Independents see net incomes rise in first quarter, rig counts also up

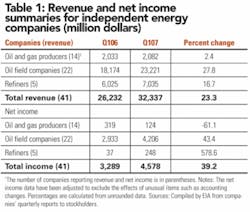

The Energy Information Administration’s recent survey of 41 independent oil and gas companies showed that earnings grew 39% in the first quarter of 2007 over earnings in the first quarter of 2006. (See Table 1.) This was driven by the performance of oilfield service and supply companies and the refiner/marketers, according to the EIA.

In contrast, oil and natural gas producers and operators saw earnings decline over the same year-ago quarter.

Net income of all 41 companies surveyed was $4.6 billion on revenues of $32.3 billion.

Energy prices

The crude oil price for the first quarter of 2007 decreased 3% relative to a year earlier, while the price of natural gas fell 15%. The US refiner average acquisition cost of imported crude decreased from $54.72 per barrel in the first quarter of 2006 to $53.16 per barrel in the first quarter of 2007. (See Table 2.)

This decline relative to the year-earlier quarter came after 18 consecutive quarters in which crude oil prices increased relative to their year-earlier levels.

The average US natural gas wellhead price fell from $7.49 per thousand cubic feet in the first quarter of 2006 to $6.37 in the first quarter of 2007. (See Table 2.)

This is the third consecutive quarter in which domestic natural gas prices fell relative to the year-earlier quarter and comes on the heels of a streak of 9 consecutive quarters in which natural gas prices increased or were unchanged relative to their year-earlier levels.

Earnings

Independent producers’ earnings dropped sharply during this same period. Net income of the independent oil and gas producers included in the EIA report declined by 61% between the first quarter of 2006 and the first quarter of 2007, with revenues increasing 2%. (See Table 1.)

This earnings drop was caused primarily by a 15% decrease in the price of natural gas over year-ago prices and to a lesser extent by a 3% decrease in crude oil prices. (See Table 2.)

Oilfield service and supply companies’ revenue and earnings increased with higher drilling rig counts. Net income of US oilfield service companies included in the EIA report jumped 43%, as revenues rose 28%. (See Table 1.)

US oilfield service company earnings were strengthened by an increase in the worldwide rig count of 5% from 3,080 in the first quarter of 2006 to 3,247 in the first quarter of 2007, according to data supplied by Baker Hughes.

Higher rig counts and the resulting higher demand for related rig services directly increased the demand for the equipment and services supplied by oilfield service companies. The Petrodata day rate indices for rig rentals reflects that, as rates in the first quarter of 2007 were substantially higher than the comparable quarter of 2006.

The US rig count growth rate of 14% over the year-ago quarter exceeded the 5% worldwide growth rate. Decomposing the total US rig count into its components, the natural gas rig count grew 13% and the oil rig count grew 17% over the year-ago period. (See Figure 1.)

This was the sixteenth consecutive quarter in which the natural gas rig count has increased relative to the year-earlier level.

Breaking down overall (oil plus natural gas) rig counts on a regional basis shows that while rig counts grew 14% in the United States from the first quarter of 2006 to the first quarter of 2007, they dropped 20% in Canada and grew 10% in the rest of the world.

Refiner earnings increase

Earnings of the independent refiners included in the EIA report increased a whopping 579% - from $37 million in the first quarter of 2006 to $248 million in the first quarter of 2007. (See Table 1.)

This increase was due to an increase in refining margins of 10% over the year-ago quarter. (See Table 2.)

The gross refining margin is the difference between the composite wholesale refined petroleum product price and the composite refiner acquisition cost of crude oil.

For additional information or to view the full EIA quarterly report, visit the website at www.eia.doe.gov.