Algeria: Great potential waiting to be explored

Historically one of the world's top gas producers and exporters, Algeria hopes to adapt to the shale gas revolution

BY FOCUS REPORTS - EXCLUSIVE TO OGFJ

EDITOR'S NOTE: Focus Reports recently interviewed The Honorable Youcef Yousfi, Energy Minister of the North African nation of Algeria, exclusively for Oil & Gas Financial Journal. The interview took place in Algiers this past July.

OIL & GAS FINANCIAL JOURNAL: Following last April's election, President Abdelaziz Bouteflika reappointed you as the Minister for Energy. Does this suggest that there will be continuity in energy policy, or are we likely to see dramatic changes?

YOUCEF YOUSFI: I am honored by the confidence the President of the Republic has shown in reassigning me to the energy portfolio. The guiding principles of our energy policy remain valid today. There is a need to considerably expand the nation's hydrocarbon reserves to meet long-term demand, to diversify our energy resources and markets, and to finance the economic development of the country and accelerate industrialization. Those are the fundamental precepts on which national energy policy has been based, and we very much intend to stick to that path.

OGFJ: Investment in Algeria's hydrocarbons sector faces multiple challenges. Last year's terrorist attack on the Tiguentourine gas facility near In Amenas has been a blow to the country's security reputation and is likely to have damaged investor confidence. Could you perhaps comment on that?

YOUSFI: All through the 1990s, there was never any interruption in the production and export of hydrocarbons despite the numerous terrorist incidents that occurred. The terrorist attack at In Amenas was brutal. It was akin to an act of war, given the scale of weaponry deployed. The incident took us all by surprise, but the army responded firmly and we have subsequently put in place very strong security measures. For instance, the army and the security services have reinforced their presence along all the borders so as to prevent any flow of armaments or terrorists into the country.

We have also been securing all industrial installations across the country and our partners are today reassured by the measures in effect. The proof of this is that expatriates have returned to the Tiguentourine facility. The situation is now fully under control and we will continue to watch over both our industrial sites and the country as a whole.

OGFJ: Another issue of interest to the investment community has been the several setbacks and changes to the hydrocarbons and investment laws. Would you please elaborate on those?

YOUSFI: Every country has its own legislation that must be adapted to the context. We have not made that many changes to ours. In 1986, we set about some fundamental reforms to the hydrocarbons law, which were fully complete by 1991. Then a new law was passed in 2005, which is the one that we have just reviewed because the world around us has been changing. The evolution of the global energy landscape has been the main driver to modifying and adapting our legislation. Our goal is to establish partnerships and render the Algerian hydrocarbon sector more attractive to external investment.

OGFJ: What would you say are the hallmarks of these current reforms?

YOUSFI: The main changes relate to introducing the concepts of conventional and unconventional hydrocarbons, and putting in place tax incentives. Our hydrocarbon resources are certainly very important. We possess 1.5 million km² of sedimentary basins with abundant potential hydrocarbon reservoirs. Some are greenfield sites while others have complex geologies without even counting the offshore opportunities. This is why it is essential to have an attractive tax regime especially suited to regions that are difficult to access and where there is a lack of processing or transport infrastructure.

For unconventional hydrocarbons, we have a special tax regime that is suited to each specific situation. We have also created incentives for the production of existing fields that require costly recovery methods to extract the hydrocarbons.

A further notable change relates to taxation. If taxes were previously calculated on the basis of the turnover of a company, now the calculation will be determined in accordance with the profitability of projects. We have introduced the concept of return on investment, which can be applied to small fields where investments are more risky.

OGFJ: Will the requirement to partner with Sonatrach (an Algerian government-owned energy company) for every project remain in force?

YOUSFI: That has never changed. Nor have our partners ever raised that issue as a problem. It is something that is accepted and something that most countries do. It has never been a constraint on business. We are in the process of launching a tender for 31 blocks, and from what I've seen there are many companies that are interested. Currently, prospective partners and the agency, ALNAFT, are in the final stages of negotiations and the process should be complete by October.

OGFJ: As you have yourself pointed out, the need to increase national hydrocarbon reserves is a core strategic pillar of the government's energy strategy. What steps are you taking to realize this objective?

