Pricing effectiveness

The fastest way to grow your revenue, profit, and market cap

PRADEEP ANAND, SEETA RESOURCES LLC, HOUSTON

He was very pleased with himself.

"I get a gross margin of almost 50% for a service and that's fantastic," he exclaimed.

Seeing no reaction from me, he asked "Isn't it?"

"No, it wasn't fantastic," I should have said but I remained silent.

This firm's CEO was inextricably trapped in the common fallacy of looking inwards, at costs, for justifying a price.

However, before I could debate with him that customers pay for value and choose a competitive alternative, he hit me with another pricing objective.

"We need to increase prices for 'other services' that aren't meeting these gross margin goals."

Same fallacy, but from a different direction.

In reality, a majority of customers' buyers, who controlled budgets, in this 'other services' segment did not see value in these 'other services' as a category. The minority that did buy these services did not see incremental competitive value in this firm's 'other services.'

Ironically, the CEO was pushing for price increases in difficult markets and ignoring segments where the ability to generate higher margins was potentially easier.

And then there was this case, where I received an email from a prospect who said, "...our firm needs to right size costs vis-à-vis manufacturing optimization before it works on pricing. We have a number of key products that are making excellent inroads, but one in particular is having issues. These issues are directly related to costing and need to be dealt with internally."

To which I replied, "I would like you to do small exercise: If the firm experienced an average price increase of 1%, what would the $ impact on operating income be? Additionally, how much reduction in COGS will be needed to accomplish the same results in $? The answers may change priorities."

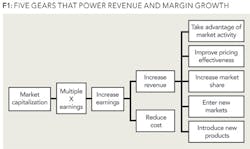

All business leaders want to maximize their profits and market capitalization and as Figure 1 shows, five gears that rev up earnings growth through higher, quality revenues.

These five avenues are:

- Take advantage of market activity. Take full advantage of a rising tide; get the wind in your sail.

- Improve pricing effectiveness. Astute pricing for maximizing margins.

- Increase market share. Get a greater margin share in the market.

- Enter new markets. Take existing products and services to adjacent and new markets.

- Introduce new products. Introduce new products to existing markets.

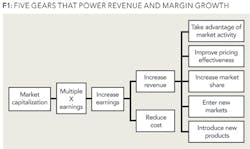

Among all these gears that can power revenue and margin growth, a focus on improving pricing effectiveness has the highest potential to deliver immediate results, including improvement in market capitalization (Figure 2).

According to a McKinsey & Company study, at an average S&P 1500 company, a 1% increase in price is 8% increase in operating profit; 50% better than a 1% drop in variable costs; and 300% better than a 1% increase in volume. Moreover, operational and other cost controls have limits in improving profitability.

Additionally, pricing management plays a very crucial role in new products and services.

Good management of initial pricing can result in increased revenues and profitability for the firm as well as the industry, during a product's entire lifecycle.

In the business-to-business world, all decision makers for developing and implementing pricing strategies and tactics for a product and service are within a firm.

Additionally, the process to determine prices is simple. The focus is on competitive value, where only two variables influence smart pricing decisions: price on value and what the market can bear.

BARRIERS TO PRICING EFFECTIVENESS

Several obstacles prevent firms from addressing pricing in a systematic manner. Some of the barriers to pricing effectiveness are:

- Innumeracy: Numerical illiteracy of the work force, especially those that deal with customers and currencies. Arithmetic is often not a required test for employing folks that deal with customers and are integral to pricing practices and implementation.

- Psychology: Buyers (and sellers) often use an "anchor", the price against which other deals are measured, to create a price for the transaction. Customer suggested anchors, previous contracts, and internal cost structures act like seductive sirens (from Greek mythology) that lure unsuspecting sailors to shipwreck on the rocky coast of their pricing island. The only rational and ethical way to not get trapped by these anchors is to tie oneself to the mast of value.

- Expertise: Effective pricing requires best-of-class knowledge of the firm's technology and solutions, customer/consumer Behavior, competition, economics, negotiation, and finance. All these skills are rarely available in a single individual. However, a group of best-of-class individuals can be coalesced into a competition-beating pricing team.

