First 45 days of 2013 slow, but Asian NOCs and MLPs remain strong buyers

Brian Lidsky, PLS Inc., Houston

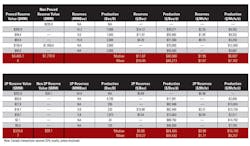

For valuation benchmarks, PLS Inc. has reviewed traditional and conventional property deals in the US during the last six months. The analysis filtered for deals with production and reserves disclosed, average R/P life and % oil versus % gas. For oil assets, general market benchmarks today are about $100,000 per daily bbl of production and $20.00 per bbl proved reserves. For gas deals, the benchmarks are about $5,000 per daily Mcf produced and $1.25 per Mcf proved reserves.

PLS also reports that the global upstream deal count (122) is down 43% and total deal value ($4.7 billion) is down 64% in the first 45 days compared to 2012. For the six-year period from 2007 to 2012, the global market averaged 150 deals and $12.0 billion in the first 45 days of the year.

Geographically, Canada deal counts were down 59% (26 v. 63 in 2012) and deal values were down 92% ($0.3B v. $3.9B); US deal counts were down 30% (50 v. 71 in 2012) and deal values were down 45% ($3.9B v. $7.2 B); International deal counts were down 42% (46 v. 79 in 2012) and deal values were down 77% ($0.4B v. $1.9B). Deal counts include deals with undisclosed values.

The downturn in 2013 is not as severe as that witnessed in the first 45 days of 2009 after the financial meltdown of the US markets, but is the second slowest start since 2007 in terms of deal values. The slow start is partly due to a deal "hangover" after a torrid pace in Q412 as companies rushed to complete deals prior to year-end and avoid uncertainty in the US markets regarding potential tax hikes in President Obama's second term. The slower deal pace is also indicative that the recent year's heightened industry deal making as it relates to raw acreage in the North American resource plays has run through its initial course. The industry deal making landscape is changing as many companies have now bought or leased desired levels of acreage and are now focusing their capital directly towards drilling – be it de-risking existing acreage or going into full development mode.

That being said, at press time, there have been several large and significant deals and the volume of activity is picking up.

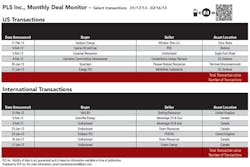

Shown below is a $1.7 billion Wolfcamp JV struck between Pioneer Natural Resources and China's state-owned Sinochem. The JV is located in the Spraberry trend area in the southern portion of the Midland basin (Upton, Reagan, Irion, Crockett and Tom Green counties, Texas) where Sinochem will be getting a 40% interest in about 207,000 net acres prospective for the horizontal Wolfcamp play. The JV is restricted to only the Wolfcamp and deeper formations while Pioneer retains all rights in the shallower formations. For rights to Pioneer's 40% share (or 82,800 net acres) Sinochem will pay $500 million upfront and then another $1.2 billion by carrying 75% of Pioneer's 60% portion of drilling and facilities costs. After attributing $150 million to existing production, PLS estimates the acreage sold at about $18,700 per acre. The partners plan on drilling 86 wells in 2013, 120 wells in 2014 and 165 wells in 2015. EURs are estimated to be 575 Mboe (90% liquids) and well costs are expected to be $7 million. The deal allows Pioneer to accelerate its program to evaluate its northern Wolfcamp/Spraberry acreage (more than 600,000 gross acres) where it plans to ramp up from one rig to four rigs this year.

Shortly after the table below was compiled, Sinopec (another Chinese NOC) struck a large deal, this time agreeing to purchase (for $1.02 billion cash) 50% of Chesapeake Energy's 850,000 net acres in the Oklahoma portion of the Mississippian Lime play. With the deal, Sinopec also gets 17,000 boepd of production (from the Mississippian and other formations) and proved reserves, according to Chesapeake, of 70 MMboe as of December 31, 2012. After attributing a value metric of $55,000 per boepd for the production, the remaining $85 million values the large acreage asset at a nominal figure. The deal provides Chesapeake with another notch towards its asset goal target and brings in a partner to share capital costs on actively developing the large resource play.

Another important deal just after the time frame of the data below is Linn Energy's $4.3 billion acquisition of Berry Petroleum. Linn used its sister company, LinnCo LLC in an equity transaction which provided a 20% premium to Berry shareholders from the prior-day closing price. The deal represents the first ever acquisition of a public C-Corp by an upstream MLP or LLC. The deal, Linn's largest to date, brings Linn additional long-life (19 year R/P) and oil-weighted reserves in California, Permian, East Texas and the Rockies plus an attractive new core area in the Uinta. In addition to increasing its proved reserves by 275 MMboe (or 34%), Linn has also identified another 633 MMboe in probable and possible reserves.

The theme of strong buyers in the form of MLPs and Asian NOC's highlighted in our 2012 review is certainly carrying over into the early part of 2013. We expect this to continue.