Paradigm shifting in oil and gas

Unconventional production alters the models for capital intensity and operational efficiency

TOM ORTIZ, HALLIBURTON, HOUSTON

Conventional oil and gas projects have traditionally followed a pattern of exploration, large up-front capital investment, and staged asset development in pursuit of long-term financial returns. It has historically been less expensive to drill in new production than to increase the efficiency of underperforming assets.

The world, however, has changed. The number and size of new discoveries worldwide has been declining steadily since the 1960s. Combined with a growing focus on short-term profitability, investors are forcing the upstream industry to demonstrate increasingly rapid production, with immediate positive cash flow, from more expensive and technically challenging resource plays.

This article considers the ramifications of that investment climate on the US unconventional oil and gas market. Independent US producers will spend $1.50 for every dollar earned from shale operations in 2014. Forbes notes that many shale plays are "balanced on the knife-edge of profitability," and extremely sensitive to downward trends in oil prices. In addition, the US Bureau of Economic Geology cautions that many shale investments are being buoyed by liquid-rich production that is effectively (and unsustainably) subsidizing shale gas. Although some recent evidence points to an increasing profitability trend, it relies on increasing economies of scale (volumes), which in turn demands increasing capital investment. Operational efficiency is offered as a solution to this problem.

Case study: capital intensity in the UK offshore market

The UK government is currently engaged in a study to determine the best strategy for maximizing the economic recovery of its national oil and gas reserves. The UK Continental Shelf (UKCS) is one of the most mature producing provinces in the world. Having come of age in an era in which operating companies were judged by investors primarily on their ability to discover and acquire proven hydrocarbon reserves, the UKCS has historically been produced with cost containment as a top of mind issue. In fact, UKCS operating costs, adjusted for inflation, have increased by only approximately 3.5% per year over the last 13 years.

Capital investment in the UKCS over the last 20 years had been relatively low, as compared to a peak in 1976, before rising sharply again, beginning in 2010. The containment of operating costs, manifested in part by decreased investment in the face of depreciation, has unfortunately resulted in decreased production efficiency, defined as the fraction of production achieved given the asset's as-engineered state (technical limits). A production efficiency of 80% is considered acceptable, and many UKCS assets are currently operating at hardly acceptable values of 60% or less.

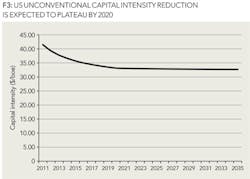

Moreover, production efficiency has been declining at an even faster rate than the corresponding increases in capital investment over the same period. This is evident from a consideration of trends in capital intensity, defined as the amount of capital investment in an asset divided by the volume of produced hydrocarbons. UKCS capital intensity has risen by an order of magnitude (in 2012 pounds) from £2.50/boe in 2000 to £23.00/boe in 2012.

The UK has an urgent need to maximize remaining revenue from a mature producing region that represents a large share of its GDP. A call to action has been raised by the UK government: increase production efficiency of the 51 largest UKCS assets (comprising 80% of production) to at least 70%. By proxy, this also implies reducing capital intensity, as newly employed capital will lift more oil and gas in a more efficient operating environment.

Alarming trends in the US unconventional market

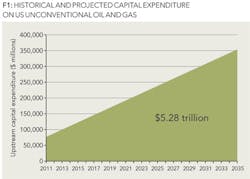

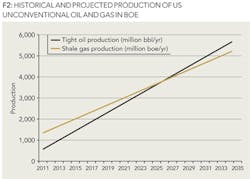

Following a lull associated with the global economic recession of 2009 through 2010, Wood Mackenzie reports that global upstream capital spending has gained significant new momentum, as shown in Figure 1. Increasingly, particularly in the United States, this spending is being driven by the growth of unconventional oil and gas projects, as shown in Figure 2.

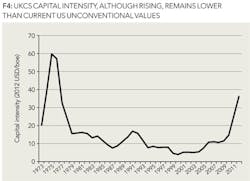

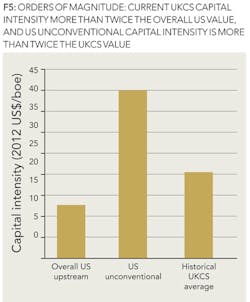

In contrast, overall US upstream capital intensity in 2012 was approximately $8/boe. A comparison of the plateau regions, as shown in Figure 3 (US unconventional) and Figure 4 (UKCS), indicates that shale operators are facing a long-term capital intensity of $32/boe.