- Incentives: Sales commissions on revenues make sense when people sell from a fixed price schedule, with different commission bands for different profit bands; variation from fixed prices requires management approval. However, when sales people have considerable latitude in defining the price, a margin-based commission schedule is desirable. In the latter situation, a sales incentive program that is based solely on revenue will not deliver optimum margins

- Competition: Limited understanding of competitive products and positions in the market leads to poor pricing and poor market margin share. Additionally, limited understanding of competitive responses to pricing moves also has similar effects.

- Customers: A common symptom of poor pricing is employees' limited comprehension of their firm's solutions' "Competitive Monetary Value" to targeted customers. This should be expressed in real money; currencies, not pictures in PowerPoint slides accompanied by arm-waving.

- Negotiation Skills: Buyers in many industries are trained and practiced in negotiation. Suppliers' frontlines have inadequate, if not poor training and support in negotiation. They may lack negotiation ammunition in the form of competitive value.

- Focus: Good pricing is not an accident. It takes a firm-wide focus on a process, multi-disciplinary team effort, discipline and practice to create and sustain it.

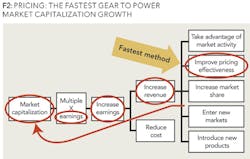

These barriers and limitations create profits leaks (Figure 3) that hemorrhage a company and an entire industry.

IDEAL COMPETITIVE SELLING PRICE

At a minimum, a firm should comprehend the Ideal Competitive Selling Price (ICSP) for its product or service under consideration. Every customer-facing person needs to know how much pricing headroom the product has compared to its competitive alternatives. It is important to answer the question, "How high is high?"

Determining the ICSP for a product or service is not complicated. It is built on a simple process, drawing upon the knowledge and perspectives of a multi-disciplinary team, working with some underlying principles.

The first principle is that pricing is and has always been a function of alternatives. Rational buyers, such as corporations buying centers, are trained to make rational decisions. These buying centers give as much attention to their sellers' costs as any consumer would to the cost of any product that s/he may be consuming. (When was the last time you wondered how much that cup of coffee you drank cost?)

As Figure 4 depicts, the selling price is in a pricing sweet spot that meets criteria such as:

- What does a customer value?

- What is the price of a competitive alternative?

- Would the firm make a reasonable profit at this price? The answer is irrelevant to the customer but relevant to company stakeholders.

The second principle is based on a simple equation: Value=Benefits-Cost.

Algebraic principles state that units on the left-hand-side of the equation should be the same as the units on the right-hand-side. If Cost is expressed in US Dollars (US$) or any other currency, it is imperative that Value and Benefits to be expressed in US$.

Benefits can be easily expressed in US$. In industrial markets, most delivered benefits can be boiled down to cost reductions and/or margin increases for customers. It is erroneous to consider revenue increases because customers retain margins not revenue.

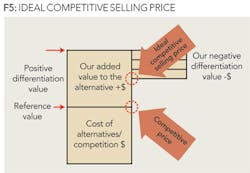

The third principle is that "Price on Value and What the Market Can Bear" can be translated monetarily into:

Ideal Competitive Selling Price (ICSP) = Competitive Price + Monetary Value of Incremental Benefits - Switching Costs.

This formula has a major benefit. All perceptions of value are pegged to competitive alternatives. This is vital in many situations, especially where sellers have erroneous perceptions of value; they can be higher or lower.

Also, it is not necessary to consider "absolute value" delivered to customers but rather incremental or relative value delivered to customers, compared to a competitor.

Figure 5 depicts the building blocks for determining ICSP.

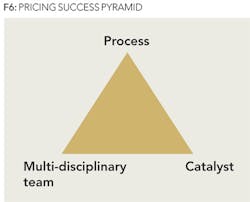

The fourth principle is that this effort requires a multi-disciplinary team, representing all aspects that contribute in the creation of customer value-Supply Chain, Engineering, Manufacturing, Finance, Service Delivery, Sales Management, and others.

