QATAR: From Strategy to Implementation

This sponsored supplement was produced by Focus Reports Report Publisher: Julie Avena

Project Director: Kirsty Avril Jane Walker

Editorial Director : Karim Meggaro

Contribution: Joan Abellan Ponce de Leon, Valerie Baia

For exclusive interviews and more info, plus log onto energyboardroom.com or write to [email protected]

Leaders in Qatar seem supremely unworried by the effect that the rise of shale gas in the US and Canada will have on its dominance of LNG markets around the world. In February 2014, Minister of Energy of Qatar Mohamed Saleh Al-Sada, told the UK's Daily Telegraph: "we do not consider the US shale gas revolution to be a game changer but rather a validation of Qatar's strategy. Global gas demand has been growing consistently and we have had the flexibility to re-plan our LNG marketing to meet growing demand in Asia and elsewhere."

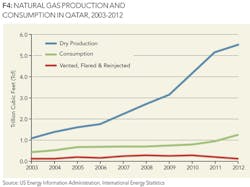

Currently, nearly 85 percent of Qatar's gas production is converted to LNG and exported through Qatargas and RasGas, Qatar's two LNG producing companies with a joint capacity of 79 Mmtpa.

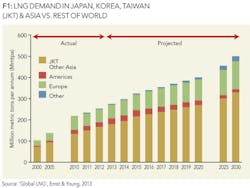

"According to some reports, the share of Qatar's LNG exports to Asia reached 73.5 percent in January 2013, a sharp jump of over 30 percent compared with 56.4 percent in 2012," reveals Seyed Mohammad Hossein Adeli, secretary general of the Gas Exporting Countries Forum (GECF). "This major shift is driven by two important factors, one of which is the surprising increase in oil and gas production in a few countries such as the US, Canada and Iraq." This has served to lower the demand for LNG deliveries in Europe and the US. The second has been the retreat from nuclear power following the Fukushima incident in Japan.

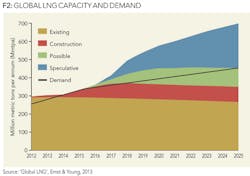

Qatargas's CEO, Khalid Bin Khalifa Al-Thani, forecasts that LNG demand in Asian markets will rise from 237 million tons in 2013 to well over 450 million tons by 2025. "This growing appetite for LNG will need to be matched by production capacity additions over and above the LNG supply, which will come from projects currently under construction in the US and Australia. Based on our projections, another 150 Mmtpa of additional non-FIDed LNG supply capacity is needed to meet global demand by 2025."

"Even if an optimistic view is taken on the number of LNG projects that will go to completion, the LNG market will continue to be tight in the short and medium term as demand growth outpaces supply," says Al-Thani of Qatargas. This sentiment is echoed by Hamad Rashid Al-Mohannadi, CEO of RasGas: "The greatest risks to ensuring timely supply of new LNG to meet growing global demand are the delay in development of new supply and the associated LNG value chain; escalating development costs and indecision or inability of customers and suppliers to agree mutually on acceptable contract terms."

It seems as if the biggest issue for Qatar to remain the world's largest of exporter of LNG will be tight supply, rather than a challenge from North America.

THE COMPASS SPINS ON NORTH FIELD

The challenge of remaining the world's leading LNG exporter is made more difficult by the fact that since early 2005, a moratorium has been in place on new exploration and development projects at Qatar's giant North field, the world's largest non-associated gas field with recoverable reserves estimated at 900 Tcf. "The moratorium was put in place by our main shareholder, Qatar Petroleum, to allow them time to study the reservoir performance of the North Field so as to ensure the long-term, efficient development of this world class gas field," explains Khalid Bin Khalifa Al-Thani, CEO of Qatargas. There is no date set for its removal.

Despite the moratorium, production at North field has ramped up in recent years, thanks to long-term projects such as RasGas's USD 10.4 billion Barzan project, which when completed will add 1.4 Bcf/d to Qatar's overall gas production, bringing the daily total to 11 Bcf/d. But much of this gas has been earmarked for use outside of LNG.

