Eastern gas basis: pipeline pain or gain?

Takeaway capacity additions and their impact on basis prices

JORDAN GRIMES, MORNINGSTAR INC., CHICAGO

The Marcellus shale gas revolution has ramped up production so quickly that pipelines have been unable to keep up. Most of the pipelines in the Marcellus and Utica shale plays were constructed to deliver gas from the Gulf of Mexico to the New York and Boston demand regions.

The lack of takeaway capacity in the Marcellus has caused basis points there to be oversupplied and basis points less than 300 miles away to be supply constrained during cold winter months. Factories in Maine are closing because of historically high gas prices, while producers in the Marcellus complain about historically low prices.

Producers financing pipelines to arbitrage the basis point spreads should solve this problem. In total, we see an 8.2 bcf/d increase in takeaway capacity heading east or southeast, 8 bcf/d moving west or southwest, and 700 MMcf/day flowing north. Brownfield expansions and flow reversals will make up the majority of the increased takeaway capacity out of the Marcellus and Utica through 2016. Greenfield projects represent more than 10 bcf/day in increased takeaway capacity in 2017-18.

We believe projects in New England have the greatest risk of being canceled based on consistently undersubscribed open seasons. Generators in New England have resisted bidding on firm gas transmission, causing projects like the Algonquin Incremental Market to ratchet down expansions. We don't see demand putting a strong bid on gas prices before the pipeline build-out is complete based on electric generator additions currently in the queue. After 2018, when more new generation has come on line and exports come into play, we could see more demand support to basis prices.

Morningstar's outlook

Current projects lead us to be most bearish on TETCO-M3 and Transco Zone 6 (non-NY), which are positioned to receive more Marcellus supply based on announced pipeline expansion projects. We expect these basis points will face significant downside pressure in winter 2017-18 with the completion of Atlantic Sunrise and NJR PennEast.

We are most bullish on TGP Zone 4 and Transco-Leidy deep in the Marcellus. Increased takeaway capacity near these lines will give more pricing power to Marcellus producers and should put a bid on these basis points above current forwards.

We're also bullish front winter with regulatory uncertainty in winters 2015-18. We think front winter AGT and TGP Zone 6 will face similar constraints as last winter. However, the oil program in ISO-New England puts a soft cap on gas prices at the price of oil. The Wright Interconnect Project will put bearish pressure on AGT in 2015 but will not solve the gas deliverability problem in the Algonquin system.

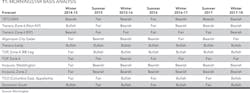

We also expect increased takeaway capacity from the TCO pool to add more winter seasonality to TCO and Dominion South, each currently trading at a discount to Henry Hub. (See Table 1 - Morningstar Basis analysis)

Supply Analysis

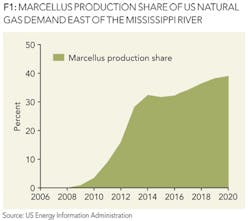

Marcellus and Utica shale production has ramped up from virtually nothing in 2005 to more than 15 bcf/d today. The Utica shale alone accounts for 1,270 MMcf/d, up from less than 200 MMcf/d in early 2013. Pipeline infrastructure that requires significant planning and capital investment has not been able to keep up. Many pipelines that were built to bring gas supply from the Gulf of Mexico into the Northeast are now being reversed. Strong "not in my backyard" attitudes for many of these projects mean the US Federal Energy Regulatory Commission (FERC) is more likely to approve brownfield projects, but there are a few greenfield infrastructure projects being constructed as well.

Marcellus shale production now represents 32% of US gas production east of the Mississippi River, and that share likely will grow to nearly 40% in the next few years (Figure 1).

This regional supply surge and lack of takeaway capacity has caused extreme pricing differentials in gas basis prices. Henry Hub pricing is irrelevant to a producer in the Marcellus when it must sell $2/MMbtu gas at the Transco-Leidy basis point and also irrelevant for a power plant that must purchase $80/MMbtu gas at TETCO-M3 in the spot market on a cold winter day.

These examples represent extremes but also highlight the most important element to investment and trading decisions: gas basis pricing. As firms move through open seasons, FERC approvals, and land easements to expand pipeline takeaway capacity from the Marcellus and Utica shales, the most pressing question for producers, traders, and end users is: What is the impact on gas basis?

Constraints and utilization

Average utilization rates on most of the Mid-Atlantic and Northeast pipelines are far below 100%, but this does not imply that there is additional capacity for use. Pipeline firms serve a seasonal market and will have much lower utilization rates in the summer and much higher in the winter, when heating demand peaks. In the winter, when gas pipelines are fully utilized, the gas basis price reflects not only the marginal cost of production but also the price the marginal buyer is willing to pay for delivery of the gas on a constrained pipe. When pipelines are constrained, the congestion price for delivery is usually bid up by competing gas generators that do not own any firm transmission rights on the pipelines and must buy interruptible supply in the spot market to burn the fuel for electricity.

Because gas demand and power demand are highly correlated, an Arctic front can cause pipeline conditions to move from underutilized to constrained in a matter of days or even hours. Alternatively, lack of takeaway capacity combined with the increased production in the Marcellus has caused oversupplied conditions at certain gas basis points (Transco-Leidy, TGP Z4, TCO, Dom South).

Gas producers have little if any pricing power when conditions are oversupplied and are forced to hit bids below their marginal cost in order to get the gas to flow. The pipeline build-out in the Marcellus and Utica is largely being financed in open seasons by producers that are eager to improve their pricing power in the region.