Finally, the fifth principle is the one that assures success. Use a neutral, external resource to manage the process. This catalyst's responsibility would be to coalesce the team and execute the process of determining the ICSP and the subsequent steps (see Figure 6).

BENEFITS OF ICSP

Determining the ICSP is a simple, repeatable process that can be applied across a spectrum, from new products to very mature ones, across product lines and across global cultures.

The frontline of simple, mature products/services can learn the process in less than 24 hours and practice the process every day. The process takes longer for new products/services, where various kinds of information may not be readily available.

Customer-facing organizations can be easily trained in the details of the program with train-the-trainer programs.

The program provides negotiation ammunition to the sales organization. This has a multiplicative effect-it not only improves margins but also success rates, delivering substantial improvements in revenue and profits.

The process also allows cross-domain teams to discover feature gaps in their offerings, thereby providing direction to and priorities for product development. This is useful for improving the effectiveness of new product development and market introduction.

The process sharpens a firm's market intelligence focus by highlighting specific, critical competitive and customer areas that are crucial for determining the ideal competitive selling price.

This ICSP process is simple. It can be understood quickly and can be implemented swiftly for speedy results, rapid turnaround, and growth in revenues and profits.

The product-, customer-, and competition-related content that is generated from the process can be used to train customer-facing organizations for improving their short-and long-term success.

Finally, this program translates very well across cultures and industries. It has been used successfully in a variety of industries and in many countries, including with the use of interpreters:

- Industries: Oilfield Equipment, Oilfield Services, Iron & Steel, Construction Services, Power Plant Services, Petrochemicals, Industrial Equipment, and Software.

- Countries: USA, Germany, UK, Canada, France, Netherlands, Belgium, Czech Republic, and Poland.

CASE STUDIES

In mid-2009, when the global economy was in a severe recession, an oilfield equipment client and one of its distributors were having a pricing disagreement. The distributor claimed that the client's equipment was too expensive at $50,000 and that a 35% discount was needed to compete effectively in the market. A competitor was pricing their product at $30,000.

The client refused to comply, saying that its prices were justified. When asked to elaborate, the client used the "we have better quality" defense.

Both sides had opinions but not facts. They were brought together for a workshop, where the client's equipment's competitive premium could be determined. Fortunately, the distributor and the client had a common goal of extracting the maximum price from the customer.

On the designated day, both sides' teams amicably and harmoniously worked together. The workshop was based on some simple premises:

- Simply stating that the firm's products are better is not good enough. Being better implies that, compared to competition, incremental benefits are delivered to customers.

- These incremental benefits need to be converted into value that is monetized and expressed in a relevant, local currency.

- The firm's product would have deficiencies, whose monetary value should also be determined.

- The sum of the monetized values of incremental benefits and deficiencies would yield the product's premium.

- Adding this premium to the competitive price would yield the ideal competitive selling price.

The process was simple enough to be intuitively understood by the rank and file of both firms. In this instance, the client and its distributor agreed to use this process to adjudicate their differences.

The meeting ended well because both parties discovered that the client's product had a premium of $30,800 or almost 103% more than the competitive price. The distributor could sell the product at about $60,800 and still be equal in competitive value to the competition.

Another client was preparing to bid on a services contract. The general belief was that the firm commanded a 20% price premium because its services were of superior quality.

Competition was expected to bid at about €900,000. With an assumed 20% premium, the client would have bid €1,100,000 or €200,000 more than the competition.

However, after being guided in a workshop, the client discovered that the premium was actually about €740,000. The client commanded a pricing premium of 82%, substantially more than the 20% that was assumed.

The client bid and won the contract. By discovering the pricing premium, the client increased its revenues by more than 40%, which had a multiplicative impact on operating profit and EVA.

In a third situation, a client discovered that its services did not possess a pricing premium; its ideal competitive selling price was substantially lower than what was required to deliver expected operating profits.

In this case, the client abandoned pursuit of that contract and decided to focus its resources on markets where the firm's premium services were valued.

About the author

Pradeep Anand is president of Seeta Resources LLC. He has more than 30 years' experience in strategic marketing of industrial and technology products and services.