North American shale update

PER MAGNUS NYSVEEN, RYSTAD ENERGY

Production set to reach 15 MMboe/d in 2015

Rystad Energy estimates total North American shale production to reach 15 million boe/d in 2015-up approximately 20% compared to 2014 total production. Over the last quarter, the short-term production forecast has been revised upward 3%, thanks, in large part, to an increase in drilling efficiency.

Over the last two years companies have focused on drilling efficiency, resulting in less drilling time and lower costs. This trend can be observed well into 2014. On average, wells drilled before the end of August 2014 were drilled 5% faster than wells drilled in 2013. One of the key reasons for the improvement is the increased usage of pad drilling. Pad drilling, which was first introduced in 2009, allows operators to drill multiple wells from the same drilling location. The method, which reduces the time spent rigging up and down, accounted for over 80% of all wells in the Eagle Ford, Bakken, and Niobrara in 2014.

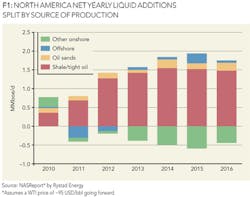

Figure 1 shows the North America year by year liquid additions split by different sources of production. Shale/tight oil production has added the most production year by year since 2010. In 2014 the net additions from shale/tight oil are expected to reach 1.55 million boe/d, of which 0.43 million boe/d is NGL. Simultaneously, the global liquids supply is expected to increase by ~1.4 million boe/d. Going forward, the shale additions are expected to remain stable as the number of new wells each year stabilizes. By 2016, the added liquids volumes from shale are estimated to be 1.5 million boe/d.

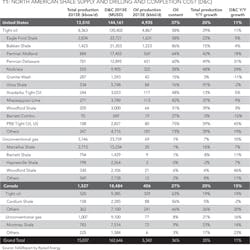

Table 1 shows the estimated production, spending levels, and trends for North American shale/tight oil. In 2015 the total supply from shale gas and tight oil plays is estimated at 13.5 million boe/d in the US, of which 4.9 million bbl/d is light oil. Canada contributes 1.5 million boe/d, with 0.4 million bbl/d of light oil.

Historically, the Eagle Ford and Bakken have added ~0.8 million boe/d yearly. However, in 2015, it is expected that these plays will only grow by 0.7 million boe/d.

Going forward, the Permian region is expected to grow faster, with 0.3 million boe/d in new light oil production in 2015. Production, primarily NGL, from the Marcellus and Utica, is also expected to grow faster in 2015. This growth comes as a result of debottlenecking of processing capacity.

To achieve the production growth, investments in shale are expected to increase by 11% in 2015 and reach a total of $162 billion. Permian Midland and Permian Delaware are expected to realize the largest growth in investment levels.