Beyond North field, exploration is continuing eslewhere in Qatar. In 2013, Wintershall reported the first new gas discovery in 40 years in Block 4 North, directly adjacent to North field. The area, renamed Al Radeef field, is located below 70m of water, covers 544km2, and has potential gas reserves of 2.5 Tcf. "Our main challenge is to get the Al Radeef field developed, and that is what we are focused on," explains Juergen Rodefeld, general manager of Wintershall Qatar. "We need to get a development plan in place, get it approved, and most importantly, get it all done on time." As this project is still in development, it is unknown where its eventual production will be allocated.

For over two decades, LNG has provided Qatar with ample revenue for growth. Now, Qatar is planning the next stage of its future, which those in power hope will decrease Qatar's financial dependence on LNG, thereby improving sustainability. One key element of this is building a globally competitive downstream sector. But there are important decisions to be made: On one hand, global demand for LNG is rising, and the country is in an excellent position to compete for contracts, given its low LNG production costs; on the other, Qatar is close to hitting installed-capacity limits on gas production, and must increase the total amount of gas allocated to domestic consumption, either as feedstock or for power generation.

"We expect gas to remain important, and in this context it is therefore important for us to stay competitive," explains Ibrahim Ibrahim, economic adviser to the Emir and architect of Qatar's National Vision 2030. "To do this while at the same time diversifying our economy will be difficult, but Qatar has come through difficult periods successfully before, and we can do it again." The plan to diversify is in place-now Qatar must work out what to prioritize when it comes to implementation.

MORE GROWTH, MORE CONSUMPTION

With rising LNG demand and capacity in the system, and a moratorium on new exploration projects potentially causing delays in increasing the supply of gas, Qatar may soon face problems. "The challenge that Qatar could end up facing sooner than expected will be related to growing internal consumption," says Seyed Mohammad Hossein Adeli, secretary general of the GECF.

"A major portion of the Barzan gas will be used by the power and water generation sectors, providing clean, natural gas to support several of Qatar's new projects that are underway," explains Hamad Rashid Al-Mohannadi, CEO of RasGas. "As Qatar develops its downstream industry, RasGas is responding and playing a pivotal role in operating its plants and major expansion projects to meet growing demand." RasGas's upstream projects are already servicing a booming downstream sector, which includes gas to liquids (GTL) projects, power generation for Qatar's two industrial cities, condensate for refineries, and feedstock for Qatar's downstream and petrochemical sectors. Early next year, once the Barzan gas project is commissioned, RasGas will supply future downstream projects with propane and butane.

Some segments of Qatar's downstream sector are already booming: Qafco, for example, is a well-established national fertilizer company with over 40 years in the market, currently providing almost 12 percent of the USA's fertilizer requirements each year. Petrochemicals, chemicals and fertilizers will play a key role in Qatar's development strategy, and following USD 25 billion of planned investment in the sector, the country hopes to boost current production of petrochemical products from 10 Mmtpa to around 23 Mmtpa by 2020.

In order to boost sales to match this production jump, Muntajat was created in 2013 to serve as a single sales and marketing entity for the entire downstream market. "To have one face in the market means that whenever anyone thinks of chemicals, petrochemicals or fertilizers coming from Qatar, they think of Muntajat, the gateway to these products," explains Abdulrahman Ali Al-Abdulla, CEO of the company. "By consolidating the marketing, sales and distribution divisions of each producing entity under one roof, we have built economies of scale and can work to share and build knowledge, focus on catering to the requirements of our customers, provide better before and after-sales service, and allow the producing entities to focus on their core business: growing production, improving quality, and furthering capacity. As one entity, Muntajat can reduce costs, add value, and achieve better netback through building reliability and credibility."

The alignment of Qatar's downstream sales and marketing into one company is a relatively new project, but there are high hopes for the future. "Marketing, sales and distribution is obviously where Muntajat will apply its expertise, and it is a crucial area: without the right marketing, finance will never be found," explains Al-Abdulla. "This means that we will be integrated in any new downstream projects originating from Qatar or Qatari companies. In the coming five years, for the new products we are going to market, we have to start with pre-marketing: bring the knowledge, train people, and communicate with the customer. Sales do not start when you have the products - they start a long time before this. We are already starting this process for these new products. We will also work on our global infrastructure in order to achieve this."