New and proposed pipelines should increase takeaway capacity 18 bcf/d by 2018 from the oversupplied region and into higher-demand regions with higher prices. Thus, the build-out should put a bid on oversupplied basis points such as Transco-Leidy, TGP Z4, TCO, and Dom South and relieve the constrained forward basis prices farther away from the Marcellus and Utica.

After supply and storage, pipeline transport capacity is the most important factor for setting market gas basis prices on the supply side. Absent delivery costs, congestion, or leakage, basis should price flat to Henry Hub.

Constraints in New England

Although less than 300 miles from abundant, cheap natural gas supply out of the Marcellus, New England has seen transmission constraints and prices increase over the past several years. There are many reasons for this problem. New England has poor soil composition and no depleted gas wells, so gas storage is not an option. The region also depends on exports not just from Canada but from Trinidad, Yemen, and Egypt. As gas prices have steadily risen in Europe over the past several years, ships now choose to dock at ports on the other side of the Atlantic. Although New England gas prices are often stronger than European ports in winter, it takes anywhere from five to 20 days for a ship to reach New England, so ships are not able to respond quick enough to pricing signals Lastly, power plants are unwilling to firmly commit the capital toward pipelines, leaving only local distribution companies to finance pipeline projects.

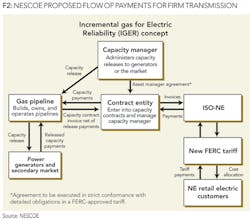

The New England States Committee on Electricity, in response to the New England governors' initiative to build out infrastructure, has proposed to have electricity ratepayers subsidize the firm capacity for generators during winter constraints. All the details of the NESCOE initiative have not been resolved yet.

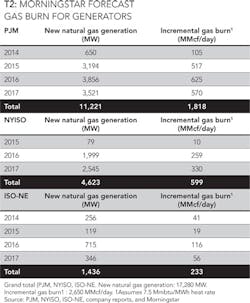

New England Power Pool (NEPOOL) recently requested an extension to consider the proposal, but participants expect a vote and a FERC filing in September. ISO-NE will appoint a capacity manager who will administer the firm capacity to gas generators after ISO-NE procures it (Table 2).

NEPOOL recently suspended its review of NESCOE's proposed ISO-NE tariff measures because of a Massachusetts hydro power purchase bill, H. 4187, which if unsuccessful would probably derail NESCOE's proposal. (Figure 2)

It is unclear the exact tenor and volume of the capacity that would release to gas generators under the proposal, which is subject to FERC approval. An auction would be held in which the generators compete to procure the firm transmission. The costs of the program would be rolled back to New England ratepayers based on their load-weighted profile in the ISO-NE. Electricity ratepayers financing the firm capacity would effectively create a subsidy for generators. FERC might view this subsidy as a necessary evil in order to lower gas prices in the region in the intermediate term, but FERC could also view this as an unfair subsidy that disadvantages other pipeline projects that have not received firm bids from electric ratepayers.

There is some worry from Iroquois and NRG Energy that any market subsidy would have distorting and unintended long-term consequences. We agree that this effective subsidy could lead to oversupply conditions in the long term, but giving a portion of New England's electricity supply access to firm transmission would be an important step toward maintaining reliability in the region.

Spectra Energy also announced that a third expansion, in addition to AIM and Atlantic Bridge projects, will also depend on the ability of ISO-NE to procure firm transmission for gas generators in the region. In its current form, we believe FERC will reject this proposal in favor of a more market-based approach. Allowing generators to recoup fixed firm gas transmission costs in the ISO capacity markets may be a more logical and market-based solution.

Demand

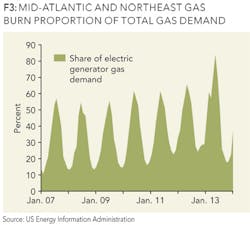

The abundant supply and low cost of gas in the Marcellus have caused generators to switch from coal to gas and to build gas generators to replace retiring coal plants. The flexibility of merchant generators to turn to gas as a fuel source now accounts for the fastest-growing proportion of gas demand. Last August, gas demand from generators reached an all-time high of 84% of all gas demand in the Northeast from Ohio to Maine (Figure 3).

Based on ISO and parent company statements, we see gas demand from generators increasing 2,649 MMcf/d (assuming a 7.5 heat rate and peak demand capacity factors) through 2017 in PJM, NYISO, and ISO-NE (Table 2). The majority of this new gas draw comes from PJM generators, with 1,817 MMcf/d through 2017. With approximately 7,200 MMcf/d of increased takeaway capacity into the PJM region by 2017, we expect PJM to be flush with gas for these plants (See Tables 2 and 3).

About Morningstar Commodities Research

Morningstar Commodities Research provides independent, fundamental research differentiated by a consistent focus on the competitive dynamics in worldwide commodities markets. This research leverages the expertise of Morningstar's 23 energy, utilities, basic materials, and commodities analysts as well as the Morningstar Commodities & Energy data platform. Morningstar Inc. provides independent investment research in North America, Europe, Australia, and Asia.

ABOUT THE AUTHOR

Jordan Grimes is a senior commodities analyst for Morningstar, covering key markets in US power and gas. Prior to joining Morningstar in 2014, Grimes spent four and a half years as a power and gas trader for Barclay's in New York. Before that, he was a cash power trader for Constellation Energy. Grimes holds a bachelor's degree in economics from the University of Georgia.