Hedge funds and petroleum markets: a primer

Hadrian Partners, Ltd.

New York

With nearly $1 trillion under management, according to a re-cent study by JP Morgan, hedge funds have considerable influence over any market they wish to participate in.

Hedge funds are a lot like the late comedian Rodney Daingerfield – they get very little respect. Although the funds have been operating since shortly after World War II, they are among the least understood participants in the financial and commodities markets by investors and the general public. Critics lambaste them for their secretiveness, lack of transparency and swashbuckling trading styles, and they are often blamed for distorting markets and driving prices far away from fair value or equilibrium levels.

Despite this criticism, hedge funds have proliferated during the past 10 to 15 years, as has the amount of money under management and the potential for profit and loss. Most observers believe hedge participation across a broad spectrum of markets, including energy and other commodities, will increase in the coming years. With this in mind, it behooves those interested to have a better understanding of the funds and their modus operandi.

What is a hedge fund?

A hedge fund is defined as a private pooled investment vehicle, not widely available to the public. Funds may hold long or short positions in virtually any market of their choosing and typically employ a high degree of leverage. Hedge funds typically pay performance or incentive fees to managers.

Offshore funds are exempt from US Securities & Exchange Commission leverage guidelines, such as Regulation T. This is the Federal Reserve Board regulation that governs the amount of credit brokerage firms and dealers may grant customers for the purchase of securities. According to Regulation T, the buyer may only borrow up to 50 percent of the purchase price of a security on margin. However, offshore hedge funds do not have to comply with US laws and regulations, and are only subject to the law of the country in which they are based.

These offshore domiciles may offer the funds substantial tax advantages, and there is no limit to the number of non-US investors. US hedge funds typically take the form of a partnership that is limited to 99 investors. However, these funds are sometimes used as a feeder fund into an offshore hedge fund.

One way to understand a hedge fund and what guidelines are followed in developing a portfolio is to compare and contrast it to a traditional mutual fund. For example, hedge fund portfolios are profit-driven – not asset-driven. A hedge fund seeks absolute returns, whereas a mutual fund is judged by its performance to a benchmark – the S&P 500 or an index of transport, energy or financial stocks, for example.

In a hedge fund, investment methodology and strategy are the primary focus of the portfolio. This makes hedge funds highly dependent on manager performance. Hedge fund investing is considered skill-based, whereas a mutual fund is considered asset-based. A hedge fund is ultimately judged by its absolute level of return, whereas a mutual fund is judged by its relative return compared to a benchmark.

The hedge and mutual funds utilize leverage differently, too. Inherent in hedge fund strategies is the employment of leverage. This is not the case with mutual funds. Additionally, mutual funds are highly regulated entities. Domestic hedge funds are not, and any attempt to regulate them would simply result in the funds moving offshore where US laws are not applicable.

How many, how much money?

Hedge funds have nearly $1 trillion under management (before leverage), according to a recent study by Jan Loeys and Laurent Fransolet of JP Morgan. This gives the funds considerable influence over any market they wish to participate in. To date, a relatively small number of funds are involved in the energy sector, although energy and other natural resource funds make up a growing proportion of hedge fund activity.

The aggregate number of hedge funds could be as many as 8,000. The amount of money each fund manages varies widely. A few pedigreed funds manage billions of dollars, but most groups have more modest capitalization. As large a sum as $1 trillion is, it still represents less than one percent of world financial assets, so there is potentially plenty of room for hedge funds to continue to grow. How much capital is devoted to commodities in general or energy in particular is difficult to determine, but by the last quarter of 2003, at least $60 billion was devoted to commodities overall. Current estimates are about $80 billion.

Why petroleum?

Most hedge funds are committed to traditional long/short equity. These funds may be interested in trading petroleum by going long or short on energy stocks. Companies would range from E&Ps, refineries, large integrated energy firms, to oil service companies. Long/short trading styles usually preclude them from actually owning the physical petroleum or in trading futures, options or Over the Counter instruments.