But this increase in petrochemical output, although good for the country's plans for economic diversification, will place a heavy burden on gas production, not just in terms of feedstock but also power supply to Qatar's two purpose-built industrial cities, Ras Laffan and Mesaieed. Planning and execution so far at these cities has been good, and the industry is extremely happy with what it has seen so far. "Ras Laffan is state-of-the-art-the newest of the new," says Gerrit Jan Pieterson, general manager of Anabeeb Services Qatar. "It is brilliant; very well organized, maintained, and cleverly constructed. All the know-how, experience, and lessons learned around the world by the large gas companies are implemented in Ras Laffan. A lot of countries would be jealous."

Essa Bin Hilal Al-Kuwari, president of Qatar's power and water company, Kahramaa, explains how the state utility has worked in tandem with the industry in order to support its growth and development - something that should continue as Qatar looks to build its downstream capacity. "Qatar's new-build projects are numerous and span a number of different sectors and technologies, which is a major challenge, but fortunately Kahramaa has very flexible plans that can adapt to the often vastly different projects currently being built in the country. The main transmission system, which is the backbone of the country's electricity supply, is well designed to meet all loads; the same applies to our distribution systems. It incorporates today's latest technologies, and is designed to be able to adapt to tomorrow's technologies when they arrive."

The country's grid was built to account for the high energy consumption in Qatar's industrial cities. "Mesaieed and Ras Laffan are the two main industrial cities in the country. This is naturally where demand for energy is very high, and this in itself brings challenges, but Kahramaa met these challenges by locating roughly 60 percent of its generation facilities in these two areas, as well as its 400 KV backbone transmission systems," explains Al-Kuwari. "The petrochemical sector is very energy intensive. Kahramaa coordinates closely with the sector in order to assess its demand and growth plans, and how its electricity and water supplies will have to accompany those plans."

The growth of Qatar's downstream sector will not only benefit the country's major investors and state-owned companies, but also service companies looking to increase their work in Qatar. Applus Velosi, an asset integrity, inspection and certification company, hopes that as these projects grow, their operations in Qatar will too: "Qatar's refineries and petrochemicals projects are a great fit for what the Velosi group does," explains Brian Dawes, Applus Velosi's regional manager for the Middle East, pointing to QP and Shell's Al Karaana petrochemical project as the perfect example of where their skills could be a great match. "Velosi has global relationships with the IOCs. We never take this for granted, but it does give us a good starting point for a dialogue about how we can work together on future projects. Our record of accomplishment is solid and ready to be used in the coming petrochemicals projects," Dawes concludes.

TAKING QATAR ABROAD

Change is coming to Qatar's international strategy, and no one saw it coming. "International growth is the only possible future for the Qatari oil and gas industry, having almost reached the potential of the activity that has taken place over the last two decades," says Nasser Khalil Al-Jaidah, CEO of Qatar Petroleum International (QPI), the international investment arm of Qatar Petroleum, the state-owned company involved in all oil and gas activities in the country, and the third largest oil and gas company in the world by reserves. "In this time, Qatar has worked hard to consolidate domestically, but now expansion is inevitable, as QP has grown to become one of the world's largest LNG suppliers. In order to reach its potential, QP must seek new markets, make new partnerships, review the full value chain and plug the gaps wherever they appear."

Until today, QPI has acted only as an investor in international projects, but this may change in the years to come: "There is no moratorium for us beyond Qatar's borders, and the country must look there in order to maintain its market share in the years to come," says Al-Jaidah. "We need to prove to our LNG customers that in the future, we will be able to supply them from different destinations, and continue to grow as a global force in the LNG market."

