OGFJ100P company update

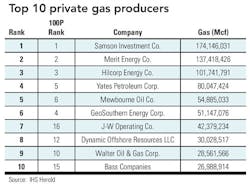

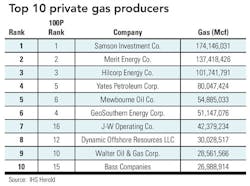

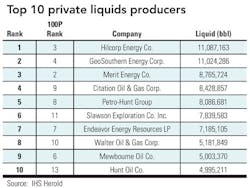

Independent research firm IHS Herold Inc. has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the United States.

There have been some notable transactions in the private company space since the October 2012 issue and the last installment of the OGFJ100P.

Asset purchase

Shortly after the October issue of OGFJ was released, Forest Oil announced that it had entered into a definitive agreement to sell all of its properties located in South Louisiana for approximately $220 million to privately-held Texas Petroleum.

The properties produced 20 MMcfe/d (65% liquids) during the third quarter of 2012 and had estimated proved reserves of 45 Bcfe (62% liquids) as of December 31, 2011.

Texas Petroleum comes in at No. 23 in this installment of the OGFJ100P, up from the No. 30 spot in October.

In another transaction, Talos Energy, a privately held, Gulf of Mexico- and Gulf Coast-focused company backed by investment funds affiliated with Apollo Global Management LLC and Riverstone Holdings LLC, has agreed to purchase oil and gas assets from Helix Energy Solutions Group Inc.

In an effort to grow its well intervention business, Helix Energy Solutions is divesting its oil and gas subsidiary Energy Resources Technology GOM Inc. to Houston-based Talos Energy's wholly owned subsidiary Talos Production LLC for roughly $700 million.

The selling price involves a base purchase price of $610 million plus contingent consideration in the form of overriding royalty interests on ERT's Wang exploration prospect as well as certain other exploration prospects. In addition, the parties have agreed to adjust the purchase price at closing, upward or downward, depending upon the results of the Wang exploration well.

The estimated value of the transaction is approximately $700 million if the Wang exploration prospect is successful and meets expectations. If the Wang exploration prospect is determined to be unsuccessful, the estimated value of the transaction to Helix is closer to $600 million.

The transaction is expected to close in the first quarter of 2013.

Divestitures

On December 20, 2012, Continental Resources Inc. announced that it had completed the transaction in which it acquired 119,218 net acres in the Bakken field, primarily in Williams and Divide counties, North Dakota, from privately-held Samson Resources Co. for $649.3 million.

The acquisition includes production of approximately 6,500 barrels of oil equivalent per day (boepd), of which 82% is crude oil. In addition, Continental completed the sale of properties and approximately 1,100 boepd of production in its Eastern Region for $125 million in cash, subject to post-close adjustments.

The acquisition includes 45,167 net acres (77% held by production) located along the Nesson Anticline in a jointly developed area of mutual interest (AMI) between Continental, as operator, and Samson. As a result of the acquisition, Continental's average working interest in the AMI acreage increased to 71%, compared with the previous working interest of 46%.

The balance of the acquired net acreage (74,051 net acres) is primarily located immediately west of the AMI acreage and is 40% held by production. Subsequent to the acquisition, Continental has an average working interest of 34% in the non-AMI area, but it will operate a majority of this acreage, due to the distribution of its ownership.

In another transaction, privately-held Viking International Resources Co. Inc., or Virco, has agreed to sell 100% of its stock to Magnum Hunter Resources Corp. subsidiary Triad Hunter LLC for $106.7 million.

The acquisition gives Magnum Hunter Resources access to 27,000 net acres in the Marcellus (19,000 in Ritchie County, West Virginia, and 8,000 in Washington and Monroe Counties, Ohio) and another 28,000 net acres in the Utica (9,000 liquids-rich and 19,000 net dry acres). The total acreage for the transaction is 51,500 net with 3,500 of overlap. The buy also comes with a small amount of production (2.9 mmcfe/d) and 22 bcfe of reserves. Consideration for the transaction will be financed by $69 million of 8% convertible preferred stock ($8.50/share conversion price) and $37 million in cash.

Approximately 98% of the total acreage position is held by shallow existing production.

Current net production from the producing assets associated with this acquisition is approximately 475 barrels of oil equivalent per day with a very low decline rate. Total estimated proved reserves are 3.7 million barrels of oil equivalent as of January 1, 2012.

Click here to download the PDF of the "2012 Year-to-date production ranked by BOE"

Click here to download the PDF of the "2012 Year-to-date production – alphabetical listing"