Shale deals drive strong US market, up 9% in Q3 as international M&A struggles

DAVID MICHAEL COHEN, PLS INC., HOUSTON

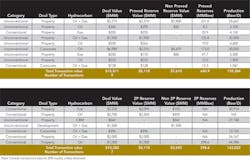

PLS reports that Q3 2014 global deal activity lost the gains made the previous quarter, dropping 32% to $39.2 billion from $57.6 billion in Q2. Canadian dealmaking fell 45% to $5.0 billion after running strong throughout H1, and international activity slumped 72% to $6.5 billion. However, US dealmaking jumped 9% to $27.7 billion, largely driven by two shale corporate takeovers, the $7.0 billion Encana/Athlon Permian deal in September (more on that below) and the $6.0 billion Whiting/Kodiak Bakken deal in July.

Moving forward, the transition from the third to the fourth quarter of 2014 (as the table below shows) was bookended by two of the biggest single-basin shale transactions in US history, each a record in its respective region. First came Encana's $7.0 billion acquisition of Permian pure-play Athlon Energy in late September. Then in mid-October, Southwestern Energy agreed to acquire Chesapeake's southern Marcellus and dry gas Utica position primarily in West Virginia for $5.4 billion. In all, the period from September 17 to October 16 saw 39 US upstream deals of which 25 had disclosed values totaling $16.5 billion-with these two deals accounting for 75% of that sum.

Both Encana and Southwestern are adding considerable running room to their portfolios. Encana will acquire a 140,000-net-acre leasehold in the heart of industry activity within the multi-pay Midland Basin, primarily in Midland, Martin, Howard and Glasscock Cos., Texas. The acreage has 5,875 vertical and 1,842 horizontal locations and includes proved reserves of 173 MMboe and production of 30,000 boepd (60% oil, 20% NGLs) from 1,121 vertical and 17 horizontal wells. The deal concludes a remarkable growth story for Athlon, founded just four years ago with backing from Apollo Global Management and going public in August 2013. It has grown its horizontal program from one rig at the IPO to three with a fourth on the way in Q4, which Encana plans to ramp to seven by the end of 2015 to boost production 67% to 50,000 boepd. As a result of this deal and its $3.1 billion Eagle Ford debut in May, Encana expects to achieve its strategic target of 75% operating cash flow from liquids by 2015, two years ahead of schedule.

As for Southwestern, it is getting a largely contiguous 413,000 net acres plus interests in 1,500 wells mainly in West Virginia, where 2014's previous top two Marcellus deals also took place: American Energy Partners' $1.3 billion acquisition from East Resources and Mountaineer Keystone Energy's $500 million purchase of PDC Energy and Lime Rock's JV assets. This hot area is also generating buzz for having some of the best results in the Utica, which in September alone included IP rates of 29.4 MMcfd for Gastar Exploration and 46.4 MMcfd for Magnum Hunter. Magnum subsequently released impressive Marcellus results there as well. Southwestern plans to aggressively ramp drilling from the current one to two rigs to four to six in 2015 and 11 by 2017. The company projects a 20-year inventory at that 11-rig pace will provide about one-third of provide reserves by YE17.

International activity during this period highlighted a renewed appetite for acquisitions among Asian NOCs. Indonesia's Pertamina agreed to buy a non-op 30% stake in Murphy Oil's Malaysian oil and gas business for $2.0 billion, reportedly beating a $1.5 billion joint bid by India's ONGC and Oil India Ltd. Like other US independents selling Asian assets in the past year, Murphy will use the proceeds to accelerate US onshore development, in this case within the Eagle Ford shale. Meanwhile, Statoil is selling its 15.5% stake in Azerbaijan's Shah Deniz gas field and associated South Caucasus Pipeline to Malaysia's Petronas for $2.25 billion. Finally, Rosneft reportedly struck a $1.0 billion deal to sell a 10% stake in Siberia's Vankor field to CNPC, highlighting closer energy ties between Russia and China in the face of Western sanctions.

In the other big international deal of the period, a Nigerian consortium led by oil trader Aiteo will pay $2.7 billion for OML 29 and the associated Nembe Creek trunk pipeline, the largest of four assets in the country being divested by Shell, Total and Eni. Foreign producers have been moving away from Nigeria's onshore oil sector, and the government has been encouraging local companies with tax concessions. In all, the period from September 17 to October 16 saw 37 international upstream deals of which 22 had disclosed values totaling $11.3 billion.