This is a marked shift from QPI's current upstream strategy, which has placed the company as a non-operating partner in projects in Brazil, Canada, Mauritania and Congo. "That is certainly our hope - to be an operator in the future," Al-Jaidah reveals. "But one always has to start from somewhere; additionally, we have a legacy of success that we do not want to tarnish by taking enormous risks. There is huge political will for the Qatari oil and gas sector to move forward and internationalize, and this activity has been spearheaded by QPI. Our ultimate ambition is to become the number one NOC in overseas investment." Qatar is also looking to expand its international reach in the downstream segment. With the creation of Muntajat, the country now has one face with which to launch overseas downstream projects, in the same way that it has been working with QPI in the upstream. "Muntajat is not only engaged in marketing, sales and distribution but also with new projects that are being established both in Qatar and abroad," explains Al-Abdulla, Muntajat's CEO. "We are very engaged with QP, QPI, and QIA (the Qatar Investment Authority) with regards to downstream ventures, building great relationships to support the future of Qatar."

THE BIRTH OF A NEW REGIONAL HUB?

In its search for diversification, Qatar is considering its potential future as a hub for regional headquarters. "Services and trade are areas where Dubai has built a first mover advantage - many of the big multinationals have decided to put their regional headquarters in Dubai and this is likely to continue," says Dieter Roelen, managing partner of McKinsey's Doha office. "While Qatar could offer a differentiated proposition to attract large players in niche areas, the question is whether this will be a sufficiently large engine of growth."

At the moment, it seems that perhaps the incentives are not in place for service companies to move their regional operations to Doha. But this may change in time, as Gerrit Jan Pieterson, general manager of Anabeeb Services Qatar, believes. "Qatar is a gold rush. Everyone is now looking for some structure and stability following the initial huge gas finds here and the subsequent rapid development of the oil and gas industry. In my opinion, overall development in Qatar is still lagging compared to the development in the oil and gas industry, although this is starting to change."

One alternative to the Dubai model is to focus on R&D, an option that Qatar is keen to incentivize. Total has one of its six decentralized global research centers based in the country, working in areas linked to energy and environment, and therefore aligned with Qatar's development goals. "There are not so many countries in the world where we have such a diverse portfolio," says Guillaume Chalmin, managing director of Total E&P Qatar.

Another alternative is to build a strong and resilient financial sector that will bring in revenues able to support diversification efforts. "As part of this strategy, significant progress has already been made in developing the financial markets and related infrastructure," explains Abdullah Bin Saoud Al-Thani, governor of the Qatar Central Bank. "Specifically, major steps have been taken to develop deep and liquid debt markets through regular issuance of treasury bills and government securities. This would lead to the development of a risk-free yield curve that will help in the efficient pricing of financial instruments in the market as well as help banks manage their liquidity." In particular, this would help develop a corporate debt market in Qatar, which could act as a platform for the corporate sector in mobilizing resources for investment in the non-hydrocarbon sector.

A key step in the development of a thriving non-oil and gas economy is the creation of a new set of SMEs in Qatar, an area that traditionally has lagged behind. "Of course, at Qatar Development Bank (QDB) we recognize that starting a business requires more than just funding, which is why we also provide a non-financing support to SMEs through our advisory services to help identify and nurture promising businesses," explains Abdulaziz Bin Nasser Al-Khalifa, QDB's CEO. "Once businesses are mature and ready to start exporting, our export arm Tasdeer offers financial solutions, credit insurances and advisory services in addition to support in developing SME export capabilities through export development and promotion."

Factbox: Qatar's LNG Giants

QATARGAS

Shareholders: Qatar Petroleum, Total, ExxonMobil, Mitsui, Marubeni, ConocoPhillips, Shell, Idemitsu Kosan, Cosmo Oil

Established: 1984

Production capacity: 42 Mmtpa

Leadership: Khalid Bin Khalifa Al-Thani, CEO

LNG infrastructure:

Qatargas 1: 3 trains of 3.3 Mmtpa capacity

Qatargas 2: 2 trains of 7.8 Mmtpa capacity

Qatargas 3: 1 train of 7.8 Mmtpa capacity

Qatargas 4: 1 train of 7.8 Mmtpa capacity

RASGAS

Shareholders: Qatar Petroleum (70%), ExxonMobil (30%)

Established: 2001

Production capacity: 37 Mmtpa

Leadership: Hamad Rashid Al Mohannadi, CEO

LNG infrastructure:

