming an oil and gas hub doesn't guarantee itself prosperity. Norwegian Ambassador Merethe Nergaard recounts how she was "struck by how underdeveloped the oil producing states of Campeche and Tabasco are," and urges the Mexican government to learn from the Norwegian example of Stavanger where the "proceeds of oil and gas wealth are reinvested back into society and hydrocarbon revenues equitably shared." Sergio Beristain echoes this sentiment. "Mexico has in excess of 40 million people in poverty and it is vitally important that the new reforms create the conditions under which the wealth from the energy sector can be more evenly distributed, because currently many of the oil and gas towns that play an influential role in servicing the sector, reap few of the rewards with the profits flowing straight to DF or abroad."

DECIPHERING THE SECONDARY LEGISLATION

Summary of the main points

New Laws

Cornerstone statutes comprise a new "Hydrocarbons Law" and "Hydrocarbons Revenue Tax Law." Together, these two bills will establish the overall framework by which the exploitation of hydrocarbons may be performed. As widely predicted, the bills set in motion all the conditions for an exploration and production contract regime that allows for the full spectrum of licenses, profit sharing and production sharing agreements, crucially permitting private investors to book reserves with the proviso that the state retains sole ownership over the subsoil resource.

Fiscal Pact

One of the more eye-catching elements of the package is the announcement that Pemex's fiscal burden will be reduced from 79 percent to 65 percent within a decade. So that the Mexican state can continue to carry out its essential obligations with respect to public investment, health, and education, the deficit instead must be made up by correspondingly higher contributions from private sector oil and gas. The government take of private sector profits for upstream contracts will come from both a tax and a royalty structure and the tax take will be over and above the standard 30 percent corporate tax applicable to all Mexican corporate activity.

Local Content

In an effort to generate burgeoning cluster industries and counteract widespread fears of energy windfall profits being repatriated abroad, the governing PRI has committed to ensuring 30 percent "national content" in energy projects by 2025. Specific national content requirements will vary according to a flexible, sliding scale system.

Green Growth

One item conspicuous by its absence in initial iterations of the package has been a distinct lack of mention of renewables and green energy. Instead the reforms concentrate heavily on gas, perhaps reflecting Mexico's transitional positioning as the country undertakes the long journey from fossil fuels to renewables via cleaner energies such as natural gas.

Community Engagement

There had been hopes for the inclusion of formal guidelines for dealing with the community aspects of energy infrastructure and power projects, but these failed to materialize. The idea of Peruvian or Colombian style regulations to enable local communities to share in the profits had been mooted. Related changes that Congressional lawmakers did manage to steer through, however, include guaranteed compensation for Mexico's rural landowner groups, or 'ejidos,' when extraction takes place on their property.

Rise of the Regulatory State

Having endured a difficult and much criticized reform of the telecoms sector, in which regulation was considered too late and ineffectual, Mexican lawmakers have been especially keen to build a strong regulatory apparatus underpinning the soon-to-be-liberalized upstream oil and gas sector. In particular, much care has been taken to lock in checks and balances, thus ensuring that no single agency has complete control over the award of E&P contracts.

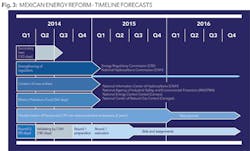

What was historically Pemex's responsibility will, from now on, be shared across a core triumvirate of power bases. The Energy Ministry (SENER) is charged with providing the scientific and technical guidelines, the Finance Ministry (SHCP) tasked with establishing award variables and the economic terms of tenders, and the hydrocarbon regulator (CNH) entrusted with the contract processing and supervision functions. Meanwhile, completely new institutions formed from scratch, such as the National Agency for Industrial Security and Environmental Protection (SEMARNAT), will also shoulder lesser regulatory functions.

DECODING ROUND ZERO

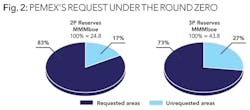

Pemex complied with its March Round Zero deadline, requesting to retain 100 percent of its current proven (1P) reserves, 83 percent of its current proven and probable (2P) reserves and 73 percent of its proven, probable and possible (3P) reserves. This equates to roughly 31 percent of the country's overall prospective hydrocarbon resources and accounts for 93 percent of onshore conventional resources, 59 percent of shallow-water resources, 29 percent of deepwater resources and 15 percent of unconventional resources.

Next Steps:

SENER has until 17 September to determine which fields Pemex can retain in the first round of non-competitive bidding, however, officials have indicated that approvals may be granted on a rolling basis leading up to that date. Once awarded assets, Pemex will generally have a three-year period, subject to a potential two-year extension, to achieve commercial discovery. The NOC will also be permitted to compete in any of the successive competitive bidding rounds for any assets not awarded at this time.