The global macro funds and the commodity trading advisors (CTAs) are much more likely to take a directional view using the petroleum markets. Macro funds, by definition, take a global view and conduct qualitative analysis on topics such as world economic growth (and, consequently, commodities demand); inflation; geopolitical risk, including potentially disruptive events in oil-producing countries; and other issues that are likely to be germane to petroleum.

CTAs are commonly exchange-traded futures and options specialists, including energy commodities. CTAs often employ a quantitative approach to analysis using often-complicated statistical/mathematical methods to track a market and issue buy or sell orders when their models give them appropriate signals. In the case of these funds, the activity and volatility in the energy markets certainly provides reason to trade.

The lackluster equity markets also encourage hedge fund managers

to look afresh at commodities in general and energy in particular. Emerging market funds may also be interested in petroleum where energy is an important part of the local economy. However, many types of hedge funds – such as the variety of bond funds – have no interest whatsoever in petroleum.

The impact of hedge funds

Some observers have blamed hedge fund participation in the futures markets and elsewhere for the historic run-up in crude oil and other petroleum prices. These critics include various government officials, the International Monetary Fund, and the Bank of International Settlements. Physical participants in the petroleum market, both producers and consumers, also have criticized the funds.

The Organization of Petroleum Exporting Countries has targeted hedge funds as a scapegoat to deflect criticism from the cartel itself for persisting in hawkish policies that contribute to the current damaging price increases.

In its quarterly review, the Bank of International Settlements singled out what it termed "herd-like" behavior directed at the funds and blaming them for pushing the price of oil higher. The IMF issued a stern warning accusing hedge funds of destabilizing other financial markets and of pushing up the price of oil. No less a figure than Gordon Brown, chancellor of the exchequer in the UK, made an unprecedented call for the hedge fund industry to increase disclosure. The BIS offered help to government agencies in this effort. The SEC is also looking at ways of increasing fund surveillance.

Whether the funds have really had so much influence on the price of crude and the refined products is debatable. But, according to S&P's Hedge Fund Indices, escalating energy prices have contributed to hedge fund profitability.

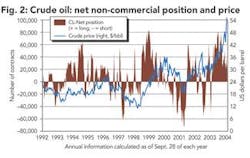

Although funds are active on OTC markets, reliable data for their activities is not available. However, trading activity on the New York Mercantile Exchange is well documented and the market is highly transparent. The crude net long non-commercial position is the category of reported positions the funds would fall under, although by no means is this category the result of fund trading. Still, it is as close a proxy as is available.

Here (Figure 2) we see the funds have had a net long position since last November. Note, however, the greatest net long positions of the non-commercials do not automatically coincide with the price highs of the market. In late May, the NYMEX recorded a record long position of more than 77,000 contracts with crude exceeding $41 a barrel.

By late June, long positions shrank to fewer than 15,000 contracts and the market fell to below $36. In late September, net long positions increased to over 33,000 contracts and crude was at just below $50, almost $9 higher than in May when the market had more than three times as many longs.

By mid October, the net position fell to just over 22,000 contracts and the market traded higher to more than $54. This implies that, while influential, the net long positions of the non-commercials (or large speculative traders such as the hedge funds) do not by themselves dictate the price of oil.

First Islamic hedge fund

Finally, the first Islamic hedge fund – compliant with "Shariah" or Koranic law – was launched in mid October. The hedge is the product of more than two years of discussion between religious scholars, legal experts and US-based Meyer Capital, which will manage the Shariah Equity Opportunity Fund.

It does not appear the fund will trade commodities outright but will operate in the equity markets. However, with this groundbreaking development, future hedge funds catering to Middle East wealth may follow along with the strong possibility of energy commodity trading.

Hedge funds likely will continue to expand, whether or not they ultimately fall under regulation. Their impact on commodities, including energy, will remain significant. Participants in the various energy markets, across the spectrum of production, consumption, risk management and trading should pay close attention.