YOUSFI: Our aim is to broaden the reserve base and prioritize exploration. This is why we are investing between 15 and 20 billion dollars a year in the hydrocarbon sector of which around 3 billion dollars are directed towards exploration activities.

In 2013, we invested 2.5 billion dollars in discoveries that brought up more than 3 billion barrels of oil equivalent. That year was a record year because we also discovered a lot of hydrocarbons beneath existing fields. Our investments paid off, and we want to continue at the same pace.

OGFJ: What other principles govern your oil and gas production policies? What role, for instance, should technology play?

YOUSFI: Our production policies obey the rules. We take into account the energy needs of the nation, but at the same time adhere to our international commitments, including those with OPEC for oil and our long-term agreements on gas production. We are currently developing a dozen fields and should be able to double our production by 2020 after which we intend to sustain production at that level .We may even exceed that target thanks to our non-conventional hydrocarbons, but that will very much depend on our ability to operate within a reasonable cost structure.

There is both a technological and an economic challenge. Sonatrach has already a lot of experience in this regard. We possess outstanding technicians, the know-how and will continue to focus our effort towards training and attracting technology service companies. We don't just aim to attract partners in upstream E&P, but also service providers. We've already done a remarkable job in this regard and the technology service providers that are working in our country have done a remarkable job, but we want to attract new entities. Another of our priorities is the manufacturing of equipment for the oil and gas industry.

OGFJ: Operationally, how are you planning to develop non-conventional resources? Will Sonatrach do it alone or in partnership? And what role could American companies potentially play?

YOUSFI: Algeria's potential for unconventional hydrocarbons, especially gas, is immense given the extent of our territory and the wealth of our source rocks. We are carrying out pilot projects to learn about this with input from our partners. We are actually in the process of sending technicians to the US for training in latest generation technologies and are looking to attract new partners. Our goal is to reduce costs and meet strict environmental standards by saving as much water as possible when carrying out hydraulic fracturing.

We are very attentive to all the latest technological innovations. Some alternative technologies such as the use of propane when fracturing may prove interesting. Sonatrach is already employing this technique in certain instances. If we are going to reduce costs we need to have a very well-oiled logistics function, and this is another area where we are focusing our energies. Naturally, American companies that are recognized for their know-how and expertise in exploiting non-conventional resources will be very welcome. Sonatrach is already in discussions with a number of such firms.

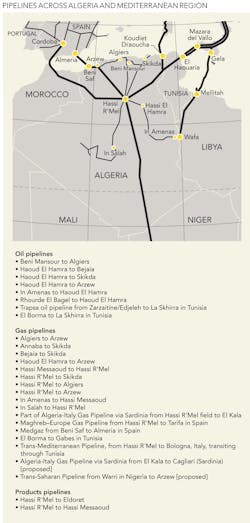

OGFJ: Algeria has historically been a leading nation in gas production, export and know-how. Not only was Algeria the first LNG exporter in the world, but the gas infrastructure includes underwater pipelines that link up with the Italian and Spanish energy networks. How would you describe the country's gas strategy today?

YOUSFI: Our gas policy is aligned with everything else. For upstream we want to expand our reserves and double our production and exports. Algeria enjoys a number of advantages: existing transportation and liquefaction infrastructure and intercontinental underwater pipelines that link Africa with Europe. As far as human resources are concerned, we already have good technicians and are well versed in the geological formations of our country. We also have competent companies - Sonatrach and its subsidiaries boast outstanding experience and have been excellent partners. Finally we have a proven track record in commercialization having successfully marketed our natural gas in all sorts of areas from the US to Europe to Asia. What we do need to do, however, is to diversify our markets in order to adapt to the shale gas revolution in the Americas and to the forthcoming entrance of new players.

OGFJ: Is there any likelihood of changes to the exported gas commercialization policy in which Sonatrach holds monopoly status?

YOUSFI: Regarding gas marketing - this is a discussion that our partners will have with Sonatrach. I believe that we are flexible. Sonatrach's partners are used to having these sorts of discussions and I am sure we will have options that are mutually beneficial to all parties.

OGFJ: Dramatic changes are happening across the global energy landscape. As a seasoned politician and expert in energy policy, what would you say are the most important energy issues globally?