Expert Analysis:

Gustavo Hernandez (Director General of Pemex E&P): "There is robust logic behind everything that we have requested. The rationale is to maintain sufficient producing fields to sustain current output levels while holding on to strategic exploratory prospects to ensure future organic growth. Firstly, we seek to keep core assets that are at an advanced development stage and where Pemex has implemented effective exploitation strategies such as Cantarell and Ku-Maloob-Zap. Secondly, we are requesting some of the deep-water fields in the north and south belts where there have been important discoveries. Thirdly, we seek to maintain a proper foothold in unconventional areas which will be vital for securing Pemex's long-term future. Fourthly, we expect to retain assets where we have already established partnerships with private sector entities such as in Chicontepec and Burgos. Finally, there are areas in the Perdido Fold Belt that we hope to be able to farm-out because we possess the knowledge, the expertise and have already shouldered a portion of the exploratory risk."

Lourdes Melgar (Undersecretary for Hydrocarbons, SENER): "We have to strike a balance between what Pemex retains and what the nation keeps to tender to new participants. It is crucially important that we make smart decisions for Round Zero and ensure that Pemex gets what it needs to be able to sustain production around the 2.5 million barrels per day mark. In the short term, that is the target, though we feel that Pemex will ultimately be productive enough to surpass this figure in the future. We want a strong Pemex. A vision that aims to shrink Pemex would be very negative and is not an option."

Edgar Rangel (Commissioner, CNH): "Round Zero is not about taking away assets from Pemex. The assets have always belonged to the state. It is about awarding the right volume and category of reserves that Pemex can reasonably put into production given its expertise and capabilities. CNH's role is to advise SENER on Pemex's allocation from scientific standpoint by objectively calculating the NOC's technical and financial capabilities for each type of field. My forecast is Pemex will be allowed to keep its shallow water acreage where the company has shown consistent results over decades of development, but that the request for 50 percent of the Perdido fold area is less likely to be granted because, though they may possess the know-how and hardware to develop the area, their execution capability in the sense of how long it will take them to drill a well and bring it on stream is going to be much below par what the private sector can offer".

MARKET ENTRY STRATEGIES

Expert local advice on how best to enter the Mexican oil & gas sector

"Resist the temptation to align just with the people who claim to have all the contacts. The people who 'know how' are more important than the people who 'know who'. This is because a new market is being created with new people. There can be no dress rehearsals this time."

- Eduardo Núñez, Founder & Managing Partner Núñez Rodríguez Abogados.

"Firstly, consider strengthening your anti-corruption policies and practices. Secondly, ask yourself whether you have the necessary expertise and talent, because the Mexican market needs your talent as much as your investment, possibly even more. Thirdly, make sure you are here for the long haul. It's not a good idea to do short-term thinking in this country."

- Vicente González Dávila, founder of Geo Estratos.

"You can import the best product, but if you do not know how to customize it to the culture you cannot hope to be successful. You will initially require proper advice from local counsel and presumably a decent indigenous partner that can be your eyes and ears throughout the entire initial stage of your market entry"

- Juan Carlos Machorro, managing partner at Santamarina y Steta.

"Consider the 19th century gold rushes. Those who actually did the most lucrative business were not the gold diggers themselves, but the people servicing the booming gold mining industry. In just the same way, I have identified that the true profits are to be found in supplying the industry that has grown up around Pemex rather than dealing directly with the NOC itself."

- José Aguilar, managing director of C&C Technologies.

"Get your skates on! British firms such as Petrofac and Grupo Sentry have demonstrated that it is a case of the 'early bird catching the worm' with the first movers reaping the greatest rewards."

- Stephen Smith, president of BritCham.

INDUSTRY SPOTLIGHT

Offshore Energy Sector Logistics and Transportation

Q&A with Rudolf Hess, President and CEO of RH Shipping

What role do firms like yours play in servicing the Mexican offshore energy sector?

Rudolf Hess: RH Shipping enjoys the distinction of having transported the largest single shipment of dismantled LPG spheres. That particular project was for a French company called Zeta Gas and entailed deploying a multipurpose cargo vessel to ship 18,000m3 of spheres all the way from Dunkirk to their gas terminal in Ensenada on the west coast of Mexico. We are also slowly but surely establishing a solid track record in transporting land-based oil rigs from the US to Mexico on a port-to-door basis.

Where do you foresee the growth spots for your industry segment?

Rudolf Hess: New market entrants will be requiring logistics and transport services for their rigs and industrial equipment. Ship brokerages able to identify the ship-owners that have the most appropriate vessels for a project, whether that involves semi-submersibles, pulling tugs or other forms of technology, are going to be much in demand. The ship chartering segment could also experience an upturn. Pemex may well be investing in its own fleet of tanker vessels, but the NOC will always be more competitive chartering from an operator than by operating and maintaining vessels themselves.

What transformative changes are occurring within offshore logistics and supply?

Rudolf Hess: Historically Pemex has hired charter services well below the worldwide average standard. A common joke that used to do the rounds in Houston was that 'Mexico represented the junkyard of the Texan backyard.' Vessels that couldn't get classified anymore were sent to the Mexican market because they could still return a minor profit due to depreciated labour costs and less stringent HSE standards. The liberalizing reforms are dramatically changing all of this by exposing incumbent firms to competition and aligning the Mexican energy market with global standards and benchmarks.