Although unconventional plays may demand a certain inherent capital premium above conventional onshore project demands, this fourfold multiplier will ultimately dampen the enthusiasm for continued investment.

To consider this disparity from another angle, compare current US values with average UK capital intensity over the period from 1964 to 2012, in which approximately £500 billion in capital investment has lifted 42 billion boe. In 2012 US dollars, this implies a capital intensity of $18.60: a 230% premium over the average US upstream capital intensity from the same period, and approximately 46% of the cost of US unconventional development, as shown in Figure 5.

Operational efficiency as an antidote to high capital intensity

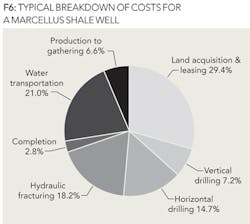

Some industry observers point to increased drilling efficiency as a way to return the unconventional market to better financial health. The Marcellus well example (Figure 6) shows that drilling is indeed a large component of unconventional well cost. However, curtailing completion and production costs, along with maximizing production with respect to the volume possible at any given point in the life cycle of the asset, is also necessary to control capital intensity.

Why hasn't the lack of operational efficiency in unconventional assets been considered to be a serious problem so far during the US shale boom? One reason may be that the small US independent producers who pioneered horizontal drilling and hydraulic fracturing obtained leases at a fraction of the current market price, and then sold their developed acreage, technology, and expertise to larger companies at a substantial profit. The majors, coming late to the game, have not been able to contain the lease acquisition cost, which now represents approximately 30% of each shale well drilled (see Figure 6); consequently, they have not been able to overcome the inefficiency of their shale operations. As a result, some of the largest companies have had much less success with their unconventional assets.

What specific operational techniques in unconventional projects will drive efficiency? A typical Marcellus well provides an example of cost distributions.

As shown in Figure 6, the largest opportunities for cost reduction (assuming equal levels of relative efficiency across the cost categories) after the land has been acquired can be classified as the following:

- Water management efficiency, particularly water transportation

- Hydraulic fracturing efficiency

- Drilling efficiency

Efficiency, rather than merely efficacy, is the key metric in this case. Although technology can and has reduced the cost of resource development in the long run, only a commitment to continuous improvement in operational performance will provide short- to medium-term relief for the acute financial problems facing the unconventional sector.

Production efficiency, a subset of operational efficiency, is particularly important for success. Inefficient production operations will decrease profitability, even if capital intensity remains low.

Consider the following example. North American unconventional operations have been constrained by a lack of infrastructure. One consequence of this constraint is that the massive new shale fields being built must use widely dispersed tank batteries to store a steadily increasing stream of produced liquids. Delays in transporting oil from full tanks will force operators to temporarily shut in production. Although these shut-ins often occur automatically when triggered by tank liquid level sensors, the reopening of the wells must typically be performed by a physically-present operator to verify that site conditions are safe.

These types of periodic deferments of production represent lost revenue and contribute to low production efficiency. Remediation of the problem simply by installing additional gathering and distribution pipelines will, all else being equal, tend to increase capital intensity with all of its associated disadvantages. Furthermore, a fast-growing new pipeline network will create new production efficiency challenges in terms of flow assurance. Therefore, regardless of capital expenditures, production efficiency must increase to ensure the long-term profitability of US shale operations. In other words, operators must begin to think more like manufacturers.

Manufacturing as a new industry paradigm

All of the challenges encountered by the oil and gas industry, whether in mature assets (such as the UKCS) or in expanding frontiers (such as North American shale), mimic those that have been encountered by all capital intensive ventures. There is a natural progression from learning a business: through investment, trial and error, and establishing the business along a stable trajectory, to finally growing the business by exploitation of economies of scale, best practices, automation, and total quality management.

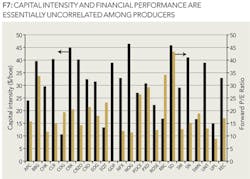

The oil and gas industry has lagged far behind its peers in terms of traversing this path. As previously described, the ability to "drill one's way out of operational problems" has been a major factor in reducing operators' motivations to adopt expensive and difficult change management programs. Unacceptable levels of capital intensity should be making the business case for operational excellence obvious to investors as well as managers. However, among the independent producers having large exposure to US shale, the correlation between capital intensity and financial performance (as measured by forward P/E ratio) is essentially zero, as shown in Figure 7.

Companies who achieve operational excellence will be able to continue production as the unconventional sector becomes more competitive and as more lower-grade acreage is brought online. This will ultimately be reflected in a moderately negative correlation between financial performance and capital intensity in the years to come.