YOUSFI: Aside from the arrival of new players, the development of new technologies is paving the way for the greatest revolution of the past 20 years. The US is poised to become a major player on the world energy scene as a producer and exporter of oil and has made a remarkable technological leap that has made it possible to exploit unconventional resources at reasonable costs. This revolution will not go away, but will evolve in two directions: firstly by reducing the cost of producing shale reserves, and by increasing the recovery rate of existing deposits. On the second point, some countries have made remarkable progress.

OGFJ: If technology and the new oil and gas frontiers are increasingly the name of the game, does this not mean that an institution like OPEC risks being obsolete?

YOUSFI: Three quarters of the world's oil reserves still rest within OPEC. The organization will continue its role of stabilizing the markets and will continue to play an important role in the future energy landscape. Moreover, investments in technologies for the development of fields, LNG, pipelines, and shipping are excessively onerous. It would therefore be a mistake to challenge the contractual balance between exporters and importers. This is a balance that has historically allowed natural gas to expand. I recall, for example, the great role played by natural gas across the world energy scene over the last fifty years. This was achieved primarily because there is equilibrium between producing and consuming countries' interests and it would be problematic if that equilibrium is broken. Such a scenario could pose problems for future supply contracts.

OGFJ: Energy producing and exporting countries are always at the center of the energy debate, however we rarely speak about the responsibility of energy consuming countries to maintain a fair balance. Do you believe that this should be taken into consideration?

YOUSFI: Greater awareness is certainly needed, particularly in the consuming countries. For example, European countries are likely to try both to secure their long-term supply and aim to reduce the price. It is difficult to have both simultaneously. There must always be a balance of interests between the exporters and importers. Otherwise there is a risk of tensions being created.

OGFJ: Algeria is a well-experienced, energy-producing nation, and opportunities are abundant. What would you like energy companies to bear in mind while selecting their next oil and gas investments?

YOUSFI: Algeria has great potential that is still waiting to be explored. Our country enjoys a long history of partnering with companies worldwide, including American companies. It is a country that is characterized by its stability, security, and the quality of its human resource base. We want to expand our partnerships, not only in exploration and production, but also in the downstream segments, in refining, in chemistry, in the manufacture of equipment, and in oilfield services. We are an open country. We have the infrastructure, and moreover, we are at the door of Europe, which represents a huge market for hydrocarbons.

OGFJ: Thank you very much, Minister Yousfi.

Energy facts about Algeria

- Algeria is the leading natural gas producer in Africa and the second-largest natural gas supplier to Europe. It is also among the top three African oil producers.

- Algeria's national oil and natural gas company, Sonatrach, owns about 80% of all hydrocarbon production in that country.

- Algeria has the third-largest amount of proved crude oil reserves in Africa, all of which are located onshore. There has been limited offshore exploration. About two-thirds of Algerian territory remains largest unexplored or underexplored.

- The country produced nearly 1.8 million bbl/d of total petroleum and other liquids in 2013, including crude oil, condensate, natural gas plant liquids, and refinery processing gain.

- The largest and oldest oil field, Hassi Messaoud, averaged 1.2 million bbl/d in 2013, more than 40% of total crude oil production.

- About 72% of Algerian crude oil exports are sent to Europe. The US was the single largest destination until 2013 when exports fell to 29,000 bbl/d, or by more than 75% compared with 2012.

- Most of Algeria's domestic petroleum consumption derives from domestically refined products. The country's consumption rate has increased about 5% annually over the past decade.

- Algeria's gross natural gas production was 6.4 tcf in 2012, a 4% decline from the previous year. Production has steadily declined over the past decade as output from the country's large, mature fields is being depleted.

- Algeria holds the world's tenth-largest amount of proved natural gas reserves and the third-largest technically recoverable shale gas resources. The government announced it would begin developing its shale resources in May of this year.

- Algeria exports natural gas via pipelines and on tankers in the form of LNG. It has three transcontinental export gas pipelines: two transport natural gas to Spain and one to Italy. Algeria's LNG plants are located in the coastal cities of Arzew and Skikda. Algeria was the first country in the world to export LNG in 1964.