RL: 2 trains of 3.3 Mmtpa capacity

RL II: 3 trains of 4.7 Mmtpa capacity

RL III: 2 trains of 7.8 Mmtpa capacity

Oil, technology, and implementation in Qatar

Although dwarfed by its daily gas production, Qatar has a solid level of crude oil production, at 1.55 million b/d in 2013, making Qatar the world's 16th largest crude producer in the world according to the EIA. Maersk Oil has been the operator of the Al Shaheen oil field in Qatar for over 20 years, the largest producting field in the country at 300,000 b/d. "We have overcome many technical challenges at Al Shaheen," explains Lewis Affleck, managing director of Maersk Oil Qatar. "For example, drilling some of the world's longest horizontal wells, implementing one of the world's largest offshore waterfloods, which currently injects over 800,000 b/d of water into the reservoirs, and applying enhanced oil recovery (EOR) techniques. We have already drilled over 300 wells and installed 33 offshore platforms, and we have ambitious plans to continue to unlock value from the field in the future."

Capitalizing on the ambitious plans of international oil companies in Qatar are companies like Tendeka, which aims to implement not just single technologies, but reservoir completion systems, for added value to the operator. "An example of these complementing technologies is the use of swellable packers and inflow control devices (ICDs) to provide compartmentalization within the reservoir," explains Derren Simpson, Tendeka's VP for the MENA region. "These are a very good fit for Qatar's oil producing reservoirs, as many of these reserves are located in thin oil rim reservoirs that are either water or injected water drive, while a number of them being gas drive. Both of these types of reservoirs benefit from these new technologies like that of autonomous ICDs. When these reservoirs start losing their gas cap, and start producing gas, autonomous ICDs can shut off gas a lot more efficiently, and the operator can continue to produce the residual oil without producing excessive gas."

According to Simpson, having international operators working in Qatar provides an excellent way to get new technologies tested and implemented quickly. "IOCs working in countries can certainly help push new technology adoption through with their partnership with NOCs, as typically the NOCs have a tendency to use large integrated services contracts, which provide a challenge to small technology driven service companies," he explains. "Qatar is one of the countries in the region with a large number of IOCs operating, with NOCs being more dominant elsewhere in the region. Working with IOCs in these countries makes it easier for a small technology service company like Tendeka to push through its technologies to the end user, as the IOC can draw from both its size, and its experience in operating fields, to help implement technological changes to the oilfield."

Qatar's oil and gas partners

The table below shows some of the relationships that currently exist between leading Qatari and international oil and gas companies - from joint projects in Qatar, both upstream and downstream, to investments internationally, research centers established in Qatar, and also stakes these companies hold in one other.

SHELL

- Qatar Investment Agency has a stake in Royal Dutch Shell (believed to be between 3% and 5%)

- Shell has a stake in Qatargas

- Research & Technology Center in Qatar

- Pearl GTL - run as a production sharing agreement between QP and Shell

- Parque das Conchas, offshore Brazil: Shell, 50%, QPI, 23%

- Petrochemical JV with Shell and QPI in Singapore

- Shell/QPI/Petrochina JV for a Chinese refining complex in central China

TOTAL

- Qatar Investment Agency has a 3% stake in Total

- Total has a stake in Qatargas

- 25% equity in Qatar Block BC

- 40% interest in Al Khalij oil field in Qatar

- Total Science & Technology Park based in Doha

- 20% interest in Mesaieed LDPE plant with Industries Qatar

- 10% in Qatargas-operated Ras Laffan condensate refinery

- 49% in Qatofin venture with QAPCO and QP: includes ethane cracker in Ras Laffan, 128km pipeline from Ras Laffan to Mesaieed, and downstream LLDPE unit

- Mauritania - 2 exploration blocks: QPI has a 20% stake, Total a 60% stake

- QPI has a share subscription of 15% to Total E&P Congo: 9 producing assets and 3 exploration licenses

EXXONMOBIL

- 30% stake in RasGas

- ExxonMobil has a stake in Qatargas

- 7% stake in Barzan gas project with QP

- 10% in Qatargas-operated Ras Laffan condensate refinery

- ExxonMobil Research Qatar

- Condensate refinery project - 10% interest, other partner Qatargas

- 3 LNG receiving terminals in Europe & the US with QP: Adriatic (Italy), South Hook (UK), Golden Pass (Texas, US)