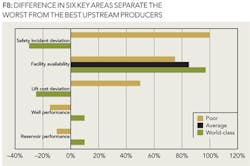

Of course, the concept of operational excellence is not new to the upstream industry. As far back as the 1980s, oil companies were realizing benefits from applying the principles of total quality management. More recently, McKinsey & Co. has reported that the differences, measured in six key areas of operational performance (Figure 8), between the worst operators and world class operators manifests as a 30% difference in project NPV.

Bain & Co. captures these key areas, and adds important human dimensions, in its list of must-succeed areas of operational excellence, including the following:

- World-class health, safety and environmental performance

- Top quartile return on capital across all assets

- Best-in-class standards and systems adopted consistently across the enterprise

- A culture of continuous improvement

- Distinctive core capabilities carried out by a highly talented workforce

Closing thoughts

America's hopes for energy independence, the UK's hopes for increased tax revenue, and investors' hopes for greater short-term financial returns all rest on the same kinds of efficiency improvements that have transformed the manufacturing of products ranging from toys to commercial aircraft. Every cost must be measured and controlled. Every hour of labor must be deployed to the highest value tasks possible. Every asset must be run as a profit center. Continuous improvement, collaboration, and quality control must be embraced as part of the upstream oil and gas culture. The UK has initiated a nationwide Maximizing Economic Recovery (MER UK) strategy that provides incentives to operators to become better practitioners of "asset stewardship" in pursuit of these goals; the US must follow suit.

Oil fields must become oil factories, or they will cease to be viable business opportunities. Too much is at stake for companies to let those opportunities slip away. Operational excellence will increasingly be viewed as a corporate cultural value and an everyday work objective. The degree to which companies succeed in adopting a culture of excellence will subsequently be reflected in the degree to which they are rewarded by the investment community.

What does an oil factory look like? An oil factory is an operation driven by data, and, more importantly, by the constant and critical analysis of that data for the purpose of supporting better, faster business decisions. In an oil factory, all departments will work in concert, passing partially finished inventory (engineering models, production plans) from one department to the next in an organized, collaborative fashion. Reservoir engineers will no longer develop strategies for pressure management in isolation from the facility engineers who must maintain surface gathering and separation systems. Individual asset managers will no longer create capital budgets without coordinating with corporate portfolio managers to ensure that the portfolio NPV is maximized by every field development decision.

Work products in an oil factory will rely on a trusted store of corporate information that enables secure access by teams operating across globally-distributed locations. Every team will have access to the organization's leading subject matter experts, regardless of where those experts are physically located. Cognizant experts will be automatically notified by business process management workflows wherever engineering models in their domains of expertise have been updated, thereby ensuring proper approvals and reducing the probability for expensive errors.

Decisions in oil factories will be made in relevant time. A production engineer will no longer have to choose between waiting for weeks for a reservoir model to be updated to reflect current well test data and using out-of-date models to rank his/her wells for workover potential. Oil factories will combine state-of-the-art science from every domain with the speed of computational technology and data analytics to accelerate critical decisions while simultaneously maximizing their accuracy.

It will be easy to recognize an oil factory. Offices will cease to be organized as blocks of cubicles in which workers operate independently to produce disjointed collections of documents that are shared with ad hoc groups of people by means of email and USB flash drives. Offices in oil factories will be organized around enterprise class software platforms that automatically group workers by their need to access information, enforce corporate best practices for the performance of tasks and the distribution of information, and serve as living corporate knowledge bases that facilitate training and automatically captures lessons for risk management and continuous improvement of business processes.

Field operations in oil factories will increasingly automate process controls based on feedback from these corporate software platforms, as has been true in automotive, aerospace, pharmaceutical, and chemical factories for many years. Human workers will be placed increasingly out of harm's way, and predictive data analytics will enable proactive responses to health, safety, and environmental concerns before they result in catastrophic events.

This is the vision for an oil industry that will be more profitable, safer, and more reliable. Investors will increasingly push for the changes that are needed to realize this vision because those changes will result in higher valuations. Put simply, oil factories will operate in a mode of decreased uncertainty with respect to the current state of the industry. All good business decisions are fundamentally about reducing uncertainty.

About the author

Thomas M. (Tom) Ortiz has more than 15 years of experience developing and managing software products for the upstream, midstream, and downstream sectors of the oil and gas industry. He holds a PhD in mechanical engineering from Purdue University and an MBA from Texas A&M University. Ortiz currently serves as a product manager for Halliburton's (Landmark) production engineering software.