WINTERSHALL

- 80% of exploration Block 4 North in a PSA with QP

- Operator at exploration Block 3

MAERSK

- PSA with QP since 1992 at the Al Shaheen oil field

- Maersk Oil & Technology Research Centre in Qatar

GDF SUEZ

- 60% stake in Qatar Block 4 with QP and PetroChina

- Operator of Ras Laffan B and C, integrated power and water plants

SASOL

- ORYX GTL plant, a joint venture between Sasol & QP

Qatarization - benefits and challenges

Qatar's National Vision 2030 places a strong emphasis on increasing national content in its joint ventures and government departments, an ambition it calls 'Qatarization.' EnergyBoardroom spoke to a number of key players to hear their opinions on Qatarization, and how the realities of the plan have impacted their operations.

"The QNV2030 is clear about the need to increase the effective participation of Qataris in the labor force. Presently, the available skills of nationals do not always match those demanded by potential employers. Qatarization is best interpreted in terms of building the nationals' skillsets, empowering citizens to participate and contribute effectively to the economy and society." - Saleh Al-Nabit, minister of development planning and statistics of Qatar

"Another trend affecting the energy industry in the Gulf is the structural weakness of its labor force. These economic challenges may surprise, since the GCC has seen mostly high rates of economic growth, thanks to high oil prices and higher production levels. But this positive data hides economic difficulties faced by nationals. The private sector has shown strong job creation, but participation of nationals in the workforce is limited." - Hilda Mulock Houwer, partner & global head of advisory, energy & natural resources, KPMG

"We are very pleased at the quality of the people we are getting in, but a simple challenge is availability, given the size of the Qatari population. A number of years ago it was very much quantity-the number of people employed-but I think everyone recognized that there simply aren't enough people to go around. Recently, the focus has been much more on recruiting, developing and retaining high-quality performers and getting them in to leadership positions." - Lewis Affleck, managing director, Maersk Oil Qatar

"There is always a danger in employing expatriates, as they never stay forever, and this is a business that thrives on continuity. We have people who need to understand the asset, operate it well, and grow their career taking care of that asset and taking care of the people involved. For that, the best are without any doubts the Qataris: they are the ones that want to live here permanently. They have family equity. When I have Qatari leaders who are able to take this company forward, that makes my business better." - Wael Sawan, managing director and chairman, Qatar Shell Companies

HSE in the Middle East

In 1997, Joseph Brincat was transferred to Dubai, marking his shift to the Middle East region after 15 years working for ABS in Europe. Today, he serves as the company's vice president for the Middle East region, responsible for the countries that stretch from Libya to Pakistan. In June 2012, ABS reached a major milestone with the opening of an expanded engineering office in Dubai to serve as a centralized resource in the Middle East. The opening of an office in Fujairah that same year further contributed to ABS's regional expansion. Both openings have had a positive response from ABS's clients, with single time zone capability for face-to-face meetings and a closer focus on both marine and offshore business.

For these businesses, ABS comes well equipped: it has the largest survey team in the region, staffed with 63 offshore surveyors and engineers, which operate out of 13 offices in six countries. Globally, ABS's classed fleet now stands at 210 million gross tons, with 24 percent of all vessels on order due to be classed by the company; in the UAE, all the offshore drilling rigs currently under construction are being built to ABS class specifications.

In 2013, ABS was named Best Class Society at both the Marine BizTv International Maritime Awards and Lloyd's List Middle East and Indian Subcontinent Awards. The organization also received the Safety and Quality Award at the tenth anniversary of the Seatrade Middle East and Indian Subcontinent Awards in November 2013. All three awards recognize ABS's contribution to classification services in the Middle East region, where it has expanded its workforce and training capabilities to address environmental and performance challenges facing the industry.

"Safety is the bylaw and driving force behind every interaction we are involved in, from our own headquarters to our far-flung research centers to every touch point where ABS and it global clients meet," says Brincat.